Concept explainers

Statement of

• LO21–4, LO21–8

Refer to the data provided in the P 21–11 for Arduous Company.

Required:

Prepare the statement of cash flows for Arduous Company using the indirect method. (Note: The following problems use the technique learned in Appendix 21B.)

P 21–11 Prepare a statement of cash flows; direct method

• LO21–3, LO21–8

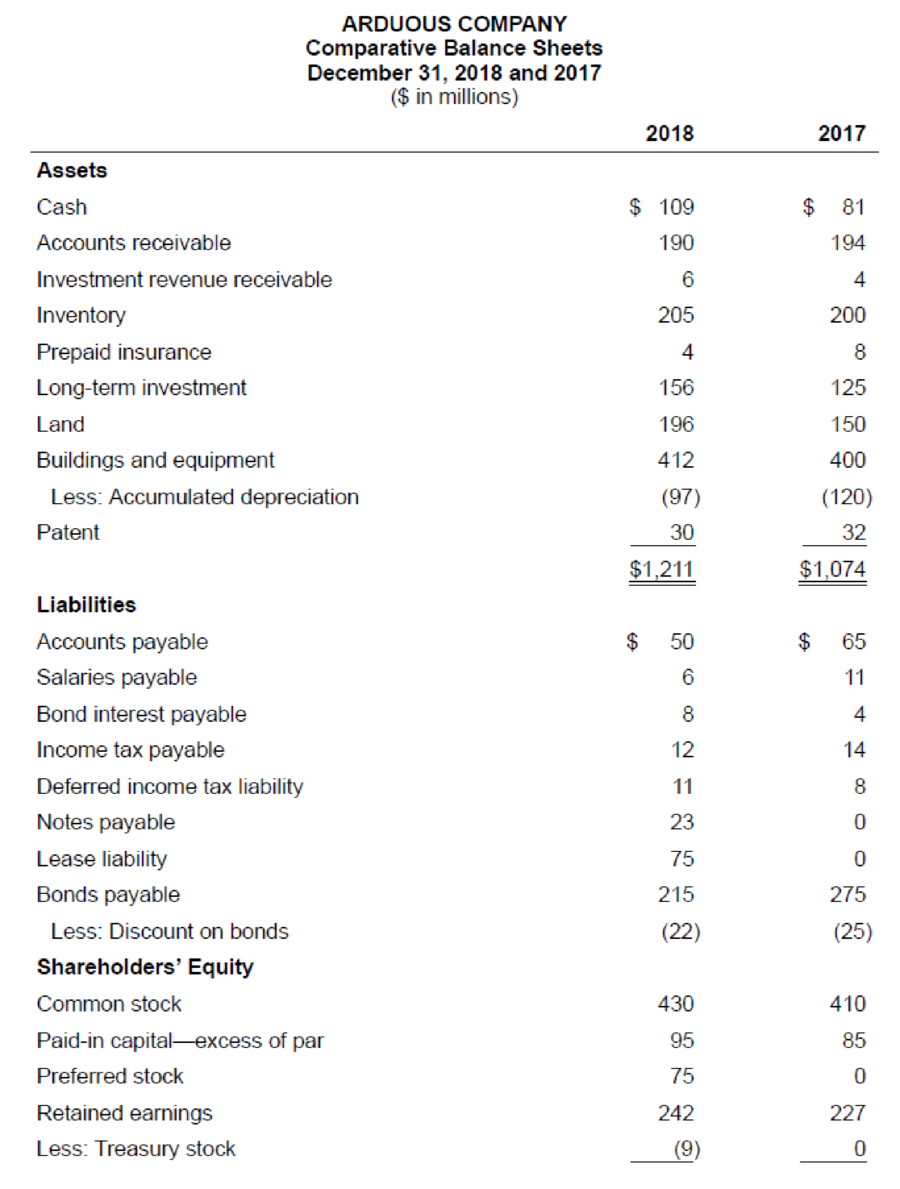

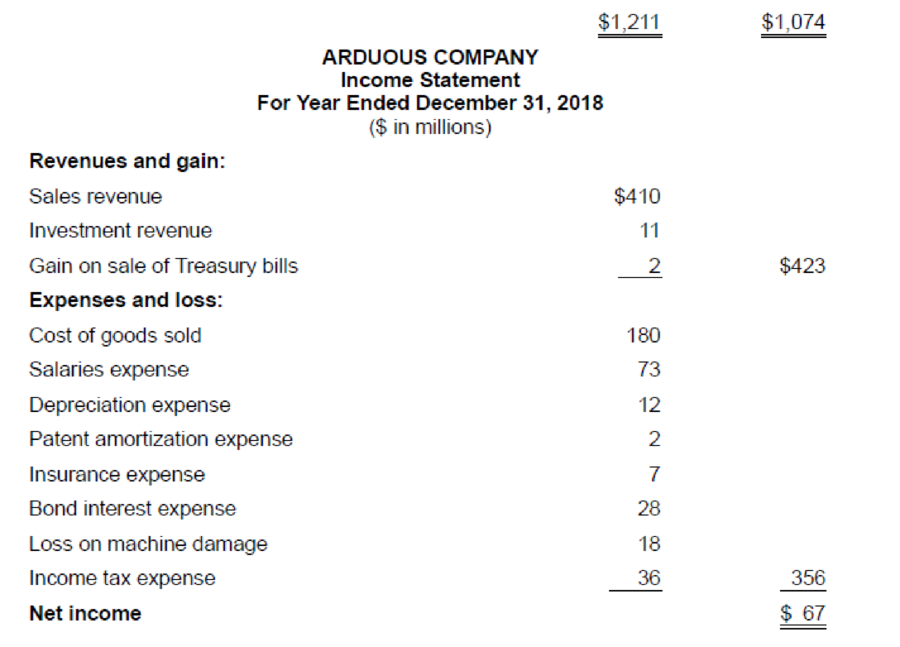

The comparative balance sheets for 2018 and 2017 and the income statement for 2018 are given below for Arduous Company. Additional information from Arduous’s accounting records is provided also.

Additional information from the accounting records:

- a. Investment revenue includes Arduous Company’s $6 million share of the net income of Demur Company, an equity method investee.

- b. Treasury bills were sold during 2018 at a gain of $2 million. Arduous Company classifies its investments in Treasury bills as cash equivalents.

- c. A machine originally costing $70 million that was one-half

depreciated was rendered unusable by a flood. Most major components of the machine were unharmed and were sold for $17 million. - d. Temporary differences between pretax accounting income and taxable income caused the

deferred income tax liability to increase by $3 million. - e. The

preferred stock of Tory Corporation was purchased for $25 million as a long-term investment. - f. Land costing $46 million was acquired by issuing $23 million cash and a 15%, four-year, $23 million note payable to the seller.

- g. The right to use a building was acquired with a 15-year lease agreement; present value of lease payments, $82 million. Annual lease payments of $7 million are paid at the beginning of each year starting January 1, 2018.

- h. $60 million of bonds were retired at maturity.

- i. In February, Arduous issued a 4% stock dividend (4 million shares). The market price of the $5 par value common stock was $7.50 per share at that time.

- j. In April, 1 million shares of common stock were repurchased as

treasury stock at a cost of $9 million.

Required:

Prepare the statement of cash flows of Arduous Company for the year ended December 31, 2018. Present cash flows from operating activities by the direct method. (A reconciliation schedule is not required.)

Statement of cash flows: This statement reports all the cash transactions which are responsible for inflow and outflow of cash and result of these transactions is reported as ending balance of cash at the end of reported period.

To Prepare: The statement of cash flows of Company A.

Explanation of Solution

Spreadsheet: The spreadsheet is a supplementary device which helps to prepare the adjusting entries and the statement of cash flows easier. The spreadsheet is a working tool of the accountant but it is not a permanent accounting record.

The spreadsheet, for the statement of cash flow analysis, is shown below.

| Company A | ||||

| Spreadsheet for the Statement of Cash Flows | ||||

| Amount in Millions | ||||

| Particulars | December 31,2017 Amount ($) | Changes | December 31,2018 Amount ($) | |

| Debit ($) | Credit ($) | |||

| Assets | ||||

| Current Assets | ||||

| Cash | $81 | (21) $28 | $109 | |

| Accounts receivable | $194 | (1) $4 | $190 | |

| Investment revenue receivable | $4 | (2) $2 | $6 | |

| Inventory | $200 | (4) $5 | $205 | |

| Prepaid insurance | $8 | (8) $4 | $4 | |

| Long-term investment | $125 | (2) $6 (13) $25 | $156 | |

| Land | $150 | (14) $46* | $196 | |

| Buildings and equipment | $400 | (15) $82* | (10) $70 | $412 |

| Less: Depreciation | ($120) | (10) $35 | (6) $12 | ($97) |

| Patent | $32 | (7) $2 | $30 | |

| Total current assets | $1,074 | $1,211 | ||

| Liabilities and Stockholders’ Equity | ||||

| Liabilities | ||||

| Accounts payable | $65 | (4) $15 | $50 | |

| Salaries payable | $11 | (5) $5 | $6 | |

| Bond interest payable | $4 | (9) $4 | $8 | |

| Income tax payable | $14 | (11) $2 | $12 | |

| Deferred tax liability | $8 | (11) $3 | $11 | |

| Notes payable | $0 | (14) $23* | $23 | |

| Lease liability | $0 | (15) $7 | (15) $82* | $75 |

| Bonds payable | $275 | (16) $60 | $215 | |

| Less: Discount | ($25) | (9) $3 | ($22) | |

| Stockholders’ equity | ||||

| Common Stock | $410 | (17) $20 | $430 | |

| Paid-in capital—excess of par | $85 | (17) $10 | $95 | |

| Preferred stock | $0 | (18) $75 | $75 | |

| Retained Earnings | $227 | (17) $30/ (19) $22 | (12) $67 | $242 |

| Less: Treasury Stock | $0 | (20) $9 | ($9) | |

| Total liabilities and stockholders’ equity | $1,074 | $1,211 | ||

| Statement of Cash Flows | ||||

| Net income | (1) $67 | |||

| Adjustments for noncash effects: | ||||

| Depreciation expense | (2) $12 | |||

| Patent amortization expense | (3) $2 | |||

| Amortization of discount | (4) $3 | |||

| Decrease in accounts receivable | (5) $4 | |||

| Increase in investment revenue receivable | (6) $2 | |||

| Equity method income | (7) $6 | |||

| Decrease in prepaid insurance | (8) $4 | |||

| Increase in inventory | (9) $5 | |||

| Decrease in accounts payable | (10) $15 | |||

| Decrease in salaries payable | (11) $5 | |||

| Increase in interest payable | (12) $4 | |||

| Decrease in tax payable | (13) $2 | |||

| Increase in deferred tax liability | (14) $3 | |||

| Loss on machine damage | (15) $18 | |||

| Net cash flows | $82 | |||

| Investing activities: | ||||

| Sale of machine components | (15) $17 | |||

| Purchase of Long Term investment | (16) $25 | |||

| Purchase of land | (17) $23 | |||

| Net cash flows | ($31) | |||

| Financing activities: | ||||

| Payment on lease liability | (15) $7 | |||

| Retirement of bonds payable | (19) $60 | |||

| Sale of preferred stock | (21) $75 | |||

| Payment of cash dividends | (22) $22 | |||

| Purchase of treasury stock | (23) $9 | |||

| Net cash flows | ($23) | |||

| Net decrease in cash | (24) $28 | $28 | ||

| Total | $588 | $588 | ||

Table (1)

Operating activities: Operating activities refer to the normal activities of a company to carry out the business. The examples for operating activities are purchase of inventory, payment of salary, sales, and others.

Investing activities: Investing activities refer to the activities carried out by a company for acquisition of long term assets. The examples for investing activities are purchase of equipment, long term investment, sale of land, and others.

Financing activities: Financing activities refer to the activities carried out by a company to mobilize funds to carry out the business activities. The examples for financing activities are purchase of bonds, issuance of common shares, and others.

The spreadsheet of Company A shows the analysis of cash flows in the reporting year 2018.

| Company R | ||

| Statement of Cash Flows | ||

| For year ended December 31, 2018 | ||

| Amount in Millions | ||

| Particulars | Amount ($) | Amount ($) |

| Net income | $67 | |

| Adjustments for non-cash effects: | ||

| Depreciation expense | $12 | |

| Patent amortization expense | $2 | |

| Amortization of discount | $3 | |

| Decrease in accounts receivable | $18 | |

| Changes in operating assets and liabilities: | ||

| Decrease in accounts receivable | $4 | |

| Increase in investment revenue receivable | ($2) | |

| Equity method income | ($6) | |

| Decrease in prepaid insurance | $4 | |

| Increase in inventory | ($5) | |

| Decrease in accounts payable | ($15) | |

| Decrease in salaries payable | ($5) | |

| Increase in interest payable | $4 | |

| Decrease in tax payable | ($2) | |

| Increase in deferred tax liability | $3 | |

| Net cash outflow from operating activities | $82 | |

| Investing activities: | ||

| Sale of machine components | $17 | |

| Purchase of Long Term investment | ($25) | |

| Purchase of land | ($23) | |

| Net cash flows from investing activities | ($31) | |

| Financing activities: | ||

| Payment on lease liability | ($7) | |

| Retirement of bonds payable | ($60) | |

| Sale of preferred stock | $75 | |

| Payment of cash dividends | ($22) | |

| Purchase of treasury stock | ($9) | |

| Net cash flows from financing activities | ($23) | |

| Net decrease in cash | $28 | |

| Cash balance, January 1, 2018 | $81 | |

| Cash balance, December 31, 2018 | $109 | |

Table (2)

The statement of cash flows of Company A, shows opening balance of cash flows for the reporting year 2018 as $81 million and the closing balance of cash as $109 million.

Note:

*Non Cash investing activity and financing activity:

- Company A acquired a building on 15 year lease for $82 million.

- Company A acquired a land for $46 million, by:

- Paying Cash of $23 million;

- Issuing 4-year note for $23 million.

Want to see more full solutions like this?

Chapter 21 Solutions

Intermediate Accounting

- Exercise 21-31 (Static) Statement of cash flows; indirect method [LO21-4, 21-5, 21-6, 21-8, Appendix 21A] Comparative balance sheets for 2024 and 2023, a statement of income for 2024, and additional information from the accounting records of Red, Incorporated, are provided below: RED, INCORPORATED Comparative Balance Sheets December 31, 2024 and 2023 ($ in millions) 2024 2023 Assets Cash $ 24 $ 110 Accounts receivable 178 132 Prepaid insurance 7 3 Inventory 285 175 Buildings and equipment 400 350 Less: Accumulated depreciation (119) (240) $ 775 $ 530 Liabilities Accounts payable $ 87 $ 100 Accrued liabilities 6 11 Notes payable 50 0 Bonds payable 160 0 Shareholders’ Equity Common stock 400 400 Retained earnings 72 19 $ 775 $ 530 RED, INCORPORATED Statement of Income For Year Ended December 31, 2024 ($ in millions) Revenues Sales revenue $ 2,000 Expenses Cost of goods sold $ 1,400…arrow_forwardProblem 21-17 (Algo) Statement of cash flows; indirect method [LO21-4, 21-8] Comparative balance sheets for 2021 and 2020 and a statement of income for 2021 are given below for Metagrobolize Industries. Additional information from the accounting records of Metagrobolize also is provided. METAGROBOLIZE INDUSTRIESComparative Balance SheetsDecember 31, 2021 and 2020($ in thousands) 2021 2020 Assets Cash $ 405 $ 245 Accounts receivable 350 190 Inventory 500 275 Land 500 450 Building 900 900 Less: Accumulated depreciation (200 ) (180 ) Equipment 2,500 2,150 Less: Accumulated depreciation (325 ) (300 ) Patent 1,000 1,150 $ 5,630 $ 4,880 Liabilities Accounts payable $ 600 $ 400 Accrued liabilities 150 130 Lease liability—land 130 0 Shareholders' Equity Common stock…arrow_forward#202 Which of the following is true concerning the statement of cash flows? Question 202 options: a When pension expense exceeds cash funding, the difference is deducted from investing activities on the statement of cash flows. b Under GAAP, the purchase of land by issuing stock will be shown as a cash outflow under investing activities and a cash inflow under financing activities. c The FASB requires companies to classify all income taxes paid as operating cash outflows. d All of these are true concerning the statement of cash flows.arrow_forward

- Appendix 2PR 13-4B Statement of cash flows—direct method The comparative balance sheet of Martinez Inc. for December 31, 20Y4 and 20Y3, is as follows:Dec. 31, 20Y4Dec. 31, 20Y3AssetsCash .....................................................$ 661,920$ 683,100Accounts receivable (net) .................................. 992,640 914,400Inventories ...............................................1,394,4001,363,800Investments ..............................................0432,000Land ..................................................... 960,0000Equipment................................................1,224,000 984,000Accumulated depreciation—equipment ....................(481,500)(368,400)Total assets ...............................................$4,751,460$4,008,900Liabilities and Stockholders’ EquityAccounts payable (merchandise creditors) ..................$1,080,000$ 966,600Accrued expenses payable (operating expenses) ............67,80079,200Dividends…arrow_forwardExercise 21-27 (Algo) Statement of cash flows; direct method [LO21-3, 21-5, 21-6, 21-8] Comparative balance sheets for 2024 and 2023, a statement of income for 2024, and additional information from the accounting records of Red, Incorporated, are provided below: RED, INCORPORATED Comparative Balance Sheets December 31, 2024 and 2023 ($ in millions) 2024 2023 Assets Cash $ 26 $ 114 Accounts receivable 203 134 Prepaid insurance 11 6 Inventory 289 177 Buildings and equipment 384 352 Less: Accumulated depreciation (121) (242) $ 792 $ 541 Liabilities Accounts payable $ 90 $ 104 Accrued liabilities 10 15 Notes payable 52 0 Bonds payable 161 0 Shareholders’ Equity Common stock 402 402 Retained earnings 77 20 $ 792 $ 541 RED, INCORPORATED Statement of Income For Year Ended December 31, 2024 ($ in millions) Revenues Sales revenue $ 2,010 Expenses Cost of goods sold $ 1,439 Depreciation expense 41…arrow_forwardRefer to the information for Cornett Company above. What amount should Cornett report on its statement of cash flows as net cash flows provided by investing activities? a. $(5,200) b. $55,200 c. $144,800 d. None of thesearrow_forward

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning