PAYROLL ACCT.,2019 ED.(LL)-TEXT

19th Edition

ISBN: 9781337619783

Author: BIEG

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 1CP

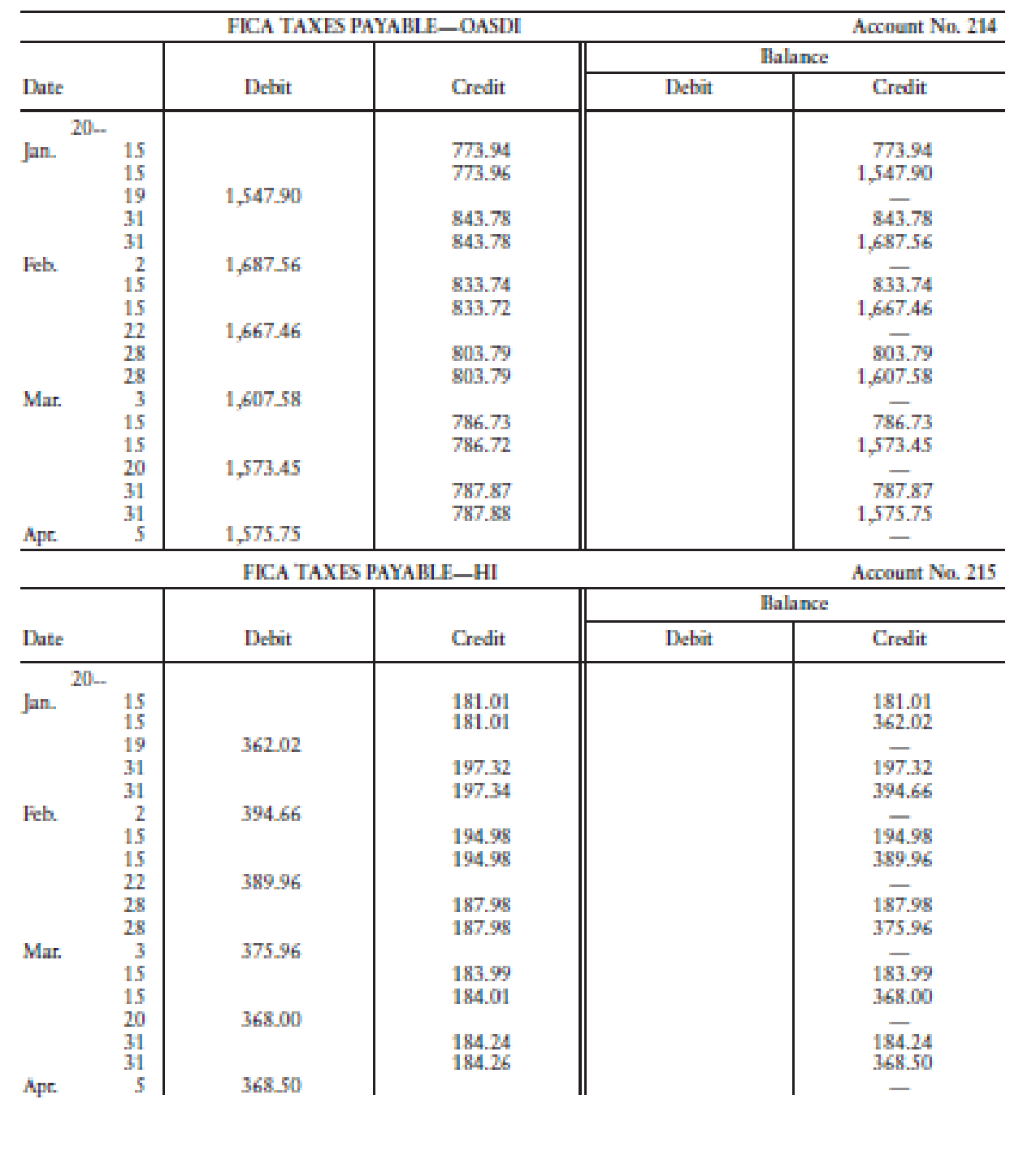

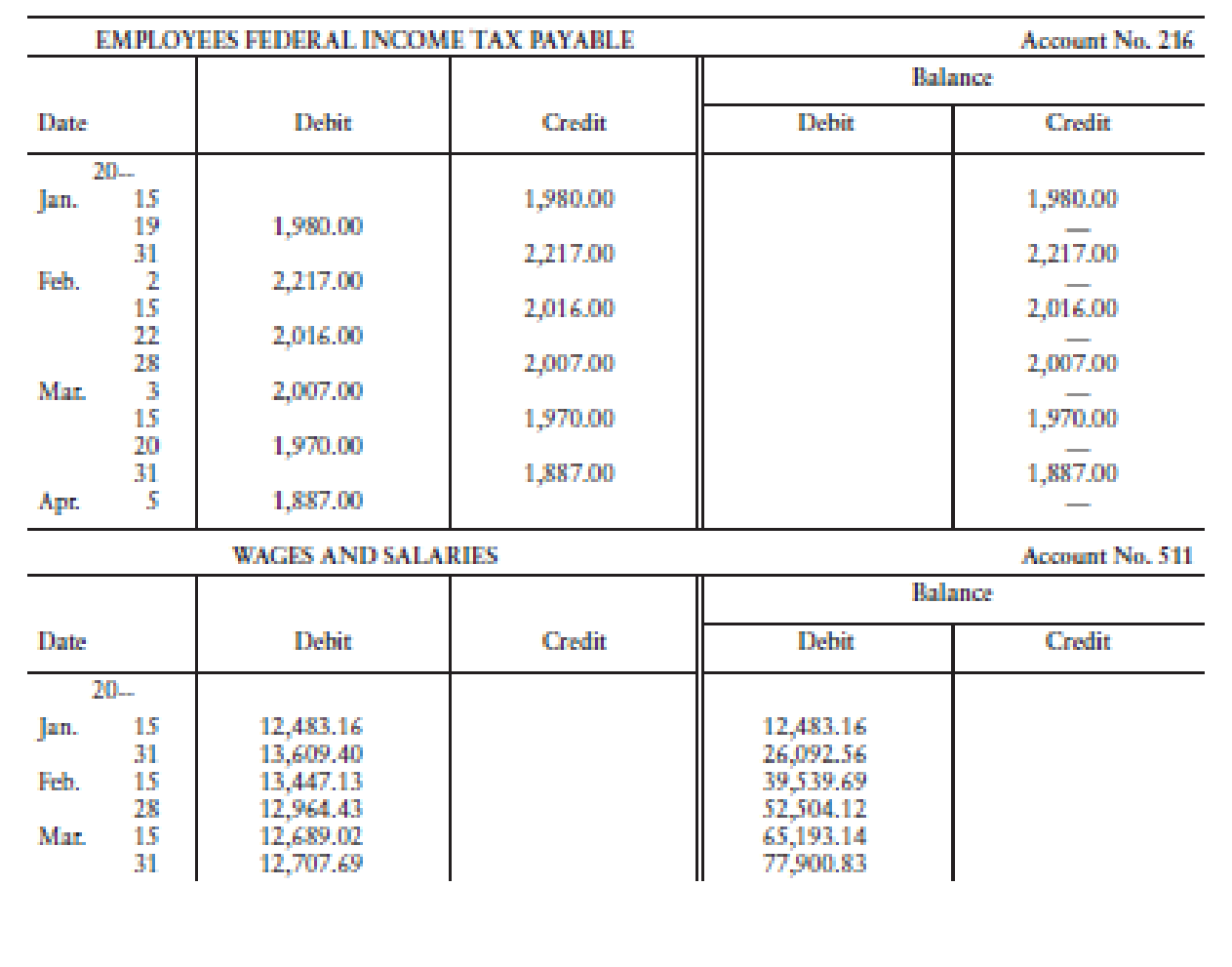

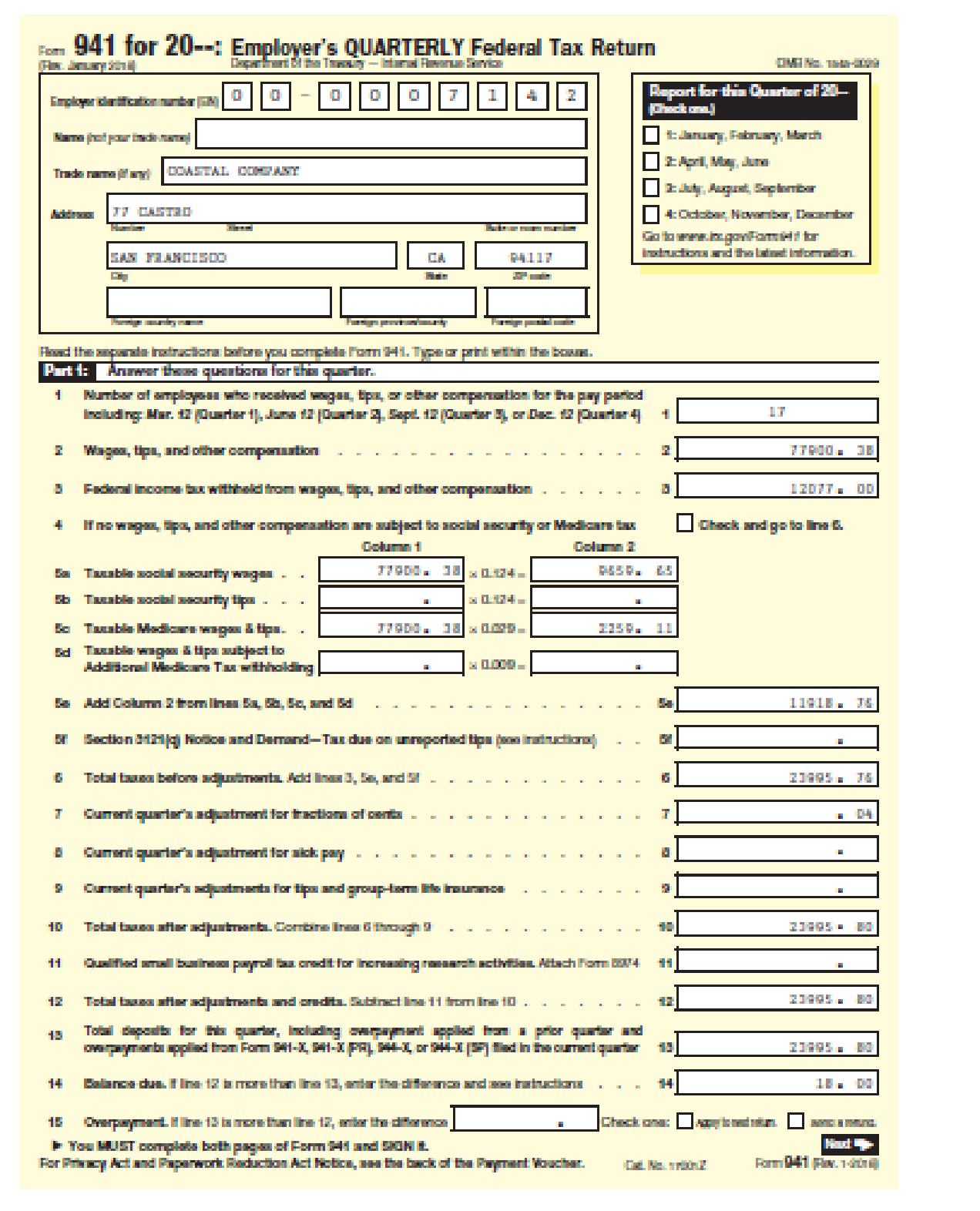

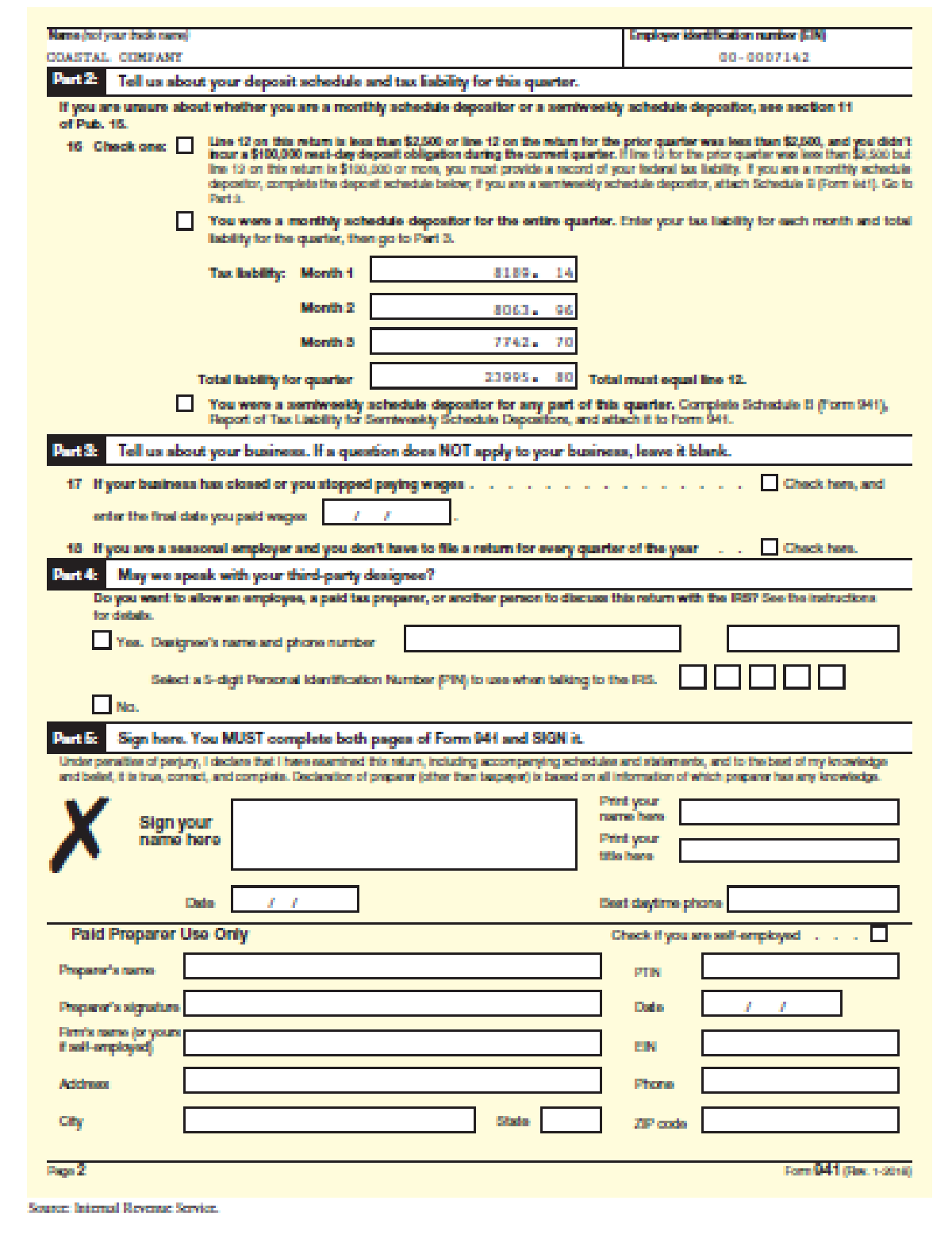

Your assistant has just completed a rough draft of Form 941, shown on pages 3-72 and 3-73, for the quarter ending March 31, 20--. As the supervisor and authorized signer, you are auditing the form before it is mailed to ensure its accuracy.

Four of the company’s general ledger accounts are shown on the following two pages. The company’s 17 employees are paid on the 15th and last day of each month. The company is a semiweekly depositor. Indicate any changes that should be made on the form before it is signed, dated, and mailed.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

During the first full week of 20--, the Payroll Department of Quigley Corporation is preparing the Forms W-2 for distribution to its employees along with their payroll checks on January 10. In this problem, you will complete six of the forms in order to gain some experience in recording the different kinds of information required.

Assume each employee earned the same weekly salary for each of the 52 paydays in 20--, the previous year. Using the following information obtained from the personnel and payroll records of the firm, complete Copy A of the last two Forms W-2 reproduced below. Also complete Form W-3. This is the second half of the problem that began with (PR.04.13A.Part1). You will need the data from the first four W-2s on Part 1, along with the two W-2s in this problem to complete the Form W-3. The form is to be signed by the president, Kenneth T. Ford, and is prepared by Ralph I. Volpe.

Company Information:

Address:

4800 River Road

Philadelphia, PA 19113-5548…

Every 2 weeks, employees for a manufacturing firm submit their time cards to the supervisor, who reviews and approves them. They are the submitted to the payroll department. At that time, the human resources clerk also submits a personnel action to the payroll clerk. The payroll clerk enters the information from these source documents into the employee records and then adds the employee hours to a payroll register reflecting employee pay rates, deductions, and job classification. One copy of the payroll register, along with the time cards, is filed in the payroll department, and one copy is sent to the AP department.Next the payroll clerk sends the employee paychecks to the cash disbursements department. The checks are signed and distributed to the employees by the paymaster. The AP department prepares a cash disbursements voucher. A copy of the voucher and a copy of the payroll register are sent to the cash disbursements department and are then posted to the general ledger. The cash…

Raspberry Co. operates an electric power station, which produces electricity 24 hrs a day, seven days a week. The company’s year-end is 30 June 18. You are an audit manager of Grapefruit & Co, the auditor of Raspberry Co. The interim audit has been completed and you are reviewing the documentation describing Raspberry Co’s payroll system.

Systems notes – payroll

Raspberry Co employs over 250 people and approximately 70% of the employees work in production at the power station. There are three shifts every day with employees working eight hours each. The production employees are paid weekly in cash. The remaining 30% of employees work at the head office in non-production roles and are paid monthly by bank transfer.

The company has anHR department, responsible for setting up all new joiners. Pre-printed forms are completed by HR for all new employees and, once verified, a copy is sent to the payroll department for the employee to be set up for payment. This form includes the staff…

Chapter 3 Solutions

PAYROLL ACCT.,2019 ED.(LL)-TEXT

Ch. 3 - Which of the following are covered by FICA...Ch. 3 - Prob. 2SSQCh. 3 - Prob. 3SSQCh. 3 - Lori Kinmark works as a jeweler for a local...Ch. 3 - _____1. Johnson Industries, a semiweekly...Ch. 3 - _____1. Employees FICA tax rates A. Severance pay...Ch. 3 - For social security purposes, what conditions must...Ch. 3 - Prob. 2QRCh. 3 - Prob. 3QRCh. 3 - Prob. 4QR

Ch. 3 - What are an employers responsibilities for FICA...Ch. 3 - Prob. 6QRCh. 3 - Prob. 7QRCh. 3 - Prob. 8QRCh. 3 - Prob. 9QRCh. 3 - Prob. 10QRCh. 3 - Prob. 11QRCh. 3 - Prob. 12QRCh. 3 - Prob. 13QRCh. 3 - Prob. 14QRCh. 3 - Prob. 15QRCh. 3 - During the year, employee Sean Matthews earned...Ch. 3 - In order to improve the cash flow of the company,...Ch. 3 - Prob. 3QDCh. 3 - Prob. 4QDCh. 3 - The biweekly taxable wages for the employees of...Ch. 3 - During 2019, Rachael Parkins, president of...Ch. 3 - Prob. 3PACh. 3 - Ken Gorman is a maitre d at Carmel Dinner Club. On...Ch. 3 - In 20-- the annual salaries paid each of the...Ch. 3 - Audrey Martin and Beth James are partners in the...Ch. 3 - Prob. 7PACh. 3 - Ralph Henwood was paid a salary of 64,600 during...Ch. 3 - Empty Fields Company pays its salaried employees...Ch. 3 - The monthly and hourly wage schedule for the...Ch. 3 - Prob. 11PACh. 3 - Prob. 12PACh. 3 - Prob. 13PACh. 3 - During the third calendar quarter of 20--, Bayview...Ch. 3 - Prob. 15PACh. 3 - Prob. 16PACh. 3 - Prob. 17PACh. 3 - Prob. 1PBCh. 3 - During 2019, Matti Conner, president of Maggert...Ch. 3 - Prob. 3PBCh. 3 - Moisa Evans is a maitre d at Red Rock Club. On...Ch. 3 - In 20-- the annual salaries paid each of the...Ch. 3 - Amanda Autry and Carley Wilson are partners in A ...Ch. 3 - Prob. 7PBCh. 3 - George Parker was paid a salary of 74,700 during...Ch. 3 - Prob. 9PBCh. 3 - The monthly and hourly wage schedule for the...Ch. 3 - Prob. 11PBCh. 3 - Prob. 12PBCh. 3 - Prob. 13PBCh. 3 - During the third calendar quarter of 20--, the...Ch. 3 - Prob. 15PBCh. 3 - Prob. 16PBCh. 3 - Prob. 17PBCh. 3 - Your assistant has just completed a rough draft of...Ch. 3 - Prob. 2CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Florenzo Corp. is a small manufacturing firm with 60 employees in seven departments. When the need arises for new workers in the plant, the departmental manager interviews applicants and hires on the basis of those interviews. The manager has each new employee complete a withholding form. The manager then writes the rate of pay on the W‐4 and forwards it to payroll. When workers arrive for their shift, they pull their time cards from a holder near the door and keep the time card with them during the day to complete the start and end times of their work day. On Friday, the time cards are removed from the holder and taken to payroll by any employee who is not busy that morning. If there were any pay rate changes for the payroll period due to raises or promotions, the manager calls the payroll department to inform payroll of these rate changes. Using the rate changes and the time cards, the payroll department prepares the checks from the regular bank account of Florenzo Corp. The manager…arrow_forwardYou are an audit senior of Samyantwi & Partners and are in the process of reviewing the systems testing completed on the payroll cycle of Brown Industries Ltd, as well as preparing the audit programmes for the final audit.Brown operates several chemical processing factories across the country, it manufactures 24 hours a day, seven days a week and employees work a standard shift of eight hours and are paid for hours worked at an hourly rate. Factory employees are paid weekly, with approximately 80% being paid by bank transfer and 20% in cash; the different payment methods are due to employee preferences and Brown has no plans to change these methods. The administration and sales teams are paid monthly by bank transfer.Factory staff are each issued a sequentially numbered clock card which details their employee number and name. Employees swipe their cards at the beginning and end of the eight-hour shift and this process is not supervised. During the shift employees are entitled to a…arrow_forwardEmployees at the Sagerod Manufacturing Company record their hours worked on paper time cards that are inserted into a time clock machine at the beginning and end of each shift. On Fridays, the supervisor collects the time cards, reviews and signs them, and sends them to the payroll clerk. The clerk calculates the pay for each employee and updates the employee earnings file. This involves adding a new record for each employee in the pay period that reflects the employee’s gross pay, tax deductions, and other withholdings for the period. The clerk then prepares a paycheck for each employee and records them in the check register. The check register and corresponding paychecks reflect each employee’s net earnings for the period. Based on these records, the clerk prepares a payroll summary, which is sent with the paychecks to the cash disbursements clerk. The clerk reviews the payroll summary, updates the cash disbursements journal to record the total payroll, and prepares a check for the…arrow_forward

- You are the audit senior of Blair & Co and your team has just completed the interim audit of Chuck Industries Co, whose year end is 31 January 2012. You are in the process of reviewing the systems testing completed on the payroll cycle, as well as preparing the audit programmes for the final audit. Chuck Industries Co manufactures lights and the manufacturing process is predominantly automated; however there is a workforce of 85 employees, who monitor the machines, as well as approximately 50 employees who work in sales and administration. The company manufactures 24 hours a day seven days a week. Below is a description of the payroll system along with deficiencies identified by the audit team: Factory workforce The company operates three shifts every day with employees working eight hours each. They are required to clock in and out using an employee swipe card, which identifies the employee number and links into the hours worked report produced by the computerised payroll system.…arrow_forwardReviewing payroll records indicates that one-fifth of employee salaries that are due to be paid on the first payday in January, totaling $15,000, are actually for hours worked in December. There was no previous balance in the Salaries Payable account at that time. Based on the information provided, make the December 31 adjusting journal entry to bring the balances to correct.arrow_forwardAn analysis of the payroll for the month of November for CinMar Inc. reveals the information shown: All regular time Andrews, Lomax, and Herzog are production workers, and Dimmick is the plant manager. Hendrick is in charge of the office. Cumulative earnings paid (before deductions) in this calendar year prior to the payroll period ending November 8 were as follows: Andrews, 21,200; Lomax, 6,800; Herzog, 11,500; Dimmick, 116,200; and Hendrick, 32,800. The solution to this problem requires the following forms, using the indicated column headings: 1. Prepare an employee earnings record for each of the five employees. 2. Prepare a payroll record for each of the four weeks. 3. Prepare a labor cost summary for the month. 4. Prepare journal entries to record the following: a. The payroll for each of the four weeks. b. The payment of wages for each of the four payrolls. c. The distribution of the monthly labor costs per the labor cost summary. d. The company's payroll taxes covering the four payroll periods.arrow_forward

- The total wages and salaries earned by all employees of James Industries during the month of February, as shown in the labor cost summary and the schedule of fixed administrative and sales salaries, are classified as follows: a. Prepare a journal entry to distribute the wages earned during February. b. What is the total amount of payroll taxes that will be imposed on the employer for the payroll, assuming that three administrative employees with combined earnings this period of 4,500 have exceeded 8,000 in earnings prior to the period?arrow_forwardThe total wages and salaries earned by all employees of Langen Electronics, Ltd. during March, as shown in the labor cost summary and the schedule of fixed administrative and sales salaries, are classified as follows: a. Prepare a journal entry to distribute the wages earned during March. b. What is the total amount of payroll taxes that will be imposed on the employer for the payroll, assuming that two administrative employees with combined earnings this period of 3,000 have exceeded 8,000 in earnings prior to the period?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:9781133935940

Author:Ulric J. Gelinas

Publisher:CENGAGE L

How JOURNAL ENTRIES Work (in Accounting); Author: Accounting Stuff;https://www.youtube.com/watch?v=Y-_Q3rANyxU;License: Standard Youtube License