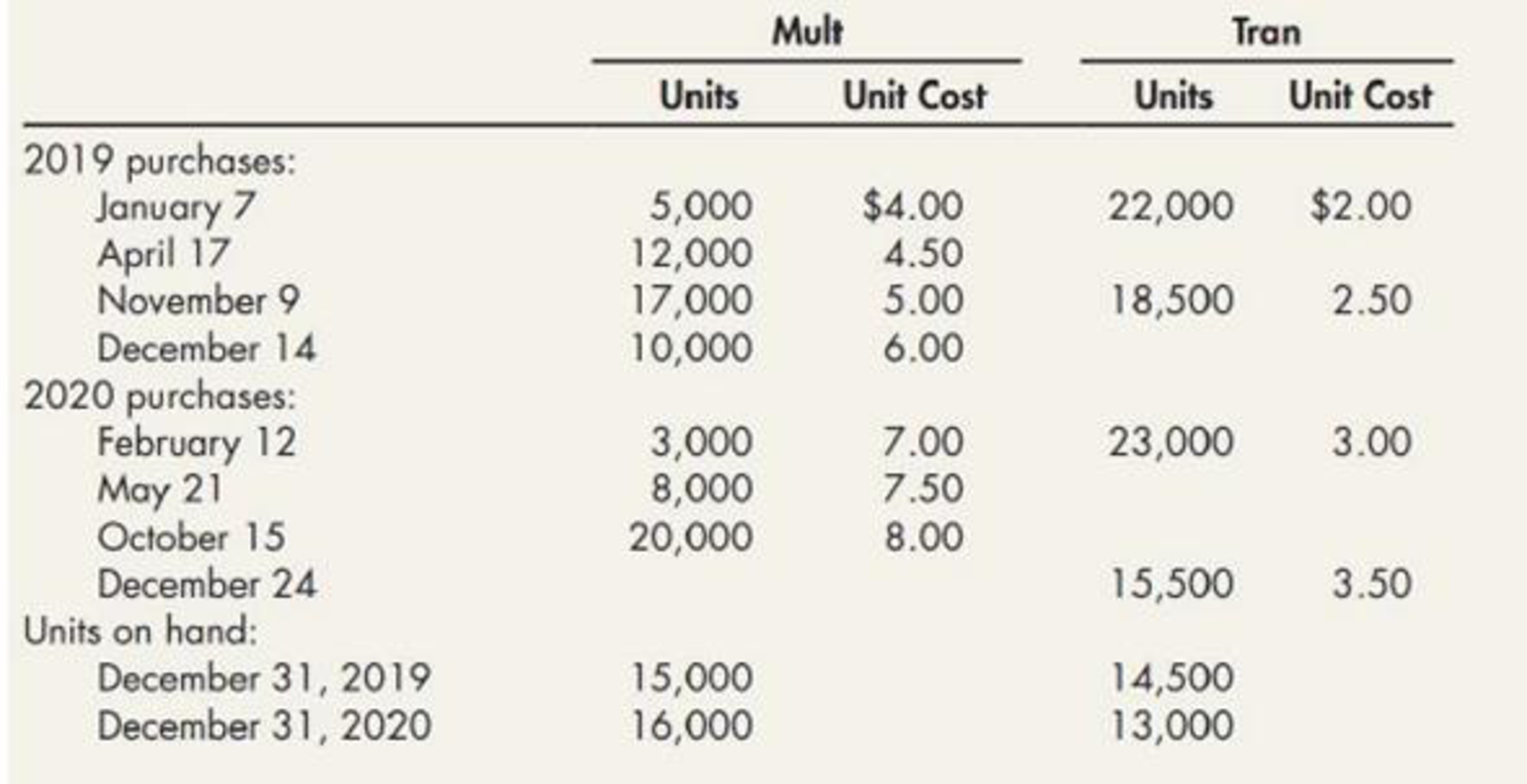

Kraft Manufacturing Company manufactures two products: Mult and Tran. At December 31, 2019, Kraft used the FIFO inventory method. Effective January 1, 2020, Kraft changed to the LIFO inventory method. The cumulative effect of this change is not determinable, and, as a result, the ending inventory of 2019, for which the FIFO method was used, is also the beginning inventory for 2020 for the LIFO method. Any layers added during 2020 should be costed by reference to the first acquisitions of 2020, and any layers liquidated during 2020 should be considered a permanent liquidation.

The following information was available from Kraft’s inventory records for the two most recent years:

Required:

Compute the effect on income before income taxes for the year ended December 31, 2020, resulting from the change from the FIFO to the LIFO inventory method.

Trending nowThis is a popular solution!

Chapter 22 Solutions

Intermediate Accounting: Reporting And Analysis

- Moore Company uses the LIFO cost flow assumption and carries Product A in inventory on December 31, 2019, at its unit cost of 9.50. Because of a sharp decline in demand for the product, the selling price was reduced to 10.00 per unit. Moores normal profit margin on Product A is 2.00, disposal costs are 1.00 per unit, and the replacement cost is 6.50. Under the lower of cost or market rule, Moores December 31, 2019, inventory of Product A should be valued at a unit cost of: a. 6.50 b. 9.00 c. 7.00 d. 9.50arrow_forwardBerg Company began operations on January 1, 2019, and uses the FIFO method in costing its raw materials inventory. During 2020, management is contemplating a change to the LIFO method and is interested in determining what effect such a change will have on net income. Accordingly, the following information has been developed: Required: What is the effect on income before income taxes in 2020 of a change to the LIFO method?arrow_forwardKoopman Company began operations on January 1, 2018, and uses they FIFO inventory method for financial reporting and the average cost inventory method for income taxes. At the beginning of 2020, Koopman decided to switch to the average cost inventory method for financial reporting. It had previously reported the following financial statement information for 2019: An analysis of the accounting records discloses the following cost of goods sold under the FIFO and average cost inventory methods: There are no indirect effects of the change in inventory method. Revenues for 2020 total 130,000; operating expenses for 2020 total 30,000. Koopman is subject to a 21% income tax rate in all years; it pays the income taxes payable of a current year in the first quarter of the next year. Koopman had 10,000 shares of common stock outstanding during all years; it paid dividends of 1 per share in 2020. At the end of 2020, Koopman had cash of 10,000, inventory of 24,000, other assets of 70,800, accounts payable of 4,500, and income taxes payable of 6,000. It desires to show financial statements for the current year and previous year in its 2020 annual report. Required: 1. Prepare the journal entry to reflect the change in methods at the beginning of 2020. Show supporting calculations. 2. Prepare the 2020 financial statements. Notes to the financial statements are not necessary. Show supporting calculations.arrow_forward

- Schmidt Company began operations on January 1, 2018, and used the LIFO inventory method for both financial reporting and income taxes. However, at the beginning of 2020, Schmidt decided to switch to the average cost inventory method for financial and income tax reporting. It had previously reported the following financial statement information for 2019: An analysis of the accounting records discloses the following cost of goods sold under the LIFO and average cost inventory methods: There are no indirect effects of the change in inventory method. Revenues for 2020 total 130,000; operating expenses for 2020 total 30,000. Schmidt is subject to a 21% income tax rate in all years; it pays all income taxes payable in the next quarter. Assume that any deferred tax liability was paid in the subsequent year. Schmidt had 10,000 shares of common stock outstanding during all years; it paid dividends of 1 per share in 2020. At the end of 2020, Schmidt had cash of 15,600, inventory of 34,000, other assets of 76,000, income taxes payable of 4,200, and accounts payable of 3,000. It desires to show financial statements for the current year and previous year in its 2020 annual report. Required: 1. Prepare the journal entry to reflect the change in method at the beginning of 2020. Show supporting calculations. 2. Prepare the 2020 financial statements. Notes to the financial statements are not necessary. Show supporting calculations.arrow_forwardWebster Company adopted do liar-value LIFO on January 1, 2019. Webster produces three products: X, Y, and Z. Websters beginning inventory consisted of the following: During 2019, Webster had the following purchases and sales: Required: 1. Compute the LIFO cost of the ending inventory assuming Webster uses a single inventory pool. Round cost index to 4 decimal places. 2. Compute the LIFO cost of the ending inventory assuming Webster uses three inventory pools. Round cost indexes to 4 decimal places.arrow_forwardRefer to the information provided in RE8-4. If Paul Corporations inventory at January 1, 2019, had a cost and net realizable value of 300,000, prepare the journal entry to record the reductions to NRV for Paul Corporation assuming that Paul uses a periodic inventory system and the direct method. Paul Corporation uses FIFO and reports the following inventory information: Assuming Paul uses a perpetual inventory system and the direct method, prepare the journal entry to record the write-down of inventory.arrow_forward

- At the end of 2019, Manny Company recorded its ending inventory at 350,000 based on a physical count. During 2020, the company discovered that the correct inventory value at the end of 2019 should have been 400,000 because it made a counting error. Upon discovery of this error in 2020, what correcting journal entry will Manny make? Ignore income taxes.arrow_forwardFava Company began operations in 2018 and used the LIFO inventory method for both financial reporting and income taxes. At the beginning of 2019, the anticipated cost trends in the industry had changed, so that it adopted the FIFO method for both financial reporting and income taxes. Fava reported revenues of 300,000 and 270,000 in 2019 and 2018, respectively. Fava reported expenses (excluding income tax expense) of 125,000 and 120,000 in 2019 and 2018, which included cost of goods sold of 55,000 and 45,000, respectively. An analysis indicates that the FIFO cost of goods sold would have been lower by 8,000 in 2018. The tax rate is 21%. Fava has a simple capital structure with 15,000 shares of common stock outstanding during 2018 and 2019. It paid no dividends in either year. Required: 1. Prepare the journal entry to reflect the change. 2. At the end of 2019, prepare the comparative income statements for 2019 and 2018. Notes to the financial statements are not necessary. 3. At the end of 2019, prepare the comparative retained earnings statements for 2019 and 2018.arrow_forwardBorys Companys periodic inventory at December 31, 2019, is understated by 10,000, but purchases are correct. Johnson correctly values its 2020 ending inventory. What is the effect of this error on Boryss 2019 and 2020 financial statements?arrow_forward

- Company Edgar reported the following cost of goods sold but later realized that an error had been made in ending inventory for year 2021. The correct inventory amount for 2021 was 12,000. Once the error is corrected, (a) how much is the restated cost of goods sold for 2021? and (b) how much is the restated cost of goods sold for 2022?arrow_forwardCompany Elmira reported the following cost of goods sold but later realized that an error had been made in ending inventory for year 2021. The correct inventory amount for 2021 was 32,000. Once the error is corrected, (a) how much is the restated cost of goods sold for 2021? and (b) how much is the restated cost of goods sold for 2022?arrow_forwardOlson Company adopted the dollar-value LIFO method for inventory valuation at the beginning of 2015. The following information about the inventory at the end of each year is available from Olsons records: Required: 1. Calculate the dollar-value LIFO inventory at the end of each year. 2. Prepare the appropriate disclosures for the 2021 annual report if Olson uses current cost internally and LIFO for financial reporting.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College