Spreadsheet from

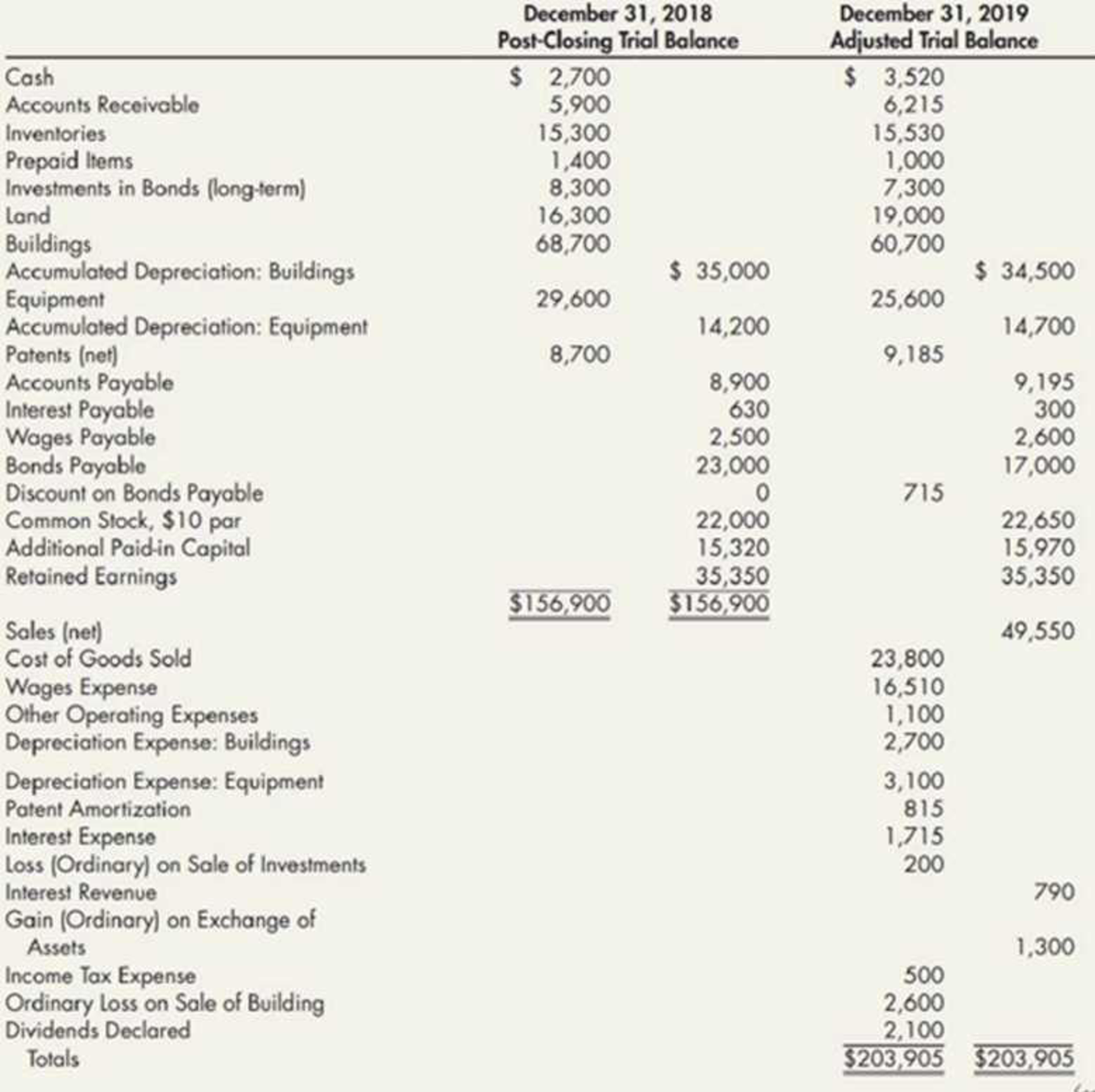

A review of the accounting records reveals the following additional information:

- a. Bomb payable with a face value, book value, and market value of $14,000 were retired on June 30, 2019.

- b. Bonds payable with a face value of $8,000 were issued at 90.25 on August 1, 2019. They mature on August 1, 2024. The company uses the straight-line method to amortize the bond discount.

- c. The company sold a building that had an original cost of $8,000 and a book value of $4,800. The company received $2,200 in cash for the building and recorded a loss of $2,600.

- d. Equipment with a cost of $4,000 and a book value of $1,400 was exchanged for an acre of land valued at $2,700. No cash was exchanged.

- e. Long-term investments in bonds being held to maturity with a cost of $ 1,000 were sold for $800.

- f. Sixty-five shares of common stock were exchanged for a patent. The common stock was selling for $20 per share at the time of the exchange.

Required:

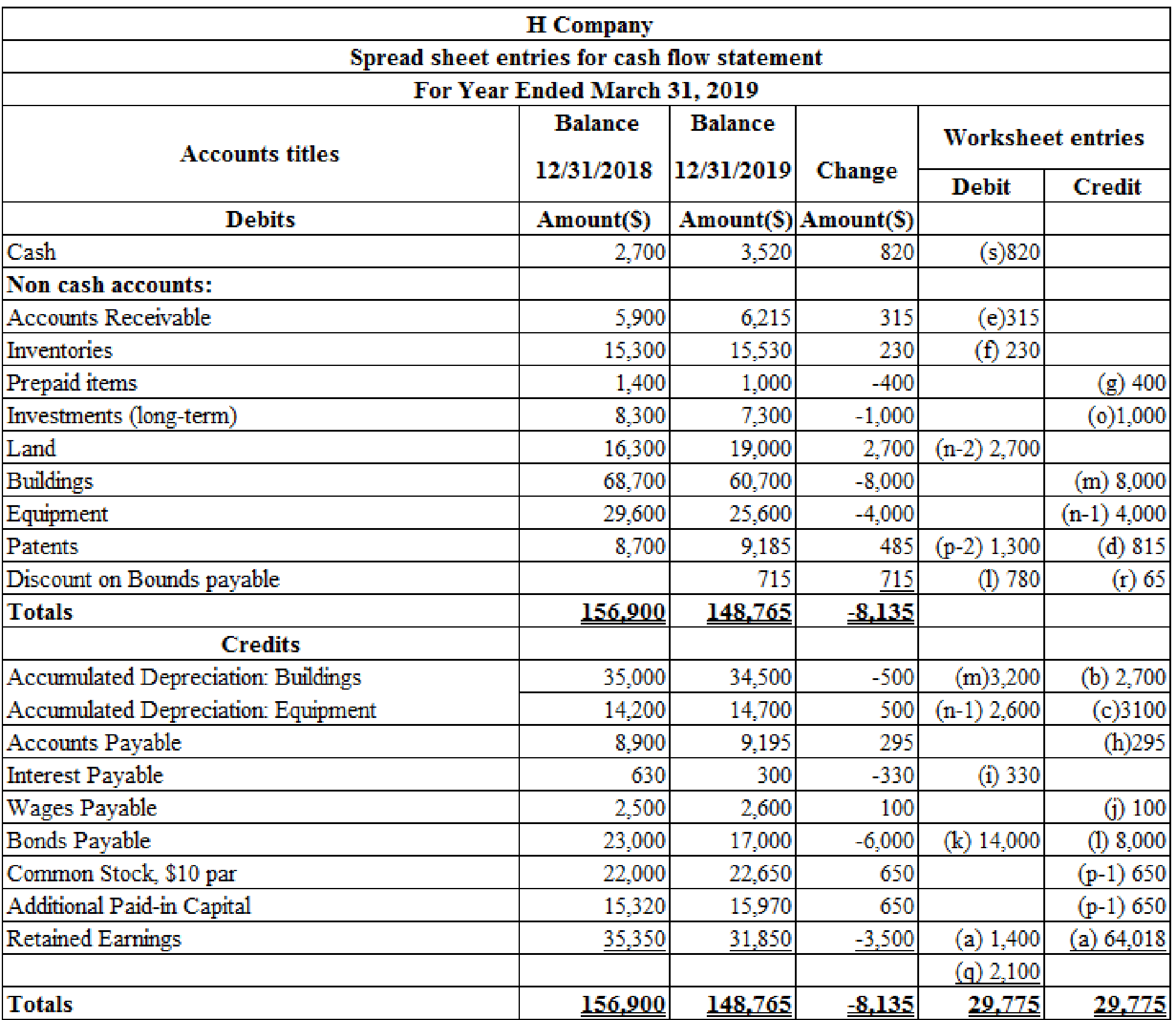

Prepare a spreadsheet to support a statement of

Prepare a spreadsheet to support a cash flow statement of H Company for the year 2019.

Explanation of Solution

Statement of cash flows: Cash flow statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period. Statement of cash flows includes the changes in cash balance due to operating, investing, and financing activities.

Worksheet: A worksheet is a spreadsheet used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Prepare a spreadsheet to support the statement of cash flows.

Table (1)

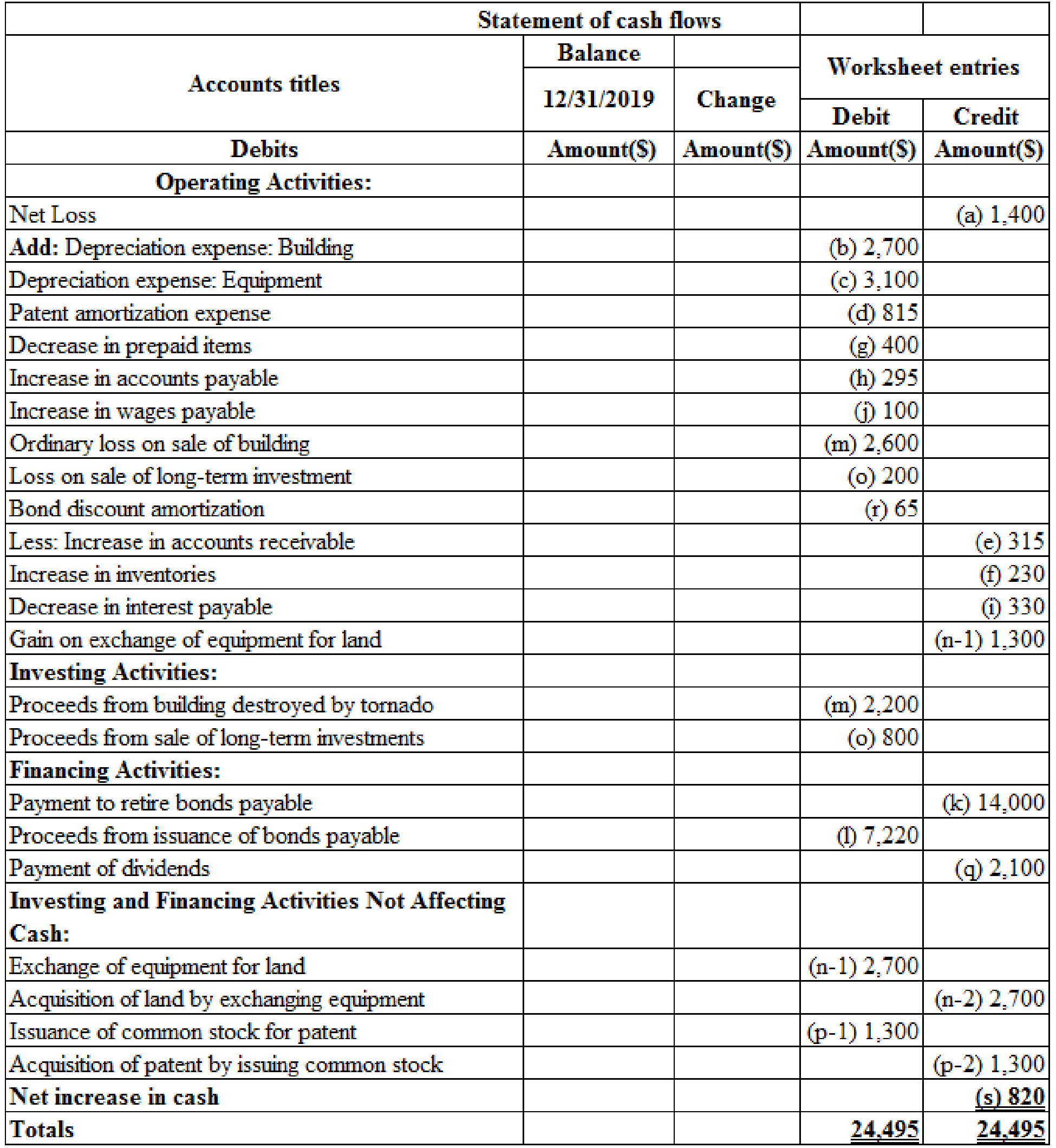

A statement of cash flows of H Company for the year 2019:

Table (2)

Working notes:

(a) Calculate the net loss.

| Particulars | Amount($) | Amount($) |

| Revenues : | ||

| Sales | 49,550 | |

| Interest revenue | 790 | |

| Gain on exchange of assets | 1,300 | |

| Total revenue | 51,640 | |

| Expenses: | ||

| Cost of goods sold | 23,800 | |

| Wages expense | 16,510 | |

| Other operating expenses | 1,100 | |

| Depreciation expense: buildings | 2,700 | |

| Depreciation expense: equipment | 3,100 | |

| Patent amortization | 815 | |

| Interest expense | 1,715 | |

| Loss on sale of investments | 200 | |

| Loss on sale of building | (2,600) | |

| Income tax expense | 500 | |

| Total expenses | (53,040) | |

| Net Loss | (1,400) |

Table (2)

Note: The $31,850 ending retained earnings balance is derived by subtracting the $1,400 net loss and the $2,100 dividends from the $35,350 beginning retained earnings balance.

(e) Calculate the increase in accounts receivable.

(f) Calculate the increase in inventories.

(g) Calculate the decrease in prepaid items.

(h) Calculate the increase in accounts payable.

(i) Calculate the decrease in interest payable.

(j) Calculate the increase in wages payable.

(l) Proceeds from issuance of bonds payable.

(m) Students may have difficulty with the extraordinary loss transaction. This may be shown in journal entry form as follows:

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| Proceeds from sale of building | 2,200 | ||

| Accumulated Depreciation | 3,200 | ||

| Ordinary Loss(net) | 2,600 | ||

| Buildings | 8000 | ||

| (To record the sale of building) |

Table (3)

(n-1) Calculate the exchange of equipment for land.

(o)Calculate the proceeds from sale of long-term investment.

(p-1) Calculate the issuance of common stock for patent.

(p-2) Acquisition of patent by issuing common stock is $1,300,

(r) Calculate the bond discount amortization.

(s) Calculate net increase in cash.

Therefore, the net increase in cash is $820.

Want to see more full solutions like this?

Chapter 21 Solutions

Intermediate Accounting: Reporting And Analysis

- Comprehensive: Income Statement and Supporting Schedules The following s a partial list of the account balances, after adjustments, of Silvoso Company on December 31, 2019: The following information is also available: 1. The company declared and paid a 0.60 per share cash dividend on its common stock. The stock was outstanding the entire year. 2. A physical count determined that the December 31, 2019, ending inventory is 34,100. 3. A tornado destroyed a warehouse, resulting in a pretax loss of 12,000. The last tornado in this area had occurred 10 years earlier. 4. On May 1, 2019, the company sold an unprofitable division (R). From January through April, Division R (a major component of the company) had incurred a pretax operating loss of 8,700. Division R was sold at a pretax gain of 10,000. 5. The company is subject to a 30% income tax rate. Its income tax expense for 2019 totals 4,230. The breakdown is as follows: 6. The company had average shareholders equity of 150,000 during 2019. Required: 1. As supporting documents for Requirement 2, prepare separate supporting schedules for cost of goods sold, selling expenses, general and administrative expenses, and depreciation expense. 2. Prepare a 2019 multiple-step income statement for Silvoso. Include any related note to the financial statements. 3. Prepare a 2019 retained earnings statement. 4. Next Level What was Silvosos return on common equity for 2019? What is your evaluation of Silvosos return on common equity if last year it was 10%?arrow_forwardWrite-Off of Uncollectible Accounts King Enterprises had 27 customers utilizing its financial planning services in 2019. Each customer paid King $25,000 for receiving Kings assistance. King estimates that 2% of its $675,000 credit sales in 2019 will be uncollectible. During 2020, King wrote off $2,700 related to services performed in 2019. Required: 1. Prepare the journal entry to record the defaulted balance. 2. Prepare the adjusting entry to record the bad debt expense for 2019.arrow_forwardAdjusting Entries Kretz Corporation prepares monthly financial statements and therefore adjusts its accounts at the end of every month. The following information is available for March 2016: Kretz Corporation takes out a 90-day, 8%, $15,000 note on March 1, 2016, with interest and principal to be paid at maturity. The asset account Office Supplies on Hand has a balance of $1,280 on March 1, 2016. During March, Kretz adds $750 to the account for purchases during the period. A count of the supplies on hand at the end of March indicates a balance of $1,370. The company purchased office equipment last year for $62,600. The equipment has an estimated useful life of six years and an estimated salvage value of $5,000. The companys plant operates seven days per week with a daily payroll of $950. Wage earners are paid every Sunday. The last day of the month is Thursday, March 31. The company rented an idle warehouse to a neighboring business on February 1, 2016, at a rate of $2,500 per month. On this date, Kretz Corporation credited Rent Collected in Advance for six months rent received in advance. On March 1, 2016, Kretz Corporation credited a liability account, Customer Deposits, for $4,800. This sum represents an amount that a customer paid in advance and that Kretz will earn evenly over a four-month period. Based on its income for the month, Kretz Corporation estimates that federal income taxes for March amount to $3,900. Required For each of the preceding situations, prepare in general journal form the appropriate adjusting entry to be recorded on March 31, 2016.arrow_forward

- Anderson Air is a customer of Handler Cleaning Operations. For Anderson Airs latest purchase on January 1, 2018, Handler Cleaning Operations issues a note with a principal amount of $1,255,000, 6% annual interest rate, and a 24-month maturity date on December 31, 2019. Record the journal entries for Handler Cleaning Operations for the following transactions. A. Entry for note issuance B. Subsequent interest entry on December 31, 2018 C. Honored note entry at maturity on December 31, 2019arrow_forwardNon-Interest-Bearing Notes Payable On November 16, 2019, Clear Glass Company borrowed 20,000 from First American Bank by issuing a 90-day, non-interest-bearing note. The bank discounted this note at 12% and remitted the difference to Clear Glass. Required: 1. Prepare the journal entries of Clear Glass to record the preceding information, the related calendar year-end adjusting entry, and payment of the note at maturity. 2. Show how the preceding items Would be reported on the December 31, 2019, balance sheet. 3. Next Level What is Clear Glass Companys effective interest rate?arrow_forwardDallas Company loaned to Ewing Company on December 1, 2019. Ewing will pay Dallas $720 of interest ($60 per month) on November 30, 2020. Dallass adjusting entry at December 31, 2019, is: a. Interest Expense ........... 60 c. Interest Receivable ....... 60 Cash ......................... 60 Interest Income ........ 60 b. Cash ............................ 60 d. No adjusting entry is required. Interest Income ........ 60arrow_forward

- Balance Sheet Baggett Companys balance sheet accounts and amounts as of December 31, 2019, are shown in random order as follows: Required: 1. Prepare a December 31, 2019, balance sheet for Baggett. 2. Compute the debt to-assets ratio.arrow_forwardWorksheet for Service Company Whitaker Consulting Company has prepared a trial balance on the following partially completed worksheet for the year ended December 31, 2019: Additional information: (a) On January 1, 2019, the company had paid 2 years rent in advance at 100 a month for office space, (b) the office equipment is being depreciated on a straight-line basis over a 10-year life, and no residua! value is expected, (c) interest of 150 has accrued on the note payable but has not been paid, and (d) the income tax rate is 30% on current income and will be paid in the first quarter of 2020. Required: 1. Complete the worksheet. 2. Prepare financial statements for 2019.arrow_forwardInferring Accounts Receivable Amounts At the end of 2019, Karras Inc. had a debit balance of 141,120 in its accounts receivable. Additionally, Karras had a credit balance in its allowance for doubtful accounts of 4,350 and 9,420 at the beginning and end of the year, respectively. During the year, Karras made credit sales of 1,530,000, collected receivables in the amount of 1,445,700, and recorded bad debt expense of 83, 750. Required: Next Level Compute the amount of accounts receivable that Karras wrote off during the year and the amount of accounts receivable at the beginning of the year.arrow_forward

- Restructuring (Debtor) Oakwood Corporation is delinquent on a 2,400,000, 10% note to Second National Bank that was due January 1, 2019. At that time, Oakwood owed the principal amount plus 34,031.82 of accrued interest. Oakwood enters into a debt restructuring agreement with the bank on January 2, 2019. Required: Prepare the journal entries for Oakwood to record the debt restructuring agreement and all subsequent interest payments assuming the following independent alternatives: 1. The bank extends the repayment date to December 31, 2022, forgives the accrued interest owed, reduces the principal by 200,000, and reduces the interest rate to 8%. 2. The bank extends the repayment date to December 31, 2022, forgives the accrued interest owed, reduces the principal by 200,000, and reduces the interest rate to 1%. 3. The bank accepts 160,000 shares of Oakwoods 55 par value common stock, which is currently selling for 14.50 per share, in full settlement of the debt. 4. The bank accepts land with a fair value of 2,300,000 in full settlement of the debt. The land is being carried on Oakwoods books at a cost of 2,200,000.arrow_forwardAccrued Interest On May 1, the Garnett Corporation wanted to purchase a $200,000 piece of equipment, but Garnett was only able to furnish $75,000 of its own cash to purchase the equipment. Garnett borrowed the remainder of the $200,000 from the Peoples National Bank on a 3-year, 4% note. Required: If the company keeps its records on a calendar year, what adjusting entry should Garnett make on December 31?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College