Concept explainers

Brief Exercise 3-28 Using High-Low to Calculate Predicted Total Variable Cost and Total Cost for a Time Period that Differs from the Data Period

Refer to the information for Speedy Pete’s on the previous page. Assume that this information was used to construct the following formula for monthly delivery cost.

Required:

Assume that 3,000 deliveries are budgeted for the coming year. Use the total delivery cost formula to make the following calculations:

- 1. Calculate total variable delivery cost for the coming year.

- 2. Calculate total fixed delivery cost for the year.

- 3. Calculate total delivery cost for the year.

Use the following information for Brief Exercises 3-26 through 3-29:

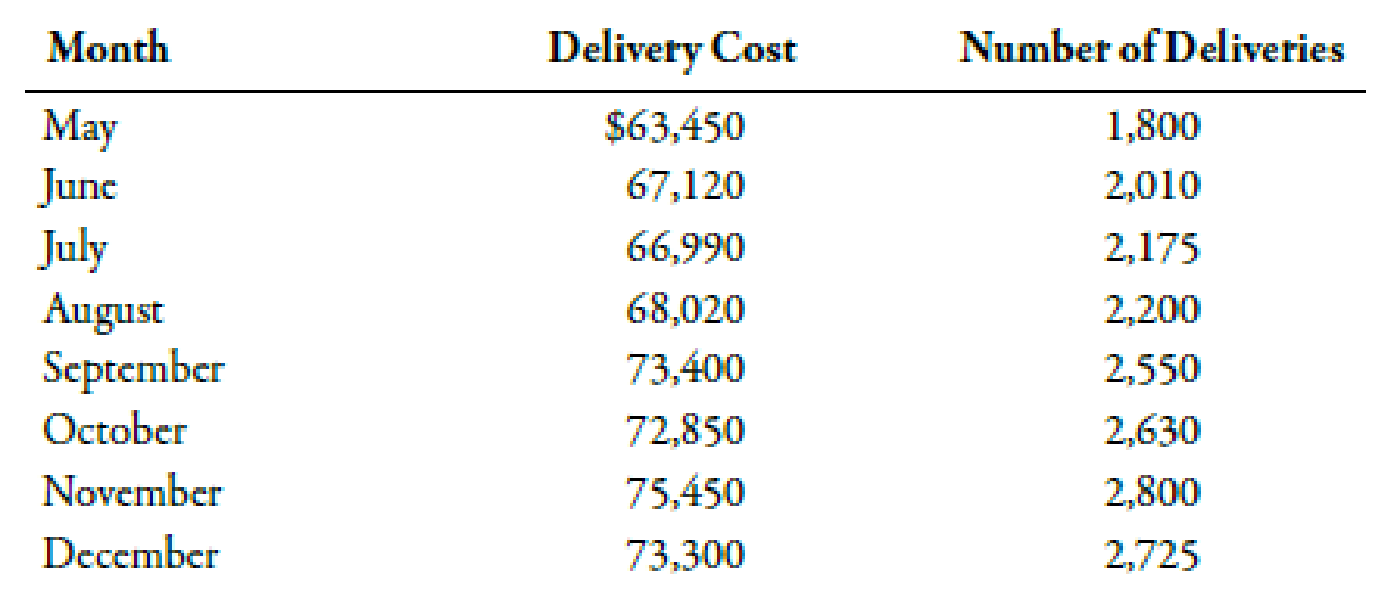

Speedy Pete’s is a small start-up company that delivers high-end coffee drinks to large metropolitan office buildings via a cutting-edge motorized coffee cart to compete with other premium coffee shops. Data for the past 8 months were collected as follows:

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Refer to Cornerstone Exercise 3.4 for data on Dohini Manufacturing Companys purchasing cost and number of purchase orders. The controller for Dohini Manufacturing ran regression on the data, and the coefficients shown by the regression program are: Required: 1. Construct the cost formula for the purchasing activity showing the fixed cost and the variable rate. 2. If Dohini Manufacturing Company estimates that next month will have 430 purchase orders, what is the total estimated purchasing cost for that month? (Round your answer to the nearest dollar.) 3. What if Dohini Manufacturing wants to estimate purchasing cost for the coming year and expects 5,340 purchase orders? What will estimated total purchasing cost be? (Round your answer to the nearest dollar.) What is the total fixed purchasing cost? Why doesnt it equal the fixed cost calculated in Requirement 1?arrow_forwardUsing High-Low to Calculate Predicted Total Variable Cost and Total Cost for Budgeted Output Refer to the information for Speedy Petes above. Assume that this information was used to construct the following formula for monthly delivery cost. TotalDeliveryCost=41,850+(12.00NumberofDeliveries) Required: Assume that 3,000 deliveries are budgeted for the following month of January. Use the total delivery cost formula for the following calculations: 1. Calculate total variable delivery cost for January. 2. Calculate total delivery cost for January.arrow_forward(Appendix 11A) Cycle Time, Velocity, Conversion Cost The theoretical cycle time for a product is 30 minutes per unit. The budgeted conversion costs for the manufacturing cell are 2,700,000 per year. The total labor minutes available are 600,000. During the year, the cell was able to produce 1.5 units of the product per hour. Suppose also that production incentives exist to minimize unit product costs. Required: 1. Compute the theoretical conversion cost per unit. 2. Compute the applied conversion cost per unit (the amount of conversion cost actually assigned to the product). 3. CONCEPTUAL CONNECTION Discuss how this approach to assigning conversion costs can improve delivery time performance.arrow_forward

- Using High-Low to Calculate Predicted Total Variable Cost and Total Cost for a Time Period That Differs from the Data Period Refer to the information for Pizza Vesuvio on the previous page. Assume that this information was used to construct the following formula for monthly labor cost. TotalLaborCost=5,237+(7.40EmployeeHours) Required: Assume that 4,000 employee hours are budgeted for the coming year. Use the total labor cost formula to make the following calculations: 1. Calculate total variable labor cost for the year. 2. Calculate total fixed labor cost for the year. 3. Calculate total labor cost for the coming year. Use the following information for Brief Exercises 3-17 through 3-20: Pizza Vesuvio makes specialty pizzas. Data for the past 8 months were collected:arrow_forwardRefer to Exercise 8.27. At the end of the year, Meliore, Inc., actually produced 310,000 units of the standard model and 115,000 of the deluxe model. The actual overhead costs incurred were: Required: Prepare a performance report for the period. In an attempt to improve budgeting, the controller for Meliore, Inc., has developed a flexible budget for overhead costs. Meliore, Inc., makes two types of products, the standard model and the deluxe model. Meliore expects to produce 300,000 units of the standard model and 120,000 units of the deluxe model during the coming year. The standard model requires 0.05 direct labor hour per unit, and the deluxe model requires 0.08. The controller has developed the following cost formulas for each of the four overhead items: Required: 1. Prepare an overhead budget for the expected activity level for the coming year. 2. Prepare an overhead budget that reflects production that is 10 percent higher than expected (for both products) and a budget for production that is 20 percent lower than expected.arrow_forwardUsing Regression to Calculate Fixed Cost, Calculate the Variable Rate, Construct a Cost Formula, and Determine Budgeted Cost Refer to the information for Speedy Petes on the previous page. Coefficients shown by a regression program for Speedy Petes data are: Required: Use the results of regression to make the following calculations: 1. Calculate the fixed cost of deliveries and the variable rate per delivery. 2. Construct the cost formula for total delivery cost. 3. Calculate the budgeted cost for next month, assuming that 3,000 deliveries are budgeted. (Note: Round answers to the nearest dollar.) Use the following information for Brief Exercises 3-26 through 3-29: Speedy Petes is a small start-up company that delivers high-end coffee drinks to large metropolitan office buildings via a cutting-edge motorized coffee cart to compete with other premium coffee shops. Data for the past 8 months were collected as follows:arrow_forward

- Variable Cost Ratio, Contribution Margin Ratio Chillmax Company plans to sell 3,500 pairs of shoes at 60 each in the coming year. Unit variable cost is 21 (includes direct materials, direct labor, variable factory overhead, and variable selling expense). Fixed factory overhead is 30,000 and fixed selling and administrative expense is 48,000. Required: 1. Calculate the variable cost ratio. 2. Calculate the contribution margin ratio. 3. Prepare a contribution margin income statement based on the budgeted figures for next year. In a column next to the income statement, show the percentages based on sales for sales, total variable cost, and total contribution margin.arrow_forwardSales Revenue Approach, Variable Cost Ratio, Contribution Margin Ratio Arberg Companys controller prepared the following budgeted income statement for the coming year: Required: 1. What is Arbergs variable cost ratio? What is its contribution margin ratio? 2. Suppose Arbergs actual revenues are 30,000 more than budgeted. By how much will operating income increase? Give the answer without preparing a new income statement 3. How much sales revenue must Arberg earn to break even? Prepare a contribution margin income statement to verify the accuracy of your answer. 4. What is Arbergs expected margin of safety? 5. What is Arbergs margin of safety if sales revenue is 380,000?arrow_forwardUsing High-Low to Calculate Predicted Total Variable Cost and Total Cost for Budgeted Output Refer to the information for Pizza Vesuvio on the previous page. Assume that this information was used to construct the following formula for monthly labor cost. TotalLaborCost=5,237+(7.40EmployeeHours) Required: Assume that 675 employee hours are budgeted for the month of September. Use the total labor cost formula for the following calculations: 1. Calculate total variable labor cost for September. 2. Calculate total labor cost for September.arrow_forward

- Flexible Budget for Various Levels of Production Budgeted amounts for the year: Required: 1. Prepare a flexible budget for 3,500, 4,000, and 4,500 units. 2. CONCEPTUAL CONNECTION Calculate the unit cost at 3,500, 4,000, and 4,500 units. (Note: Round unit costs to the nearest cent.) What happens to unit cost as the number of units produced increases?arrow_forwardExercise 22-17 a-d Carla Vista Bucket Co., a manufacturer of rain barrels, had the following data for 2019. Sales 2,960 units Sales price $60 per unit Variable costs $42 per unit Fixed costs $26,640 What is the contribution margin ratio? Contribution margin ratio % LINK TO TEXT LINK TO TEXT LINK TO TEXT What is the break-even point in dollars? Break-even point $ LINK TO TEXT LINK TO TEXT LINK TO TEXT What is the margin of safety in dollars and as a ratio? Margin of safety $ Margin of safety ratio % LINK TO TEXT LINK TO TEXT LINK TO TEXT If the company wishes to increase its total dollar contribution margin by 30% in 2020, by how much will it need to increase its sales if selling price per unit, variable price per…arrow_forwardRequired:1. Prepare a performance report for Marston’s manufacturing costs in the current year.2. Assume that one of the products produced by Marston is budgeted to use 10,000 directlabor hours, 15,000 machine hours, and 500 moves and will be produced in five batches. A total of 10,000 units will be produced during the year. Calculate the budgeted unit manufac-turing cost. 3. One of Marston’s managers said the following: “Budgeting at the activity level makes a lot of sense. It really helps us manage costs better. But the previous budget really needs to pro-vide more detailed information. For example, I know that the moving materials activity involves the use of forklifts and operators, and this information is lost when only the total cost of the activity for various levels of output is reported. We have four forklifts, each capable of providing 10,000 moves per year. We lease these forklifts for five years, at $10,000 per year. Furthermore, for our two shifts, we need up to eight…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning