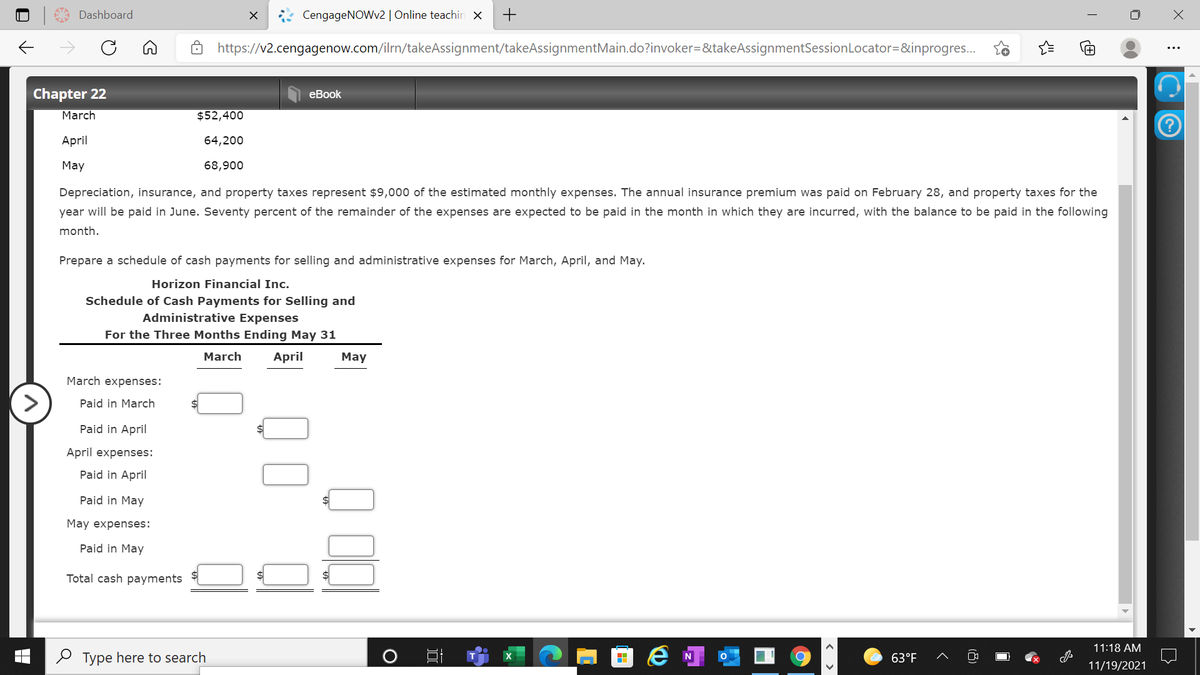

Schedule of Cash Payments for a Service Company Horizon Financial Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three months of operations are as follows: March $52,400 April 64,200 May 68,900 Depreciation, insurance, and property taxes represent $9,000 of the estimated monthly expenses. The annual insurance premium was paid on February 28, and property taxes for the year will be paid in June. Seventy percent of the remainder of the expenses are expected to be paid in the month in which they are incurred, with the balance to be paid in the following month. Prepare a schedule of cash payments for selling and administrative expenses for March, April, and May.

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Schedule of Cash Payments for a Service Company

Horizon Financial Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three months of operations are as follows:

| March | $52,400 |

| April | 64,200 |

| May | 68,900 |

Prepare a schedule of cash payments for selling and administrative expenses for March, April, and May.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images