Product Pricing using the Cost-Plus Approach Methods; Differential Analysis for Accepting Additional Business Crystal Displays Inc. recently began production of a new product, flat panel displays, which required the investment of $1,500,000 in assets. The costs of producing and selling 5,000 units of flat panel displays are estimated as follows: Variable costs per unit: Fixed costs: Direct materials $120 Factory overhead $250,000 Direct labor 30 Selling and administrative expenses 150,000 Factory overhead 50 Selling and administrative expenses 35 Total variable cost per unit $235 Crystal Displays Inc. is currently considering establishing a selling price for flat panel displays. The president of Crystal Displays has decided to use the cost-plus approach to product pricing and has indicated that the displays must earn a 15% return on invested assets. Required: Note: Round all markup percentages to two decimal places, if required. Round all costs per unit and selling prices per unit to the nearest whole dollar.

Product Pricing using the Cost-Plus Approach Methods; Differential Analysis for Accepting Additional Business

Crystal Displays Inc. recently began production of a new product, flat panel displays, which required the investment of $1,500,000 in assets. The costs of producing and selling 5,000 units of flat panel displays are estimated as follows:

| Variable costs per unit: | Fixed costs: | |||

| Direct materials | $120 | Factory overhead | $250,000 | |

| Direct labor | 30 | Selling and administrative expenses | 150,000 | |

| Factory overhead | 50 | |||

| Selling and administrative expenses | 35 | |||

| Total variable cost per unit | $235 |

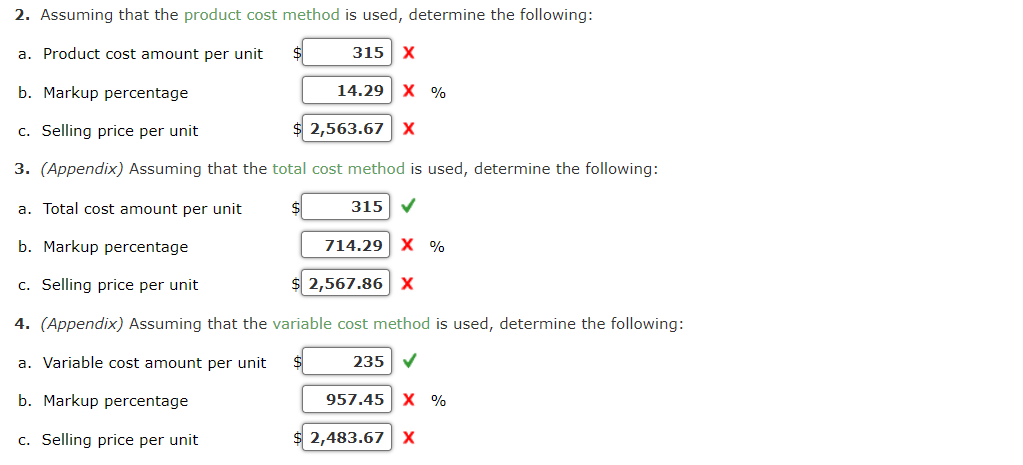

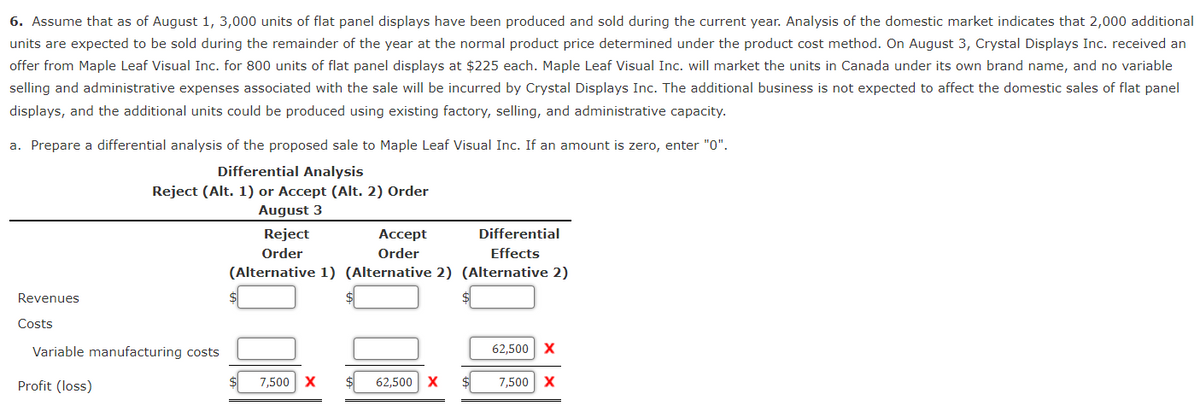

Crystal Displays Inc. is currently considering establishing a selling price for flat panel displays. The president of Crystal Displays has decided to use the cost-plus approach to product pricing and has indicated that the displays must earn a 15% return on invested assets.

Required:

Note: Round all markup percentages to two decimal places, if required. Round all costs per unit and selling prices per unit to the nearest whole dollar.

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 12 images