Concept explainers

Cost Allocation and Regulated Prices

The City of Imperial Falls contracts with Evergreen Waste Collection to provide solid waste collection to households and businesses. Until recently, Evergreen had an exclusive franchise to provide this service in Imperial Falls, which meant that other waste collection firms could not operate legally in the city. The price per pound of waste collected was regulated at 20 percent above the

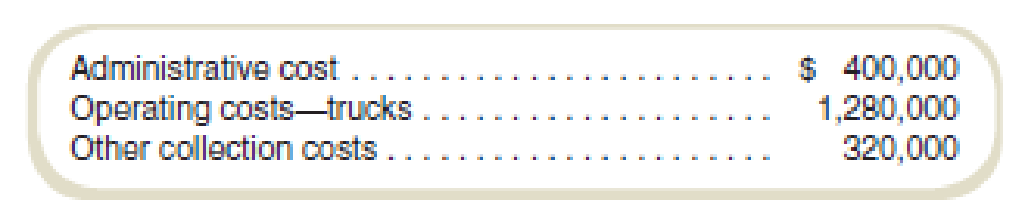

Cost data for the most recent year of operations for Evergreen are as follows:

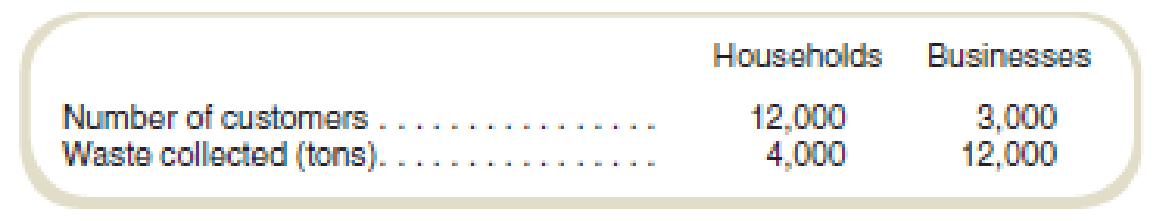

Data on customers for the most recent year are:

The City Council of Imperial Falls is considering allowing other private waste haulers to collect waste from businesses, but not from households. Service to businesses from other waste collection firms would not be subject to price regulation. Based on information from neighboring cities, the price that other private waste collection firms will charge is estimated to be $0.04 per pound (= $80 per ton).

Evergreen’s CEO has approached the city council with a proposal to change the way costs are allocated to households and businesses, which will result in different rates for households and businesses. She proposes that administrative costs and truck operating costs be allocated based on the number of customers and the other collection costs be allocated based on pounds collected. The total costs allocated to households would then be divided by the estimated number of pounds collected from households to determine the cost of collection. The rate would then be 20 percent above the cost. The rate for businesses would be determined using the same calculation.

Required

- a. Based on cost data from the most recent year, what is the price per pound charged by Evergreen for waste collection under the current system (the same rate for both types of customers)?

- b. Based on cost and waste data from the most recent year, what would be the price per pound charged to households and to businesses by Evergreen for waste collection if the CEO’s proposal were accepted?

- c. As a staff member to one of the council members, would you support the proposal to change the way costs are allocated? Explain.

a.

Calculate the price per pound charged by Company E for waste collection under the current system.

Answer to Problem 71P

The price per pound is $0.075 for waste collection under the current system.

Explanation of Solution

Price of the unit:

Price of a unit is the amount per unit that is charged by the customer to generate the sales of the business. It is calculated above the cost of the product in order to generate sales.

Calculate the price per pound:

Thus, the price per pound is $0.075 for waste collection under the current system. The premium on rate is 20%. So the net premium rate is 1.2.

Working note 1:

Calculate the average cost per pound:

Working note 2:

Calculate the total cost of collection:

| Particulars | Amount |

| Administrative cost | $400,000 |

| Operating costs—trucks | $1,280,000 |

| Other collection costs | $320,000 |

| Total cost of collection | $2,000,000 |

Table: (1)

Working note 3:

Calculate the total waste collection:

| Particulars | Amount |

| Waste collection of household | 4,000 |

| Waste collection of businesses | 12,000 |

| Total waste collection (tons) | 16,000 |

Table: (2)

Thus, the total waste collection is 16,000 tons. It will be $32,000,000 in the pound. One ton is equal to 2000 pound.

b.

Calculate the price per pound charged to households and businesses by Evergreen for waste collection if the CEO’s proposal were accepted.

Answer to Problem 71P

The price per pound is $0.21 and $0.03 for household and business respectively that should be charged to households and businesses by Evergreen for waste collection if the CEO’s proposal were accepted.

Explanation of Solution

Price of the unit:

Price of a unit is the amount per unit that is charged by the customer to generate the sales of the business. It is calculated above the cost of the product in order to generate sales.

Calculate the price per pound:

| Particulars | Household | Businesses |

| Customer cost | $1,344,000 (1) | $336,000 (2) |

| Other cost | $80,000(3) | $240,000 (4) |

| Total cost | $1,424,000 | $576,000 |

|

Total number of pound | 8,000,000 | 24,000,000 |

| Average cost per pound | $0.178 | $0.024 |

| Price premium (1.2) | 1.20 | 1.20 |

| Net price | $0.21 | $0.03 |

Table: (1)

Thus, the net price is $0.21 and $0.03 for household and business respectively.

Working note 1:

Calculate the customer cost for a household:

Working note 2:

Calculate the customer cost for businesses:

Working note 3:

Calculate the other cost for household:

Working note 4:

Calculate the other cost for businesses:

c.

Give opinion on the change in the cost allocation.

Explanation of Solution

Allocation of cost:

Allocation of cost refers to the cost of distribution of the common cost among the various departments on the basis of the resource utilized by the department.

Opinion on cost allocation:

Cost allocation can play a very important in price determination. Price in the first allocation was $0.075, and it was $0.24 in the second allocation. Second cost allocation allows the business to evaluate the cost of each unit (businesses and household). In future reference, this allocation can be used as it will calculate all the variables of each unit.

Thus, if there is any bottleneck in any of the unit, then it can be identified by the second allocation of cost.

Want to see more full solutions like this?

Chapter 2 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- Cost Classification, Income Statement Gateway Construction Company, run by Jack Gateway, employs 25 to 30 people as subcontractors for laying gas, water, and sewage pipelines. Most of Gateways work comes from contracts with city and state agencies in Nebraska. The companys sales volume averages 3 million, and profits vary between 0 and 10% of sales. Sales and profits have been somewhat below average for the past 3 years due to a recession and intense competition. Because of this competition, Jack constantly reviews the prices that other companies bid for jobs. When a bid is lost, he analyzes the reasons for the differences between his bid and that of his competitors and uses this information to increase the competitiveness of future bids. Jack believes that Gateways current accounting system is deficient. Currently, all expenses are simply deducted from revenues to arrive at operating income. No effort is made to distinguish among the costs of laying pipe, obtaining contracts, and administering the company. Yet all bids are based on the costs of laying pipe. With these thoughts in mind, Jack looked more carefully at the income statement for the previous year (see below). First, he noted that jobs were priced on the basis of equipment hours, with an average price of 165 per equipment hour. However, when it came to classifying and assigning costs, he needed some help. One thing that really puzzled him was how to classify his own 114,000 salary. About half of his time was spent in bidding and securing contracts, and the other half was spent in general administrative matters. Required: 1. Classify the costs in the income statement as (1) costs of laying pipe (production costs), (2) costs of securing contracts (selling costs), or (3) costs of general administration. For production costs, identify direct materials, direct labor, and overhead costs. The company never has significant work in process (most jobs are started and completed within a day). 2. Assume that a significant driver is equipment hours. Identify the expenses that would likely be traced to jobs using this driver. Explain why you feel these costs are traceable using equipment hours. What is the cost per equipment hour for these traceable costs?arrow_forwardStrategic Cost Management NUBD Inc. manufactures clothing and sells these products to retail outlets. The following costs were incurred in performing quality activities at NUBD during the year: Product recall activities- 370,000 Quality training activities- 240,000 Quality improvement activities- 154,000 Warranty claim activities- 109,000 Quality inspection and testing activities- 61,000 Rework activities- 38,000 Quality data collection and reporting activities- 16,000 What is the total of the prevention costs for NUBD?arrow_forwardMathes Corporation manufactures paper products. The company operates a landfill, which it uses to dispose of nonhazardous trash. The trash is hauled from the two nearby manufacturing facilities in trucks that can carry up to seven tons of trash in a load. The landfill operation requires certain preparation activities regardless of the amount of trash in a truck (i.e., for each load). The budget for the landfill for next year follows. Volume of trash 1,000 tons (250 loads) Preparation costs (varies by loads) $ 60,000 Other variable costs (varies by tons) 60,000 Fixed costs 158,000 Total budgeted costs $ 278,000 Mathes is considering making the landfill a profit center and charging the manufacturing plants for disposal of the trash. The landfill has sufficient capacity to operate for at least the next 20 years. Other landfills are available in the area (both private and municipal), and each plant would be free to decide which landfill to use. Required: a.…arrow_forward

- Allocation of Administrative Costs Wical Rental Management Services manages four apartment buildings, each with a different owner. Wical’s CEO has observed that the apartment buildingswith more expensive rental rates tend to require more of her time and also the time of her staff. Thefour apartment buildings incur a total annual operating expense of $7,345,733, and these operatingexpenses are traced directly to the apartment buildings for the purpose of determining the profitearned by the building owners. The annual management fee that Wical earns is based on a percentageof total annual operating expenses and is negotiated each year. For the current year, the fee rate is 6%,and Wical has the following information for current-year average rental rates and occupancy rates:[LO 18-3]Apartment Complex Number of Units Average Occupancy Average RentCape Point 100 88.0% $1,895Whispering Woods 250 77.0 1,295Hanging Rock 200 72.0 995College Manor 350 82.0 895Total 900For the current year, Wical…arrow_forwardPlanning and control decisions. Gavin Adams is the president of Trusted Pool Service. He takes the following actions, not necessarily in the order given. For each action state whether it is a planning decision or a control decision. Adams decides to expand service offerings into an adjacent market. Adams calculates material costs of a project that was recently completed. Adams weighs the purchase of an expensive new excavation machine proposed by field managers. Adams estimates the weekly cost of providing maintenance services next year to the city recreation department. Adams compares payroll costs of the past quarter to budgeted costs.arrow_forwardWithout regard to costs, identify the advantages to QualSupport Corporation of continuing to obtain covers from its own Denver Cover Plant. QualSupport Corporation plans to prepare a financial analysis that will be used in deciding whether or not to close the Denver Cover Plant. Management has asked you to identify: The annual budgeted costs that are relevant to the decision regarding closing the plant (show the dollar amounts). The annual budgeted costs that are irrelevant to the decision regarding closing the plant and explain why they are irrelevant (again show the dollar amounts). Any nonrecurring costs that would arise due to the closing of the plant, and explain how they would affect the decision (again show any dollar amounts). Looking at the data you have prepared in (2) above, what is the financial advantage (disadvantage) of closing the plant? Show computations and explain your answer. Identify any revenues or costs not specifically mentioned in the problem that…arrow_forward

- Ethics in Action TAC Industries Inc. sells heavy equipment to large corporations and federal, state, and local governments. Corporate sales are the result of a competitive bidding process, where TAC competes against other companies based on selling price. Sales to the government, however, are determined on a cost plus basis, where the selling price is determined by adding a fixed markup percentage to the total job cost. Tandy Lane is the cost accountant for the Equipment Division of TAC Industries Inc. The division is under pressure from senior management to improve income from operations. As Tandy reviewed the division's job cost sheets, she realized that she could increase the division's income from operations by moving a portion of the direct labor hours that had been assigned to the job order cost sheets of corporate customers onto the job order costs sheets of government customers. She believed that this would create a “win–win” for the division by (1) reducing the cost of…arrow_forwardCost classification; ethics. Paul Howard, the new plant manager of Garden Scapes Manufacturing Plant Number 7, has just reviewed a draft of his year-end financial statements. Howard receives a year-end bonus of 11.5% of the plant’s operating income before tax. The year-end income statement provided by the plant’s controller was disappointing to say the least. After reviewing the numbers, Howard demanded that his controller go back and “work the numbers” again. Howard insisted that if he didn’t see a better operating income number the next time around he would be forced to look for a new controller. Garden Scapes Manufacturing classifies all costs directly related to the manufacturing of its product as product costs. These costs are inventoried and later expensed as costs of goods sold when the product is sold. All other expenses, including finished-goods warehousing costs of $3,640,000, are classified as period expenses. Howard had suggested that warehousing costs be included as…arrow_forward[The following information applies to the questions displayed below.] Jorgansen Lighting, Inc., manufactures heavy-duty street lighting systems for municipalities. The company uses variable costing for internal management reports and absorption costing for external reports to shareholders, creditors, and the government. The company has provided the following data: Year 1 Year 2 Year 3 Inventories Beginning (units) 220 170 190 Ending (units) 170 190 220 Variable costing net operating income $290,000 $279,000 $250,000 The company’s fixed manufacturing overhead per unit was constant at $400 for all three years. Required: 1. Calculate each year’s absorption costing net operating income. (Enter any losses or deductions as a negative value.) Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Year 1 Year 2 Year 3 Variable costing net operating income Add (deduct) fixed manufacturing overhead…arrow_forward

- The following information applies to the questions displayed below.] Jorgansen Lighting, Inc., manufactures heavy-duty street lighting systems for municipalities. The company uses variable costing for internal management reports and absorption costing for external reports to shareholders, creditors, and the government. The company has provided the following data: Year 1 Year 2 Year 3 Inventories Beginning (units) 220 170 190 Ending (units) 170 190 220 Variable costing net operating income $290,000 $279,000 $250,000 The company’s fixed manufacturing overhead per unit was constant at $400 for all three years. 2. Assume in Year 4 that the company’s variable costing net operating income was $250,000 and its absorption costing net operating income was $270,000. a. Did inventories increase or decrease during Year 4? multiple choice Increase Decrease b. How much fixed manufacturing overhead cost was deferred or released from…arrow_forwardProvincial Government of Ilocos Sur established a one-stop quarantine facility where returning residents shall be given proper monitoring and treatment to protect the province against the wrath of the COVID-19 pandemic. During the first three months of operations, the province’s government allocates quarantine costs to the local government units (LGUs) based on the number of quarantiners. However, the newly-appointed provincial accountant suggested the adoption of Activity-Based Costing system which she believes that it is a more accurate approach of allocating costs to the LGUs. After the critical analysis and evaluation of the different major activity centers, cost drivers and cost estimates, the accountant presented the following data to the governor for review and approval: Activity Center Quarantine Cost Cost Driver Activity Level Transportation P 340,000 kilometers 42,500 Swab Testing P 1,200,000 tests 960 Accommodation P 1,575,000…arrow_forwardCost-plus and market-based pricing. (CMA, adapted) Precision Laboratories evaluates the reaction of materials to extreme increases in temperature. Much of the company’s early growth was attributable to government contracts, but recent growth has come from expansion into commercial markets. Two types of testing at Precision are Heat Testing (HTT) and Arctic-Condition Testing (ACT). Currently, all of the budgeted operating costs are collected in a single overhead pool. All of the estimated testing-hours are also collected in a single pool. One rate per test-hour is used for both types of testing. This hourly rate is marked up by 40% to recover administrative costs and taxes and to earn a profit. Jeff Boone, Precision’s controller, believes that there is enough variation in the test procedures and cost structure to establish separate costing rates and billing rates at a 40% markup. He also believes that the inflexible rate structure the company is currently using is inadequate in today’s…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning