The current price of Estelle Corporation stock is $25. In each of the next two years, this stock price will either go up by 20% or go down by 20%. The stock pays no dividends. The one-year risk-free interest rate is 6% and will remain constant. Using the Binomial Model, calculate the price of a one-year call option on Estelle stock with a strike price of $25.

To determine: The price of a one year call option on ET stock.

Introduction: A binomial model portrays the development of irregular variables over a progression of time steps, relegating specified probabilities to increase or decrease in the variable. The binomial option pricing model makes the improving supposition that, toward the finish of every period, the price of stocks has just two conceivable values.

Answer to Problem 1P

Explanation of Solution

Determine the increase or decrease in the stock price.

Therefore, the stock price either increases to $30 or decreases to $20

Here

S – Denotes the current stock price

K – Denotes the strike price

C – Denotes the call price

B – Denotes the risk-free investment or initial investment in the portfolio

Su – Denotes the probability of increase in stock price (the price to go up)

Sd – Denotes the probability of decrease in stock price next period (the price to go down)

rf – Denotes the risk-free rate

Cu – Denotes the price of the call option if the stock price increases (the price to go up)

Cd – Denotes the price of the call option if the stock price decreases (the price to go down)

Δ – Denotes the shares of stock in the portfolio or the sensitivity of option price to stock price

Determine the option payoff:

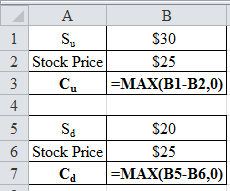

Using Excel function =MAX, the option payoff is determined as follows:

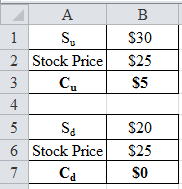

Excel spreadsheet:

Excel workings:

Therefore, the option payoff either increases to $5 or decreases to $0.

Determine the shares of stock in the replicating portfolio:

Therefore, the share of stock in the replicating portfolio is 0.5.

Determine the risk-free investment or initial investment in the portfolio:

Therefore, the risk-free investment or initial investment in the portfolio is -9.4340.

Determine the price of a one year call option on ET stock:

Therefore, the price of a one year call option on ET stock is $3.07.

Want to see more full solutions like this?

Chapter 21 Solutions

Corporate Finance: The Core, Student Value Edition Plus Mylab Finance With Pearson Etext -- Access Card Package (4th Edition)

Additional Business Textbook Solutions

Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Foundations of Finance (9th Edition) (Pearson Series in Finance)

Foundations Of Finance

Marketing: An Introduction (13th Edition)

Financial Accounting, Student Value Edition (4th Edition)

- The current price of KD Industries stock is $20. In the next year the stock price will either go up by 20% or go down by 20%. KD pays no dividends. The one-year risk-free rate is 5% and will remain constant. Using the binomial pricing model, the calculated price of a one-year put option on KD stock with a strike price of $20 is closest to:arrow_forwardThe current price of XL Corporation stock is $40. In each of the next two years, this stock price can either go up by $15.00 or go down by $15.00. XL stock pays no dividends. The one-year risk-free interest rate is 15% and will remain constant. Using the binomial pricing model, calculate the price of a two-year American straddle option on XL stock with a strike price of $40.arrow_forwardThe current stock price is $10. In each of the next two years, the stock price can either go up by $2 or go down by $2. The stock pays no dividends. The one-year risk-free interest rate is 5% and will remain constant during this two-year period. a) Using the Binomial Model of option pricing, calculate the price of a two-year call option on the stock with a strike price of $13. b) Using Risk Neutral valuation calculate the price of two-year put option on the stock with a strike price of $7.arrow_forward

- The current price of MMX Corporation stock is $10. In each of the next two years, this stock price can either go up by $3.00 or go down by $2.00. MMX stock pays no dividends. The one-year risk-free interest rate is 5% and will remain constant. Using the binomial pricing model, calculate the price of a two-year call option on MMX stock with a strike price of $9. PLease answer with solutionarrow_forwardThe common stock of the P.U.T.T. Corporation has been trading in a narrow price range for the past month, and you are convinced it is going to break far out of that range in the next three months. You do not know whether it will go up or down, however. The current price of the stock is $100 per share, and the price of a 3-month call option at an exercise price of $100 is $10.a. If the risk-free interest rate is 10% per year, what must be the price of a 3-month put option on P.U.T.T. stock at an exercise price of $100? (The stock pays no dividends.)b. What would be a simple options strategy to exploit your conviction about the stock price’s future movements? How far would it have to move in either direction for you to make a profit on your initial investment?arrow_forwardThe common stock of the C.A.L.L. Corporation has been trading in a narrow range around $50per share for months, and you believe it is going to stay in that range for the next 3 months. Theprice of a 3-month put option with an exercise price of $50 is $4.a. If the risk-free interest rate is 10% per year, what must be the price of a 3-month call optionon C.A.L.L. stock at an exercise price of $50 if it is at the money? (The stock pays nodividends.)b. What would be a simple options strategy using a put and a call to exploit your convictionabout the stock price’s future movement? What is the most money you can make on thisposition? How far can the stock price move in either direction before you lose money?c. How can you create a position involving a put, a call, and riskless lending that would havethe same payoff structure as the stock at expiration? What is the net cost of establishing thatposition now?arrow_forward

- TreeOlivia's stock price is $180 and could halve or double in each six-month period. The interest rate is 12% a year. What is the value of a six-month call option on TreeOlivia with an exercise price of $120? What is the option delta for the six-month call with an exercise of $120? The payoffs of the six-month call option can be replicated by buying shares of stock and borrowing. What amount should be invested in stock and what amount must be borrowed? Assume the exercise price is $120. What is the value of the one-year call option on TreeOlivia with an exercise of $150? (Hint: use the two-step binominal tree) What is the value of the one-year put option on TreeOlivia with an exercise of $150?arrow_forwardLett Incorporated’s stock price is now $50, but it is expected eitherto rise by a factor of 1.5 or to fall by a factor of 0.7 by the end ofthe year. There is a call option on Lett’s stock with a strike price of$55 and an expiration date 1 year from now. What are the stock’spossible prices at the end of the year? ($75 or $35) What is thecall option’s payoff if the stock price goes up? ($20) If the stockprice goes down? ($0) If we sell 1 call option, how many sharesof Lett’s stock must we buy to create a riskless hedged portfolioconsisting of the option position and the stock? (0.5) What is thepayoff of this portfolio? ($17.50) If the annual risk-free rate is 6%,then how much is the riskless portfolio worth today (assumingdaily compounding)? ($16.48) What is the current value of the calloption? ($8.52)arrow_forwardThe current price of a stock is $22, and at the end of one year its price will be either $29 or $15. The annual risk-free rate is 3%, based on daily compounding. A 1-year call option on the stock, with an exercise price of $22, is available. Based on the binominal model, what is the option's value?arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning