Concept explainers

Statement of

• LO21–3, LO21–8

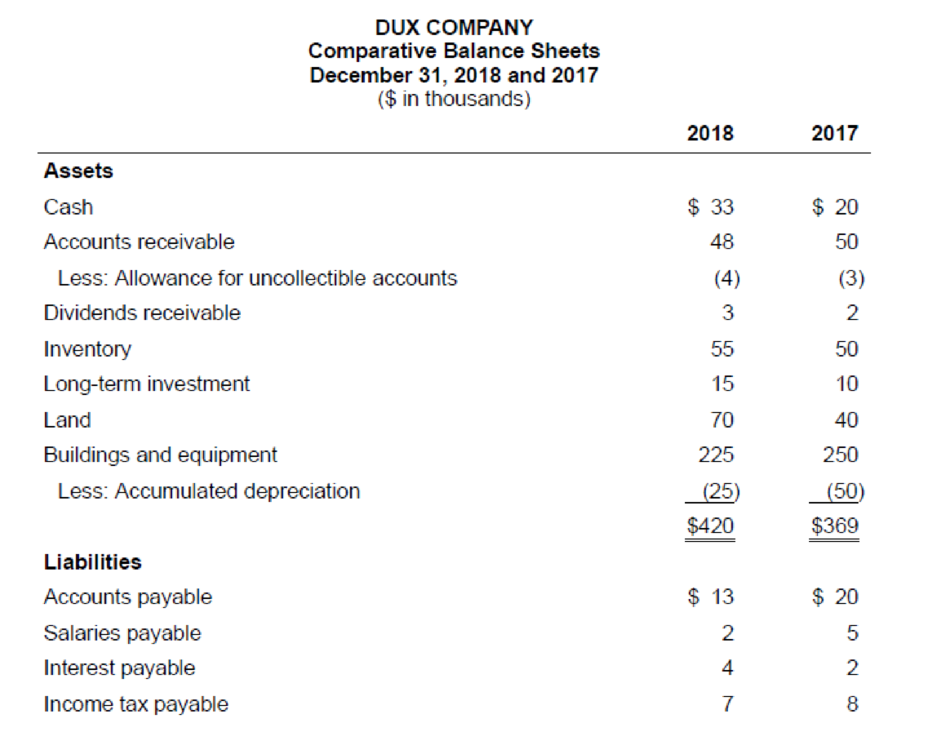

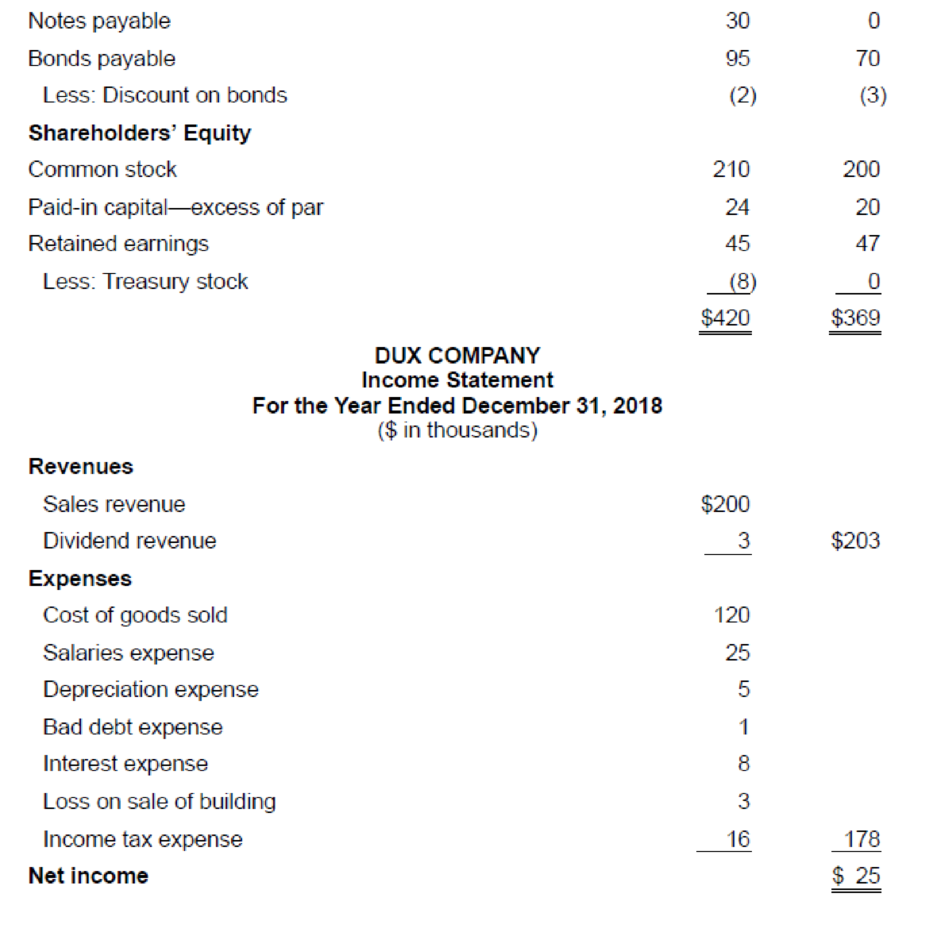

The comparative balance sheets for 2018 and 2017 and the statement of income for 2018 are given below for Dux Company. Additional information from Dux’s accounting records is provided also.

Additional information from the accounting records:

a. A building that originally cost $40,000, and which was three-fourths

b. The common stock of Byrd Corporation was purchased for $5,000 as a long-term investment.

c. Property was acquired by issuing a 13%, seven-year, $30,000 note payable to the seller.

d. New equipment was purchased for $15,000 cash.

e. On January 1, 2018, bonds were sold at their $25,000 face value.

f. On January 19, Dux issued a 5% stock dividend (1,000 shares). The market price of the $10 par value common stock was $14 per share at that time.

g. Cash dividends of $13,000 were paid to shareholders.

h. On November 12, 500 shares of common stock were repurchased as

Required:

Prepare the statement of cash flows of Dux Company for the year ended December 31, 2018. Present cash flows from operating activities by the direct method. (You may omit the schedule to reconcile net income to cash flows from operating activities.)

Statement of cash flows: This statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as the ending balance of cash at the end of the accounting period.

Direct method:

This method uses the basis of cash for preparing the cash flows of statement.

Operating activities:

Operating activities refer to the normal activities of a company to carry out the business. The examples for operating activities are purchase of inventory, payment of salary, sales, and others.

Investing activities:

Investing activities refer to the activities carried out by a company for acquisition of long term assets. The examples for investing activities are purchase of equipment, long term investment, sale of land, and others.

Financing activities:

Financing activities refer to the activities carried out by a company to mobilize funds to carry out the business activities. The examples for financing activities are purchase of bonds, issuance of common shares, and others.

To prepare: The statement of cash flow of Company D under direct method for the year ended December 31, 2018.

Explanation of Solution

Spreadsheet:

The spreadsheet is a supplementary device which helps to prepare the adjusting entries and the statement of cash flows easier. The spreadsheet is a working tool of the accountant but it is not a permanent accounting record.

Spreadsheet for the Statement of cash flows of DUX Company:

| DUX Company | ||||

| Spreadsheet for the Statement of Cash Flows | ||||

| Amount in Millions | ||||

| Particulars | December 31,2017 Amount ($) | Changes | December 31,2018 Amount ($) | |

| Debit ($) | Credit ($) | |||

| Assets | ||||

| Assets | ||||

| Cash | 20 | (17) 13 | 33 | |

| Accounts receivable | 50 | (1) 2 | 48 | |

| Less: Allowance | (3) | (1) 1 | (4) | |

| Dividends receivable | 2 | (2) 1 | 3 | |

| Inventory | 50 | (3) 5 | 55 | |

| Long term investment | 10 | (10) 5 | 15 | |

| Land | 40 | (11) 30 X | 70 | |

| Buildings and equipment | 250 | (12) 15 | (7) 40 | 225 |

| Less: Acc. depreciation | (50) | (7) 30 | (5) 5 | (25) |

| Total assets | 369 | 420 | ||

| Liabilities and Stockholders’ Equity | ||||

| Liabilities | ||||

| Accounts payable | 20 | (3) 7 | 13 | |

| salaries payable | 5 | (4) 3 | 2 | |

| Interest payable | 2 | (6) 2 | 4 | |

| Income tax payable | 8 | (8) 1 | 7 | |

| Notes payable | 0 | X (11) 30 | 30 | |

| Bonds payable | 70 | (13) 25 | 95 | |

| Less: Discount on bonds | (3) | (6) 1 | (2) | |

| Stockholders’ equity | ||||

| Common Stock | 200 | (14) 10 | 210 | |

| Paid in capital –ex of par | 20 | (14) 4 | 24 | |

| Retained Earnings | 47 | (14) 14 | ||

| (15) 13 | (9) 25 | 45 | ||

| Less: Treasury stock | 0 | (16) 8 | (8) | |

| Total liabilities and stockholders’ equity | 369 | 420 | ||

| Income Statement | ||||

| Revenues | ||||

| Sales revenue | (1) 200 | 200 | ||

| Dividend revenue | (2) 3 | 3 | ||

| Expenses | ||||

| Cost of goods sold | (3) 120 | (120) | ||

| Salaries expense | (4) 25 | (25) | ||

| Depreciation expense | (5) 5 | (5) | ||

| Bad debt expense | (1) 1 | (1) | ||

| Interest expenses | (6) 8 | (8) | ||

| Loss on sale of building | (7) 3 | (3) | ||

| Income tax expense | (8) 16 | (16) | ||

| Net income | (9) 25 | 25 | ||

| Statement of Cash Flows | ||||

| Operating activities: | ||||

| Cash Inflows: | ||||

| From customers | (1) 202 | |||

| From dividends received | (2) 2 | |||

| Cash Outflows: | ||||

| To suppliers of goods | (3) 132 | |||

| To employees | (4) 28 | |||

| For interest | (6) 5 | |||

| For income taxes | (8) 17 | |||

| Net cash flows | 22 | |||

| Investing activities: | ||||

| Sale of building | (7) 7 | |||

| Purchase of long term investment | (10) 5 | |||

| Purchase of equipment | (12) 15 | |||

| Net cash flows | (13) | |||

| Financing activities: | ||||

| Sale of bonds payable | (13) 25 | |||

| Payment of cash dividends | (15) 13 | |||

| Purchase of treasury stock | (16) 8 | |||

| Net cash flows | 4 | |||

| Net increase in cash | (17) 13 | 13 | ||

| Total | 584 | 584 | ||

Table (1)

Note (X):

Purchase $30,000 worth of land by issuing a 13%, 7-year note is considered as non cash investing and financing activities.

The spreadsheet of Company D shows the analysis of cash flows in the reporting year 2018:

| DUX Company | ||

| Statement of Cash Flows (Direct Method) | ||

| Year Ended December 31, 2018 | ||

| Details | Amount ($) | Amount ($) |

| Cash flows from operating activities: | ||

| Cash inflows: | ||

| From customers | 202 | |

| From dividends received | 2 | |

| Cash outflows: | ||

| To suppliers of goods | (132) | |

| To employees | (28) | |

| For interest | (5) | |

| For income taxes | (17) | |

| Net cash flows from operating activities | 22 | |

| Cash flows from investing activities: | ||

| Sale of building | 7 | |

| Purchase of long-term investment | (5) | |

| Purchase of equipment | (15) | |

| Net cash flows from investing activities | (13) | |

| Cash flows from financing activities: | ||

| Sale of bonds payable | 25 | |

| Purchase of treasury stock | (8) | |

| Payment of cash dividends | (13) | |

| Net cash flows from financing activities | 4 | |

| Net increase in cash | 13 | |

| Cash balance, January 1, | 20 | |

| Cash balance, December 31, | 33 | |

Table (2)

Note (X):

| Schedule of Non Cash Investing and Financing Activities: | ||

| Purchase of land issuing notes payable | $30 |

Table (3)

Hence, the opening cash balance is $20 million and closing cash balance is $33 million.

Want to see more full solutions like this?

Chapter 21 Solutions

Intermediate Accounting

- Statement of cash flows direct method The comparative balance sheet of Martinez Inc. for December 31, 20Y4 and 20Y3, is as follows: Dec. 31, 20Y4 Dec. 31, 20Y3 Assets Cash 661,920 683,100 Accounts receivable (net) 992,640 914,400 Inventories 1,394,400 1,363,800 Investments 0 432,000 Land 960,000 0 Equipment 1,224,000 984,000 Accumulated depreciationequipment (481,500) (368,400) Total assets 4,751,460 4,008,900 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) 1,080,000 966,600 Accrued expenses payable (operating expenses) 67,800 79,200 Dividends payable 100,800 91,200 Common stock, 5 par 130,000 30,000 Paid in capital: Excess of issue price over parcommon stock 950,000 450,000 Retained earnings 2,422,860 2,391,900 Total liabilities and stockholders' equity 4,751,460 4,008,900 The income Statement for the year ended December 51. 20Y3. is as follows: Sales 4,512,000 Cost of goods sold 2,352,000 Gross profit 2,160,000 Operating expenses: Depredation expense 113,100 Other operating expenses 1,344,840 Total operating expenses 1,457,940 Operating income 702,060 Other income: Gain on sale of investments 156,000 Income before income tax 858,060 Income tax expense 299,100 Net income 558,960 Additional data obtained from an examination of the accounts in the ledger for 20Y3 are as follows: A. Equipment and land were acquired for cash. B. There were no disposals of equipment during the year. C. The investments were sold for 588,000 cash. D. The common stock was issued for cash. E. There was a 528,000 debit to Retained Earnings for cash dividends declared. Instructions Prepare a statement of cash flows, using the direct method of presenting cash flows from operating activities.arrow_forwardQ 23.21: Last year, Alpha Corporation spent $250,000 to repurchase 15,000 shares of its own outstanding common stock. The company also paid $40,000 in interest on a construction loan that it had obtained from its bank. How should these transactions be reflected on Alpha’s annual statement of cash flows, and why? A : The two transactions should be reported in separate sections of the statement because one involves long-term assets while the other involves long-term liability. Specifically, Alpha should record a $250,000 cash outflow in the investing section and a $40,000 cash outflow in the financing section. B : The two transactions should be reported in separate sections of the statement because one involves a change in equity while the other involves a change in income. Specifically, Alpha should record a $250,000 cash outflow in the financing section and a $40,000 cash outflow in the operating section. C : Both transactions should be reported in the…arrow_forwardProblem 11-4A Prepare a statement of cash flows—indirect method (LO11-2, 11-3, 11-4, 11-5) The income statement, balance sheets, and additional information for Video Phones, Inc., are provided. VIDEO PHONES, INC. Income Statement For the Year Ended December 31, 2021 Net sales $ 2,636,000 Expenses: Cost of goods sold $ 1,600,000 Operating expenses 788,000 Depreciation expense 20,000 Loss on sale of land 7,300 Interest expense 11,500 Income tax expense 41,000 Total expenses 2,467,800 Net income $ 168,200 VIDEO PHONES, INC. Balance Sheets December 31 2021 2020 Assets Current assets: Cash $ 159,180 $ 85,940 Accounts receivable 73,300 53,000 Inventory 105,000 128,000 Prepaid rent 9,120 4,560 Long-term assets: Investments 98,000…arrow_forward

- Problem 21-4 (Algo) Statement of cash flows; direct method [LO21-3, 21-8] The comparative balance sheets for 2021 and 2020 and the statement of income for 2021 are given below for Dux Company. Additional information from Dux's accounting records is provided also. DUX COMPANYComparative Balance SheetsDecember 31, 2021 and 2020($ in thousands) 2021 2020 Assets Cash $ 49 $ 24 Accounts receivable 46 53 Less: Allowance for uncollectible accounts (3 ) (2 ) Dividends receivable 3 2 Inventory 65 60 Long-term investment 21 18 Land 85 60 Buildings and equipment 273 290 Less: Accumulated depreciation (70 ) (90 ) $ 469 $ 415 Liabilities Accounts payable $ 35 $ 43 Salaries payable 3 7 Interest payable 7 2 Income tax payable 8 9 Notes payable 25 0 Bonds payable…arrow_forwardRequired information Exercise 21-13 (Static) Identifying cash flows from investing activities and financing activities [LO21-5, 21-6] [The following information applies to the questions displayed below.] In preparation for developing its statement of cash flows for the year ended December 31, 2024, Rapid Pac, Incorporated, collected the following information: ($ in millions) Fair value of shares issued in a stock dividend $ 65 Payment for the early extinguishment of long-term bonds (book value: $97 million) 102 Proceeds from the sale of treasury stock (cost: $17 million) 22 Gain on sale of land 4 Proceeds from sale of land 12 Purchase of Microsoft common stock 160 Declaration of cash dividends 44 Distribution of cash dividends declared in 2023 40 Exercise 21-13 (Static) Part 1 Required: 1. In Rapid Pac’s statement of cash flows, what were net cash inflows (or outflows) from investing activities for 2024? Note: Cash outflows should be indicated with a…arrow_forwardExercise 21-31 (Static) Statement of cash flows; indirect method [LO21-4, 21-5, 21-6, 21-8, Appendix 21A] Comparative balance sheets for 2024 and 2023, a statement of income for 2024, and additional information from the accounting records of Red, Incorporated, are provided below: RED, INCORPORATED Comparative Balance Sheets December 31, 2024 and 2023 ($ in millions) 2024 2023 Assets Cash $ 24 $ 110 Accounts receivable 178 132 Prepaid insurance 7 3 Inventory 285 175 Buildings and equipment 400 350 Less: Accumulated depreciation (119) (240) $ 775 $ 530 Liabilities Accounts payable $ 87 $ 100 Accrued liabilities 6 11 Notes payable 50 0 Bonds payable 160 0 Shareholders’ Equity Common stock 400 400 Retained earnings 72 19 $ 775 $ 530 RED, INCORPORATED Statement of Income For Year Ended December 31, 2024 ($ in millions) Revenues Sales revenue $ 2,000 Expenses Cost of goods sold $ 1,400…arrow_forward

- Exercise 21-27 (Algo) Statement of cash flows; direct method [LO21-3, 21-5, 21-6, 21-8] Comparative balance sheets for 2024 and 2023, a statement of income for 2024, and additional information from the accounting records of Red, Incorporated, are provided below: RED, INCORPORATED Comparative Balance Sheets December 31, 2024 and 2023 ($ in millions) 2024 2023 Assets Cash $ 26 $ 114 Accounts receivable 203 134 Prepaid insurance 11 6 Inventory 289 177 Buildings and equipment 384 352 Less: Accumulated depreciation (121) (242) $ 792 $ 541 Liabilities Accounts payable $ 90 $ 104 Accrued liabilities 10 15 Notes payable 52 0 Bonds payable 161 0 Shareholders’ Equity Common stock 402 402 Retained earnings 77 20 $ 792 $ 541 RED, INCORPORATED Statement of Income For Year Ended December 31, 2024 ($ in millions) Revenues Sales revenue $ 2,010 Expenses Cost of goods sold $ 1,439 Depreciation expense 41…arrow_forwardStatement of cash flowsdirect method applied to PR 131B The comparative balance sheet of Merrick Equipment Co. for Dec. 31, 20Y9 and 20Y8, is: Dec. 31, 20Y9 Dec. 31, 20Y8 Assets Cash 70,720 47,940 Accounts receivable (net) 207,230 188,190 Inventories 298,520 289,850 Investments 0 102,000 Land 295,800 0 Equipment 438,600 358,020 Accumulated depreciationequipment (99,110) (84,320) Total assets 1,211,760 901,680 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors).................. 205,700 194,140 Accrued expenses payable (operating expenses) 30,600 26,860 Dividends payable 25,500 20,400 Common stock. 1 par 202,000 102,000 Paid-in capital: Excess of issue price over parcommon stock 354,000 204,000 Retained earnings 393,960 354,280 Total liabilities and stockholders' equity 1,211,760 901,680 The income statement for the year ended December 31,20Y9, is as fallow s: Sales 2,023,898 Cost of goods sold 1,245,476 Gross profit 778,422 Operating expenses: Depreciation expense 14,790 Other operating expenses 517,299 Total operating expenses 532,089 Operating income 246,333 Other expenses: Loss on sale of investments (10,200) Income before income tax 236,133 Income tax expense 94,453 Net income 141,680 Additional data obtained from an examination of the- accounts in the ledger for 20Y9 are as follows: A. Equipment and land were acquired for cash. B. There were no disposals of equipment during the year. C. The investments were sold for 91,800 cash. D. The common stock was issued for cash. E. There was a 102,000 debit to Retained Earnings for cash dividends declared. Instructions Prepare a statement of cash flows, using the direct method of presenting cash flows from operating activities.arrow_forwardStatement of cash flows direct method applied to PR 131A The comparative balance sheet of Livers Inc. for December 31, 20Y3 and 20Y2 is as follows: Dec. 31, 20Y3 Dec. 31, 20Y2 Assets Cash 155,000 150,000 Accounts receivable (net) 450,000 400,000 Inventories 770,000 750,000 Investments 0 100,000 Land 500,000 0 Equipment 1,400,000 1,200,000 Accumulated depreciationequipment (600,000) (500,000) Total assets Liabilities and Stockholders' Equity 2,675,000 2,100,000 Accounts payable (merchandise creditors) 340,000 300,000 Accrued expenses payable (operating expenses) 45,000 50,000 Dividends payable 30,000 25,000 Common stock, 4 par 700,000 600,000 Paid-in capital: Excess of issue price over parcommon stock 200,000 175,000 Retained earnings 1,360,000 950,000 Total liabilities and stockholders' equity 2,675,000 2,100,000 The income statement for the year ended December 31, 20Y3, is as follows: Sales 3,000,000 Cost of goods sold 1,400,000 Gross profit 1,600,000 Operating expenses: Depreciation expense 100,000 Other operating expenses. 950,000 Total operating expenses 1,050,000 Operating income 550,000 Gain on sale of investments 75,000 Income before income tax 625,000 Income tax expense 125,00 Net income 500,000 Additional data obtained from an examination of the accounts in the ledger for 20Y3 are as follows: A. The investments were sold for 175,000 cash. B. Equipment and land were acquired for cash. C. There were no disposals of equipment during the year. D. The common stock was issued for cash. E. There was a 90,000 debit to Retained Earnings for cash dividends declared. Instructions Prepare a .statement of cash flows, using the direct method of presenting cash flows from operating activities.arrow_forward

- Statement of cash flowsdirect method applied to PR 1618 The Comparative balance sheet of Merrick Equipment Co. for Dec. 31, 20Y9 and 20Y8, is as follows: Dec. 31, 20Y9 Dec. 31, 20Y8 Assets Cash.................................. 70,720 47,940 Accounts receivable (net).................................. 207,230 188,190 Inventories............................................... 298,520 289,850 Investments.............................................. 0 102,000 Land..................................................... 295,800 0 Equipment................................................ 438,600 358,020 Accumulated depreciationequipment.................... (99,110) (184,320) Total assets............................................ 1,211,760 901,680 Liabilities and Stockholders' Equity Accounts payable......................................... 205,700 194,140 Accrued expenses payable................................. 30,600 26,860 Dividends payable....................................... 25,500 20,400 Common stock, 1 par..................................... 202,000 102,000 Paid-in capital: Excess of issue price over parcommon stock...... 354,000 204,000 Retained earnings......................................... 393,960 354,280 Total liabilities and stockholders' equity.................. 1,211,760 901,680 The income statement for the year ended December 31. 20Y9, is as follows: Sales........................................... 2,023,898 Cost of merchandise sold........................ 1,245,476 Gross profit..................................... 778,422 Operating expenses: Depreciation expense........................ 14,790 Other operating expenses.................... 517,299 Total operating expenses.................. 532,089 Operating income............................... 246,333 Other expenses: Loss on sale of investments................... (10,200) Income before income tax....................... 236,133 Income tax expense............................. 94,453 Net income..................................... 141,680 Additional data obtained from an examination of the accounts in the ledger for 20Y9 are as follows: a. Equipment and land were acquired for cash. b. There were no disposals of equipment during the year. c. The investments were sold for 91,800 cash. d. The common stock was issued for cash. e. There was a 102,000 debit to Retained Earnings for cash dividends declared. Instructions Prepare a statement of cash flows, using the direct method of presenting cash flows from operating activities.arrow_forwardStatement of cash flowsdirect method The comparative balance sheet of Martinez Inc. for December 31, 20Y4 and 20Y3, is as follows: Dec 31, 20Y4 Dec. 31,20Y3 Assets Cash.................................. 661,920 683,100 Accounts receivable (net).................................. 992,640 0 914,400 Inventories............................................... 1,394,40 1,363,800 Investments.............................................. 0 432,000 Land..................................................... 960,000 0 Equipment................................................ 1,224,000 984,000 Accumulated depreciationequipment.................... (481,500) (368,400) Total assets............................................ 4,751,460 4,008,900 Liabilities and Stockholders' Equity Accounts payable......................................... 1,080,000 966,600 Accrued expenses payable................................ 67,800 79,200 Dividends payable.................................. 100,800 91,200 Common stock. S par .................................... 130,000 30,000 Paid in capital: Excess of issue price over parcommon stock...... 950,000 450,000 Retained earnings......................................... 2,422,860 2,391,900 Total liabilities and stockholders' equity.................. 4,751,460 4,008,900 The income statement for the year ended December 31, 20Y4, is as follows: Sales.......................................... 4,512,000 Cost of merchandise sold....................... 2,352,000 Gross profit.................................... 2,160,000 Operating expenses: Depreciation expense....................... 113,100 Other operating expenses................... 1,344,840 Total operating expenses................. 1,457,940 Operating income.............................. 702,060 Other income: Gain on sale of investments.................. 156,000 Income before income tax...................... 858,060 Income tax expense............................ 299,100 Net income.................................... 558,960 Additional data obtained from an examination of the accounts in the ledger for 20Y4 are as follows: a. Equipment and land were acquired for cash. b. There were no disposals of equipment during the year. c. The investments were sold for 588,000 cash. d. The common stock was issued for cash. e. There was a 528,000 debit to Retained Earnings for cash dividends declared. Instructions Prepare a statement of cash flows, using the direct method of presenting cash flows from operating activities.arrow_forward

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning