College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 1PA

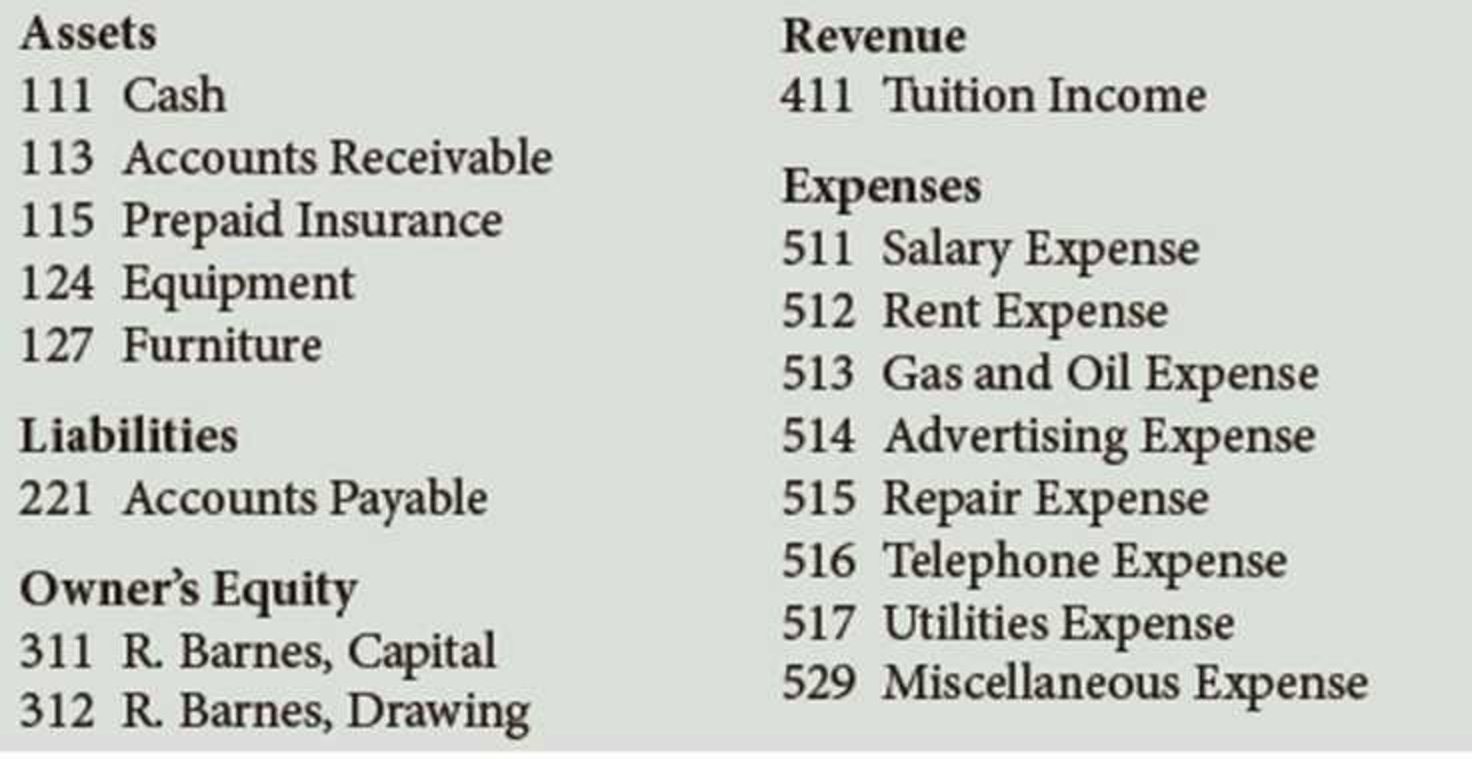

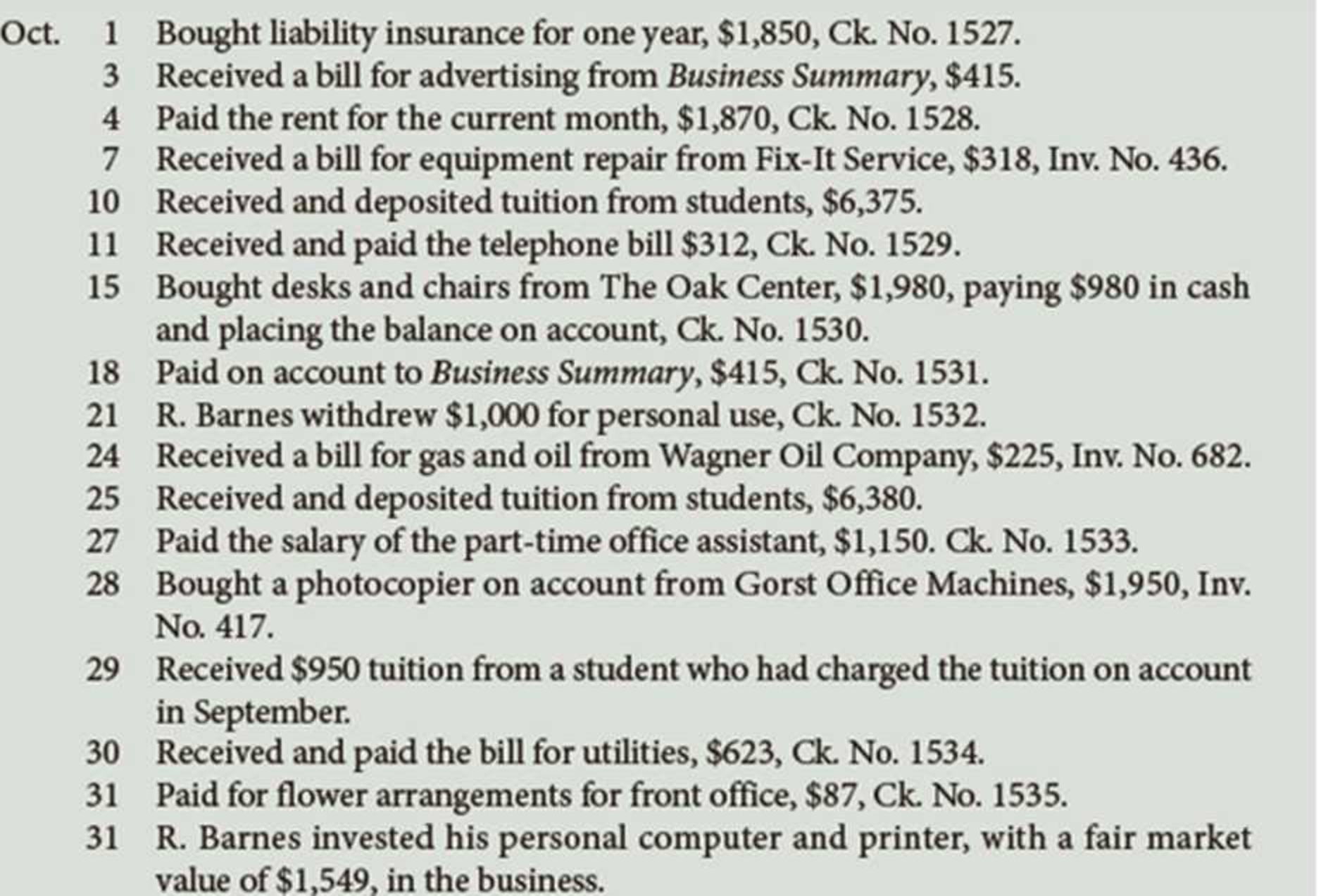

The chart of accounts of the Barnes School is shown here, followed by the transactions that took place during October of this year.

Required

Record these transactions in the general journal, including a brief explanation for each entry. If you are using working papers, number the journal pages 31 and 32.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

EMB Consulting Services had the following transactions for the month of November. Journalize the transactions and include an explanation with each entry. Thank you

Using the information in the photo, how would I prepare Journal Entries for the December transactions?

For the March Transactions set forth below, prepare the journal entries for the month of March in a general journal

Chapter 3 Solutions

College Accounting (Book Only): A Career Approach

Ch. 3 - A __________ is a book in which business...Ch. 3 - Transferring information from the journal to the...Ch. 3 - For a journal entry to be complete, it must...Ch. 3 - The __________ is used to determine where the...Ch. 3 - Prob. 5QYCh. 3 - A 250 payment for salaries expense was incorrectly...Ch. 3 - Prob. 1DQCh. 3 - How does the journal differ from the ledger?Ch. 3 - What is the purpose of providing a ledger account...Ch. 3 - List by account classification the order of the...

Ch. 3 - Arrange the following steps in the posting process...Ch. 3 - Prob. 6DQCh. 3 - Prob. 7DQCh. 3 - In the following two-column journal, the capital...Ch. 3 - Decor Services completed the following...Ch. 3 - Montoya Tutoring Service completed the following...Ch. 3 - Prob. 4ECh. 3 - Arrange the following steps in the posting process...Ch. 3 - The bookkeeper for Nevado Company has prepared the...Ch. 3 - Determine the effect of the following errors on a...Ch. 3 - Journalize correcting entries for each of the...Ch. 3 - The chart of accounts of the Barnes School is...Ch. 3 - Laras Landscaping Service has the following chart...Ch. 3 - Following is the chart of accounts of Sanchez...Ch. 3 - The chart of accounts of Ethan Academy is shown...Ch. 3 - Leanders Landscaping Service maintains the...Ch. 3 - Following is the chart of accounts of Smith...Ch. 3 - Why Does It Matter? ECOTOUR EXPEDITIONS, INC.,...Ch. 3 - What Would You Say? You are the new bookkeeper for...Ch. 3 - What Do You Think? You work as an accounting...Ch. 3 - What Would You Do?

You are responsible for...Ch. 3 - Prob. 1CP

Additional Business Textbook Solutions

Find more solutions based on key concepts

Preparing Financial Statements from a Trial Balance The following accounts are taken from Equilibrium Riding, I...

Fundamentals of Financial Accounting

Interest-bearing notes payable with year-end adjustments P1 Keesha Co. borrows $200,000 cash on November 1, 201...

Financial Accounting: Information for Decisions

Disposal of assets. Answer the following questions. 1. A company has an inventory of 1,300 assorted parts for a...

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Determine the estimated cost of the work performed each week given the tasks—with their associated costs and sc...

Construction Accounting And Financial Management (4th Edition)

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (4th Edition)

Analysis of inventory errors A2 Hallam Company’s financial statements show the following. The company recently ...

FINANCIAL ACCT.FUND.(LOOSELEAF)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The chart of accounts of Ethan Academy is shown here, followed by the transactions that took place during December of this year. Required Record these transactions in the general journal, including a brief explanation for each entry. If you are using working papers, number the journal pages 31 and 32.arrow_forwardSage Learning Centers was established on July 20 to provide educational services. The services provided during the remainder of the month are as follows: Instructions 1. Journalize the transactions for July, using a single-column revenue journal and a two-column general journal. Post to the following customer accounts in the accounts receivable ledger and insert the balance immediately after recording each entry: D. Chase; J. Dunlop; F. Mintz; T. Quinn; K. Tisdale. 2. Post the revenue journal and the general journal to the following accounts in the general ledger, inserting the account balances only after the last postings: 3. a. What is the sum of the balances of the customer accounts in the subsidiary ledger at July 31? b. What is the balance of the accounts receivable controlling account at July 31? 4. Assume Sage Learning Centers began using a computerized accounting system to record the sales transactions on August 1. What are some of the benefits of the computerized system over the manual system?arrow_forwardOn the printed "Worksheet" page, record the information from the "Transactions" page and total of each column at the end of August.arrow_forward

- Use the following excerpts from the year-end Adjusted Trial Balance to prepare the four journal entries required to close the books:arrow_forwardSage Learning Centers was established on July 20 to provide educational services.The services provided during the remainder of the month are as follows:July 21. Issued Invoice No. 1 to J. Dunlop for $115 on account.22. Issued Invoice No. 2 to K. Tisdale for $350 on account.24. Issued Invoice No. 3 to T. Quinn for $85 on account.25. Provided educational services, $300, to K. Tisdale in exchange for educationalsupplies.27. Issued Invoice No. 4 to F. Mintz for $225 on account.30. Issued Invoice No. 5 to D. Chase for $170 on account.30. Issued Invoice No. 6 to K. Tisdale for $120 on account.31. Issued Invoice No. 7 to T. Quinn for $105 on account.Instructions1. Journalize the transactions for July, using a single-column revenue journal and atwo-column general journal. Post to the following customer accounts in the accountsreceivable ledger and insert the balance immediately after recording each entry:D. Chase; J. Dunlop; F. Mintz; T. Quinn; K. Tisdale.2. Post the revenue journal and the…arrow_forwardThe following selected accounts and normal balances existed at year-end. Record the journal entries required to close the booksarrow_forward

- The following selected accounts and normal balances existed at year-end. Make the four journal entries required to close the books:arrow_forwardSage Learning Centers was established on July 20, 2016, to provide educational services. The services provided during the remainder of the month are as follows: Instructions 1. Journalize the transactions for July, using a single-column revenue journal and a two-column general journal. Post to the following customer accounts in the accounts receivable ledger, and insert the balance immediately after recording each entry: D. Chase; J. Dunlop; F. Mintz; T. Quinn; K. Tisdale. 2. Post the revenue journal and the general journal to the following accounts in the general ledger, inserting the account balances only after the last postings: 3. a. What is the sum of the balances of the customer accounts in the subsidiary ledger at July 31? b. What is the balance of the accounts receivable controlling account at July 31? 4. Assume Sage Learning Centers began using a computerized accounting system to record the sales transactions on August 1. What are some of the benefits of the computerized system over the manual system?arrow_forwardThe following selected transactions were completed by Niles Co. during March of the current year: Instructions Journalize the entries to record the transactions of Niles Co. for March.arrow_forward

- In the following two-column journal, the capital letters represent where parts of a journal entry appear. Write the numbers 1 through 8 on a sheet of paper. After each number, match the capital letter where these items appear with the number of the item. (Not all letters will be used.) 1. Year 2. Month 3. Explanation 4. Title of account debited 5. Ledger account number of account credited 6. Amount of debit 7. Day of the month 8. Title of account creditedarrow_forwardBased on the data presented in Exercise 6-23, journalize the closing entriesarrow_forwardThe following accounts and normal balances existed at year-end. Make the four journal entries required to close the books:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY