Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 24, Problem 1MAD

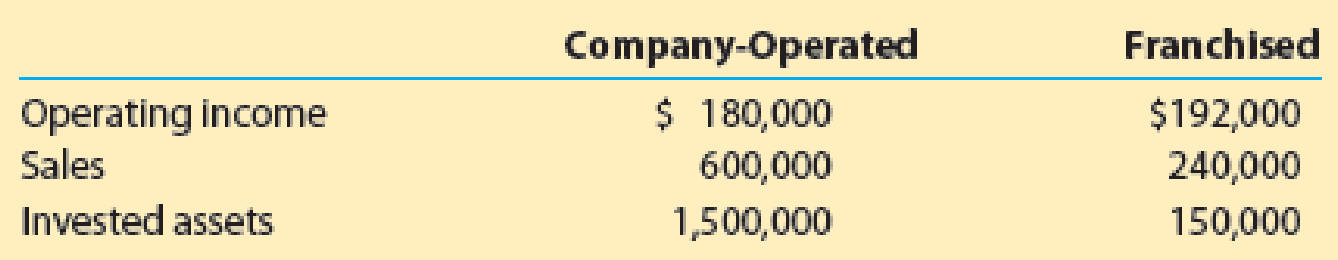

Kelly Kitchens operates both franchised and company-operated restaurants under the brand name Kelly Kitchens. Operating income, sales, and invested assets for both segments are provided as follows:

- a. Determine the profit margin for company-operated and franchised restaurants. Round to the nearest whole percent.

- b. Determine the investment turnover for company-operated and franchised restaurants. Round to two decimal places.

- c. Use the DuPont formula to determine the return on investment for company-operated and franchised restaurants.

- d.

Kelly Kitchens is expanding to the Midwest. How would you advise management regarding the use of company-operated versus franchised restaurants in the expansion?

Kelly Kitchens is expanding to the Midwest. How would you advise management regarding the use of company-operated versus franchised restaurants in the expansion?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

The Bottlebrush Division has income from operations of $90,300, invested assets of $258,000, and sales of $903,000. Use the DuPont formula to compute the return on investment, and show (a) the profit margin, (b) the investment turnover, and (c) the return on investment. Round answers to one decimal place.

a. Profit Margin

%

b. Investment Turnover

c. Return on Investment

%

Bottlebrush Company has operating income of $150,720, invested assets of $314,000, and sales of $1,004,800.

Use the DuPont formula to compute the return on investment, and show (a) the profit margin, (b) the investment turnover, and (c) the return on investment. Round answers to one decimal place.

Ralston Company has operating income of $75,000, invested assets of $360,000, and sales of $790,000.

Use the DuPont formula to compute the return on investment (ROI), and show (a) the profit margin, (b) the investment turnover, and (c) the return on investment. Round the profit margin percentage to two decimal places, the investment turnover to three decimal places, and the return on investment to two decimal places.

Chapter 24 Solutions

Financial And Managerial Accounting

Ch. 24 - Differentiate between centralized and...Ch. 24 - Differentiate between a profit center and an...Ch. 24 - Weyerhaeuser Co. (WY) developed a system that...Ch. 24 - What is the major shortcoming of using operating...Ch. 24 - In a decentralized company in which the divisions...Ch. 24 - Prob. 6DQCh. 24 - (a) Explain how return on investment might lead a...Ch. 24 - Prob. 8DQCh. 24 - When is the negotiated price approach preferred...Ch. 24 - Prob. 10DQ

Ch. 24 - Budgetary performance for cost center Vinton...Ch. 24 - Support department allocations The centralized...Ch. 24 - Prob. 3BECh. 24 - Profit margin, investment turnover, and ROI Briggs...Ch. 24 - Residual income Obj. The Commercial Division of...Ch. 24 - Transfer pricing The materials used by the...Ch. 24 - Budget performance reports for cost centers...Ch. 24 - The following data were summarized from the...Ch. 24 - Prob. 3ECh. 24 - Prob. 4ECh. 24 - Service department charges In divisional income...Ch. 24 - Varney Corporation, a manufacturer of electronics...Ch. 24 - Horton Technology has two divisions, Consumer and...Ch. 24 - Rocky Mountain Airlines Inc. has two divisions...Ch. 24 - Championship Sports Inc. operates two divisionsthe...Ch. 24 - The operating income and the amount of invested...Ch. 24 - The operating income and the amount of invested...Ch. 24 - Prob. 12ECh. 24 - The condensed income statement for the Consumer...Ch. 24 - Prob. 14ECh. 24 - Data are presented in the following table of...Ch. 24 - Prob. 16ECh. 24 - Materials used by the Instrument Division of...Ch. 24 - Prob. 18ECh. 24 - GHT Tech Inc. sells electronics over the Internet....Ch. 24 - Profit center responsibility reporting for a...Ch. 24 - Divisional income statements and return on...Ch. 24 - Effect of proposals on divisional performance A...Ch. 24 - Divisional performance analysis and evaluation The...Ch. 24 - Prob. 6PACh. 24 - Budget performance report for a cost center The...Ch. 24 - Profit center responsibility reporting for a...Ch. 24 - Divisional income statements and return on...Ch. 24 - Effect of proposals on divisional performance A...Ch. 24 - Prob. 5PBCh. 24 - Prob. 6PBCh. 24 - Kelly Kitchens operates both franchised and...Ch. 24 - Panera Bread Company (PNRA) operates over 2,000...Ch. 24 - Papa Johns International, Inc. (PZZA), operates...Ch. 24 - Panera Bread Company (PNRA) operates over 2,000...Ch. 24 - McDonalds Corporation (MCD) operates company-owned...Ch. 24 - Prob. 1TIFCh. 24 - Prob. 2TIFCh. 24 - Communication The Norse Division of Gridiron...Ch. 24 - The three divisions of Yummy Foods are Snack...Ch. 24 - Last Resort Industries Inc. is a privately held...Ch. 24 - Sara Bellows, manager of the telecommunication...Ch. 24 - Most firms allocate corporate and other support...Ch. 24 - Prob. 3CMACh. 24 - Prob. 4CMA

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Papa Johns International, Inc. (PZZA), operates over 5,000 restaurants in the United States and 45 countries. The company operates primarily as a franchisor with 4,353 franchised restaurants and 744 company-operated restaurants. Recent data (in millions) for the company-operated and North America franchised restaurants are as follows: a. Determine the profit margin for each segment. Round to one decimal place. b. Determine the investment turnover for each segment. Round to two decimal places. c. Use the DuPont formula to determine the return on investment for each segment. Round to one decimal place. d. Analyze and interpret the results of (a), (b), and (c).arrow_forwardXenold, Inc., manufactures and sells cooktops and ovens through three divisions: Home, Restaurant, and Specialty. Each division is evaluated as a profit center. Data for each division for last year are as follows (numbers in thousands): The income tax rate for Xenold, Inc., is 40 percent. Xenold, Inc., has two sources of financing: bonds paying 5 percent interest, which account for 25 percent of total investment, and equity accounting for the remaining 75 percent of total investment. Xenold, Inc., has been in business for over 15 years and is considered a relatively stable stock, despite its link to the cyclical construction industry. As a result, Xenold stock has an opportunity cost of 5 percent over the 4 percent long-term government bond rate. Xenolds total capital employed is 5.04 million (2,600,000 for the Home Division, 1,700,000 for the Restaurant Division, and the remainder for the Specialty Division). Required: 1. Prepare a segmented income statement for Xenold, Inc., for last year. 2. Calculate Xenolds weighted average cost of capital. (Round to four significant digits.) 3. Calculate EVA for each division and for Xenold, Inc. 4. Comment on the performance of each of the divisions.arrow_forwardEastlawn Travel has two operating divisions, Tours and Resorts. The two divisions meet the requirements for segment disclosures. Before transactions between the two divisions are considered, revenues and costs are as follows: Revenues Costs Tours $ 35,200,000 19,800,000 The two divisions have an arrangement by which Resorts gives coupons redeemable for tours and Tours gives discount coupons good for stays at a resort. The value of the coupons for the tours redeemed during the past year totaled $5.3 million. The discount coupons redeemed at the resorts totaled $2.2 million. As of the end of the year, all coupons for the current year expired. Tours Resorts Resorts $ 24,200,000 17,600,000 Required: What are the operating profits for each division considering the effects of the costs arising from the joint agreement? Note: Enter your answers in thousands. Operating Profitsarrow_forward

- Papa’s Pizza is the market leader and Pizza Prince is an up-and-coming player in the highly competitive delivery pizza business. The companies reported the following selected financial data ($ in thousands): Papa’s Pizza Pizza PrinceNet sales $ 24,128 $ 1,835Net income 2,223 129Total assets, beginning 14,998 919Total assets, ending 15,465 1,157Required:1. Calculate the return on assets, profit margin, and asset turnover ratio for Papa’s Pizza.2. Calculate the return on assets, profit margin, and asset turnover ratio for Pizza Prince.3. Which company has the higher profit margin and which company has the higher asset turnover?arrow_forwardBottlebrush Company has operating income of $49,749, invested assets of $309,000, and sales of $710,700. Use the DuPont formula to compute the return on investment, and show (a) the profit margin, (b) the investment turnover, and (c) the return on investment. Round answers to one decimal place. a. Profit margin % b. Investment turnover c. Return on investment %arrow_forwardThe Bottlebrush Company has income from operations of $69,768, invested assets of $204,000, and sales of $775,200. Round answers to one decimal place. (a) Determine the profit margin. % (b) Determine investment turnover. (c) Use the DuPont formula to determined the rate of return on investment. %arrow_forward

- Carson Electronics’ management has long viewed BGT Electronics as an industry leader and uses this firm as a model firm for analyzing its own performance. The balance sheet and income statements for the two firms are as follows: Calculate the following ratios for both Carson and BGT: a) Current ratio: b) Times interest earned: c) Inventory turnover:arrow_forwardBottlebrush Company has income from operations of $96,492, invested assets of $258,000, and sales of $567,600. Use the DuPont formula to calculate the return on investment, and show (a) the profit margin, (b) the investment turnover, and (c) the return on investment. Round answers to one decimal place. a. Profit Margin fill in the blank 1 % b. Investment Turnover fill in the blank 2 c. Return on Investment fill in the blank 3 %arrow_forwardCash Company has income from operations of $51,520, invested assets of $230,000, and sales of $644,000. Use the DuPont formula to compute the return on investment. If required, round your answers to two decimal places. a. Profit margin b. Investment turnover c. Return on investmentarrow_forward

- Forchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 2. For the Cleaning Products Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 3. What if operating income for the Small Appliances Division was 2,000,000? How would that affect average operating assets? Margin? Turnover? ROI? Calculate any changed ratios (round to four significant digits).arrow_forwardPanera Bread Company (PNRA) operates over 2,000 bakery-cafe locations throughout the United States and Canada and serves over 9 million customers per week. Paneras operations are divided into the following segments: Company-Operated Bakery-Cafes Franchised Bakery-Cafes Fresh Dough and Other Products The Fresh Dough and Other Products segment supplies fresh dough, produce, tuna, and other products to the company-operated and franchised cafes. Recent data (in millions) for each of these segments are as follows: a. Determine the profit margin for each segment. Round to one decimal place. b. Determine the investment turnover for each segment. Round to two decimal places. c. Use the DuPont formula to determine the return on investment for each segment. Round to one decimal place. d. Which segment has the highest profit margin, investment turnover, and return on investment? Explain why. e. If franchised cafes are more profitable, why would Panera operate company- owned cafes? MAD 24-3 Analyze Papa Johns International, Inc.Obj. 6 Papa Johns International, Inc. (PZZA), operates over 5,000 restaurants in the United States and 45 countries. The company operates primarily as a franchisor with 4,353 franchised restaurants and 744 company-operated restaurants. Recent data (in millions) for the company-operated and North America franchised restaurants are as follows: a. Determine the profit margin for each segment. Round to one decimal place. b. Determine the investment turnover for each segment. Round to two decimal places. c. Use the DuPont formula to determine the return on investment for each segment. Round to one decimal place. d. Analyze and interpret the results of (a), (b), and (c). MAD 24-4 Compare Panera Bread and Papa JohnsObj. 6 Compare Panera Bread (PNRA) and Papa Johns (PZZA) using your computations from MAD 24-2 and MAD 24-3.arrow_forwardPanera Bread Company (PNRA) operates over 2,000 bakery-cafe locations throughout the United States and Canada and serves over 9 million customers per week. Paneras operations are divided into the following segments: Company-Operated Bakery-Cafes Franchised Bakery-Cafes Fresh Dough and Other Products The Fresh Dough and Other Products segment supplies fresh dough, produce, tuna, and other products to the company-operated and franchised cafes. Recent data (in millions) for each of these segments are as follows: a. Determine the profit margin for each segment. Round to one decimal place. b. Determine the investment turnover for each segment. Round to two decimal places. c. Use the DuPont formula to determine the return on investment for each segment. Round to one decimal place. d. Which segment has the highest profit margin, investment turnover, and return on investment? Explain why. e. If franchised cafes are more profitable, why would Panera operate company- owned cafes?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Cost-Volume-Profit (CVP) Analysis and Break-Even Analysis Step-by-Step, by Mike Werner; Author: Accounting Step by Step;https://www.youtube.com/watch?v=D0MOfse9OWk;License: Standard Youtube License