Concept explainers

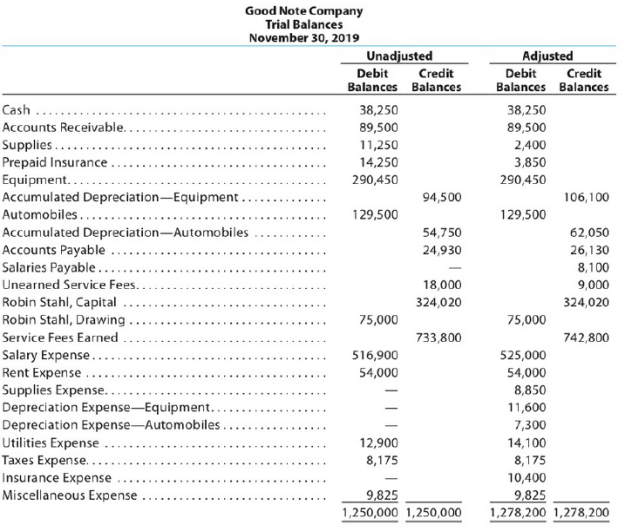

Good Note Company specializes in the repair of music equipment and is owned and operated by Robin Stahl. On November 30, 2019, the end of the current year, the accountant for Good Note prepared the following

Instructions

Journalize the seven entries that adjusted the accounts at November 30. None of the accounts were affected by more than one adjusting entry.

Adjusting entries:

Adjusting entries refers to the entries that are made at the end of an accounting period in accordance with revenue recognition principle, and expenses recognition principle. All adjusting entries affect at least one income statement account (revenue or expense), and one balance sheet account (asset or liability).

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

Ø Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

Ø Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

To prepare: The adjusting entries in the books of Company GN at the end of the year.

Answer to Problem 3.4APR

An adjusting entry for Supplies expenses:

In this case, Company GN recognized the supplies expenses at the end of the year. So, the necessary adjusting entry that the Company GN should record to recognize the supplies expense is as follows:

| Date | Description |

Post Ref. | Debit ($) | Credit ($) | |

| 2019 | Supplies expenses (1) | 8,850 | |||

| November | 30 | Supplies | 8,850 | ||

| (To record the supplies expenses incurred at the end of the year) | |||||

Table (1)

Explanation of Solution

Working note:

Calculate the value of supplies expense

Explanation:

- Supplies expense decreases the value of owner’s equity by $8,850; hence debit the supplies expenses for $8,850.

- Supplies are an asset, and it decreases the value of asset by $8,850, hence credit the supplies for $8,850.

An adjusting entry for insurance expenses:

In this case, Company GN recognized the insurance expenses at the end of the year. So, the necessary adjusting entry that the Company GN should record to recognize the prepaid expense is as follows:

| Date | Description |

Post Ref. | Debit ($) | Credit ($) | |

| 2019 | Insurance expenses (2) | 10,400 | |||

| November | 30 | Prepaid insurance | 10,400 | ||

| (To record the insurance expenses incurred at the end of the year) | |||||

Table (2)

Working note:

Calculate the value of insurance expense

Explanation:

- Insurance expense decreases the value of owner’s equity by $10,400; hence debit the insurance expenses for $10,400.

- Prepaid insurance is an asset, and it decreases the value of asset by $10,400, hence credit the prepaid insurance for $10,400.

An adjusting entry for depreciation expenses-Equipment:

In this case, Company GN recognized the depreciation expenses on equipment at the end of the year. So, the necessary adjusting entry that the Company GN should record to recognize the accrued expense is as follows:

| Date | Description |

Post Ref. | Debit ($) | Credit ($) | |

| 2019 | Depreciation expenses –Equipment (3) | 11,600 | |||

| November | 30 | Accumulated depreciation-Equipment | 11,600 | ||

| (To record the depreciation expenses incurred at the end of the year) | |||||

Table (3)

Working note:

Calculate the value of depreciation expense-Equipment

Explanation:

- Depreciation expense decreases the value of owner’s equity by $11,600; hence debit the depreciation expenses for $11,600.

- Accumulated depreciation is a contra-asset account, and it decreases the value of asset by $11,600, hence credit the accumulated depreciation for $11,600.

An adjusting entry for depreciation expenses-Automobiles:

In this case, Company GN recognized the depreciation expenses on automobiles at the end of the year. So, the necessary adjusting entry that the Company GN should record to recognize the accrued expense is as follows:

| Date | Description |

Post Ref. | Debit ($) | Credit ($) | |

| 2019 | Depreciation expenses –Automobiles (4) | 7,300 | |||

| November | 30 | Accumulated depreciation-Automobiles | 7,300 | ||

| (To record the depreciation expenses incurred at the end of the year) | |||||

Table (4)

Working note:

Calculate the value of depreciation expense-Automobiles

Explanation:

- Depreciation expense decreases the value of owner’s equity by $7,300; hence debit the depreciation expenses for $7,300.

- Accumulated depreciation is a contra-asset account, and it decreases the value of asset by $7,300, hence credit the accumulated depreciation for $7,300.

An adjusting entry for utilities expenses:

In this case, Company GN recognized the utilities expenses at the end of the year. So, the necessary adjusting entry that the Company GN should record to recognize the accrued expense is as follows:

| Date | Description |

Post Ref. | Debit ($) | Credit ($) | |

| 2019 | Utilities expenses (5) | 1,200 | |||

| November | 30 | Accounts payable | 1,200 | ||

| (To record the utilities expenses incurred at the end of the year) | |||||

Table (5)

Working note:

Calculate the value of utilities expense

Explanation:

- Utilities expense decreases the value of owner’s equity by $1,200; hence debit the utilities expenses for $1,200.

- Accounts payable is a liability, and it increases the value of liability by $1,200, hence credit the accounts payable for $1,200.

An adjusting entry for salaries expenses:

In this case, Company GN recognized the salaries expenses at the end of the year. So, the necessary adjusting entry that the Company GN should record to recognize the accrued expense is as follows:

| Date | Description |

Post Ref. | Debit ($) | Credit ($) | |

| 2019 | Salaries expenses (6) | 8,100 | |||

| November | 30 | Salaries payable | 8,100 | ||

| (To record the salaries expenses incurred at the end of the year) | |||||

Table (6)

Working note:

Calculate the value of salaries expense

Explanation:

- Salaries expense decreases the value of owner’s equity by $8,100; hence debit the salaries expenses for $8,100.

- Salaries payable is a liability, and it increases the value of liability by $8,100, hence credit the salaries payable for $8,100.

An adjusting entry for unearned service fees:

In this case, Company GN received cash in advance before the service provided to customer. So, the necessary adjusting entry that the Company GN should record for the unearned fees revenue at the end of the year is as follows:

| Date | Description |

Post Ref. | Debit ($) | Credit ($) | |

| 2019 | Unearned service fees | 9,000 | |||

| November | 30 | Service fees earned (7) | 9,000 | ||

| (To record the unearned service fees at the end of the year) | |||||

Table (7)

Working note:

Calculate the value of service fees earned

Explanation:

- Unearned service fees are a liability, and it decreases the value of liability by $9,000, hence debit the unearned service fees for $9,000.

- Service fees earned increases owner’s equity by $9,000; hence credit the service fees earned for $9,000.

Want to see more full solutions like this?

Chapter 3 Solutions

Accounting

- Adjusting entries Good Note Company specializes in the repair of music equipment and is owned and operated by Robin Stahl. On June 30, 20Y6, the end of the current year, the accountant for Good Note prepared the following trial balances: Instructions Journalize the seven entries that adjusted the accounts at June 30. None of the accounts were affected by more than one adjusting entry.arrow_forwardGood Note Company specializes in the repair of music equipment and is owned and operated by Robin Stahl. On November 30, 2016, the end of the current year, the accountant for Good Note Company prepared the following trial balances: Instructions Journalize the seven entries that adjusted the accounts at November 30. None of the accounts were affected by more than one adjusting entry.arrow_forwardThe unadjusted trial balance of Recessive Interiors at January 31, 2019, the end of the year, follows: The data needed to determine year-end adjustments are as follows: a. Supplies on hand at January 31 are 2,850. b. Insurance premiums expired during the year are 3,150. c. Depreciation of equipment during the year is 5,250. d. Depreciation of trucks during the year is 4,000. e. Wages accrued but not paid at January 31 are 900. Instructions 1. For each account listed in the unadjusted trial balance, enter the balance in the appropriate Balance column of a four-column account and place a check mark () in the Posting Reference column. 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (3) as needed. 3. Journalize and post the adjusting entries, inserting balances in the accounts affected. Record the adjusting entries on Page 26 of the journal. The following additional accounts from Recessive Interiors chart of accounts should be used: Wages Payable, 22; Depreciation ExpenseEquipment, 54; Supplies Expense, 55; Depreciation ExpenseTrucks, 56; Insurance Expense, 57. 4. Prepare an adjusted trial balance. 5. Prepare an income statement, a statement of owners equity (no additional investments were made during the year), and a balance sheet. 6. Journalize and post the closing entries. Record the closing entries on Page 27 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. 7. Prepare a post-closing trial balance.arrow_forward

- The trial balance of Wikki Cleaners at December 31, 2012, the end of the current fiscal year, is as follows: Information for the adjusting entries is as follows: a. Cleaning supplies on hand on December 31, 2012, 18,750. b. Insurance premiums expired during the year, 1,800. c. Depreciation on equipment during the year, 21,600. d. Wages accrued but not paid at December 31, 2012, 1,830. Suppose you discover that an assistant in your department had misunderstood your instructions and had provided you with the wrong information on two of the adjusting entries. Cleaning supplies consumed during the year should have been 18,750, and insurance premiums unexpired at year-end were 1,800. Make the corrections on your worksheet and save the corrected file as F1WORK4. Reprint the worksheet.arrow_forwardAdjusting Entries At the end of 2019, Richards Company prepared a trial balance, recorded and posted its adjusting entries, and then prepared an adjusted trial balance. Selected accounts and account balances from the trial balance and adjusted trial balance are as follow: Required: 1. Next Level By comparing the partial trial balance to the partial adjusted trill balance, determine the adjusting; entries that the company made on December 31, 2019 Prepare your answer in general journal form. 2. Assuming that the company uses reversing entries, indicate which adjusting entries should be reversed.arrow_forwardThe trial balance of Wikki Cleaners at December 31, 2012, the end of the current fiscal year, is as follows: Information for the adjusting entries is as follows: a. Cleaning supplies on hand on December 31, 2012, 18,750. b. Insurance premiums expired during the year, 1,800. c. Depreciation on equipment during the year, 21,600. d. Wages accrued but not paid at December 31, 2012, 1,830. As the accountant for Wikki Cleaners, you have been asked to prepare financial statements for the year. A file called F1WORK has been provided to assist you in this assignment. As you review this file, it should be noted that columns H and I will automatically change when you enter values in columns E or G.arrow_forward

- Worksheet Victoria Company has the following account balances on December 31, 2019, prior to any adjustments: Additional adjustment information: (a) depreciation on buildings, 1,100; on equipment, 600; (b) bad debts expense, 240; (c) interest accumulated but not paid: on note payable, 50; on mortgage payable, 530 (this interest is due during the next accounting period); (d) insurance expired, 175; (e) salaries accrued but not paid 370; (f) rent was collected in advance and the performance obligation is now satisfied, 800; (g) office supplies cm hand at year-end, 230 (expensed when originally purchased earlier in the year); and (h) the income tax rate is 30% on current income and is payable in the first quarter of 2020. Required: 1. Transfer the account balances to a 10-column worksheet and prepare a trial balance. 2. Prepare the adjusting entries in the general journal and complete the worksheet. 3. Prepare the companys income statement, retained earnings statement, and balance sheet. 4. Prepare closing entries in the general journal.arrow_forwardReviewing insurance policies revealed that a single policy was purchased on March 1, for one years coverage, in the amount of $9,000. There was no previous balance in the Prepaid Insurance account at that time. Based on the information provided, A. Make the December 31 adjusting journal entry to bring the balances to correct. B. Show the impact that these transactions had.arrow_forwardReviewing insurance policies revealed that a single policy was purchased on August 1, for one years coverage, in the amount of $6,000. There was no previous balance in the Prepaid Insurance account at that time. Based on the information provided: A. Make the December 31 adjusting journal entry to bring the balances to correct. B. Show the impact that these transactions had.arrow_forward

- Reece Financial Services Co., which specializes in appliance repair services, is owned and operated by Joni Reece. Reece Financial Services accounting clerk prepared the following unadjusted trial balance at July 31, 2019: The data needed to determine year-end adjustments are as follows: Depreciation of building for the year, 6,400. Depreciation of equipment for the year, 2,800. Accrued salaries and wages at July 31, 900. Unexpired insurance at July 31, 1,500. Fees earned but unbilled on July 31, 10,200. Supplies on hand at July 31, 615. Rent unearned at July 31, 300. Instructions 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable, Rent Revenue, Insurance Expense, Depreciation ExpenseBuilding, Depreciation ExpenseEquipment, and Supplies Expense. 2. Determine the balances of the accounts affected by the adjusting entries and prepare an adjusted trial balance.arrow_forwardWORKING BACKWARD FROM ADJUSTED TRIAL BALANCE TO DETERMINE ADJUSTING ENTRIES The partial work sheet shown below is taken from the books of Burnside Auto Parts, a business owned by Barbara Davis, for the year ended December 31, 20--. REQUIRED 1. Determine the adjusting entries by analyzing the difference between the adjusted trial balance and the trial balance. 2. Journalize the adjusting entries in a general journal.arrow_forwardPrepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. supplies actual count at year end, $6,500 B. remaining unexpired insurance, $6,000 C. remaining unearned service revenue, $1,200 D. salaries owed to employees, $2,400 E. depreciation on property plant and equipment, $18,000arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning