College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN: 9781305666160

Author: James A. Heintz, Robert W. Parry

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 21, Problem 8SPB

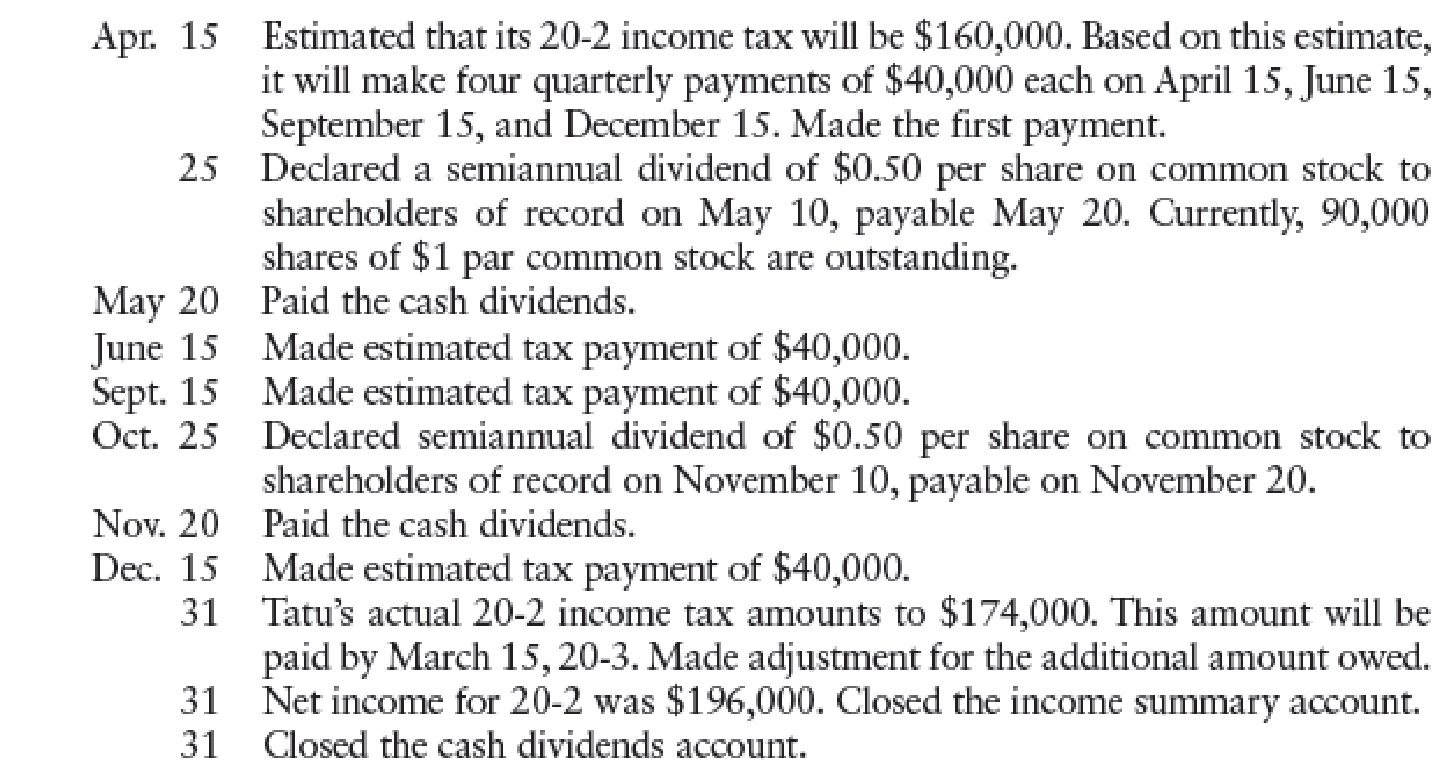

CASH DIVIDENDS AND INCOME TAXES During the year ended December 31, 20-2, Tatu Company completed the following selected transactions:

REQUIRED

Prepare

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Chapter 21 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

Ch. 21 - Income taxes are a unique expense of the corporate...Ch. 21 - Prob. 2TFCh. 21 - Prob. 3TFCh. 21 - Prob. 4TFCh. 21 - Prob. 5TFCh. 21 - Prob. 1MCCh. 21 - Prob. 2MCCh. 21 - Prob. 3MCCh. 21 - Prob. 4MCCh. 21 - Prob. 5MC

Ch. 21 - Prob. 1CECh. 21 - Prob. 2CECh. 21 - Teway Company declared and paid dividends in the...Ch. 21 - Prob. 4CECh. 21 - Prob. 5CECh. 21 - Prob. 1RQCh. 21 - Prob. 2RQCh. 21 - Prob. 3RQCh. 21 - Prob. 4RQCh. 21 - Prob. 5RQCh. 21 - Prob. 6RQCh. 21 - Prob. 7RQCh. 21 - Prob. 8RQCh. 21 - Prob. 9RQCh. 21 - Prob. 10RQCh. 21 - Prob. 11RQCh. 21 - CORPORATE INCOME TAX Stanton Company estimates...Ch. 21 - CLOSING INCOME SUMMARY AND DIVIDENDS TO RETAINED...Ch. 21 - Prob. 3SEACh. 21 - STOCK DIVIDENDS Kaufman Company currently has...Ch. 21 - STOCK SPLIT Goldstein Company has 100,000 shares...Ch. 21 - Prob. 6SEACh. 21 - STATEMENT OF RETAINED EARNINGS McGregor Company...Ch. 21 - Prob. 8SPACh. 21 - Prob. 9SPACh. 21 - Prob. 10SPACh. 21 - Prob. 11SPACh. 21 - Prob. 1SEBCh. 21 - CLOSING INCOME SUMMARY AND DIVIDENDS TO RETAINED...Ch. 21 - COMMON AND PREFERRED CASH DIVIDENDS Ramirez...Ch. 21 - STOCK DIVIDENDS Martinez Company currently has...Ch. 21 - Prob. 5SEBCh. 21 - Prob. 6SEBCh. 21 - Prob. 7SEBCh. 21 - CASH DIVIDENDS AND INCOME TAXES During the year...Ch. 21 - CASH DIVIDENDS, STOCK DIVIDEND, AND STOCK SPLIT...Ch. 21 - Prob. 10SPBCh. 21 - Prob. 11SPBCh. 21 - Prob. 1MYWCh. 21 - Prob. 1ECCh. 21 - MASTRY PROBLEM On January 1, 20--, Dover Companys...Ch. 21 - CHALLENGE PROBLEM This problem challenges you to...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Entries for selected corporate transactions Morrow Enterprises Inc. manufactures bathroom fixtures. Morrow Enterprises stockholders equity accounts, with balances on January 1, 20Y6, are as follows: The following selected transactions occurred during the year: Instructions 1. Enter the January 1 balances in T accounts for the stockholders equity accounts listed. Also prepare T accounts for the following: Paid-In Capital from Sale of Treasury Stock; Stock Dividends Distributable; Stock Dividends; Cash Dividends. 2. Journalize the entries to record the transactions, and post to the eight selected accounts. Assume that the closing entry for revenues and expenses has been made and post net income of 1,125,000 to the retained earnings account. 3. Prepare a statement of stockholders equity for the year ended December 31, 20Y6. Assume that net income was 1,125,000 for the year ended December 31, 20Y6. 4. Prepare the Stockholders Equity section of the December 31, 20Y6, balance sheet.arrow_forwardFedEx Corporation had the following revenue and expense account balances (in millions) for a recent year ending May 31: Prepare an income statement.arrow_forwardThe income statement, statement of retained earnings, and balance sheet for Somerville Company are as follows: Includes both state and federal taxes. Brief Exercise 15-20 Calculating the Average Common Stockholders Equity and the Return on Stockholders Equity Refer to the information for Somerville Company on the previous pages. Required: Note: Round answers to four decimal places. 1. Calculate the average common stockholders equity. 2. Calculate the return on stockholders equity.arrow_forward

- The following selected accounts and their current balances appear in the ledger of Clairemont Co. for the fiscal year ended May 31, 2019: Instructions 1. Prepare a multiple-step income statement. 2. Prepare a statement of owners equity. 3. Prepare a balance sheet, assuming that the current portion of the note payable is 50,000. 4. Briefly explain how multiple-step and single-step income statements differ.arrow_forwardEntries for selected corporate transactions Nav-Go Enterprises Inc. produces aeronautical navigation equipment. Navo-Go Enterprises stockholders equity accounts, with balances on January 1, 20Y1, are as follows: The following selected transactions occurred during the year: Instructions 1. Enter the January 1 balances in T accounts for the stockholders equity accounts listed. Also prepare T accounts for the following: Paid-In Capital from Sale of Treasury Stock; Stock Dividends Distributable; Stock Dividends; Cash Dividends. 2. Journalize the entries to record the transactions, and post to the eight selected accounts. Assume that the closing entry for revenues and expenses has been made and post net income of 775,000 to the retained earnings account. 3. Prepare a statement of stockholders equity for the year ended December 31, 20Y1. Assume that net income was 775,000 for the year ended December 31, 20Y6. 4. Prepare the Stockholders Equity section of the December 31, 20Y1, balance sheet.arrow_forwardIncome statement, retained earnings statement, and balance sheet The following financial data were adapted from a recent annual report of Ta get Corporation (TGT) for the year ending January 31. Instructions Prepare Target’s statement of stockholders’ equity for the year ending January 31. Use the following additional information for the year:arrow_forward

- Included in the December 31, 2018, Jacobi Company balance sheet was the following shareholders equity section: The company engaged in the following stock transactions during 2019: Required: 1. Prepare journal entries to record the preceding transactions. 2. Prepare the December 31, 2019, shareholders equity section (assume that 2019 net income was 270,000).arrow_forwardFedEx Corporation had the following revenue and expense account balances (in millions) for a recent year ending May 31: a.Prepare an income statement. b.Compare your income statement with the income statement that is available at the FedEx Corporation Web site, (http://investors.fedex.com). Click on Annual Report and Download Annual Report. What similarities and differences do you see?arrow_forwardMultiple-step income statement and balance sheet The following selected accounts and their current balances appear in the ledger of Kanpur Co. for the fiscal year ended June 30, 20Y7: Instructions 1. Prepare a multiple-step income statement. 2. Prepare a statement of stockholders equity. Additional common stock of 7,500 was issued during the year ended June 30, 20Y7. 3. Prepare a balance sheet, assuming that the current portion of the note payable is 7,000. 4. Briefly explain how multiple and single-step income statements differ.arrow_forward

- Prepare journal entries to record the following transactions that occurred in April: A. on first day of the month, issued common stock for cash, $15,000 B. on eighth day of month, purchased supplies, on account, $1,800 C. on twentieth day of month, billed customer for services provided, $950 D. on twenty-fifth day of month, paid salaries to employees, $2,000 E. on thirtieth day of month, paid for dividends to shareholders, $500arrow_forwardMultiple-step income statement and report form of balance sheet The following selected accounts and their current balances appear in the ledger of Prescott Inc. for the fiscal year ended September 30. 20Y8: Instructions Prepare a statement of stockholders’ equity. No common stock was issued during the year.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY