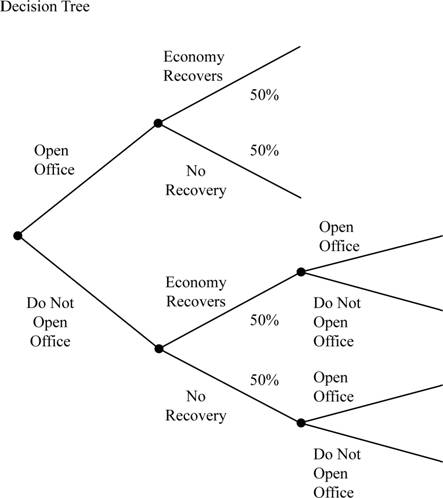

Your company is planning on opening an office in Japan. Profits depend on how fast the economy in Japan recovers from its current recession. There is a 50% chance of recovery this year. You are trying to decide whether to open the office now or in a year. Construct the decision tree that shows the choices you have to open the office either today or one year from now.

To draw: The decision tree.

Introduction:

Decision tree is a tree-like graph which helps to identify strategies which are most likely to achieve goals. A decision tree comprises decision support tools.

Explanation of Solution

Given information:

A company is planning on opening an office in Japan. Company profit depends on Japanʼs economyʼs recovery from its current recession. The chance of recovery from recession is 50.00%.

Possible decision:

Possible decision in the decision tree:

- 1. To open office

- 2. To not open office

If to open office, then two possible decisions:

- 1. Economy recover

- 2. Economy doesn’t recover

If to not open office, then two possible decisions:

- 1. Economy recover

- 2. Economy doesn’t recover

If to not open office and economy recover, then two possible decisions:

- 1. To open office

- 2. To not open office

If to not open office and the economy does not recover, then two possible decisions:

- 1. To open office

- 2. To not open office

Diagram from decision tree:

Want to see more full solutions like this?

Chapter 22 Solutions

Corporate Finance: The Core Plus MyLab Finance with Pearson eText -- Access Card Package (4th Edition)

Additional Business Textbook Solutions

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Foundations of Finance (9th Edition) (Pearson Series in Finance)

Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

Foundations Of Finance

Essentials of MIS (13th Edition)

Horngren's Accounting (12th Edition)

- A prospective MBA student earns $55,000 per year in her current job and expects that amount to increase by 6% per year. She is considering leaving her job to attend business school for two years at a cost of $30,000 per year. She has been told that her starting salary after business school is likely to be $120,000 and that amount will increase by 15% per year. Consider a time horizon of 10 years, use a discount rate of 10%, and ignore all considerations not explicitly mentioned here. Assume all cash flows occur at the start of each year (i.e., immediate, one year from now, two years from now,..., nine years from now). Also assume that the choice can be implemented immediately so that for the MBA alternative the current year is the first year of business school. What is the net present value of the more attractive choice? Please round your answer to the nearest dollar. Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.…arrow_forwardA prospective MBA student earns $45,000 per year in her current job and expects that amount to increase by 8% per year. She is considering leaving her job to attend business school for two years at a cost of $30,000 per year. She has been told that her starting salary after business school is likely to be $95,000 and that amount will increase by 14% per year. Consider a time horizon of 10 years, use a discount rate of 14%, and ignore all considerations not explicitly mentioned here. Assume all cash flows occur at the start of each year (i.e., immediate, one year from now, two years from now,..., nine years from now). Also assume that the choice can be implemented immediately so that for the MBA alternative the current year is the first year of business school. What is the net present value of the more attractive choice? Please round your answer to the nearest dollar.arrow_forwardThe Food Store is planning a major expansion for 4 years from today. In preparation for this, the company is setting aside $35,000 each quarter, starting today, for the next 4 years. How much money will the firm have when it is ready to expand if it can earn an average of 6.25 percent on its savings?arrow_forward

- A recently hired chief executive officer wants to reduce future production costs to improve the company’s earnings, thereby increasing the value of the company’s stock. The plan is to invest $84,000 now and $62,000 in each of the next 4 years to improve productivity. By how much must annual costs decrease in years 5 through 13 to recover the investment plus a return of 11% per year?arrow_forwardYou are a marketing executive and your ad agency has come to you with a recommendation for a three-year ad campaign. Due to the length of ad and the timing of when it runs, it is projected to increase sales for your company by $250,000 per year. If the current interest rate is 8%, what would you be willing to pay for this ad campaign?arrow_forwardYou recently got promoted at your job. You have since decided to buy your dream car and expect that it will cost you $94,000 seven years from today. After budgeting your expenses, you decide that you can save $9,000 per year at the beginning of each year. Given a market interest rate of 13%, will you be able to purchase your car at the end of year 7? Would you be able to afford it one year later? (Using financial calculator)arrow_forward

- A small, US-based manufacturing firm is interested developing a new product to that would be produced andsold starting in 2022. Based on a preliminary market analysis, a demand forecast for the product (i.e., aprediction of the number of units sold each year) anticipates that 72,000 units can be sold the first year at aprice of $99.95 per unit. However, after that, sales are expected to decline each year according to a 95%learning curve.The required manufacturing process can produce 12 units of product per hour, up to a maximum of 72,000units per year. It would cost $4,000,000 to purchase and install the necessary manufacturing equipment,which would have a 10-year useful life. The equipment is expected to have little, if any, salvage value at theend of its useful life. While the equipment belongs to the 7-year MACRS property class, the firm willdepreciate the equipment using the most advantageous method allowed by US tax law.The manufacturing process requires the labor of a team of…arrow_forwardA northern California consulting firm wants to start saving money for replacement of network servers. If the company invests $10,000 at the end of year 1 but decreases the amount invested by 5% each year, how much will be available 5 years from now at an earning rate of 10% per year?arrow_forwardYou are thinking of pursuing an actuarial career, so you have agreed to serve as an intern at Love Actuaries LLP. The managing partner, Karen Thompson, has asked you to do some quick calculations for her. She wants you to use the current yield curve, flat at 6%, in your calculations. Client Annie Inc. has a pension plan that pays pension benefits annually at a rate of $10 million per year, starting one year from today. The pension obligation will end in 40 years. Karen wants to know the duration of these required pension payments. Client Billy Mack Co. wants to immunize its pension obligations (present value = $150 million with a duration of 22 years) with two $1000 face value bonds. The first bond is a 7-year 5% annual coupon bond issued by Jaime Corp. The second bond issuer, Kari Ltd., has issued a consol bond paying a 10% annual coupon perpetually. Ms. Thompson wants you to calculate the money Billy Mack should allocate to each of these bonds to immunize its pension against…arrow_forward

- A business industry has a new product whose sales are expected to be 1.2, 3.5, 7, 5, 3 million units per year over the next 5 years. Production, distribution, and overhead costs are stable at $120 per unit. The price will be $200 per unit for the first two years, and then $180, $160 and $140 for the next three years. The remaining R&D and production costs are $300 million. If the interest rate is 15%, determine whether this business will profit using present worth method. What is the future worth? *arrow_forwardA recently hired chief executive officer wants to reduce future production costs to improve the company’s earnings, thereby increasing the value of the company’s stock. The plan is to invest $98,000 now and $58,000 in each of the next 6 years to improve productivity. By how much must annual costs decrease in years 7 through 12 to recover the investment plus a return of 10% per year? The annual cost decreases by $ ___.arrow_forwardYou are currently a worker earning $60,000 per year but are considering becoming an entrepreneur. You will not switch unless you earn an accounting profit that is on average at least as great as your current salary. You look into opening a small grocery store. Suppose that the store has annual costs of $150,000 for labor, $50,000 for rent, and $30,000 for equipment. There is a one-half probability that revenues will be $210,000 and a one-half probability that revenues will be $400,000. Instructions: Enter your answers as a whole number. If you are entering any negative numbers be sure to include a negative sign (−) in front of those numbers. Enter a loss as a negative number. a. In the low-revenue situation, what will your accounting profit or loss be? $ What will your accounting profit or loss be in the high-revenue situation? $ b. On average, how much do you expect your revenue to be? $ Your accounting profit? $ Your economic profit? $…arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education