Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 31BEB

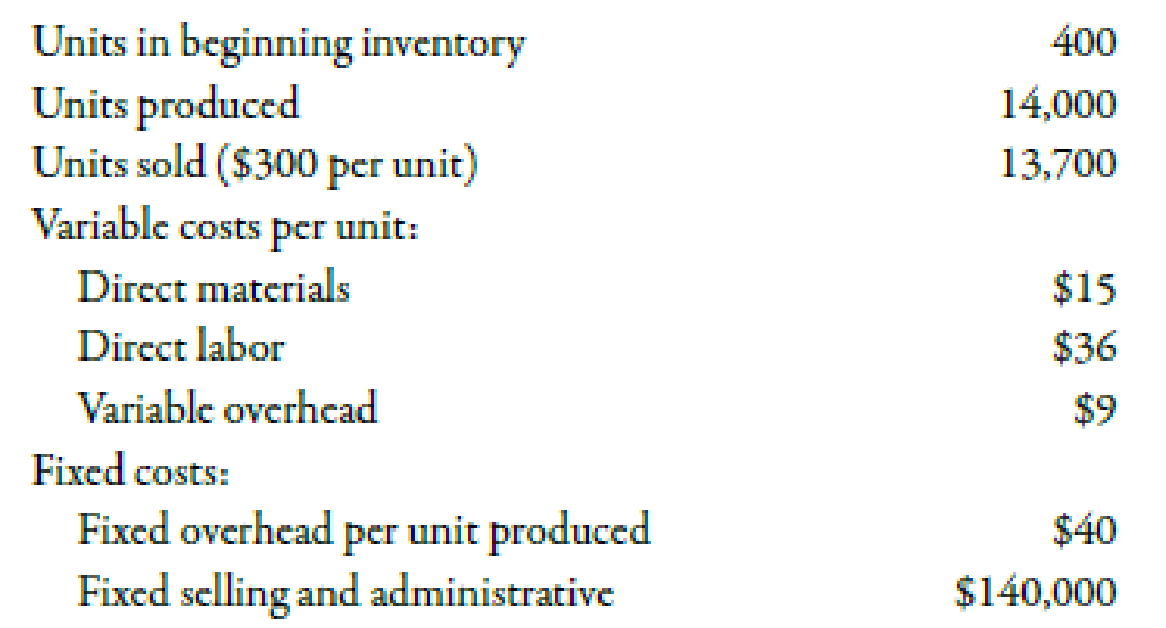

Refer to the data for Pelham Company on the previous page.

Required:

- 1. How many units are in ending inventory?

- 2. Using variable costing, calculate the per-unit product cost.

- 3. What is the value of ending inventory under variable costing?

Use the following information for Brief Exercises 3-30 and 3-31:

During the most recent year, Pelham Company had the following data associated with the product it makes:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Ch. 3 - Prob. 1DQCh. 3 - What is a driver? Give an example of a cost and...Ch. 3 - Suppose a company finds that shipping cost is...Ch. 3 - Some firms assign mixed costs to either the fixed...Ch. 3 - Explain the difference between committed and...Ch. 3 - Explain why the concept of relevant range is...Ch. 3 - Why do mixed costs pose a problem when it comes to...Ch. 3 - Describe the cost formula for a strictly fixed...Ch. 3 - Describe the cost formula for a strictly variable...Ch. 3 - What is the scattergraph method, and why is it...

Ch. 3 - Describe how the scattergraph method breaks out...Ch. 3 - What are the advantages of the scattergraph method...Ch. 3 - Prob. 13DQCh. 3 - What is meant by the best-fitting line?Ch. 3 - What is the difference between the unit cost of a...Ch. 3 - Prob. 16DQCh. 3 - (Appendix 3A) Explain the meaning of the...Ch. 3 - A factor that causes or leads to a change in a...Ch. 3 - Which of the following would probably be a...Ch. 3 - Prob. 3MCQCh. 3 - In the cost formula, the term 128,000,000 a. is...Ch. 3 - In the cost formula, the term 12,000 a. is the...Ch. 3 - Prob. 6MCQCh. 3 - Prob. 7MCQCh. 3 - The following cost formula for total purchasing...Ch. 3 - An advantage of the high-low method is that it a....Ch. 3 - Prob. 10MCQCh. 3 - Prob. 11MCQCh. 3 - Prob. 12MCQCh. 3 - The total cost for monthly supervisory cost in a...Ch. 3 - Yates Company shows the following unit costs for...Ch. 3 - (Appendix 3A) In the method of least squares, the...Ch. 3 - Creating and Using a Cost Formula Big Thumbs...Ch. 3 - Using High-Low to Calculate Fixed Cost, Calculate...Ch. 3 - Using High-Low to Calculate Predicted Total...Ch. 3 - Using High-Low to Calculate Predicted Total...Ch. 3 - Using Regression to Calculate Fixed Cost,...Ch. 3 - Inventory Valuation under Absorption Costing Refer...Ch. 3 - Inventory Valuation under Variable Costing Refer...Ch. 3 - Absorption-Costing Income Statement Refer to the...Ch. 3 - Variable-Costing Income Statement Refer to the...Ch. 3 - Creating and Using a Cost Formula Kleenaire Motors...Ch. 3 - Using High-Low to Calculate Fixed Cost, Calculate...Ch. 3 - Using High-Low to Calculate Predicted Total...Ch. 3 - Brief Exercise 3-28 Using High-Low to Calculate...Ch. 3 - Using Regression to Calculate Fixed Cost,...Ch. 3 - Inventory Valuation under Absorption Costing Refer...Ch. 3 - Inventory Valuation under Variable Costing Refer...Ch. 3 - Brief Exercise 3-32 Absorption-Costing Income...Ch. 3 - Brief Exercise 3-33 Variable-Costing Income...Ch. 3 - Variable and Fixed Costs What follows are a number...Ch. 3 - Cost Behavior, Classification Smith Concrete...Ch. 3 - Prob. 36ECh. 3 - Prob. 37ECh. 3 - Prob. 38ECh. 3 - Step Costs, Relevant Range Bellati Inc. produces...Ch. 3 - Matching Cost Behavior Descriptions to Cost...Ch. 3 - Examine the graphs in Exercise 3-40. Required: As...Ch. 3 - Prob. 42ECh. 3 - Prob. 43ECh. 3 - High-Low Method Refer to the information for Luisa...Ch. 3 - Scattergraph Method Refer to the information for...Ch. 3 - Method of Least Squares Refer to the information...Ch. 3 - Use the following information for Exercises 3-47...Ch. 3 - Use the following information for Exercises 3-47...Ch. 3 - Method of Least Squares, Developing and Using the...Ch. 3 - The method of least squares was used to develop a...Ch. 3 - Identifying the Parts of the Cost Formula;...Ch. 3 - Inventory Valuation under Absorption Costing...Ch. 3 - Inventory Valuation under Variable Costing Lane...Ch. 3 - Income Statements under Absorption and Variable...Ch. 3 - (Appendix 3A) Method of Least Squares Using...Ch. 3 - (Appendix 3A) Method of Least Squares Using...Ch. 3 - Identifying Fixed, Variable, Mixed, and Step Costs...Ch. 3 - Identifying Use of the High-Low, Scattergraph, and...Ch. 3 - Identifying Variable Costs, Committed Fixed Costs,...Ch. 3 - Scattergraph, High-Low Method, and Predicting Cost...Ch. 3 - Method of Least Squares, Predicting Cost for...Ch. 3 - Cost Behavior, High-Low Method, Pricing Decision...Ch. 3 - Prob. 63PCh. 3 - Variable and Fixed Costs, Cost Formula, High-Low...Ch. 3 - Cost Separation About 8 years ago, Kicker faced...Ch. 3 - Variable-Costing and Absorption-Costing Income...Ch. 3 - Refer to the information for Farnsworth Company...Ch. 3 - (Appendix 3A) Scattergraph, High-Low Method,...Ch. 3 - (Appendix 3A) Separating Fixed and Variable Costs,...Ch. 3 - (Appendix 3A) Cost Formulas, Single and Multiple...Ch. 3 - Suspicious Acquisition of Data, Ethical Issues...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Inventory Valuation under Variable Costing Refer to the data for Judson Company above. Required: 1. How many units are in ending inventory? 2. Using variable costing, calculate the per-unit product cost. 3. What is the value of ending inventory under variable costing? Use the following information for Brief Exercises 3-21 and 3-22: During the most recent year, Judson Company had the following data associated with the product it makes:arrow_forwardInventory Valuation under Absorption Costing Refer to the data for Judson Company above. Required: 1. How many units are in ending inventory? 2. Using absorption costing, calculate the per-unit product cost. 3. What is the value of ending inventory under absorption costing? Use the following information for Brief Exercises 3-21 and 3-22: During the most recent year, Judson Company had the following data associated with the product it makes:arrow_forwardVariable-Costing Income Statement Refer to the data for Osterman Company on the previous page. Required: 1. Calculate the cost of goods sold under variable costing. 2. Prepare an income statement using variable costing. Use the following information for Brief Exercises 3-23 and 3-24: During the most recent year, Osterman Company had the following data:arrow_forward

- The following data were adapted from a recent income statement of The Procter Gamble Company (PG): Assume that the variable amount of each category of operating costs is as follows: a. Based on the data given, prepare a variable costing income statement for Procter Gamble, assuming that the company maintained constant inventory levels during the period. b. If Procter Gamble reduced its inventories during the period, what impact would that have on the operating income determined under absorption costing?arrow_forwardAbsorption-Costing Income Statement Refer to the data for Osterman Company above. Required: 1. Calculate the cost of goods sold under absorption costing. 2. Prepare an income statement using absorption costing. Use the following information for Brief Exercises 3-23 and 3-24: During the most recent year, Osterman Company had the following data:arrow_forwardMethod of Least Squares, Predicting Cost for Different Time Periods from the One Used to Develop a Cost Formula Refer to the information for Farnsworth Company on the previous page. However, assume that Tracy has used the method of least squares on the receiving data and has gotten the following results: Required: 1. Using the results from the method of least squares, prepare a cost formula for the receiving activity. 2. Using the formula from Requirement 1, what is the predicted cost of receiving for a month in which 1,450 receiving orders are processed? (Note: Round your answer to the nearest dollar.) 3. Prepare a cost formula for the receiving activity for a quarter. Based on this formula, what is the predicted cost of receiving for a quarter in which 4,650 receiving orders are anticipated? Prepare a cost formula for the receiving activity for a year. Based on this formula, what is the predicted cost of receiving for a year in which 18,000 receiving orders are anticipated?arrow_forward

- When prices are falling (deflation), which costing method would produce the highest gross margin for the following? Choose first-in, first-out (FIFO); last-in, first-out (LIFO); or weighted average, assuming that B62 Company had the following transactions for the month. Calculate the gross margin for each of the following cost allocation methods, assuming B62 sold just one unit of these goods for $400. Provide your calculations. A. first-in, first-out (FIFO) B. last-in, first-out (LIFO) C. weighted average (AVG)arrow_forwardWeighted Average Method, Unit Costs, Valuing Inventories Byford Inc. produces a product that passes through two processes. During November, equivalent units were calculated using the weighted average method: The costs that Byford had to account for during the month of November were as follows: Required: 1. Using the weighted average method, determine unit cost. 2. Under the weighted average method, what is the total cost of units transferred out? What is the cost assigned to units in ending inventory? 3. CONCEPTUAL CONNECTION Bill Johnson, the manager of Byford, is considering switching from weighted average to FIFO. Explain the key differences between the two approaches and make a recommendation to Bill about which method should be used.arrow_forwardThe following information pertains to Vladamir, Inc., for last year: There are no work-in-process inventories. Normal activity is 100,000 units. Expected and actual overhead costs are the same. Costs have not changed from one year to the next. Required: 1. How many units are in ending inventory? 2. Without preparing an income statement, indicate what the difference will be between variable-costing income and absorption-costing income. 3. Assume the selling price per unit is 29. Prepare an income statement using (a) variable costing and (b) absorption costing.arrow_forward

- Evaluating selling and administrative cost allocations Gordon Gecco Furniture Company has two major product lines with the following characteristics: Commercial office furniture: Few large orders, little advertising support, shipments in full truckloads, and low handling complexity Home office furniture: Many small orders, large advertising support, shipments in partial truckloads, and high handling complexity The company produced the following profitability report for management: The selling and administrative expenses are allocated to the products on the basis of relative sales dollars. Evaluate the accuracy of this report and recommend an alternative approach.arrow_forwardRefer to Cornerstone Exercise 18.3. Required: 1. Calculate the cost of each unit using variable costing. 2. How many units remain in ending inventory? What is the cost of ending inventory using variable costing? 3. Prepare a variable-costing income statement for Pattison Products, Inc., for the month of October. 4. What if November production was 40,000 units, costs were stable, and sales were 41,000 units? What is the cost of ending inventory? What is operating income for November?arrow_forwardScattergraph, High-Low Method, and Predicting Cost for a Different Time Period from the One Used to Develop a Cost Formula Refer to the information for Farnsworth Company on the previous page. Required: 1. Prepare a scattergraph based on the 10 months of data. Does the relationship appear to be linear? 2. Using the high-low method, prepare a cost formula for the receiving activity. Using this formula, what is the predicted cost of receiving for a month in which 1,450 receiving orders are processed? 3. Prepare a cost formula for the receiving activity for a quarter. Based on this formula, what is the predicted cost of receiving for a quarter in which 4,650 receiving orders are anticipated? Prepare a cost formula for the receiving activity for a year. Based on this formula, what is the predicted cost of receiving for a year in which 18,000 receiving orders are anticipated? Use the following information for Problems 3-60 and 3-61: Farnsworth Company has gathered data on its overhead activities and associated costs for the past 10 months. Tracy Heppler, a member of the controllers department, has convinced management that overhead costs can be better estimated and controlled if the fixed and variable components of each overhead activity are known. One such activity is receiving raw materials (unloading incoming goods, counting goods, and inspecting goods), which she believes is driven by the number of receiving orders. Ten months of data have been gathered for the receiving activity and are as follows:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY