Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 20, Problem 2E

Lessee Accounting with Payments Made at Beginning of Year Adden Company signs a lease agreement dated January 1, 2019, that provides for it to lease non-specialized heavy equipment from Scott Rental Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows:

- 1. The lease term is 4 years. The lease is noncancelable and requires annual rental payments of $20,000 to be paid in advance at the beginning of each year.

- 2. The cost, and also fair value, of the heavy equipment to Scott at the inception of the lease is $68,036.62. The equipment has an estimated life of 4 years and has a zero estimated residual value at the end of this time.

- 3. Adden agrees to pay all executory costs directly to a third party.

- 4. The lease contains no renewal or bargain purchase options.

- 5. Scott’s interest rate implicit in the lease is 12%. Adden is aware of this rate, which is equal to its borrowing rate.

- 6. Adden uses the straight-line method to record

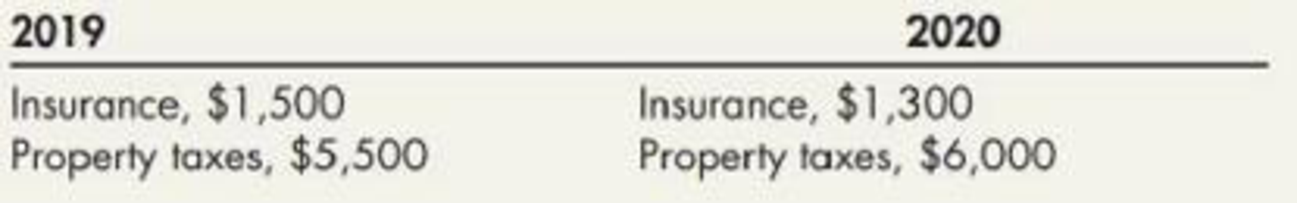

depreciation on similar equipment. - 7. Executory costs paid at the end of the year by Adden are:

Required:

- 1. Next Level Determine what type of lease this is for Adden.

- 2. Prepare a table summarizing the lease payments and interest expense for Adden.

- 3. Prepare

journal entries for Adden for the years 2019 and 2020.

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 20 Solutions

Intermediate Accounting: Reporting And Analysis

Ch. 20 - Prob. 1GICh. 20 - List four potential benefits to the lessor of...Ch. 20 - Prob. 3GICh. 20 - What is a substitution right, and when does that...Ch. 20 - Prob. 5GICh. 20 - List the five criteria used to determine if a...Ch. 20 - Prob. 7GICh. 20 - Prob. 8GICh. 20 - Describe briefly the procedures followed by the...Ch. 20 - Owens Company leased equipment for 4 years at...

Ch. 20 - Describe the difference between how a lessee would...Ch. 20 - Prob. 12GICh. 20 - What is the basic difference between the...Ch. 20 - Why are compound interest concepts appropriate and...Ch. 20 - Describe briefly the accounting procedures...Ch. 20 - Prob. 16GICh. 20 - Prob. 17GICh. 20 - Which of the following should be included by the...Ch. 20 - East Company leased a new machine from North...Ch. 20 - Prob. 3MCCh. 20 - Fox Company, a dealer in machinery and equipment,...Ch. 20 - Fox Company, a dealer in machinery and equipment,...Ch. 20 - In the third year of a 6-year finance lease, the...Ch. 20 - Prob. 7MCCh. 20 - At its inception, the lease term of Lease G is 65%...Ch. 20 - Rent received in advance by the lessor for an...Ch. 20 - On August 1, 2019, Kern Company leased a machine...Ch. 20 - Next Level Keller Corporation (the lessee) entered...Ch. 20 - Use the information in RE20-1. Prepare the journal...Ch. 20 - Next Level Garvey Company (the lessee) entered...Ch. 20 - Use the information in RE20-3. Prepare the journal...Ch. 20 - Use the information in RE20-3. Prepare the journal...Ch. 20 - Montevallo Corporation leased equipment from Folio...Ch. 20 - Use the information in RE20-6. However, assume...Ch. 20 - Use the following information to decide whether...Ch. 20 - Use the information in RE20-3. Prepare the journal...Ch. 20 - Determining Type of Lease and Subsequent...Ch. 20 - Lessee Accounting with Payments Made at Beginning...Ch. 20 - Lessee Accounting Issues Sax Company signs a lease...Ch. 20 - Lessee Accounting for Finance Lease On January 1,...Ch. 20 - Prob. 5ECh. 20 - Lessor Accounting Issues Ramsey Company leases...Ch. 20 - Lessor Accounting with Receipts at End of Year...Ch. 20 - Lessor Accounting with Unguaranteed Residual Value...Ch. 20 - Lessor Accounting with Guaranteed Residual Value...Ch. 20 - Determining Type of Lease and Subsequent...Ch. 20 - Guaranteed and Unguaranteed Residual Values...Ch. 20 - Lessor Accounting Issues Rexon Company leases...Ch. 20 - Lessee and Lessor Accounting Issues Diego Leasing...Ch. 20 - Lessee and Lessor Accounting Issues The following...Ch. 20 - Lease Income and Expense Reuben Company retires a...Ch. 20 - Determining Type of Lease and Subsequent...Ch. 20 - Determining Type of Lease and Subsequent...Ch. 20 - Accounting for Leases by Lessee and Lessor Scupper...Ch. 20 - Lessee Accounting Issues Timmer Company signs a...Ch. 20 - Sales-Type Lease with Guaranteed Residual Value...Ch. 20 - Sales-Type Lease with Unguaranteed Residual Value...Ch. 20 - Sales-Type Lease with Receipts at End of Year...Ch. 20 - Initial Direct Costs and Related Issues On January...Ch. 20 - Various Lease Issues for Lessor and Lessee Lessee...Ch. 20 - Prob. 10PCh. 20 - Various Lease Issues Farrington Company leases a...Ch. 20 - Comprehensive Landlord Company and Tenant Company...Ch. 20 - Prob. 1CCh. 20 - Identified Asset A customer enters into a 3-year...Ch. 20 - Prob. 3CCh. 20 - Types of Leases On January 1, Hazard Company, a...Ch. 20 - Initial Direct Costs Efland Company leases...Ch. 20 - Prob. 6C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lessee Accounting Issues Timmer Company signs a lease agreement dated January 1, 2019, that provides for it to lease equipment from Landau Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: The lease is noncancelable and has a term of 5 years. The annual rentals are 83,222.92, payable at the end of each year, and provide Landau with a 12% annual rate of return on its net investment. Timmer agrees to pay all executory costs directly to a third party on December 1 of each year. In 2019, these were insurance, 3,760; property taxes, 5,440. In 2020: insurance, 3,100; property taxes, 5,330. There is no renewal or bargain purchase option. Timmer estimates that the equipment has a fair value of 300,000, an economic life of 5 years, and a zero residual value. Timmers incremental borrowing rate is 16%, it knows the rate implicit in the lease, and it uses the straightline method to record depreciation on similar equipment. Required: 1. Calculate the amount of the asset and liability of Timmer at the inception of the lease. (Round to the nearest dollar.) 2. Prepare a table summarizing the lease payments and interest expense. 3. Prepare journal entries on the books of Timmer for 2019 and 2020. 4. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the present value of next years payment approach to classify the finance lease obligation between current and noncurrent. 5. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the change in present value approach to classify the finance lease obligation between current and noncurrent.arrow_forwardLessee Accounting Issues Sax Company signs a lease agreement dated January 1, 2019, that provides for it to lease computers from Appleton Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 5 years. The lease is noncancelable and requires equal rental payments to be made at the end of each year. The computers are not specialized for Sax. 2. The computers have an estimated life of 5 years, a fair value of 300,000, and a zero estimated residual value. 3. Sax agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. The annual payment is set by Appleton at 83,222.92 to earn a rate of return of 12% on its net investment. Sax is aware of this rate. Saxs incremental borrowing rate is 10%. 6. Sax uses the straight-line method to record depreciation on similar equipment. Required: 1. Next Level Examine and evaluate each capitalization criteria and determine what type of lease this is for Sax. 2. Calculate the amount of the asset and liability of Sax at the inception of the lease (round to the nearest dollar). 3. Prepare a table summarizing the lease payments and interest expense. 4. Prepare journal entries for Sax for the years 2019 and 2020.arrow_forwardLessor Accounting Issues Ramsey Company leases heavy equipment to Terrell Inc. on March 1, 2019, on the following terms: 1. Twenty-four lease rentals of 2,950 at the beginning of each month are to be paid by Terrell, and the lease is noncancelable. 2. The cost of the heavy equipment to Ramsey was 55,000. 3. Ramsey uses an implicit interest rate of 18% per year and will account for this lease as a sales-type lease. Required: Prepare journal entries for Ramsey (the lessor) to record the lease contract on March 1, 2019, the receipt of the first two lease rentals, and any interest income for March and April 2019. (Round your answers to the nearest dollar.)arrow_forward

- Determining Type of Lease and Subsequent Accounting On January 1, 2019, Ballieu Company leases specialty equipment with an economic life of 8 years to Anderson Company. The lease contains the following terms and provisions: The lease is noncancelable and has a term of 8 years. The annual rentals arc 35,000, payable at the beginning of each year. The interest rate implicit in the lease is 14%. Anderson agrees to pay all executory costs directly to a third party and is given an option to buy the equipment for 1 at the end of the lease term, December 31, 2026. The cost of the equipment to the lessee is 150,000, and the fair value is approximately 185,100. Ballieu incurs no material initial direct costs. It is probable that Ballieu will collect the lease payments. Ballieu estimates that the fair value is expected to be significantly greater than 1 at the end of the lease term. Ballieu calculates that the present value on January 1, 2019, of 8 annual payments in advance of 35,000 discounted at 14% is 185,090.68 (the 1 purchase option is ignored as immaterial). Required: 1. Next Level Identify the classification of the lease transaction from Ballices point of view. Give the reasons for your classification. 2. Prepare all the journal entries tor Ballieu for the years 2019 and 2020. 3. Discuss the disclosure requirements for the lease transaction in Ballices notes to the financial statements.arrow_forwardDetermining Type of Lease and Subsequent Accounting On January 1, 2019, Caswell Company signs a 10-year cancelable (at the option of either party) agreement to lease a storage building from Wake Company. The following information pertains to this lease agreement: 1. The agreement requires rental payments of 100,000 at the beginning of each year. 2. The cost and fair value of the building on January 1, 2019, is 2 million. The storage building has not been specialized for Caswell. 3. The building has an estimated economic life of 50 years, with no residual value. Caswell depreciates similar buildings according to the straight-line method. 4. The lease does not contain a renewable option clause. At the termination of the lease, the building reverts to the lessor. 5. Caswells incremental borrowing rate is 14% per year. Wake set the annual rental to ensure a 16% rate of return (the loss in service value anticipated for the term of the lease). Caswell knows the implicit interest rate. 6. Executory costs of 7,000 annually, related to taxes on the property, are paid by Caswell directly to the taxing authority on Dec. 31 of each year. Required: 1. Determine what type of lease this is for the lessee. 2. Prepare appropriate journal entries on the lessees books to reflect the signing of the lease agreement and to record the payments and expenses related to this lease for the years 2019 and 2020.arrow_forwardComprehensive Landlord Company and Tenant Company enter into a noncancelable, direct financing lease on January 1, 2019, for nonspecialized equipment that cost the Landlord 280,000 (useful life is 6 years with no residual value). The fair value of the equipment is 300,000. The interest rate implicit in the lease is 14%. The 6-year lease requires 6 equal annual amounts payable each January 1, beginning with January 1, 2019. Tenant pays all executory costs directly to a third party on December 1 of each year. The equipment reverts to the lessor at the termination of the lease. Assume that there are no initial direct costs. Landlord expects to collect all rental payments. Required: 1. Next Level (a) Show how landlord should compute the annual rental amounts, (b) Discuss how the Tenant Company should compute the present value of the lease payments. What additional information would be required to make this computation? 2. Next Level Prepare a table summarizing the lease and interest receipts that would be suitable for Landlord. Under what conditions would this table be suitable for Tenant? 3. Assuming that the table prepared in Requirement 2 is suitable for both the lessee and the lessor, prepare the journal entries for both firms for the years 2019 and 2020. Use the straight-line depreciation method for the leased equipment. The executory costs paid by the lessee are in 2019: insurance, 700 and property taxes, 800; in 2020: insurance, 600 and property taxes, 750. 4. Next Level Show the items and amounts that would be reported on the comparative 2019 and 2020 income statements and ending balance sheets for both the lessor and the lessee, using the change in present value approach.arrow_forward

- Lessee and Lessor Accounting Issues The following information is available for a noncancelable lease of equipment entered into on March 1, 2019. The lease is classified as a sales-type lease by the lessor (Anson Company) and as a finance lease by the lessee (Bullard Company). Assume that the lease payments are nude at the beginning of each month, interest and straight-line depreciation are recognized at the end of each month, and the residual value of the leased asset is zero at the end of a 3-year life. Required: 1. Record the lease (including the initial receipt of 2,000) and the receipt of the second and third installments of 2,000 in Ansons accounts. Carry computations to the nearest dollar. 2. Record the lease (including the initial payment of 2,000), the payment of the second and third installments of 2,000, and monthly depreciation in Bullards accounts. The lessee records the lease obligation at net present value. Carry computations to the nearest dollar.arrow_forwardLessee and Lessor Accounting Issues Diego Leasing Company agrees to provide La Jolla Company with equipment under a noncancelable lease for 5 years. The equipment has a 5-year life, cost Diego 25,000, and will have no residual value when the lease term ends. The fair value of the equipment is 30,000. La Jolla agrees to pay all executory costs (500 per year) throughout the lease period directly to a third party. On January 1, 2019, the equipment is delivered. Diego expects a 14% return on its net investment. The five equal annual rents are payable in advance starting January 1, 2019. Required: 1. Assuming this is a sales-type lease for the Diego and a finance lease for the La Jolla, prepare a table summarizing the lease and interest payments suitable for use by either party. 2. Next Level On the assumption that both companies adjust and close books each December 31, prepare journal entries relating to the lease for both companies through December 31, 2020, based on data derived in the table. Assume that La Jolla depreciates similar equipment by the straight line methodarrow_forwardUse the information in RE20-3. Prepare the journal entries that Richie Company (the lessor) would make in the first year of the lease assuming the lease is classified as a sales-type lease. Assume that the lessee is required to make payments on December 31 each year. Also assume that Richie had purchased the equipment at a cost of 200,000.arrow_forward

- Sales-Type Lease with Unguaranteed Residual Value Lessor Company and Lessee Company enter into a 5-year, noncancelable, sales-type lease on January 1, 2019, for equipment that cost Lessor 375,000 (useful life is 5 years). The fair value of the equipment is 400,000. Lessor expects a 12% return on the cost of the asset over the 5-year period of the lease. The equipment will have an estimated unguaranteed residual value of 20,000 at the end of the fifth year of the lease. The lease provisions require 5 equal annual amounts, payable each January 1, beginning with January 1, 2019. Lessee pays all executory costs directly to a third party. The equipment reverts to the lessor at the termination of the lease. Assume there are no initial direct costs, and the lessor expects to be able to collect all lease payments. Required: 1. Show how Lessor should compute the annual rental amounts. 2. Prepare a table summarizing the lease and interest receipts that would be suitable for Lessor. 3. Prepare a table showing the accretion of the unguaranteed residual asset. 4. Prepare the journal entries for Lessor for the years 2019, 2020, and 2021.arrow_forwardSales-Type Lease with Guaranteed Residual Value Calder Company, the lessor, enters into a lease with Darwin Company, the lessee, to provide heavy equipment beginning January 1, 2017. The lease is appropriately classified as a sales-type lease. The lease terms, provisions, and related events are as follows: The lease is noncancelable, has a term of 8 years, and has no renewal or bargain purchase option. The annual rentals are 65,000, payable at the end of each year. The interest rate implicit in the lease is 15%. Darwin agrees to pay all executory costs directly to a third party. The cost of the equipment is 280,000. The fair value of the equipment to Calder is 308,021.03. Calder incurs no material initial direct costs. Calder expects that it will be able to collect all lease payments. Calder estimates that the fair value at the end of the lease term will be 50,000 and that the economic life the equipment is 9 years. This residual value is guaranteed by Darwin. The following present value factors are relevant: PV of an ordinary annuity n = 8, i = 15% = 4.487322 PV n = 8, i = 15% = 0.326902 PV n = 1, i = 15% = 0.869565 Required: 1. Determine the proper classification of the lease. 2. Prepare a table summarizing the lease receipts and interest income earned by Calder for this lease. 3. Prepare journal entries for Calder for the years 2019, 2020, and 2021. 4. Next Level Prepare partial balance sheets for December 31, 2019, and December 31, 2020, showing how the accounts should be reported. Use the present value of next years payment approach to classify the lease receivable as current and noncurrent. 5. Next Level Prepare partial balance sheets for December 31, 2019, and December 31, 2020, showing how the accounts should be reported. Use the change in present value approach to classify the lease receivable as current and noncurrent.arrow_forwardFinancial Statement Violations of U.S. GAAP The following are the financial statements issued by Allen Corporation for its fiscal year ended October 31, 2019: Notes to Financial Statements: 1. Long-Term Lease. Under the terms of a 5-year, noncancelable lease for a building, Allen is obligated to make annual rental payments of 40,000 in each of the next 4 fiscal years. 2. Pension Plan. Substai1tially all employees are covered by Allens defined benefit pension plan. Pension expense is equal to the total of pension benefits accrued and paid to retired employees during the year. Because it is a defined benefit plan that is paid every year, no pension liability exists. 3. Patent. The patent had an estimated remaining life of 10 years at the time of purchase. Allens patent was purchased from Apex Corporation on January 1, 2019, for 250,000. 4. Deferred Income Tax Payable. The entire balai1ce in the Deferred Income Tax Payable account arose from tax-exempt municipal bonds that were held during the previous fiscal year, giving rise to a difference between taxable income and reported net earnings for the fiscal year ended October 31, 2019. The deferred liability amount was calculated on the basis of past tax rates. 5. Warrants. On January 1, 2018, one common stock warrant was issued to shareholders of record for each common share owned. An additional share of common stock is to be issued upon exercise of 10 stock warrants and receipt of an amount equal to par value. For the 6 months ended October 31, 2019, the average market value for Allens common stock was 5 per share and no warrants had yet been exercised. 6. Contingent Liability. On October 31, 2019, Allen was contingently liable for product warranties in an amount estimated to aggregate 75,000. Required: Next Level Review the preceding financial state1nents and related notes. Identify any inclusions or exclusions from them that would be in violation of GAAP, and indicate corrective action to be taken. Do not comment as to format or style. Respond in the following order: 1. Balance sheet 2. Notes 3. Income statement 4. Statement of retained earnings 5. Generalarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Accounting for Finance and Operating Leases | U.S. GAAP CPA Exams; Author: Maxwell CPA Review;https://www.youtube.com/watch?v=iMSaxzIqH9s;License: Standard Youtube License