Concept explainers

Reese Manufacturing Company manufactures and sells a limited line of products made to customer order. The company uses a perpetual inventory system and keeps its accounts on a calendar year basis. A 6-column spreadsheet is presented on page 1100.

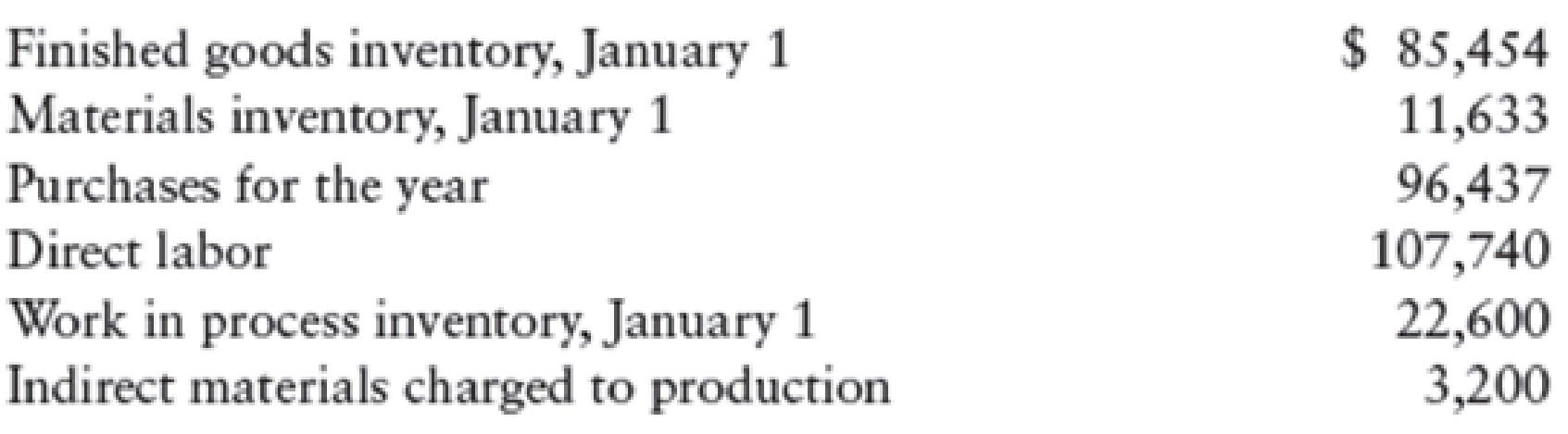

Additional information needed to prepare the income statement and schedule of cost of goods manufactured is as follows:

REQUIRED

- 1. Prepare an income statement and schedule of cost of goods manufactured for the year ended December 31,20--.

- 2. Prepare a statement of

retained earnings for the year ended December 31,20--. - 3. Prepare a balance sheet as of December 31, 20--.

- 4. Prepare the adjusting, closing, and reversing entries.

1.

Prepare an income statement and a schedule for cost of goods manufactured of Company R for the year ended December 31, 20--.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Cost of goods manufactured:

Cost of goods manufactured refers to the cost incurred for a making a product, that are available for sales at the end of the accounting period.

Prepare an income statement and a schedule for cost of goods manufactured of Company R for the year ended December 31, 20—as follows:

Income statement:

| Company R | ||

| Income Statement | ||

| For Year Ended December 31, 20-- | ||

| Particulars | Amount ($) | Amount ($) |

| Net sales | 537,137 | |

| Less: Sales return and allowances | 10,840 | 526,297 |

| Less: Cost of goods sold | ||

| Finished goods inventory, January 1 | 85,454 | |

| Add: Estimated returns inventory, January 1 | 70 | |

| Add: Cost of goods manufactured | 239,269 | |

| Cost of goods available for sale | 324,793 | |

| Less: Estimated returns inventory, December 31 | 640 | |

| Less: Finished goods inventory, December 31 | 42,675 | |

| Cost of goods sold | 281,478 | |

| Gross profit | 244,819 | |

| Less: Operating expenses: | ||

| Wages expense | 58,380 | |

| Advertising expense | 11,450 | |

| Office rent expense | 5,443 | |

| Office supplies expense | 800 | |

| Bad debt expense | 956 | |

| Insurance expense—office equipment | 98 | |

| Depreciation expense—office equipment | 923 | |

| Total operating expenses | 78,050 | |

| Operating income | 166,769 | |

| Less: Other expense: | ||

| Interest expense | 1,421 | |

| Income before income taxes | 165,348 | |

| Less: Income tax | 30,725 | |

| Net income | 134,623 | |

Table (1)

Schedule of cost of goods manufactured:

| Company R | |||

| Schedule of Cost of Goods Manufactured | |||

| For Year Ended December 31, 20-- | |||

| Particulars | Amount ($) | Amount ($) | Amount ($) |

| Work in process, January 1 | 22,600 | ||

| Direct materials | |||

| Materials inventory, January 1 | 11,633 | ||

| Add: Materials purchases | 96,437 | ||

| Materials available for use | 108,070 | ||

| Less: Materials inventory, December 31 | 22,353 | ||

| Cost of materials used | 85,717 | ||

| Less: Indirect materials charged to production | 3,200 | ||

| Cost of direct materials used | 82,517 | ||

| Direct labor | 107,740 | ||

| Factory overhead | 67,654 | ||

| Total manufacturing costs | 257,911 | ||

| Total work in process during the period | 280,511 | ||

| Less: Work in process, December 31 | 41,242 | ||

| Cost of goods manufactured | 239,269 | ||

Table (2)

2.

Prepare a statement of retained earnings of Company R for the year ended December 31, 20--.

Explanation of Solution

Statement of Retained Earnings:

This is a financial statement that determines the amount of earnings kept by the business as retained earnings at the end of the financial year. This statement shows the retained earnings held by the business at the beginning and at the end of the financial year, amount of net income earned during the year and the amount of dividend declared to the shareholder for the year.

Prepare a statement of retained earnings of Company R for the year ended December 31, 20—as follows:

| Company R | |

| Statement of Retained Earnings | |

| For Year Ended December 31, 20-- | |

| Particulars | Amount ($) |

| Retained earnings, January 1 | 195,341 |

| Add: Net income for the year | 134,623 |

| Subtotal | 329,964 |

| Less: Cash dividends | 36,000 |

| Retained earnings, December 31 | 293,964 |

Table (3)

3.

Prepare a balance sheet of Company R as of December, 20--.

Explanation of Solution

Balance sheet: Balance Sheet is one of the financial statements that summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Prepare a balance sheet of Company R as of December, 20—as follows:

| Company R | |||

| Balance Sheet | |||

| December 31, 20-- | |||

| Assets | Amount ($) | Amount ($) | Amount ($) |

| Current assets: | |||

| Cash | 44,783 | ||

| Accounts receivable | 78,096 | ||

| Less: Allowance for doubtful accounts | 6,030 | 72,066 | |

| Inventories: | |||

| Finished goods | 42,675 | ||

| Work in process | 41,242 | ||

| Materials | 22,353 | 106,270 | |

| Estimated returns inventory | 640 | ||

| Office supplies | 2,746 | ||

| Factory supplies | 489 | ||

| Prepaid insurance | 46 | ||

| Total current assets | 227,040 | ||

| Property, plant, and equipment: | |||

| Factory building | 186,674 | ||

| Less: Accumulated depreciation | 36,054 | 150,620 | |

| Factory equipment | 46,986 | ||

| Less: Accumulated depreciation | 3,839 | 43,147 | |

| Total property, plant, and equipment | 193,767 | ||

| Total assets | 420,807 | ||

| Liabilities | |||

| Current liabilities: | |||

| Notes payable | 12,470 | ||

| Accounts payable | 10,356 | ||

| Income tax payable | 14,725 | ||

| Customer refunds payable | 1,160 | ||

| Interest payable | 132 | ||

| Total liabilities | 38,843 | ||

| Stockholders’ Equity | |||

| Capital stock | 88,000 | ||

| Retained earnings | 293,964 | ||

| Total stockholders’ equity | 381,964 | ||

| Total liabilities and stockholders’ equity | 420,807 | ||

Table (4)

4.

Prepare the adjusting, closing, and reversing entries of Company R.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

Reversing entries: Reversing entries are made at the beginning of the accounting period when the accountant needs to cancel any entry made in the previous accounting period. It is done in order to eliminate any errors that might have occurred in the calculation of the revenue or expenses and henceforth increase the efficiency of the financial statements for an improved decision making.

Closing entries: The journal entries prepared to close the temporary accounts to Retained Earnings account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Prepare the adjusting, closing, and reversing entries of Company R as follows:

Adjusting entries:

| Date | Account Title and Explanation | Post ref. | Debit ($) | Credit ($) | |

| December 31 | a. | Interest Expense | 132 | ||

| Interest Payable | 132 | ||||

| (To record the interest expense incurred at the end of the accounting year) | |||||

| December 31 | b. | Office Supplies Expense | 800 | ||

| Office Supplies | 800 | ||||

| (To record the office supplies expense incurred at the end of the accounting year) | |||||

| December 31 | c. | Factory Overhead | 1,389 | ||

| Factory Supplies | 1,389 | ||||

| (To record the factory overhead incurred at the end of the accounting year) | |||||

| December 31 | d. | Depreciation Expense-Office Equipment | 923 | ||

| Accumulated Depreciation-Office Equipment | 923 | ||||

| (To record the depreciation expense incurred at the end of the accounting year) | |||||

| December 31 | e. | Factory Overhead (Depreciation expense-Factory Equipment) | 12,553 | ||

| Accumulated Depreciation-Factory Equipment | 12,553 | ||||

| (To record the depreciation expense incurred at the end of the accounting year) | |||||

| December 31 | f. | Factory Overhead (Insurance Expense) | 1,356 | ||

| Insurance Expense-Office Equipment | 98 | ||||

| Prepaid Insurance | 1,454 | ||||

| (To record the factory overhead and insurance expense incurred) | |||||

| December 31 | g. | Bad Debt Expense | 956 | ||

| Allowance for Doubtful Accounts | 956 | ||||

| (To record the bad debt expense incurred at the end of the account) | |||||

| December 31 | h. | Sales return and allowances | 570 | ||

| Customer refunds payable | 570 | ||||

| (To record the sales return from the customer) | |||||

| December 31 | i. | Estimated returns inventory | 1,040 | ||

| Cost of goods sold | 1,040 | ||||

| (To record the expected return of cost of goods sold) | |||||

| December 31 | j. | Income Tax Expense | 14,725 | ||

| Income Tax Payable | 14,725 | ||||

| (To record the income tax expense incurred at the end of the account) | |||||

| December 31 | k. | Work in Process Inventory | 1,567 | ||

| Factory Overhead | 1,567 | ||||

| (To record the factory overhead transferred to the work in process inventory) | |||||

| December 31 | l. | Cost of Goods Sold | 641 | ||

| Factory Overhead | 641 | ||||

| (To record the factory overhead transferred to the cost of goods sold) |

Table (5)

Closing entries:

| Date | Account Title and Explanation | Post ref. | Debit ($) | Credit ($) |

| December 31 | Income Summary | 67,654 | ||

| Factory Overhead (Subsidiary ledger account) | 67,654 | |||

| (To close the subsidiary factory overheads account) | ||||

| December 31 | Factory Overhead | 67,654 | ||

| Income Summary | 67,654 | |||

| (To close the factory overhead account) | ||||

| December 31 | Sales | 537,137 | ||

| Income Summary | 537,137 | |||

| (To close the sales revenue account) | ||||

| December 31 | Income Summary | 402,514 | ||

| Sales return and allowances | 10,840 | |||

| Cost of Goods Sold | 281,478 | |||

| Wages Expense | 58,380 | |||

| Advertising Expense | 11,450 | |||

| Office Rent Expense | 5,443 | |||

| Office Supplies Expense | 800 | |||

| Bad Debt Expense | 956 | |||

| Insurance Expense-Office Equipment | 98 | |||

| Depreciation Expense-Office Equipment | 923 | |||

| Interest Expense | 1,421 | |||

| Income Tax Expense | 30,725 | |||

| (To close all expenses account) | ||||

| December 31 | Income Summary | 134,623 | ||

| Retained Earnings (1) | 134,623 | |||

| (To close the income summary account) | ||||

| December 31 | Retained Earnings | 36,000 | ||

| Cash dividends | 36,000 | |||

| (To close the cash dividends account) |

Table (6)

Closing entry for factory overhead:

In this closing entry, the factory overhead account is closed by transferring the amount of factory overhead to the income summary account in order to bring the factory overhead accounts balance to zero. Hence, debit the factory overhead account for $67,654, and credit the income summary account for $67,654.

Closing entry for revenue account:

In this closing entry, the sales revenue account is closed by transferring the amount of sales revenue to the income summary account in order to bring the revenue accounts balance to zero. Hence, debit the sales revenue account for $537,137, and credit the income summary account for $537,137.

Closing entry for expenses account:

In this closing entry, all expenses are closed by transferring the amount of all expenses to the income summary account in order to bring all the expense accounts balance to zero. Hence, debit the income summary account for $402,514, and credit all the expenses account for $402,514.

Closing entry for income summary account:

In this closing entry, the income summary account is closed by transferring the amount of net income to the retained earnings account in order to bring the income summary balance to zero. Hence, debit the income summary account for $134,623, and credit the retained earnings for $134,623.

Closing entry for dividends account:

The dividends are paid to the shareholders out of the retained earnings. Thus, retained earnings are debited since the earnings are decreased on payment of dividend. Dividends are a component of shareholders’ equity account. It is credited because dividends are transferred to retained earnings account.

Working note (1):

Calculate the value of retained earnings.

Reversing entries:

| Date | Account Title and Explanation | Post ref. | Debit ($) | Credit ($) |

| January 1 | Interest Payable | 132 | ||

| Interest Expense | 132 | |||

| (To record the reversing entry of interest expense) | ||||

| January 1 | Factory Overhead | 1,567 | ||

| Work in Process Inventory | 1,567 | |||

| (To record the reversing entry of factory overhead) |

Table (7)

- ■ Interest payable is a liability account and it decreases in the value of liabilities. Hence, debit the interest payable with $132.

- ■ Interest expense is component of shareholders’ equity, and it increases the value of shareholders equity. Hence, credit the interest expense with $132.

- ■ Factory overhead (expense) is a component of owner’s equity, and there is an increase in the value of expense. Hence, debit the factory overhead account with $1,567.

- ■ Work in process inventory is an asset account, and it decreases the value of asset. Hence, credit the work in process inventory account with $1,567.

Want to see more full solutions like this?

Chapter 27 Solutions

College Accounting, Chapters 1-27

- Golden Eagle Company began operations on April 1 by selling a single product. Data on purchases and sales for the year are as follows: Purchases: Sales: The president of the company, Connie Kilmer, has asked for your advice on which inventory cost flow method should be used for the 32,000-unit physical inventory that was taken on December 31. The company plans to expand its product line in the future and uses the periodic inventory system. Write a brief memo to Ms. Kilmer comparing and contrasting the LIFO and FIFO inventory cost flow methods and their potential impacts on the companys financial statements.arrow_forwardDymac Appliances uses the periodic inventory system. Details regarding the inventory of appliances at January 1, purchases invoices during the next 12 months, and the inventory count at December 31 are summarized as follows: Instructions 1. Determine the cost of the inventory on December 31 by the first-in, first-out method. Present data in columnar form, using the following headings: If the inventory of a particular model comprises one entire purchase plus a portion of another purchase acquired at a different unit cost, use a separate line for each purchase. 2. Determine the cost of the inventory on December 31 by the last-in, first-out method, following the procedures indicated in (1). 3. Determine the cost of the inventory on December 31 by the weighted average cost method, using the columnar headings indicated in (1). 4. Discuss which method (FIFO or LIFO) would be preferred for income tax purposes in periods of (a) rising prices and (b) declining prices.arrow_forwardThe general merchandise retail industry has a number of segments represented by the following companies: For a recent year, the following cost of goods sold and beginning and ending inventories are provided from corporate annual reports (in millions) for these three companies: a. Determine the inventory turnover ratio for all three companies. Round all calculations to one decimal place. b. Determine the number of days sales in inventory for all three companies. Use 365 days and round all calculations to one decimal place. c. Interpret these results based on each companys merchandising concept.arrow_forward

- The following data are taken from the general ledger and other records of Phoenix Products Co. on October 31, the end of the first month of operations in the current fiscal year: a. Prepare a statement of cost of goods manufactured. b. Prepare the cost of goods sold section of the income statement.arrow_forwardBay Book and Software has two sales departments: Book and Software. After recording and posting all adjustments, including the adjustments for merchandise inventory, the accountant prepared the adjusted trial balance (shown on the next page) at the end of the fiscal year. Merchandise inventories at the beginning of the year were as follows: Book Department, 53,410; Software Department, 23,839. The bases (and sources of figures) for apportioning expenses to the two departments are as follows (rounded to the nearest dollar): Sales Salary Expense (payroll register): Book Department, 45,559; Software Department, 35,629 Advertising Expense (newspaper column inches): Book Department, 550 inches; Software Department, 450 inches Depreciation Expense, Store Equipment (property and equipment ledger): Book Department, 7,851; Software Department, 2,682 Store Supplies Expense (requisitions): Book Department, 205; Software Department, 199 Miscellaneous Selling Expense (volume of gross sales): Book Department, 240; Software Department, 110 Rent Expense and Utilities Expense (floor space): Book Department, 9,000 square feet; Software Department, 7,000 square feet Bad Debts Expense (volume of gross sales): Book Department, 1,029; Software Department, 441 Miscellaneous General Expense (volume of gross sales): Book Department, 364; Software Department, 156 Required Prepare an income statement by department to show income from operations, as well as a nondepartmentalized income statement (using the Total columns) to show net income for the entire company.arrow_forwardPalisade Creek Co. is a merchandising business that uses the perpetual inventory system. The account balances for Palisade Creek Co. as of May 1, 2016 (unless otherwise indicated), are as follows: During May, the last month of the fiscal year, the following transactions were completed: Instructions 1. Enter the balances of each of the accounts in the appropriate balance column of a four-column account. Write Balance in the item section, and place a check mark () in the Posting Reference column. Journalize the transactions for July, starting on Page 20 of the journal. 2. Post the journal to the general ledger, extending the month-end balances to the appropriate balance columns after all posting is completed. In this problem, you are not required to update or post to the accounts receivable and accounts payable subsidiary ledgers. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete (5) and (6). 5. (Optional) Enter the unadjusted trial balance on a 10-column end-of-period spreadsheet (work sheet), and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 22 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of owners equity, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 23 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. Insert the new balance in the owners capital account. 10. Prepare a post-closing trial balance.arrow_forward

- Pappas Appliances uses the periodic inventory system. Details regarding the inventory of appliances at January 1, purchases invoices during the year, and the inventory count at December 31 are summarized as follows: Instructions 1. Determine the cost of the inventory on December 31 by the first-in, first-out method. Present data in columnar form, using the following headings: If the inventory of a particular model comprises one entire purchase plus a portion of another purchase acquired at a different unit cost, use a separate line for each purchase. 2. Determine the cost of the inventory on December 31 by the last-in, first-out method, following the procedures indicated in (1). 3. Determine the cost of the inventory on December 31 by the weighted average cost method, using the columnar headings indicated in (1). 4. Discuss which method (FIFO or LIFO) would be preferred for income tax purposes in periods of (a) rising prices and (b) declining prices.arrow_forwardTrini Company had the following transactions for the month. Calculate the cost of goods sold dollar value for the period for each of the following cost allocation methods, using periodic inventory updating. Provide your calculations. A. first-in, first-out (FIFO) B. last-in, first-out (LIFO) C. weighted average (AVG)arrow_forwardCarla Company uses the perpetual inventory system. The following information is available for January of the current year when Carla sold 1,600 units of inventory on January 14. Using the FIFO method, calculate Carlas cost of goods sold for January and its January 31 inventory.arrow_forward

- John Neff owns and operates Waikiki Surf Shop. A year-end trial balance is provided on page 561. Year-end adjustment data for the Waikiki Surf Shop are shown below. Neff uses the periodic inventory system. Year-end adjustment data are as follows: (a, b)A physical count shows that merchandise inventory costing 51,800 is on hand as of December 31, 20--. (c, d, e)Neff estimates that customers will be granted 2,000 in refunds of this years sales next year and the merchandise expected to be returned will have a cost of 1,200. (f)Supplies remaining at the end of the year, 600. (g)Unexpired insurance on December 31, 2,600. (h)Depreciation expense on the building for 20--, 5,000. (i)Depreciation expense on the store equipment for 20--, 3,000. (j)Wages earned but not paid as of December 31, 1,800. (k)Neff also offers boat rentals which clients pay for in advance. Unearned boat rental revenue as of December 31 is 3,000. Required 1. Prepare a year-end spreadsheet. 2. Journalize the adjusting entries. 3. Compute cost of goods sold using the spreadsheet prepared for part (1).arrow_forwardCalculate the cost of goods sold dollar value for A66 Company for the month, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for last-in, first-out (LIFO).arrow_forwardThe following data are taken from the general ledger and other records of Coral Park Production Co. on January 31, the end of the first month of operations in the current fiscal year: a. Prepare a statement of cost of goods manufactured. b. Prepare the cost of goods sold section of the income statement.arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning