Concept explainers

Hemmingway, Inc., is considering a $50 million research and development (R&D) project. Profit projections appear promising, but Hemmingway’s president is concerned because the

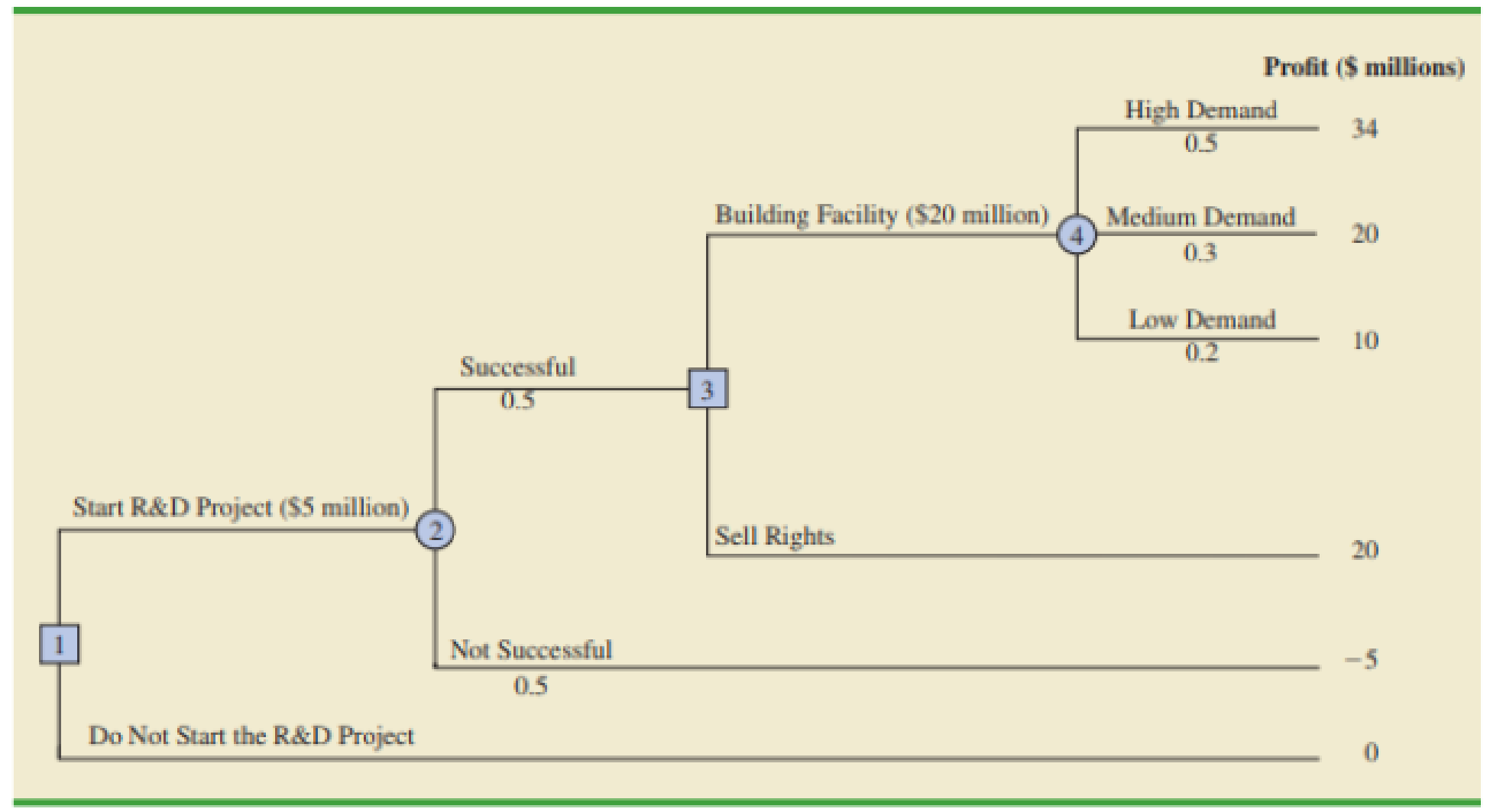

FIGURE 20.11 DECISION TREE FOR HEMMINGWAY, INC.

The decision tree is shown in Figure 20.11. The profit projection for each outcome is shown at the end of the branches. For example, the revenue projection for the high-demand outcome is $59 million. However, the cost of the R&D project ($5 million) and the cost of the production facility ($20 million) show the profit of this outcome to be $59 – $5 – $20 = $34 million. Branch probabilities are also shown for the chance

- a. Analyze the decision tree to determine whether the company should undertake the R&D project. If it does, and if the R&D project is successful, what should the company do? What is the

expected value of your strategy? - b. What must the selling price be for the company to consider selling the rights to the product?

Trending nowThis is a popular solution!

Chapter 20 Solutions

Modern Business Statistics with Microsoft Office Excel (with XLSTAT Education Edition Printed Access Card) (MindTap Course List)

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL College AlgebraAlgebraISBN:9781305115545Author:James Stewart, Lothar Redlin, Saleem WatsonPublisher:Cengage Learning

College AlgebraAlgebraISBN:9781305115545Author:James Stewart, Lothar Redlin, Saleem WatsonPublisher:Cengage Learning