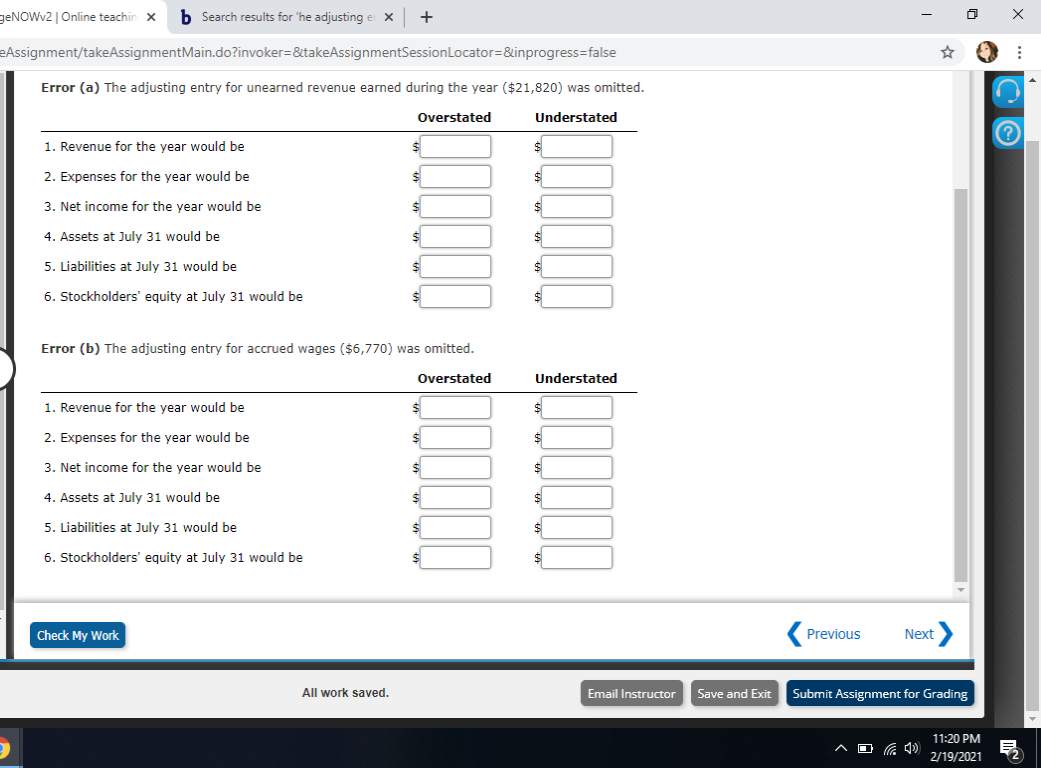

signment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Error (a) The adjusting entry for unearned revenue earned during the year ($21,820) was omitted Overstated Understated 1. Revenue for the year would be 2. Expenses for the year would be 3. Net income for the year would be 4. Assets at July 31 would be 5. Liabilities at July 31 would be 6. Stockholders' equity at July 31 would be Error (b) The adjusting entry for accrued wages ($6,770) was omitted. Overstated Understated 1. Revenue for the year would be 2. Expenses for the year would be 3. Net income for the year would be 4. Assets at July 31 would be 5. Liabilities at July 31 would be 6. Stockholders' equity at July 31 would be %24 %24 %24 %24 %24 %24

The accountant for Healthy Life Company, a medical services consulting firm, mistakenly omitted

Indicate the effect of each error, considered individually, on the income statement for the current year ended July 31. Also indicate the effect of each error on the July 31 balance sheet.

Enter all amounts as positive numbers. Enter "0" in those spaces where there is no overstatement or no understatement.

Error (a) The adjusting entry for unearned revenue earned during the year ($21,820) was omitted.

The question pertains to the application of accounting concepts and adjustment entries impact due to non-application of those concepts. The major concept which is being discussed in this question is the "accrual" concept.

As per the accrual concept, an entity should recognize income and expense in the year in which the same has been incurred irrespective of the fact that the transaction has occurred in some other year.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images