MASTERY PROBLEM

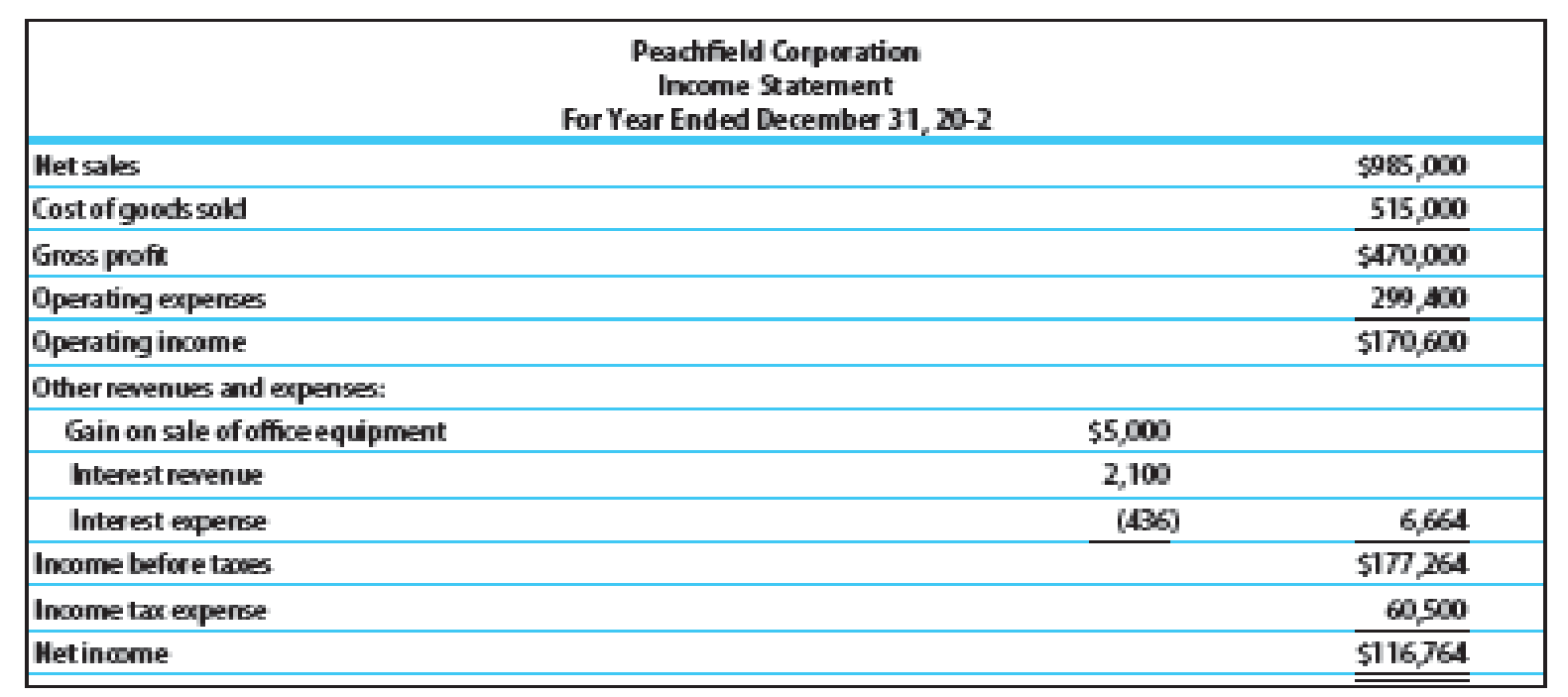

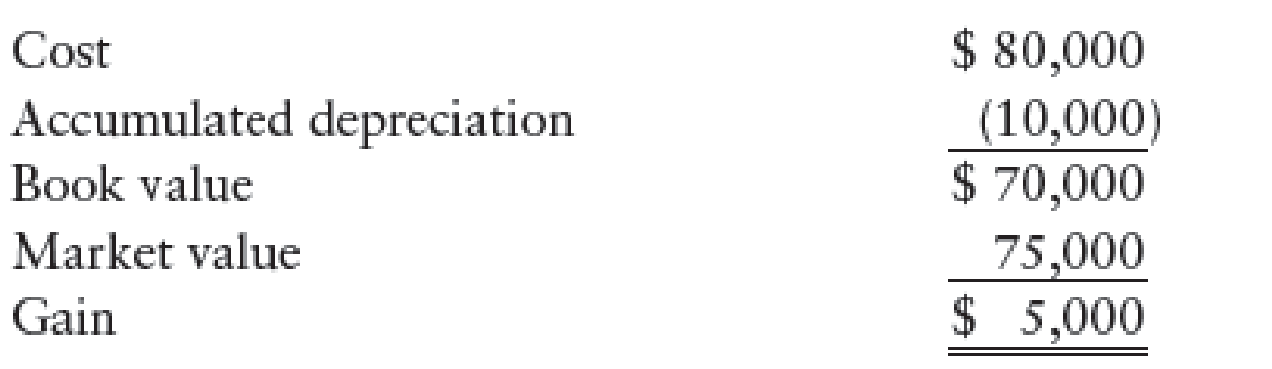

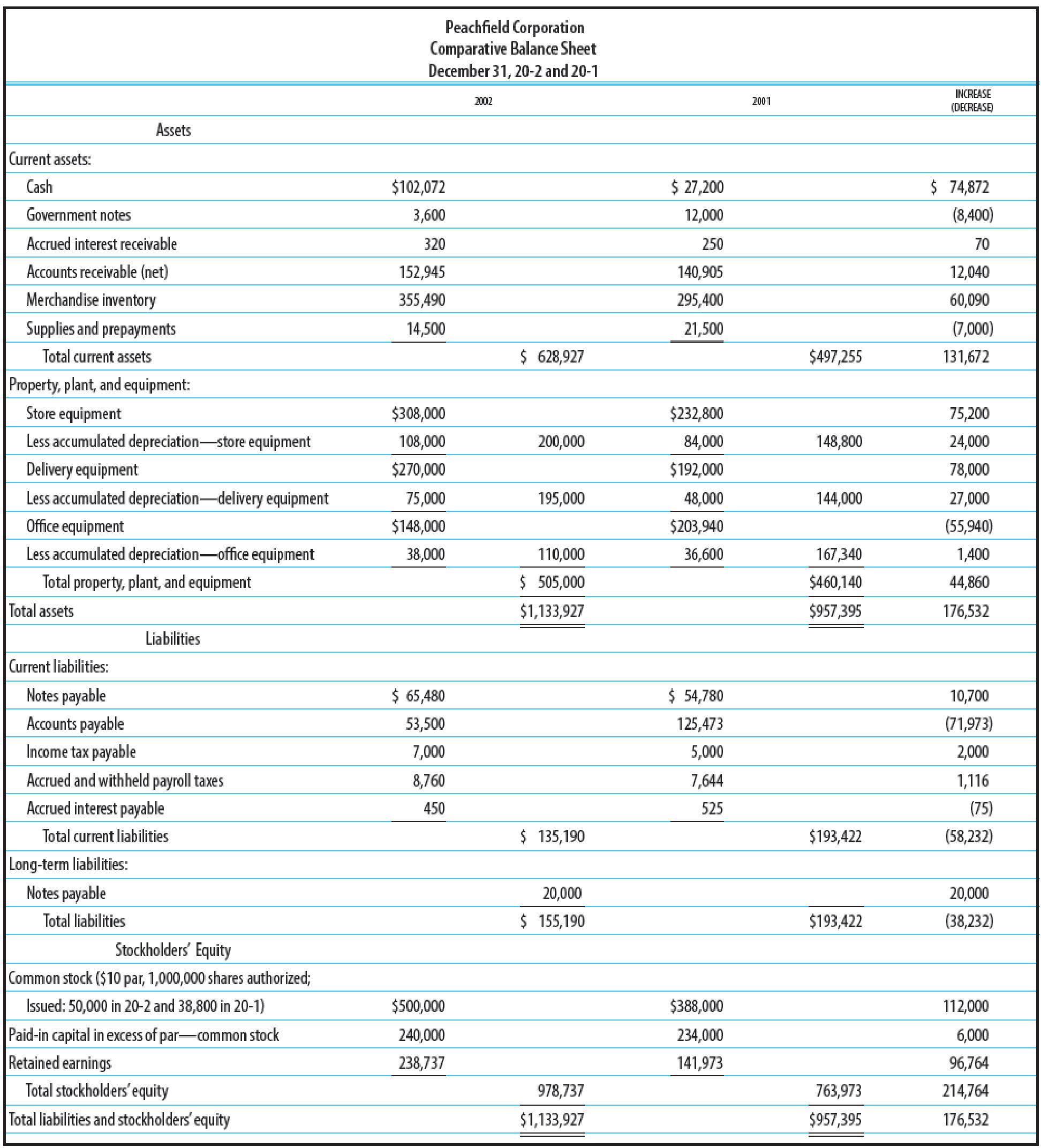

Financial statements for Peachfield Corporation as well as additional information relevant to

Additional information:

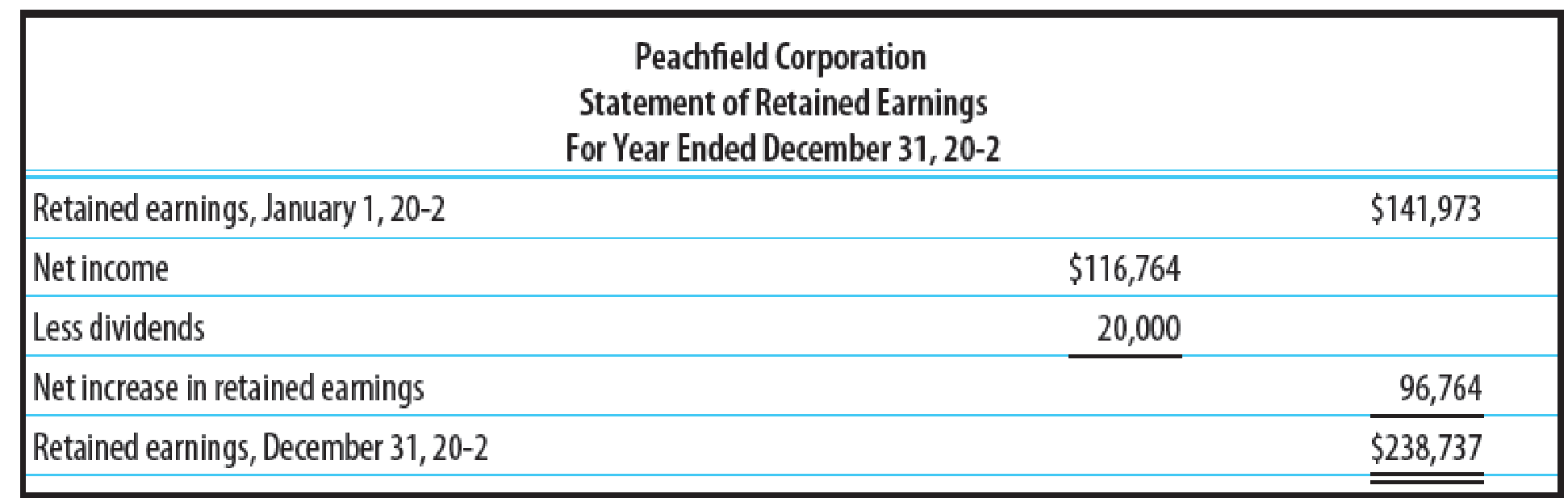

1. Office equipment was sold during the year for $75,000.

2.

3. No other equipment was sold during the year. The following purchases were made for cash.

4. Declared and paid cash dividends of $20,000.

5. Issued 11,200 shares of $10 par common stock for $118,000.

6. Issued a note payable for $10,700.

7. Additional store equipment was acquired by issuing a long-term note payable for $20,000.

REQUIRED

1. Prepare a statement of cash flows explaining the change in cash and cash equivalents.

2. Reconcile cash and cash equivalents at the bottom of the statement of cash flows.

1.

Prepare a statement of cash flows explaining the change in cash and cash equivalents.

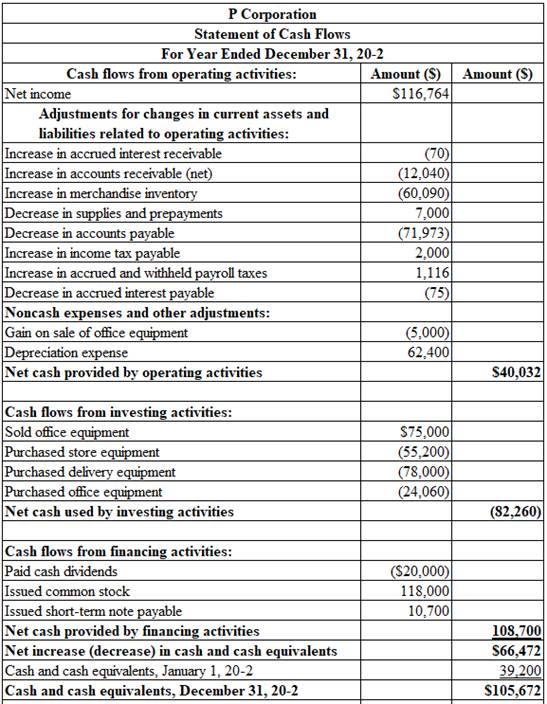

Explanation of Solution

Statement of cash flows: This statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period. Statement of cash flows includes the changes in cash balance due to operating, investing, and financing activities.

Indirect method: Under indirect method, net income is reported first, and then non-cash expenses, losses from fixed assets, and changes in opening balances and ending balances of current assets and current liabilities are adjusted to reconcile the net income balance.

Cash flows from operating activities: Operating activities refer to the normal activities of a company to carry out the business.

The below table shows the way of calculation of cash flows from operating activities:

| Cash flows from operating activities (Indirect method) |

| Net income: |

| Add: Decrease in current assets |

| Increase in current liability |

| Depreciation expense and amortization expense |

| Loss on sale of plant assets |

| Deduct: Increase in current assets |

| Decrease in current liabilities |

| Gain on sale of plant assets |

| Net cash provided from or used by operating activities |

Table (1)

Cash flows from investing activities: Investing activities refer to the activities carried out by a company for acquisition of long term assets. It includes the purchase or sale of equipment or land, or marketable securities, which is used for business operations.

The below table shows the way of calculation of cash flows from investing activities:

| Cash flows from investing activities |

| Add: Proceeds from collection of loan made to borrowers |

| Sale of marketable securities / investments |

| Sale of property, plant and equipment |

| Proceeds from discounting notes receivables |

| Deduct: Purchase of fixed assets/long-lived assets |

| Loan made by the company to others |

| Purchase of marketable securities |

| Net cash provided from or used by investing activities |

Table (2)

Cash flows from financing activities: Financing activities refer to the activities carried out by a company to mobilize funds to carry out the business activities. It includes raising cash from long-term debt or payment of long-term debt, which is used for business operations.

The below table shows the way of calculation of cash flows from financing activities:

| Cash flows from financing activities |

| Add: Issuance of common stock |

| Proceeds from borrowings by signing of a mortgage |

| Proceeds from sale of treasury stock |

| Proceeds from issuance of debt |

| Deduct: Payment of dividend |

| Repayment of debt |

| Repayment of the principal on loan |

| Redemption of debt |

| Purchase of treasury stock |

| Net cash provided from or used by financing activities |

Table (3)

Prepare a statement of cash flows explaining the change in cash and cash equivalents.

Table (1)

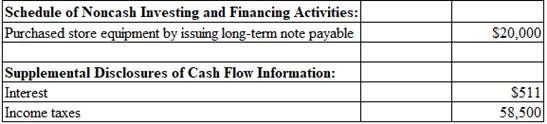

Working notes:

Compute the amount of cash paid for interest in 20-2.

Compute the amount of cash paid for income taxes in 20-2.

2.

Reconcile cash and cash equivalents at the bottom of the statement of cash flows.

Explanation of Solution

Cash: Cash is the money readily available in the form of currency. Since cash can be easily converted into other types of assets, it is reported as first item in the assets section as the most liquid asset.

Cash equivalents: Cash equivalents are the near-cash items, which are readily convertible into cash. Cash equivalents have a maturity period of three months, or less than 3 months. Cash equivalents are reported along with cash in the assets section of the balance sheet, as ‘Cash and cash equivalents’.

Calculate the amount of cash and cash equivalents at January 1, 20-2.

Calculate the amount of cash and cash equivalents at December 31, 20-2.

Want to see more full solutions like this?

Chapter 23 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

- EXPANDED STATEMENT OF CASH FLOWS Financial statements for McGinnis Company as well as additional information relevant to cash flows during the period are given below and on the next page. Additional information: 1. Office equipment was sold in 20-2 for 35,000. Additional information on the office equipment sold is provided below. 2. Depreciation expense for the year was 70,000. 3. The following purchases were made for cash: 4. Declared and paid cash dividends of 40,000. 5. Issued 10,000 shares of 10 par common stock for 22 per share. 6. Acquired additional office equipment by issuing a note payable for 8,000. REQUIRED Prepare a statement of cash flows explaining the change in cash and cash equivalents for the year ended December 31, 20-2.arrow_forwardEXPANDED STATEMENT OF CASH FLOWS Financial statements for McGinnis Company as well as additional information relevant to cash flows during the period are given below and on the next page. Additional information: 1. Office equipment was sold in 20-2 for 35,000. Additional information on the office equipment sold is provided below. 2. Depreciation expense for the year was 70,000. 3. The following purchases were made for cash: 4. Declared and paid cash dividends of 40,000. 5. Issued 10,000 shares of 10 par common stock for 22 per share. 6. Acquired additional office equipment by issuing a note payable for 8,000. REQUIRED Prepare a statement of cash flows explaining the change in cash and cash equivalents for the year ended December 31, 20-2. STATEMENT OF CASH FLOWS UNDER THE DIRECT METHOD Using the information provided in Problem 23-12B for McGinnis Company, prepare the following: 1. A schedule for the calculation of cash generated from operating activities for McGinnis Company for the year ended December 31, 20-2. 2. A statement of cash flows for McGinnis Company prepared under the direct method for the year ended December 31, 20-2.arrow_forwardEXPANDED STATEMENT OF CASH FLOWS Financial statements for McDowell Company as well as additional information relevant to cash flows during the period are given below and on the next page. Additional information: 1. Store equipment was sold in 20-2 for 35,000. Additional information on the store equipment sold is provided below. 2. Depreciation expense for the year was 112,000. 3. The following purchases were made for cash: 4. Declared and paid cash dividends of 60,000. 5. Issued 10,000 shares of 10 par common stock for 142 per share. 6. Acquired additional office equipment by issuing a note payable for 16,000. REQUIRED Prepare a statement of cash flows explaining the change in cash and cash equivalents for the year ended December 31, 20-2. SCHEDULE FOR CALCULATION OF CASH GENERATED FROM OPERATING ACTIVITIES Using the information provided in Problem 23-12A for McDowell Company, prepare the following: 1. A schedule for the calculation of cash generated from operating activities for McDowellCompany for the year ended December 31, 20-2. 2. A partial statement of cash flows for McDowell Company reporting cash from operating activities under the direct method for the year ended December 31, 20-2.arrow_forward

- Statement of Cash Flows A list of Fischer Companys cash flow activities is presented here: a. Patent amortization expense, 3,500 b. Machinery was purchased for 39,500 c. At year-end, bonds payable with a face value of 20,000 were issued for 17,000 d. Net income, 47,200 k. Inventories increased by 15,400 e. Dividends paid, 16,000 f. Depreciation expense, 12,900 g. Preferred stock was issued for 13,600 h. Investments were acquired for 21,000 i. Accounts receivable increased by 4,300 j. Land was sold at cost, 11,000 k. Inventories increased by 15,400 l. Accounts payable increased by 2,700 m. Beginning cash balance, 19,400 Required: Prepare Fischers statement of cash flows.arrow_forwardEXPANDED STATE MENT OF CASH FLOWS Financial statements for McDowell Company as well as additional information relevant to cash flows during the period are given on pages 922923. Additional information: 1. Store equipment was sold in 20-2 for 25,000. Additional information on the store equipment sold is provided below. 2. Depreciation expense for the year was 112,000. 3. The following purchases were made for cash: 4. Declared and paid cash dividends of 60,000. 5. Issued 10,000 shares of 10 par common stock for 14 per share. 6. Acquired additional store equipment by issuing a note payable for 16,000. REQUIRED Prepare a statement of cash flows explaining the change in cash and cash equivalents for the year ended December 31, 20-2.arrow_forwardStatement of Cash Flows The following items involve the cash flow activities of Rocky Horror Picture Co.: a. Net income, 41,000 b. Payment of dividends, 16,000 c. Ten year, 28,000 bonds payable were issued at face value d. Depreciation expense, 11,000 e. Building acquired at a con of 40,000 f. Accounts receivable decreased by 2,000 g. Accounts payable decreased by 4,000 h. Equipment acquired at a cost of 8,000 i. Inventories increased by 7,000 j. Beginning cash balance, 13,000 Required: Prepare Rocky Horror Pictures statement of cash flows using the indirect method.arrow_forward

- Statement of cash flowsdirect method The comparative balance sheet of Martinez Inc. for December 31, 20Y4 and 20Y3, is as follows: The income statement for the year ended December 31, 20Y3, is as follows: Additional data obtained from an examination of the accounts in the ledger for 20Y3 are as follows: A. Equipment and land were acquired for cash. B. There were no disposals of equipment during the year. C. The investments were sold for 588,000 cash. D. The common stock was issued for cash. E. There was a 528,000 debit to Retained Earnings for cash dividends declared. Instructions Prepare a statement of cash flows, using the direct method of presenting cash flows from operating activities.arrow_forwardNet Cash Flow from Operating Activities The following are accounting items taken from Tyrone Shoelaces Required: a. Net income, 22,900 b. Payment for purchase of land, 4,000 c. Payment for retirement of bonds, 6,000 d. Depreciation expense, 7,800 e. Receipt from issuance of common stock, 7,000 f. Patent amortization expense, 2,700 g. Increase in accounts receivable, 3,400 h. Payment of dividends, 5,000 i. Decrease in accounts payable, 2,600 Required: Prepare the operating activities section of Tyrones statement of cash flows using the indirect method.arrow_forwardStatement of Cash Flows The following are several items involving Tejera Companys cash flow activities: a. Net income, 60,400 b. Receipt from issuance of common stock, 32,000 c. Payment for purchase of equipment, 41,500 d. Payment for purchase of land, 19,600 e. Depreciation expense, 20,500 f. Patent amortization expense, 1,200 g. Payment of dividends, 21,000 h. Decrease in salaries payable, 2,600 i. Increase in accounts receivable, 10,300 j. Beginning cash balance, 30,700 Required: Prepare Tejeras statement of cash flows using the direct method.arrow_forward

- Balance sheets for Brierwold Corporation follow: Additional transactions were as follows: a. Purchased equipment costing 50,000. b. Sold equipment costing 60,000, with a book value of 25,000, for 40,000. c. Retired preferred stock at a cost of 110,000. (The premium is debited to Retained Earnings.) d. Issued 10,000 shares of common stock (par value, 4) for 10 per share. e. Reported a loss of 15,000 for the year. f. Purchased land for 50,000. Required: Prepare a statement of cash flows using the worksheet approach. Use the indirect method to prepare the statement.arrow_forwardBalance sheets for Brierwold Corporation follow: Additional transactions were as follows: a. Purchased equipment costing 50,000. b. Sold equipment costing 60,000, with a book value of 25,000, for 40,000. c. Retired preferred stock at a cost of 110,000. (The premium is debited to Retained Earnings.) d. Issued 10,000 shares of common stock (par value, 4) for 10 per share. e. Reported a loss of 15,000 for the year. f. Purchased land for 50,000. Required: Prepare a statement of cash flows using the indirect method.arrow_forwardPartial Statement of Cash Flows Service Company had net income during the current year of $65,800. The following information was obtained from Services balance sheet: Accounts receivable $26,540 increase Inventory 32,180 increase Accounts payable 9,300 decrease Interest payable 2,120 increase Accumulated depreciation (Building) 14,590 increase Accumulated depreciation (Equipment) 32,350 increase Additional Information: 1. Equipment with accumulated depreciation of $18,000 was sold during the year. 2. Cash dividends of $29,625 were paid during the year. Required: 1. Prepare the net cash flows from operating activities using the indirect method. 2. CONCEPTUAL CONNECTION How would the cash proceeds from the sale of equipment he reported on the statement of cash flows? 3. CONCEPTUAL CONNECTION How would the cash dividends be reported on the statement of cash flows? 4. CONCEPTUAL CONNECTION What could the difference between net income and cash flow from operating activities signal to financial statement users?arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning