Capital rationing decision for a service company involving four proposals

Renaissance Capital Group is considering allocating a limited amount of capital investment funds among four proposals. The amount of proposed investment, estimated income from operations, and net cash flow for each proposal are as follow:

| Investment | Year | Income from Operations | Net Cash Flow | |

| Proposal A: | $680,000 | 1 | $ 64,000 | $200,000 |

| 2 | 64,000 | 200,000 | ||

| 3 | 64,000 | 200,000 | ||

| 4 | 24,000 | 160,000 | ||

| 5 | 24,000 | 160,000 | ||

| $240,000 | $ 920,000 | |||

| Proposal B: | $320,000 | 1 | $ 26,000 | $ 90,000 |

| 2 | 26,000 | 90,000 | ||

| 3 | 6,000 | 70,000 | ||

| 4 | 6,000 | 70,000 | ||

| 5 | (44,000) | 20,000 | ||

| $ 20,000 | $ 340,000 | |||

| Proposal C: | $108,000 | 1 | $ 33,400 | $ 55,000 |

| 2 | 31,400 | 53,000 | ||

| 3 | 28,400 | 50,000 | ||

| 4 | 25,400 | 47,000 | ||

| 5 | 23,400 | 45,000 | ||

| $142,000 | $ 250,000 | |||

| Proposal D: | $400,000 | 1 | $100,000 | $ 180,000 |

| 2 | 100,000 | 180,000 | ||

| 3 | 80,000 | 160,000 | ||

| 4 | 20,000 | 100,000 | ||

| 5 | 0 | 80,000 | ||

| $300,000 | $700,000 |

The company’s capital rationing policy requires a maximum cash payback period of three years. In addition, a minimum average

Instructions

1. Compute the cash payback period for each of the four proposals.

2. Giving effect to straight-line

3. Using the following format, summarize the results of your computations in parts (1) and (2). By placing the calculated amounts in the first two columns on the left and by placing a check mark in the appropriate column to the right, indicate which proposals should be accepted for further analysis and which should be rejected.

| Proposal | Cash Payback Period | Average Rate of Return | Accept for Further Analysis | Reject |

| A | ||||

| B | ||||

| C | ||||

| D |

4. For the proposals accepted for further analysis in part (3), compute the net present value. Use a rate of 15% and the present value of $1 table appearing in this chapter (Exhibit 2).

5. Compute the present value index for each of the proposals in part (4). Round to two decimal places.

6. Rank the proposals from most attractive to least attractive, based oil the present values of net

7. Rank the proposals from most attractive to least attractive, based on the present value indexes computed in part (5).

8. Based on the analyses, comment on the relative attractiveness of the proposals ranked in parts (6) and (7).

1.

Cash payback method:

Cash payback period is the expected time period which is required to recover the cost of investment. It is one of the capital investment method used by the management to evaluate the long-term investment (fixed assets) of the business.

Average rate of return method:

Average rate of return is the amount of income which is earned over the life of the investment. It is used to measure the average income as a percent of the average investment of the business, and it is also known as the accounting rate of return.

The average rate of return is computed as follows:

Net present value method:

Net present value method is the method which is used to compare the initial cash outflow of investment with the present value of its cash inflows. In the net present value, the interest rate is desired by the business based on the net income from the investment, and it is also called as the discounted cash flow method.

Present value index:

Present value index is a technique, which is used to rank the proposals of the business. It is used by the management when the business has more investment proposals, and limited fund.

The present value index is computed as follows:

To determine: The cash payback period for the given proposals.

Explanation of Solution

The cash payback period for the given proposals is as follows:

Proposal A:

Initial investment=$680,000

| Cash payback period of Proposal A | ||||

| Year | Net cash flows | Cumulative net cash flows | ||

| 1 | 200,000 | 200,000 | ||

| 2 | 200,000 | 400,000 | ||

| 3 | 200,000 | 600,000 | ||

| 6 months (1) | 80,000 | 680,000 | ||

Table (1)

Hence, the cash payback period of proposal A is 3 years and 6 months.

Working note:

1. Calculate the no. of months in the cash payback period:

Proposal B:

Initial investment=$320,000

| Cash payback period of Proposal B | ||||

| Year | Net cash flows | Cumulative net cash flows | ||

| 1 | 90,000 | 90,000 | ||

| 2 | 90,000 | 180,000 | ||

| 3 | 70,000 | 250,000 | ||

| 4 | 70,000 | 320,000 | ||

Table (2)

Hence, the cash payback period of proposal B is 4 years.

Proposal C:

Initial investment=$108,000

| Cash payback period of Proposal C | ||||

| Year | Net cash flows | Cumulative net cash flows | ||

| 1 | 55,000 | 55,000 | ||

| 2 | 53,000 | 108,000 | ||

Table (3)

Hence, the cash payback period of proposal C is 2 years.

Proposal D:

Initial investment=$400,000

| Cash payback period of Proposal D | ||||

| Year | Net cash flows | Cumulative net cash flows | ||

| 1 | 180,000 | 180,000 | ||

| 2 | 180,000 | 360,000 | ||

| 3 months (2) | 40,000 | 400,000 | ||

Table (4)

Hence, the cash payback period of proposal D is 2 years and 3 months.

Working note:

2. Calculate the no. of months in the cash payback period:

2.

Explanation of Solution

The average rate of return for the given proposals is as follows:

Proposal A:

Hence, the average rate of return for Proposal A is 14.1%.

Proposal B:

Hence, the average rate of return for Proposal B is 2.5%.

Proposal C:

Hence, the average rate of return for Proposal C is 52.6%.

Proposal D:

Hence, the average rate of return for Proposal D is 30.0%.

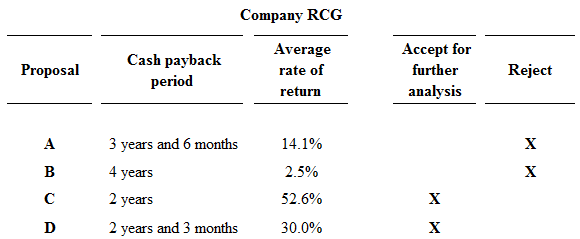

3.

To indicate: The proposals which should be accepted for further analysis, and which should be rejected.

Explanation of Solution

The proposals which should be accepted for further analysis, and which should be rejected is as follows:

Figure (1)

Proposals A and B are rejected, because proposal A and B fails to meet the required maximum cash back period of 3 years, and they has less rate of return than the other proposals. Hence, Proposals C and D are preferable.

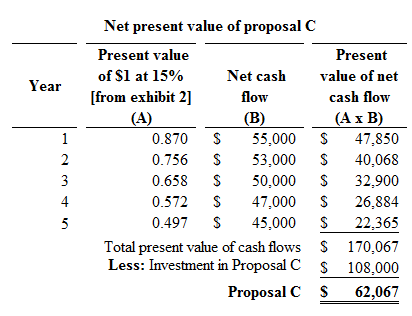

4.

Explanation of Solution

Calculate the net present value of the proposals which has 12% rate of return as follows:

Proposal C:

Figure (2)

Hence, the net present value of proposal C is $62,067.

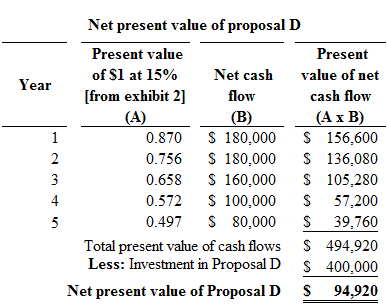

Proposal D:

Figure (3)

Hence, the net present value of proposal D is $94,920.

5.

To determine: The present value index for each proposal.

Explanation of Solution

The present value index for each proposal is as follows:

Proposal C:

Calculate the present value index for proposal C:

Hence, the present value index for proposal C is 1.575.

Proposal D:

Calculate the present value index for proposal D:

Hence, the present value index for proposal D is 1.237.

6.

To rank: The proposal from most attractive to least attractive, based on the present value of net cash flows.

Explanation of Solution

Proposals are arranged by rank is as follows:

| Proposals | Net present value | Rank |

| Proposal D | $ 94,920 | 1 |

| Proposal C | $ 62,067 | 2 |

Table (5)

7.

To rank: The proposal from most attractive to least attractive, based on the present value of index.

Explanation of Solution

Proposals are arranged by rank is as follows:

| Proposals | Present value index | Rank |

| Proposal C | 1.57 | 1 |

| Proposal D | 1.24 | 2 |

Table (6)

8.

To analysis: The proposal which is favor to investment, and comment on the relative attractiveness of the proposals based on the rank.

Explanation of Solution

On the basis of net present value:

The net present value of Proposal C is $62,067, and Proposal D is $94,920. In this case, the net present value of proposal D is more than the net present value of proposal C. Hence, investment in Proposal D is preferable.

On the basis of present value index:

The present value index of Proposal C is 1.57, and the present value index of Proposal D is 1.24. In this case, Proposal C has the favorable present value index, because the present value index of Proposal C (1.57) is more than Proposal D (1.24). Thus, the investment in Proposal C is preferable (favorable).

Every business tries to get maximum profit with minimum investment. Hence, the cost of investment in Proposal C is less than the proposal D. Thus, investment in Proposal C is preferable.

Want to see more full solutions like this?

Chapter 26 Solutions

Accounting

- Capital rationing decision involving four proposals Kopecky Industries Inc. is considering allocating a limited amount of capital investment funds among four proposals. The amount of proposed investment, estimated income from operations, and net cash flow for each proposal are as follows: The company’s capital rationing policy requires a maximum cash payback period of three years. In addition, a minimum average rate of return of 12% is required on allprojects. 1f the preceding standards are met, the net present value method and presentvalue indexes are used to rank the remaining proposals. Instructions Compute the present value index for each oldie proposals in part (4). Round to two decimal places.arrow_forwardCash payback period for a service company Janes Clothing Inc. is evaluating two capital investment proposals for a retail outlet, each requiring an investment of 975,000 and each with a seven-year life and expected total net cash flows of 1,050,000. Location 1 is expected to provide equal annual net cash flows of 150,000, and Location 2 is expected to have the following unequal annual net cash flows: Determine the cash payback period for both location proposals.arrow_forwardResidual Distribution Policy Harris Company must set its investment and dividend policies for the coming year. It has three independent projects from which to choose, each of which requires a 3 million investment. These projects have different levels of risk, and therefore different costs of capital. Their projected IRRs and costs of capital are as follows: Project A: Cost of capital = 17%; IRR = 20% Project B: Cost of capital = 13%; IRR = 10% Project C: Cost of capital = 7%; IRR = 9% Harris intends to maintain its 35% debt and 65% common equity capital structure, and its net income is expected to be 4,750,000. If Harris maintains its residual dividend policy (with all distributions in the form of dividends), what will its payout ratio be?arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,