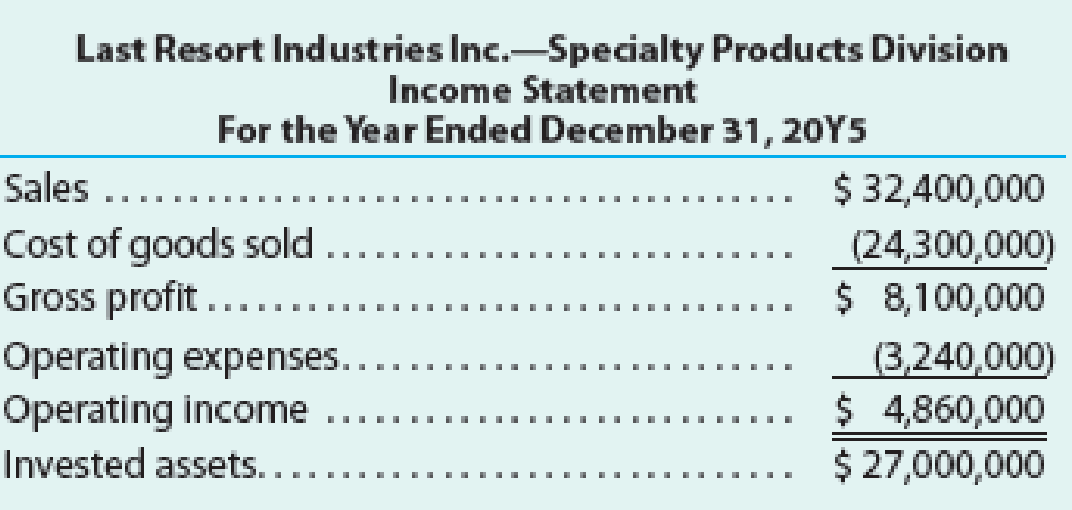

Last Resort Industries Inc. is a privately held diversified company with five separate divisions organized as investment centers. A condensed income statement for the Specialty Products Division for the past year, assuming no support department allocations, along with asset information is as follows:

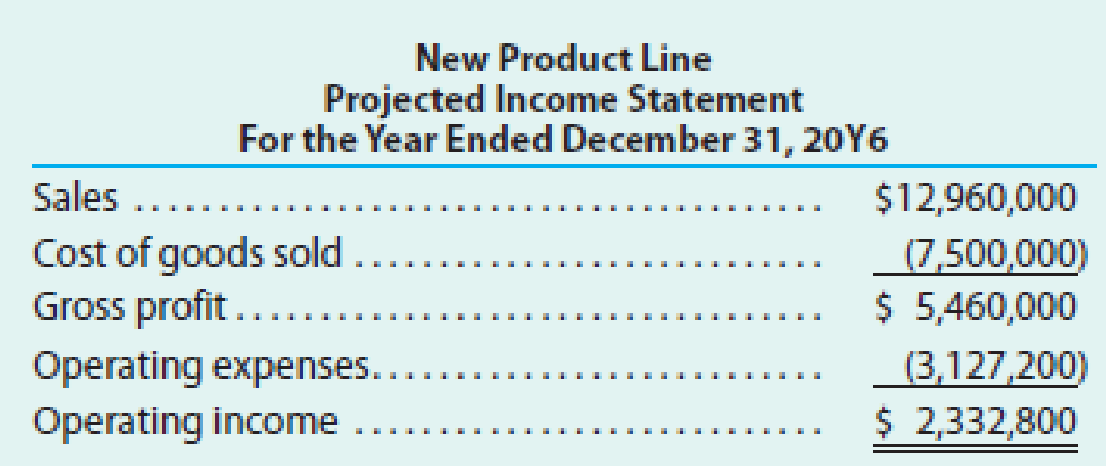

The manager of the Specialty Products Division was recently presented with the opportunity to add an additional product line, which would require invested assets of $14,400,000. A

The Specialty Products Division currently has $27,000,000 in invested assets, and Last Resort Industries Inc.’s overall return on investment, including all divisions, is 10%. Each division manager is evaluated on the basis of divisional return on investment. A bonus is paid, in $8,000 increments, for each whole percentage point that the division’s return on investment exceeds the company average.

The president is concerned that the manager of the Specialty Products Division rejected the addition of the new product line, even though all estimates indicated that the product line would be profitable and would increase overall company income. You have been asked to analyze the possible reasons the Specialty Products Division manager rejected the new product line.

- a. Determine the return on investment for the Specialty Products Division for the past year.

- b. Determine the Specialty Products Division manager’s bonus for the past year.

- c. Determine the estimated return on investment for the new product line. Round percentages to one decimal place and the investment turnover to two decimal places.

- d.

Why might the manager of the Specialty Products Division decide to reject the new product line? Support your answer by determining the projected return on investment for 20Y6, assuming that the new product line was launched in the Specialty Products Division and 20Y6 actual operating results were similar to those of 20Y5.

Why might the manager of the Specialty Products Division decide to reject the new product line? Support your answer by determining the projected return on investment for 20Y6, assuming that the new product line was launched in the Specialty Products Division and 20Y6 actual operating results were similar to those of 20Y5. - e.

Suggest an alternative performance measure for motivating division managers to accept new investment opportunities that would increase the overall company income and return on investment.

Suggest an alternative performance measure for motivating division managers to accept new investment opportunities that would increase the overall company income and return on investment.

Trending nowThis is a popular solution!

Chapter 24 Solutions

Financial And Managerial Accounting

- The condensed income statement for the Consumer Products Division of Tri-State Industries Inc. is as follows (assuming no support department allocations): The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that 143,750,000 of assets have been invested in the Consumer Products Division. b. If expenses could be reduced by 3,450,000 without decreasing sales, what would be the impact on the profit margin, investment turnover, and return on investment for the Consumer Products Division?arrow_forwardThis exercise parallels the machine-purchase decision for the Mendoza Company that is discussed in the body of the chapter. Assume that Mendoza is exploring whether to enter a complementary line of business. The existing business line generates annual cash revenues of approximately $4,590,000 and cash expenses of $3,699,000, one-third of which are labor costs. The current level of investment in this existing division is $13,000,000. (Sales and costs of this division are not affected by the investment decision regarding the complementary line.) Mendoza estimates that incremental (noncash) net working capital of $44,000 will be needed to support the new business line. No additional facilities-level costs would be needed to support the new line—there is currently sufficient excess capacity. However, the new line would require additional cash expenses (overhead costs) of $446,000 per year. Raw materials costs associated with the new line are expected to be $1,520,000 per year, while the…arrow_forwardTerra Company has two divisions, the Retail Division and the Wholesale Division. The following information was gathered for the two divisions for the current year: Retail Division Wholesale Division Operating income $ 2,750,000 $ 6,250,000 Operating assets $ 18,500,000 $ 38,500,000 Terra Company has set a target return on investment (ROI) of 14% for both divisions. Which of the following statements is accurate? Residual income for the wholesale division was $160,000. Residual income for the wholesale division was $860,000. Residual income for the retail division was $860,000. None of these answers are correct.arrow_forward

- The AAA Division has permanent current assets of P50,000 and operating non-current assets of 350,000. It provides annual operating income after tax of P100,000. Its cost of capital is 15% but the minimum required rate of return by the entity is 16%. 1. How much is its current return on investment? 2. How much is its economic value added? 3. How much is its residual income? 4. Assume that the Senna Division is presented by the head office to manage a P60,000 investment option yielding a 20% return on its investment. Should the Division agree to manage this investment opportunity? A. Yes, because the ROI will increase. B. Yes, because the RI and EVA will increase. C. No, because the ROI will decrease. D. No, because the RI and EVA will decrease.arrow_forwardThis exercise parallels the machine-purchase decision for the Mendoza Company that is discussed in the body of the chapter. Assume that Mendoza is exploring whether to enter a complementary line of business. The existing business line generates annual cash revenues of approximately $5,000,000 and cash expenses of $3,600,000, one-third of which are labor costs. The current level of investment in this existing division is $12,000,000. (Sales and costs of this division are not affected by the investment decision regarding the complementary line.)Mendoza estimates that incremental (noncash) net working capital of $30,000 will be needed to support the new business line. No additional facilities-level costs would be needed to support the new line—there is currently sufficient excess capacity. However, the new line would require additional cash expenses (overhead costs) of $400,000 per year. Raw materials costs associated with the new line are expected to be $1,200,000 per year, while the…arrow_forwardThis exercise parallels the machine-purchase decision for the Mendoza Company that is discussed in the body of the chapter. Assume that Mendoza is exploring whether to enter a complementary line of business. The existing business line generates annual cash revenues of approximately $5,000,000 and cash expenses of $3,600,000, one-third of which are labor costs. The current level of investment in this existing division is $12,000,000. (Sales and costs of this division are not affected by the investment decision regarding the complementary line.)Mendoza estimates that incremental (noncash) net working capital of $30,000 will be needed to support the new business line. No additional facilities-level costs would be needed to support the new line—there is currently sufficient excess capacity. However, the new line would require additional cash expenses (overhead costs) of $400,000 per year. Raw materials costs associated with the new line are expected to be $1,200,000 per year, while the…arrow_forward

- This exercise parallels the machine-purchase decision for the Mendoza Company that is discussed in the body of the chapter. Assume that Mendoza is exploring whether to enter a complementary line of business. The existing business line generates annual cash revenues of approximately $5,000,000 and cash expenses of $3,600,000, one-third of which are labor costs. The current level of investment in this existing division is $12,000,000. (Sales and costs of this division are not affected by the investment decision regarding the complementary line.)Mendoza estimates that incremental (noncash) net working capital of $30,000 will be needed to support the new business line. No additional facilities-level costs would be needed to support the new line—there is currently sufficient excess capacity. However, the new line would require additional cash expenses (overhead costs) of $400,000 per year. Raw materials costs associated with the new line are expected to be $1,200,000 per year, while the…arrow_forwardMr. Bailey asks that you prepare Divisional Income Statements showing what 20Y8 results would have been had the Audit Division purchased all the excess capacity of the Tax Division, using a market transfer price. The divisional managers tell you that, with the excess capacity of the Tax Division of 800 hours, the Audit Division can perform 4 more audits during the year, and the Tax Division would charge the Audit Division the market rate of $100 per hour for the additional hours required, selling all its excess capacity to the Audit Division. The Tax Division would still be responsible for paying the salaries of their employees. Complete the following Divisional Income Statements. If there is no amount or an amount is zero, enter “0”. BOR CPAs, Inc.Divisional Income StatementsFor the Year Ended December 31, 20Y8 Audit Division Tax Division Total Company Fees earned: Audit fees (16 engagements) $1,200,000 $1,200,000 Tax fees (45 engagements) $708,750…arrow_forwardThe condensed income statement for the Consumer Products Division of Tri-State Industries Inc. is as follows (assuming no support department allocations): Sales $744,000 Cost of goods sold (334,800) Gross profit $409,200 Administrative expenses (148,800) Operating income $260,400 The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $1,240,000 of assets have been invested in the Consumer Products Division. Round the investment turnover to one decimal place. Profit margin % Investment turnover Return on investment % b. If expenses could be reduced by $37,200 without decreasing sales, what would be the impact on the profit margin, investment turnover, and return on investment for the Consumer Products Division? Round the investment…arrow_forward

- Gemma Company is a midsize manufacturing company with 120 employees and approximately $45 million in sales. Management has established a set of processes to purchase fixed assets, described in the following paragraphs: When a user department decides to purchase a new fixed asset, the departmental manager prepares an asset request form. When completing the form, the manager must describe the fixed asset, the advantages or efficiencies offered by the asset, and estimates of costs and benefits. The asset request form is forwarded to the director of finance. Personnel in the finance department review estimates of costs and benefits and revise these if necessary. A discounted cash flow analysis is prepared and forwarded to the vice president of operations, who reviews the asset request forms and the discounted cash flow analysis, and then interviews user department managers if he or she feels it is warranted. After this review, she selects assets to purchase until she has exhausted the…arrow_forwardCasual Living Inc. is a privately held diversified company with five separate divisions organized as investment centers. A condensed income statement for the Apparel Division for the past year, assuming no service department charges, is as follows: Casual Living Inc.—Apparel Division Income Statement For the Year Ended December 31, 2009 ____________________________________________________ Sales …………………………………........……… $22,500,000 Cost of goods sold …………………….……... 16,870,000 Gross profit …………………………….....……. $ 5,630,000 Operating expenses …………………………… 1,130,000 Income from operations …………...…….. $ 4,500,000 Invested assets …………………………..….. $30,000,000 The manager of the Apparel Division was recently presented with the opportunity to add an additional product line, which would require invested assets of $15,000,000. A projected income statement for the new product line is as follows: New Product Line Projected Income Statement For the Year Ended December 31, 2010…arrow_forwardCasual Living Inc. is a privately held diversified company with five separate divisions organized as investment centers. A condensed income statement for the Apparel Division for the past year, assuming no service department charges, is as follows: Casual Living Inc.—Apparel Division Income Statement For the Year Ended December 31, 2009 ____________________________________________________ Sales …………………………………........……… $22,500,000 Cost of goods sold …………………….……... 16,870,000 Gross profit …………………………….....……. $ 5,630,000 Operating expenses …………………………… 1,130,000 Income from operations …………...…….. $ 4,500,000 Invested assets …………………………..….. $30,000,000 The manager of the Apparel Division was recently presented with the opportunity to add an additional product line, which would require invested assets of $15,000,000. A projected income statement for the new product line is as follows: New Product Line Projected Income Statement For the Year Ended December 31, 2010…arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning