Concept explainers

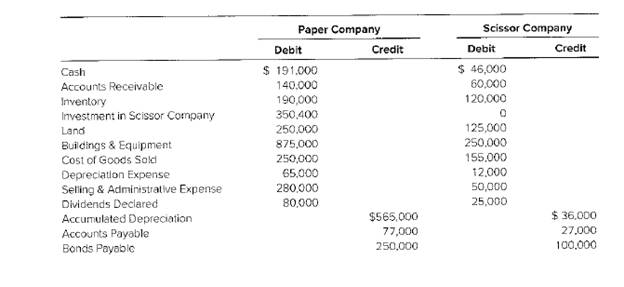

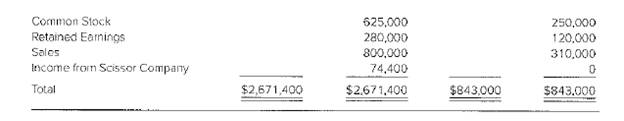

Consolidated Worksheet at End of the First Year of Ownership (Equity Method)

Paper Company acquired 80 percent of Scissor Company’s outstanding common stock for$296,000 on January 1, 20X8, when the book value of Scissor’s net assets was equal to $370,000.Paper uses the equity method to account for investments.

Required

a. Prepare any equity-method entry(ies) related to the investment in Scissor Company during20X8.

b. Prepare a consolidation worksheet for 20X8 in good form.

a.

Introduction:

The consolidated balance sheet and the worksheets are the computed tools that are used to calculate the retained earnings and the dividend produced by the subsidiaries towards its parent company.

To prepare: A journal entry by equity method for the investment in S company in the year

Explanation of Solution

| Equity method entry onP company books | Amount ($) | Amount ($) |

| Investment in S co. Dr. | ||

| Cash Cr. | ||

| (To recordthe initial investment in S co.) | ||

| Investment in S co. Dr. | ||

| Income from S co. Cr. | ||

| (To record share of P co in S co.) | ||

| Cash Dr. | ||

| Investment in S company. Cr. | ||

| (To record P co.’s share in S Co.’s dividend) |

b.

Introduction:

The consolidated balance sheet and the worksheets are the computed tools that are used to calculate the retained earnings and the dividend produced by the subsidiaries towards its parent company.

To prepare:The consolidated worksheet for the final values.

Explanation of Solution

| Book value calculation | |||||||

| NCI | + | P co | = | Common stock | + | Retained earnings | |

| Book value | |||||||

| Net income | |||||||

| Dividend | |||||||

| Ending book value |

| Income statement | P co | S co | Eliminated Dr. | Eliminated Cr. | Consolidated |

| Cash | |||||

| Accounts received | |||||

| Inventory | |||||

| Investment in scissor co | |||||

| Land | |||||

| Building and equipment | |||||

| Less accumulated depreciation | |||||

| Total assets | |||||

| Accountspayable | |||||

| Bonds | |||||

| Common stocks | |||||

| Retained earnings | |||||

| NCI in NA of Snoopy Co. | |||||

| Total liabilities |

Want to see more full solutions like this?

Chapter 3 Solutions

Advanced Financial Accounting

- Peanut Company acquired 80 percent of Snoopy Company’s outstanding common stock for $300,000 on January 1, 20X8, when the book value of Snoopy’s net assets was equal to $375,000. Peanut uses the equity method to account for investments. The following trial balance summarizes the financial position and operations for Peanut and Snoopy as of December 31, 20X9: Peanut Company Snoopy Company Debit Credit Debit Credit Cash $ 269,000 $ 80,000 Accounts Receivable 193,000 85,000 Inventory 196,000 106,000 Investment in Snoopy Company 306,600 0 Land 211,000 85,000 Buildings and Equipment 702,000 194,000 Cost of Goods Sold 375,000 168,000 Depreciation Expense 45,000 20,000 Selling & Administrative Expense 214,000 25,750 Dividends Declared 221,000 49,000 Accumulated Depreciation $ 495,000 $ 60,000 Accounts Payable 66,000 60,000 Bonds Payable 137,000 46,750 Common Stock 496,000 195,000 Retained Earnings 631,800 145,000 Sales 833,000 306,000 Income from Snoopy Company 73,800 0 Total $ 2,732,600…arrow_forwardPeanut Company acquired 100 percent of Snoopy Company’s outstanding common stock for $300,000 on January 1, 20X8, when the book value of Snoopy’s net assets was equal to $300,000. Peanut uses the equity method to account for investments. Trial balance data for Peanut and Snoopy as of December 31, 20X8, are as follows: Peanut Company Snoopy Company Debit Credit Debit Credit Cash $ 130,000 $ 80,000 Accounts Receivable 165,000 65,000 Inventory 200,000 75,000 Investment in Snoopy Company 355,000 0 Land 200,000 100,000 Buildings and Equipment 700,000 200,000 Cost of Goods Sold 200,000 125,000 Depreciation Expense 50,000 10,000 Selling and Administrative Expense 225,000 40,000 Dividends Declared 100,000 20,000 Accumulated Depreciation $ 450,000 $ 20,000 Accounts Payable 75,000 60,000 Bonds Payable 200,000 85,000 Common Stock 500,000 200,000 Retained Earnings 225,000 100,000 Sales 800,000…arrow_forwardP Inc. purchased 81% of the voting shares of S Inc for $696,143 cash on January 1, year 2. P recorded Investment in S at cost. The Balance Sheet of P Inc. & S Inc. for year 5 showed the following balances P Inc. S Inc. Investment $696,143 $90,653 What is the amount for Investment on Consolidated Balance Sheet of P Inc. for year5?arrow_forward

- Upper Company holds 60 percent of Lower Company’s voting shares. During the preparation of consolidated financial statements for 20x4, the following eliminating entry was made: Retained earnings, January 1 10,000 Land 10,000 Which of the following statements is correct? A. Upper Company purchased land from Lower Company during 20x4. B. Upper Company purchase land from Lower Company before January 1, 20x4. C. Lower Company purchased land from Upper Company during 20x4. D. Lower Company purchased land from Upper Company before January 1, 20x4.arrow_forwardOn January 2, year 1, ABC Company purchased 75% of XYZ's outstanding common stock. On that date, the fair value of the 25% noncontrolling interest was $35,000. During year 1, XYZ had net income of $20,000. Selected balance sheet data at December 31, year 1, is as follows: ABC (Column 1), XYZ (Column 2) In ABC's December 31, year 1, consolidated balance sheet, what amount should be reported as noncontrolling interest in net assets?arrow_forwardPeanut Company acquired 90 percent of Snoopy Company’s outstanding common stock for $270,000 on January 1, 20X8, when the book value of Snoopy’s net assets was equal to $300,000. Peanut uses the equity method to account for investments. Trial balance data for Peanut and Snoopy as of December 31, 20X8, follow: Peanut Company Snoopy Company Debit Credit Debit Credit Cash $ 158,000 $ 80,000 Accounts Receivable 165,000 65,000 Inventory 200,000 75,000 Investment in Snoopy Company 319,500 0 Land 200,000 100,000 Buildings and Equipment 700,000 200,000 Cost of Goods Sold 200,000 125,000 Depreciation Expense 50,000 10,000 Selling & Administrative Expense 225,000 40,000 Dividends Declared 100,000 20,000 Accumulated Depreciation $ 450,000 $ 20,000 Accounts Payable 75,000 60,000 Bonds Payable 200,000 85,000 Common Stock 500,000 200,000 Retained Earnings 225,000 100,000 Sales 800,000 250,000…arrow_forward

- Peanut Company acquired 90 percent of Snoopy Company’s outstanding common stock for $270,000 on January 1, 20X8, when the book value of Snoopy’s net assets was equal to $300,000. Peanut uses the equity method to account for investments. Trial balance data for Peanut and Snoopy as of December 31, 20X8, follow: Peanut Company Snoopy Company Debit Credit Debit Credit Cash $ 158,000 $ 80,000 Accounts Receivable 165,000 65,000 Inventory 200,000 75,000 Investment in Snoopy Company 319,500 0 Land 200,000 100,000 Buildings and Equipment 700,000 200,000 Cost of Goods Sold 200,000 125,000 Depreciation Expense 50,000 10,000 Selling & Administrative Expense 225,000 40,000 Dividends Declared 100,000 20,000 Accumulated Depreciation $ 450,000 $ 20,000 Accounts Payable 75,000 60,000 Bonds Payable 200,000 85,000 Common Stock 500,000 200,000 Retained Earnings 225,000 100,000 Sales 800,000 250,000…arrow_forwardkayend Corporation purchases 85% of Subil Products' common stock. Assume that Kayend already recorded the acquisition on January 1, 20X1. During the year, Kayend reports operating earnings of $450,000, excluding its income from investing in Subil, and declares dividends of $70,000. Subil reports 20X1 net income of $50,000 and declares dividends of $30,000. Which of the following is Kayend's journal entry to record its share of Subil's income? Debit Noncontrolling Interest for $42,500; Credit Cash for $42,500 Debit Investment in Subil Products for $42,500; Credit Cash for $42,500 Debit Cash for $42,500; Credit Noncontrolling Interest for $42,500 Debit Investment in Subil Products for $42,500; Credit Income from Subil Products for $42,500arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning