Reset the Data Section of the CAPBUD2 worksheet to the original values. In requirement 4, you assessed the sensitivity of the investment’s

- a. What annual cash flow (approximately) is required to:

- (1) earn 0% rate of return? _______________

- (2) earn 10% rate of return? _______________

- (3) earn over 20% rate of return? _______________

- b. Approximately, how much is the rate of return reduced for each drop of $10,000 annual cash flow?

When the assignment is complete, close the file without saving it again.

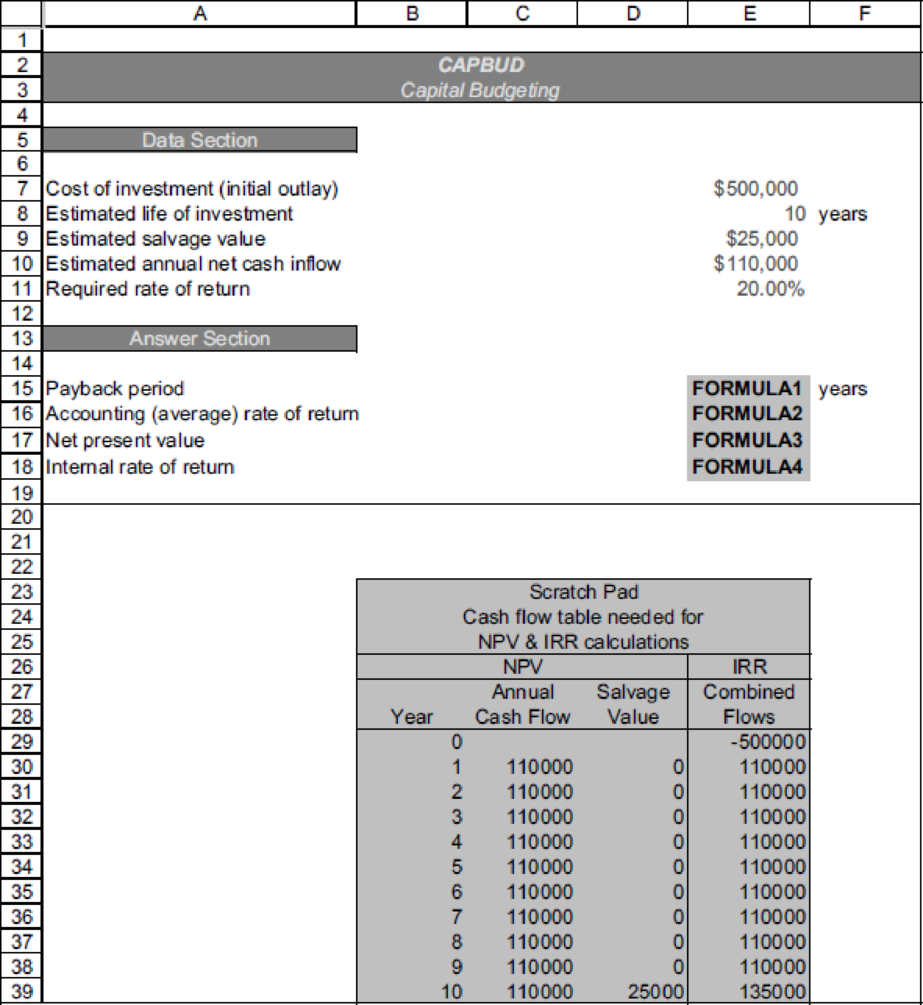

Worksheet. The CAPBUD2 worksheet handles only cash inflows that are even in amount each year. Many capital projects generate uneven cash inflows. Suppose that the new store had expected cash earnings of $80,000 per year for the first two years, $140,000 for the next four years, and $220,000 for the last four years. The new store will generate the same total cash return ($1,600,000) as in the original problem, but the timing of the cash flows is different. Alter the CAPBUD2 worksheet so that the NPV and IRR calculations can be made whether there are even or uneven cash flows. When done, preview the printout to make sure that the worksheet will print neatly on one page, and then print the worksheet. Save the completed file as CAPBUDT.

Hint: One suggestion is to label column F in the scratch pad as Uneven cash flows.

Enter the uneven cash flows for each year. Modify FORMULA3 to include these cash flows. Modify the formulas in the range E30 to E39 to include the new data. Then set cell E10 (estimated Annual Net

Note that this solution causes garbage to come out in cells E15 and E16 because those formulas were not altered. Check figure for uneven cash flows: NPV (cell E17), $68,674.

Chart. Using the CAPBUD2 file, develop a chart just like the one used in requirement 6 to show the sensitivity of

Want to see the full answer?

Check out a sample textbook solution

Chapter 26 Solutions

Excel Applications for Accounting Principles

- Please answer the following question. In this method, the company compares the amount spent on the investment with the discounted expected future cash inflows. a.Payback b.NRV c.Investment d.IRRarrow_forwardThe accounting rate of return (also known as the unadjusted rate of return) can be calculated as: (See your Chapter 25 notes, page 2) Initial cost of the investment divided by the annual net cash inflow Initial cost of the investment minus the annual net cash inflow Average amount of the investment divided by the average annual net income Average annual net income divided by the average amount of the investment Present value of net cash inflow divided by the initial cost of the investment Annual net cash inflow minus the initial cost of the investment Future value of net cash inflow divided by the initial cost of the investment Present value of the net cash inflow minus the initial cost of the investmentarrow_forwardPlease answer the following questions 1. _________________ is the discounted net future cash inflows divided by the initial cash outlay. a.Payback b.NRV c.Profitability Index d.IRR 2. __________________________ serves as a framework for measuring performance. a.NRV b.Payback c.Profitability Index d.Balanced Scorecard 3. Which of the following is a performance measures of the balanced scorecard: a.internal Business perspective b.all of the answers are correct c.financial Perspective d.customer perspectivearrow_forward

- Present and Future Values of Single Cash Flows for Different Interest Rates Use both the TVM equations and a financial calculator to find the following values. (Hint: If you are using a financial calculator, you can enter the known values and then press the appropriate key to find the unknown variable. Then, without clearing the TVM register, you can "override" the variable that changes by simply entering a new value for it and then pressing the key for the unknown variable to obtain the second answer. This procedure can be used in parts b and d, and in many other situations, to see how changes in input variables affect the output variable.) Do not round intermediate calculations. Round your answers to the nearest cent. An initial $700 compounded for 10 years at 6%. $ An initial $700 compounded for 10 years at 12%. $ The present value of $700 due in 10 years at a 6% discount rate. $ The present value of $700 due in 10 years at a 12% discount rate. $arrow_forwardThe ____ of an investment is the period of time for the ____ to equal the initial cash outlay. a. profitability index; present value of the cash inflows b. payback period; cumulative cash inflows c. payback period; present value of the cash inflows d. None of these are correctarrow_forwardWhat is the project’s internal rate of return? Round your answer to two decimal places. % For the press brake project, at what annual rates of return do the net present value and internal rate of return methods assume that the net cash inflows are being reinvested? Round your answers to two decimal places. The net present value calculation assumes the net cash flows are reinvested at %. The internal rate of return calculation assumes the net cash flows are reinvested at %.arrow_forward

- Rate-based statistics (such as payback and discounted payback) represent summary cash flows, and these summaries tend to lose which two important details? O The investment size and the cash outflows that occur before the testing period O The investment size and the cash inflows that occur during the testing period O The investment size and the cash inflows that occur before the testing period O The investment size and cash inflows that occur after the rather arbitrary testing periodarrow_forwardAll parts are under one questions and per your policy therefore all parts can be answered. 1. Concepts used in cash flow estimation and risk analysis You can come across different situations in your life where the concepts from capital budgeting will help you in evaluating the situation and making calculated decisions. Consider the following situation: The following table contains five definitions or concepts. Identify the term that best corresponds to the concept or definition given. A. Concept or Definition Term A computer-generated probability simulation of the most likely outcome, given a set of probable future events The most likely scenario in a capital budgeting analysis A measure of the project’s effect on the firm’s earnings variability A method to determine market risk by using the betas of single-product companies in a given industry The risk that is measured by the project’s beta coefficient B. Marston…arrow_forwardDefining capital investments and the capital budgeting process Match each definition with its capital budgeting method. Methods Accounting rate of return Internal rate of return Net present value Payback Definitions It is only concerned with the time it takes to get cash outflows returned. It considers operating income but not the time value of money in its analyses. Compares the present value of cash outflows to the present value of cash inflows to determine investment worthiness. The true rate of return an investment earns.arrow_forward

- Describe and explain the significance of each of the following: payback period, internal rate of return (IRR), modified internal rate of return (MIRR), net present value (NPV), and profitability index (PI). Explain. Provide examples for better clarity. Discuss the notions of conventional and nonconventional cash flows in capital budgeting. Which investment evaluation criteria would you use for unconventional cash flows and why? Provide a fictitious unconventional cash flow example and apply the payback period, NPV, IRR, MIRR, and PI methods to your example. Interpret the results.arrow_forwardFind the value of the unknown quantity in the cash flow diagram to establish equivalence of cash inflows and outflows. Let i = 12% per year. Use a uniform gradient factor in your solution.arrow_forwardPlease answer each of the following questions in detail. Make sure to provide examples for each of the questions below. Describe and explain the significance of each of the following: payback period, internal rate of return (IRR), modified internal rate of return (MIRR), net present value (NPV), and profitability index (PI). Explain. Provide examples for better clarity.Discuss the notions of conventional and nonconventional cash flows in capital budgeting. Which investment evaluation criteria would you use for unconventional cash flows and why? Provide a fictitious unconventional cash flow example and apply the payback period, NPV, IRR, MIRR, and PI methods to your example. Interpret the results. Kindly answer all the questions and sub-questions.arrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning