Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 27E

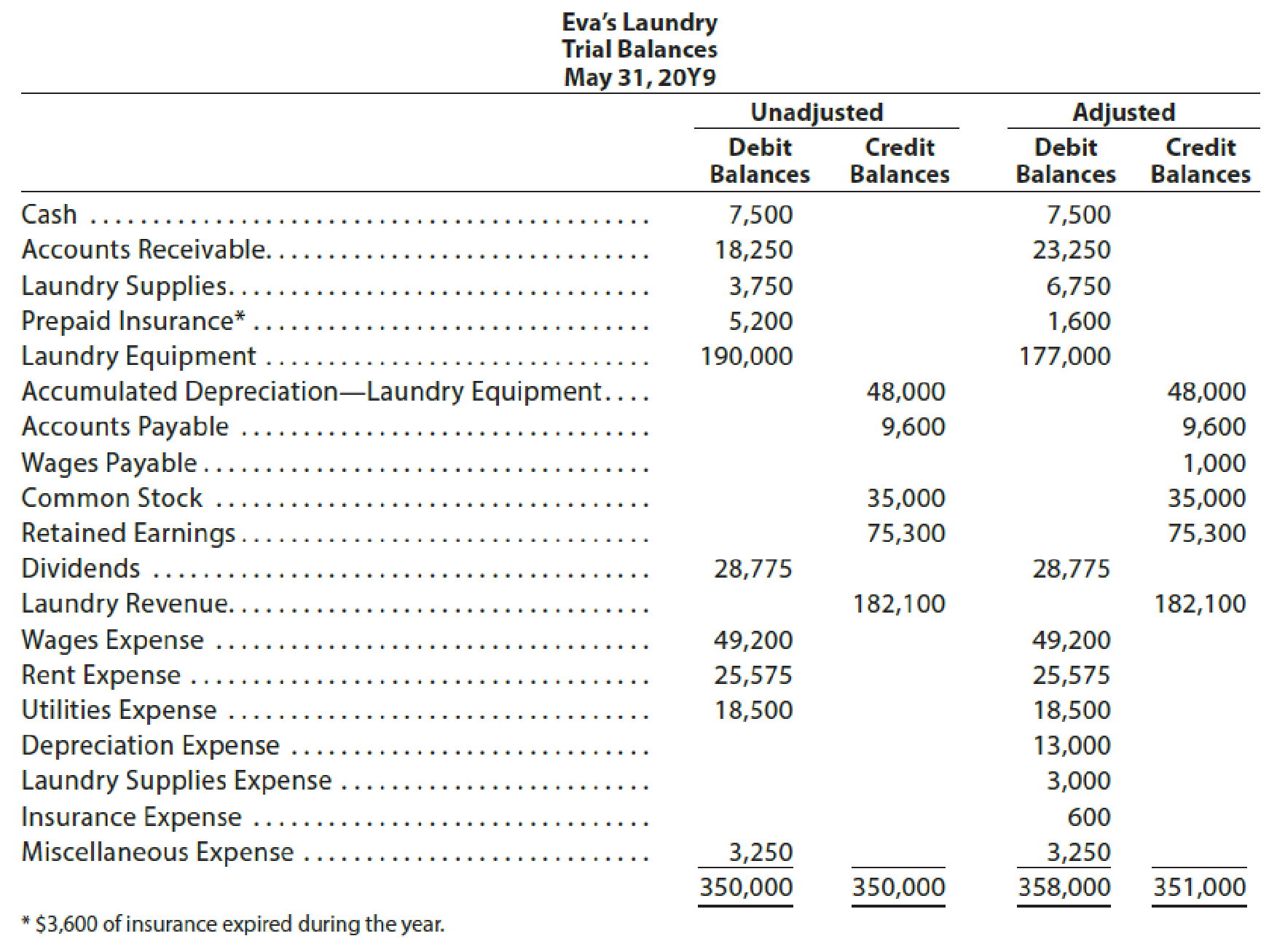

The accountant for Eva’s Laundry prepared the following unadjusted and adjusted trial balances. Assume that all balances in the unadjusted

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

The accountant for Eva’s Laundry prepared the following unadjusted and adjusted trial balances. Assume that all balances in the unadjusted trial balance and the amounts of the adjustments are correct. Identify the errors in the accountant’s adjusting entries, assuming that none of the accounts were affected by more than one adjusting entry.

The accountant for Eva’s Laundry prepared the following unadjusted and adjusted trialbalances. Assume that all balances in the unadjusted trial balance and the amounts of theadjustments are correct. Identify the errors in the accountant’s adjusting entries, assumingthat none of the accounts were affected by more than one adjusting entry.

Adjusting Entries from Trial Balances

The accountant for Eva’s Laundry prepared the following unadjusted and adjusted trial balances. Assume that all balances in the unadjusted trial balance and the amounts of the adjustments are correct.

Eva's Laundry

Trial Balance

May 31, 2019

Unadjusted

Adjusted

DebitBalances

CreditBalances

DebitBalances

CreditBalances

Cash

8,070

8,070

Accounts Receivable

19,590

23,510

Laundry Supplies

3,920

5,760

Prepaid Insurance*

5,580

1,510

Laundry Equipment

197,120

190,670

Accumulated Depreciation—Laundry Equipment

51,600

51,600

Accounts Payable

10,330

10,330

Wages Payable

1,290

Eva Baldwin, Capital

118,700

118,700

Eva Baldwin, Drawing

30,900

30,900

Laundry Revenue

188,410

188,410

Wages Expense

52,940

52,940

Rent Expense

27,540

27,540

Utilities Expense

19,940

19,940

Depreciation Expense

6,450

Laundry Supplies Expense

1,840

Insurance Expense…

Chapter 3 Solutions

Financial And Managerial Accounting

Ch. 3 - How are revenues and expenses reported on the...Ch. 3 - Is the matching concept related to (A) the cash...Ch. 3 - Why are adjusting entries needed at the end of an...Ch. 3 - What is the difference between adjusting entries...Ch. 3 - Identify the four different categories of...Ch. 3 - If the effect of the debit portion of an adjusting...Ch. 3 - If the effect of the credit portion of an...Ch. 3 - Prob. 8DQCh. 3 - Prob. 9DQCh. 3 - (A) Explain the purpose of the two accounts:...

Ch. 3 - Accounts requiring adjustment Indicate with a Yes...Ch. 3 - Prob. 2BECh. 3 - Adjustment for accrued revenues At the end of the...Ch. 3 - Prob. 4BECh. 3 - Adjustment for unearned revenue On June 1, 20Y2,...Ch. 3 - Adjustment for prepaid expense The prepaid...Ch. 3 - Adjustment for depreciation The estimated amount...Ch. 3 - Effect of omitting adjustments For the year ending...Ch. 3 - Effect of errors on adjusted trial balance For...Ch. 3 - Prob. 10BECh. 3 - Prob. 1ECh. 3 - Classifying adjusting entries The following...Ch. 3 - Adjusting entry for accrued fees At the end of the...Ch. 3 - Effect of omitting adjusting entry Paradise Realty...Ch. 3 - Adjusting entries for accrued salaries Paradise...Ch. 3 - Determining wages paid The wages payable and wages...Ch. 3 - Effect of omitting adjusting entry Accrued...Ch. 3 - Effect of omitting adjusting entry When preparing...Ch. 3 - Adjusting entries for unearned fees The balance in...Ch. 3 - Effect of omitting adjusting entry At the end of...Ch. 3 - Adjusting entry for supplies The balance in the...Ch. 3 - Determining supplies purchased The supplies and...Ch. 3 - Effect of omitting adjusting entry At March 31,...Ch. 3 - Adjusting entries for prepaid insurance The...Ch. 3 - Adjusting entries for prepaid insurance The...Ch. 3 - Adjusting entries for unearned and accrued fees...Ch. 3 - Adjusting entries for prepaid and accrued taxes...Ch. 3 - Adjustment for depreciation The estimated amount...Ch. 3 - Determining fixed assets book value The balance in...Ch. 3 - Prob. 20ECh. 3 - Effects of errors on financial statements For a...Ch. 3 - Effects of errors on financial statements For a...Ch. 3 - Effects of errors on financial statements The...Ch. 3 - Prob. 24ECh. 3 - Prob. 25ECh. 3 - Adjusting entries from trial balances The...Ch. 3 - Adjusting entries from trial balances The...Ch. 3 - Adjusting entries On March 31, the following data...Ch. 3 - Adjusting entries Selected account balances before...Ch. 3 - Adjusting entries Trident Repairs Service, an...Ch. 3 - Adjusting entries Good Note Company specializes in...Ch. 3 - Adjusting entries and adjusted trial balances...Ch. 3 - Prob. 6PACh. 3 - Adjusting entries On May 31, the following data...Ch. 3 - Adjusting entries Selected account balances before...Ch. 3 - Prob. 3PBCh. 3 - Adjusting entries The Signage Company specializes...Ch. 3 - Adjusting entries and adjusted trial balances...Ch. 3 - Adjusting entries and errors At the end of August,...Ch. 3 - The unadjusted trial balance that you prepared for...Ch. 3 - Analyze Amazon.com Amazon.com, Inc. (AMZN) is the...Ch. 3 - Prob. 2MADCh. 3 - Prob. 3MADCh. 3 - Analyze Chipotle Mexican Grill Chipotle Mexican...Ch. 3 - Analyze Nike The following data are taken from...Ch. 3 - Prob. 6MADCh. 3 - Ethics in Action Chris P. Bacon is the chief...Ch. 3 - Prob. 2TIFCh. 3 - Prob. 4TIFCh. 3 - Prob. 5TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- WORKING BACKWARD FROM ADJUSTED TRIAL BALANCE TO DETERMINE ADJUSTING ENTRIES The partial work sheet shown below is taken from the books of Stark Street Computers, a business owned by Logan Cowart, for the year ended December 31, 20--. REQUIRED 1. Determine the adjusting entries by analyzing the difference between the adjusted trial balance and the trial balance. 2. Journalize the adjusting entries in a general journal.arrow_forwardWORKING BACKWARD FROM ADJUSTED TRIAL BALANCE TO DETERMINE ADJUSTING ENTRIES The partial work sheet shown below is taken from the books of Burnside Auto Parts, a business owned by Barbara Davis, for the year ended December 31, 20--. REQUIRED 1. Determine the adjusting entries by analyzing the difference between the adjusted trial balance and the trial balance. 2. Journalize the adjusting entries in a general journal.arrow_forwardCORRECTING WORK SHEET WITH ERRORS A beginning accounting student tried to complete a work sheet for Dick Adys Bookkeeping Service. The following adjusting entries were to have been analyzed and entered in the work sheet: (a) Ending inventory of supplies on July 31, 130. (b) Unexpired insurance on July 31, 420. (c) Depreciation of office equipment, 325. (d) Wages earned, but not paid as of July 31, 95. REQUIRED Review the work sheet shown on page 174 for addition mistakes, transpositions, and other errors and make all necessary corrections.arrow_forward

- An accountant prepared the following post-closing trial balance: Prepare a corrected post-closing trial balance. Assume that all accounts have normal balances and that the amounts shown are correct.arrow_forwardPrepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. amount due for employee salaries, $4,800 B. actual count of supplies inventory, $ 2,300 C. depreciation on equipment, $3,000arrow_forwardAdjusting Entries The following partial list of accounts and account balances has been taken from the trial balance and the adjusted trial balance of Baye Company: Required: Next Level Prepare the adjusting entry that caused the change in each account balance.arrow_forward

- Post-closing trial balance An accountant prepared the following post-closing trial balance: Prepare a corrected post-closing trial balance. Assume that all accounts have normal balances and that the amounts shown are correct.arrow_forwardThe trial balance of Wikki Cleaners at December 31, 2012, the end of the current fiscal year, is as follows: Information for the adjusting entries is as follows: a. Cleaning supplies on hand on December 31, 2012, 18,750. b. Insurance premiums expired during the year, 1,800. c. Depreciation on equipment during the year, 21,600. d. Wages accrued but not paid at December 31, 2012, 1,830. Suppose you discover that an assistant in your department had misunderstood your instructions and had provided you with the wrong information on two of the adjusting entries. Cleaning supplies consumed during the year should have been 18,750, and insurance premiums unexpired at year-end were 1,800. Make the corrections on your worksheet and save the corrected file as F1WORK4. Reprint the worksheet.arrow_forwardAn accountant prepared the following post-closing trial balance: Prepare a corrected post-closing trial balance. Assume that all accounts have normal balances and that the amounts shown are correct.arrow_forward

- Correct any obvious errors in the following closing entries by providing the four corrected closing entries. Assume all accounts held normal account balances in the Adjusted Trial Balance. A. B. C. D.arrow_forwardAdjusting entries Good Note Company specializes in the repair of music equipment and is owned and operated by Robin Stahl. On June 30, 20Y6, the end of the current year, the accountant for Good Note prepared the following trial balances: Instructions Journalize the seven entries that adjusted the accounts at June 30. None of the accounts were affected by more than one adjusting entry.arrow_forwardThe accountant for Eva’s Laundry prepared the following unadjusted and adjusted trial balances. Assume that all balances in the unadjusted trial balance and the amounts of the adjustments are correct. Eva's Laundry Trial Balance May 31, 2019 Unadjusted Adjusted DebitBalances CreditBalances DebitBalances CreditBalances Cash 6,360 6,360 Accounts Receivable 15,430 18,520 Laundry Supplies 3,090 4,540 Prepaid Insurance* 4,390 1,190 Laundry Equipment 168,180 163,090 Accumulated Depreciation—Laundry Equipment 40,700 40,700 Accounts Payable 8,130 8,130 Wages Payable 1,020 Eva Baldwin, Capital 93,500 93,500 Eva Baldwin, Drawing 24,300 24,300 Laundry Revenue 161,230 161,230 Wages Expense 41,700 41,700 Rent Expense 21,690 21,690 Utilities Expense 15,710 15,710 Depreciation Expense 5,090 Laundry Supplies Expense 1,450 Insurance Expense 670 Miscellaneous Expense 2,710…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY