Concept explainers

Communication

Jamarcus Bradshaw, plant, manager of Georgia Paper Company's papermaking mill, was looking over the cost of production reports for July and August for the Papermaking Department. The reports revealed the following:

| July | August | |

| Pulp and chemicals | $295,600 | $304,100 |

| Conversion cost | 146,000 | 149,600 |

| Total cost | $441,600 | $453,700 |

| Number of tons | + 1,200 | + 1,130 |

| Cost per ton | $ 368 | $ 401.50 |

Jamarcus was concerned about the increased cost per ton from the output of the department. As a result, he asked the plant controller to perform a study to help explain these results. The controller, Leann Brunswick, began the analysis by performing some interviews of key plant personnel in order to understand what the problem might be. Excerpts from an interview with Len Tyson, a paper machine operator, follow:

Len: We have two papermaking machines in the department I have no data, but I think paper machine No. 1 is applying too much pulp and, thus, is wasting both conversion and materials resources. We haven't had repairs on paper machine No. 1 in a while. Maybe this is the problem.

Leann. How does too much pulp result i n wasted resources?

Len: Well, you see, if too much pulp is applied, then we will waste pulp material. The customer will not pay for the extra product we just use more material to make the product. Also, when there is too much pulp, the machine must be slowed down in order to complete the drying process. This results in additional conversion costs.

Leann: Do you have any other suspicions?

Len: Well, as you know, we have two products—green pa per and yellow pa per. They are identical except for the color. The color is added to the papermaking process in the paper machine. I think that during August these two color papers have been behaving differently. I don't have any data, but it seems as though the amount of waste associated with the green paper has increased.

Leann. Why is this?

Len: I understand that there has been a change in specifications for the green paper, starting near the beginning of August This change could be causing the machines to run poorly when making green paper. If that is the case, the cost per ton would increase for green paper.

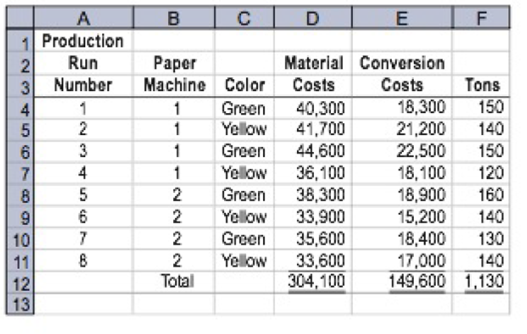

Leann also asked for a database printout providing greater detail on August's operating results. September 9 Requested by: Leann Brunswick Papermaking Department—August detail

Prior to preparing a report, Leann resigned from Georgia Paper Company to start her own business. You have been asked to lake the data that Leann collected and write a memo to Jamarcus Bradshaw with a recommendation to management. Your memo should include analysis of the August data to determine whether the paper machine or the paper color explains the increase in the unit cost from July. Include any supporting schedules that are appropriate. Round all calculations to the nearest cent.

Trending nowThis is a popular solution!

Chapter 20 Solutions

Accounting

- Communications Jamarcus Bradshaw, plant manager of Georgia Paper Companys papermaking mill, was looking over the cost of production reports for July and August for the Papermaking Department. The reports revealed the following: Jamarcus was concerned about the increased cost per ton from the output of the department. As a result, he asked the plant controller to perform a study to help explain these results. The controller, Leann Brunswick, began the analysis by performing some interviews of key plant personnel in order to understand what the problem might be. Excerpts from an interview with Len Tyson, a paper machine operator, follow: Len: We have two papermaking machines in the department. I have no data, but I think paper machine No. 1 is applying too much pulp and, thus, is wasting both conversion and materials resources. We haven't had repairs on paper machine No. 1 in a while. Maybe this is the problem. Leann: How does too much pulp result in wasted resources? Len: Well, you see, if too much pulp is applied, then we will waste pulp material. The customer will not pay for the extra product; we just use more material to make the product. Also, when there is too much pulp, the machine must be slowed down in order to complete the drying process. This results in additional conversion costs. Leann: Do you have any other suspicions? Len: Well, as you know, we have two productsgreen paper and yellow paper. They are identical except for the color. The color is added to the papermaking process in the paper machine. I think that during August these two color papers have been behaving very differently. I don't have any data, but it just seems as though the amount of waste associated with the green paper has increased. Leann: Why is this? Len: I understand that there has been a change in specifications for the green paper, starting near the beginning of August. This change could be causing the machines to run poorly when making green paper. If this is the case, the cost per ton would increase for green paper. Leann also asked for a database printout providing greater detail on Augusts operating results. September 9 Requested by: Leann Brunswick Papermaking DepartmentAugust detail Prior to preparing a report, Leann resigned from Georgia Paper Company to start her own business. You have been asked to take the data that Leann collected, and write a memo to Jamarcus Bradshaw with a recommendation to management. Your memo should include analysis of the August data to determine whether the paper machine or the paper color explains the increase in the unit cost from July. Include any supporting schedules that are appropriate. Round any calculations to the nearest cent.arrow_forwardAlgers Company produces dry fertilizer. At the beginning of the year, Algers had the following standard cost sheet: Algers computes its overhead rates using practical volume, which is 54,000 units. The actual results for the year are as follows: a. Units produced: 53,000 b. Direct materials purchased: 274,000 pounds at 2.50 per pound c. Direct materials used: 270,300 pounds d. Direct labor: 40,100 hours at 17.95 per hour e. Fixed overhead: 161,700 f. Variable overhead: 122,000 Required: 1. Compute price and usage variances for direct materials. 2. Compute the direct labor rate and labor efficiency variances. 3. Compute the fixed overhead spending and volume variances. Interpret the volume variance. 4. Compute the variable overhead spending and efficiency variances. 5. Prepare journal entries for the following: a. The purchase of direct materials b. The issuance of direct materials to production (Work in Process) c. The addition of direct labor to Work in Process d. The addition of overhead to Work in Process e. The incurrence of actual overhead costs f. Closing out of variances to Cost of Goods Soldarrow_forwardUse the following information for Brief Exercises 2-19 and 2-20: Slapshot Company makes ice hockey sticks. Last week, direct materials (wood, paint, Kevlar, and resin) costing 32,000 were put into production. Direct labor of 28,000 (10 workers 200 hours 14 per hour) was incurred. Manufacturing overhead equaled 60,000. By the end of the week, the company had manufactured 500 hockey sticks. Brief Exercise 2-20 Prime Cost and Conversion Cost Refer to the information for Slapshot Company on the previous page. Required: 1. Calculate the total prime cost for last week. 2. Calculate the per-unit prime cost. 3. Calculate the total conversion cost for last week. 4. Calculate the per-unit conversion cost.arrow_forward

- Preparation of Income Statement: Manufacturing Firm Laworld Inc. manufactures small camping tents. Last year, 200,000 tents were made and sold for 60 each. Each tent includes the following costs: The only selling expenses were a commission of 2 per unit sold and advertising totaling 100,000. Administrative expenses, all fixed, equaled 300,000. There were no beginning or ending finished goods inventories. There were no beginning or ending work-in-process inventories. Required: 1. Calculate the product cost for one tent. Calculate the total product cost for last year. 2. CONCEPTUAL CONNECTION Prepare an income statement for external users. Did you need to prepare a supporting statement of cost of goods manufactured? Explain. 3. CONCEPTUAL CONNECTION Suppose 200,000 tents were produced (and 200,000 sold) but that the company had a beginning finished goods inventory of 10,000 tents produced in the prior year at 40 per unit. The company follows a first-in, first-out policy for its inventory (meaning that the units produced first are sold first for purposes of cost flow). What effect does this have on the income statement? Show the new statement.arrow_forwardStandard unit cost and journal entries The normal capacity of Algonquin Adhesives Inc. is 40,000 direct labor hours and 20,000 units per month. A finished unit requires 6 lb of materials at an estimated cost of 2 per pound. The estimated cost of labor is 10.00 per hour. The plant estimates that overhead (all variable) for a month will be 40,000. During the month of March, the plant totaled 34,800 direct labor hours at an average rate of 9.50 an hour. The plant produced 18,000 units, using 105,000 lb of materials at a cost of 2.04 per pound. 1. Prepare a standard cost summary showing the standard unit cost. 2. Make journal entries to charge materials and labor to Work in Process.arrow_forwardPetrillo Company produces engine parts for large motors. The company uses a standard cost system for production costing and control. The standard cost sheet for one of its higher volume products (a valve) is as follows: During the year, Petrillo had the following activity related to valve production: a. Production of valves totaled 20,600 units. b. A total of 135,400 pounds of direct materials was purchased at 5.36 per pound. c. There were 10,000 pounds of direct materials in beginning inventory (carried at 5.40 per pound). There was no ending inventory. d. The company used 36,500 direct labor hours at a total cost of 656,270. e. Actual fixed overhead totaled 110,000. f. Actual variable overhead totaled 168,000. Petrillo produces all of its valves in a single plant. Normal activity is 20,000 units per year. Standard overhead rates are computed based on normal activity measured in standard direct labor hours. Required: 1. Compute the direct materials price and usage variances. 2. Compute the direct labor rate and efficiency variances. 3. Compute overhead variances using a two-variance analysis. 4. Compute overhead variances using a four-variance analysis. 5. Assume that the purchasing agent for the valve plant purchased a lower-quality direct material from a new supplier. Would you recommend that the company continue to use this cheaper direct material? If so, what standards would likely need revision to reflect this decision? Assume that the end products quality is not significantly affected. 6. Prepare all possible journal entries (assuming a four-variance analysis of overhead variances).arrow_forward

- Use the following information for Brief Exercises 2-19 and 2-20: Slapshot Company makes ice hockey sticks. Last week, direct materials (wood, paint, Kevlar, and resin) costing 32,000 were put into production. Direct labor of 28,000 (10 workers 200 hours 14 per hour) was incurred. Manufacturing overhead equaled 60,000. By the end of the week, the company had manufactured 500 hockey sticks. Brief Exercise 2-19 Total Product Cost and Per-Unit Product Cost Refer to the information for Slapshot Company above. Required: 1. Calculate the total product cost for last week. 2. Calculate the per-unit cost of one hockey stick that was produced last week.arrow_forwardZippy Inc. manufactures a fuel additive, Surge, which has a stable selling price of 44 per drum. The company has been producing and selling 80,000 drums per month. In connection with your examination of Zippys financial statements for the year ended September 30, management has asked you to review some computations made by Zippys cost accountant. Your working papers disclose the following about the companys operations: Standard costs per drum of product manufactured: Materials: Costs and expenses during September: Chemicals: 645,000 gallons purchased at a cost of 1,140,000; 600,000 gallons used. Empty drums: 94,000 purchased at a cost of 94,000; 80,000 drums used. Direct labor: 81,000 hours worked at a cost of 816,480. Factory overhead: 768,000. Required: Calculate the following for September, using the formulas on pages 421422 and 424 (Round unit costs to the nearest whole cent and compute the materials variances for both Surge and for the drums.): 1. Materials quantity variance. 2. Materials purchase price variance. 3. Labor efficiency variance. 4. Labor rate variance.arrow_forwardSCHEDULE OF COST OF GOODS MANUFACTURED The following information is supplied for Maupin Manufacturing Company. Prepare a schedule of cost of goods manufactured for the year ended December 31, 20--. Assume that all materials inventory items are direct materials. Work in process, January 1 77,000 Materials inventory, January 1 31,000 Materials purchases 35,000 Materials inventory, December 31 26,000 Direct labor 48,000 Overhead 20,000 Work in process, December 31 62,000arrow_forward

- Eyring Manufacturing produces a component used in its production of washing machines. The time to set up and produce a batch of the components is two days. The average daily usage is 800 components, and the maximum daily usage is 875 components. Required: Compute the reorder point assuming that safety stock is carried by Eyring Manufacturing. How much safety stock is carried by Eyring?arrow_forwardFresno Industries Inc. manufactures and sells high-quality camping tents. The company began operations on January 1 and operated at 100% of capacity (150,000 units) during the first month, creating an ending inventory of 20,000 units. During February, the company produced 130,000 units during the month but sold 150,000 units at 500 per unit. The February manufacturing costs and selling and administrative expenses were as follows: a. Prepare an income statement according to the absorption costing concept for the month ending February 28. b. Prepare an income statement according to the variable costing concept for for the month ending February 28. c. What is the reason for the difference in the amount of operating income reported in (a) and (b)?arrow_forwardA production department within a company received materials of $10,000 and conversion costs of $10,000 from the prior department. It added material of $27,200 and conversion costs of $53,000. The equivalent units are 20,000 for material and 18,000 for conversion. What is the unit cost for materials and conversion?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,