College Accounting (Book Only): A Career Approach

12th Edition

ISBN: 9781305084087

Author: Cathy J. Scott

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 3A

What Do You Think?

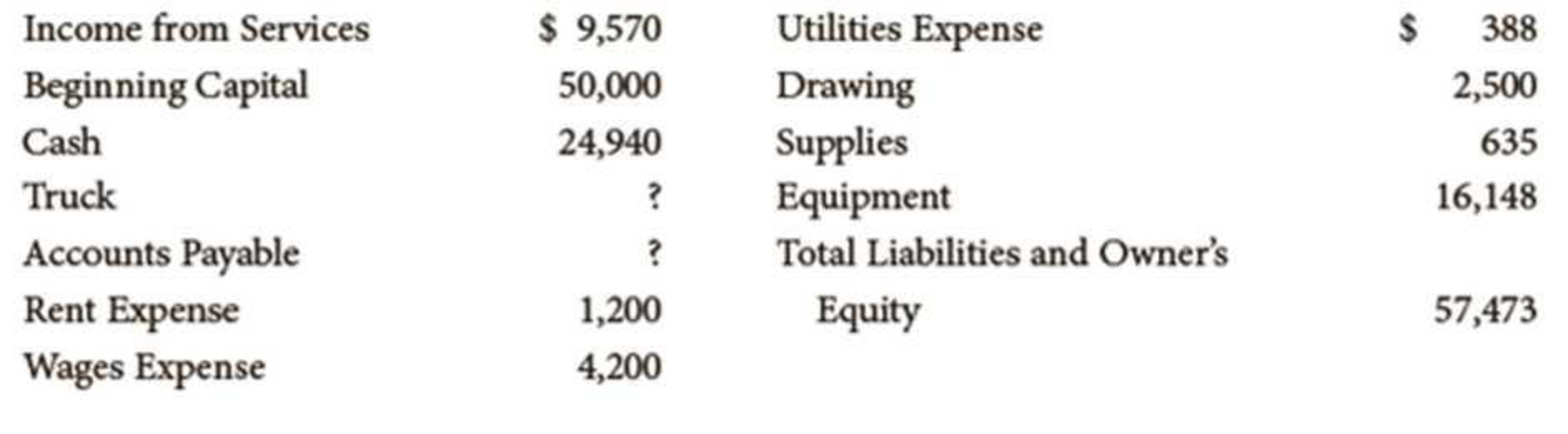

You work as an accounting clerk. You have received the following information supplied by a client, S. Winston, from the client’s bank statement, the client’s tax returns, and a variety of other July documents. The client wants you to prepare an income statement, a statement of owner’s equity, and a balance sheet for the month of July for Winston Company.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

As the bookkeeper of a new start-up company, you are responsible for keeping the chart of accounts up to date. At the end of each year, you analyze the accounts to verify that each account should be active for accumulation of costs, revenues, and expenses.

In July, the accounts payable (A/P) clerk asked you to open an account named New Expenses. You know that an account name should be specific and well defined, and you're afraid the A/P clerk might charge some expenses to the account that are inappropriate.

Respond to the following in a minimum of 175 words:

Why do you think the A/P clerk needs the New Expenses account?

Who needs to know this information and what action should you consider?

As the bookkeeper of a new start-up company, you are responsible for keeping the chart of accounts up to date. At the end of each year, you analyze the accounts to verify that each account should be active for accumulation of costs, revenues, and expenses.

In July, the accounts payable (A/P) clerk asked you to open an account named New Expenses. You know that an account name should be specific and well defined, and you're afraid the A/P clerk might charge some expenses to the account that are inappropriate.

Why do you think the A/P clerk needs the New Expenses account?

Who needs to know this information and what action should you consider?

As the bookkeeper of a new start-up company, you are responsible for keeping the chart of accounts up to date. At the end of each year, you analyze the accounts to verify that each account should be active for accumulation of costs, revenues, and expenses. In July, the accounts payable clerk has asked you to open an account named New Expenses. You know that an account name should be specific and well defined. You feel that the A/P clerk might want to charge some expenses to that account that would not be appropriate. Why do you think the A/P clerk needs this New Expenses account? Who needs to know this information and what action should you consider?

Chapter 3 Solutions

College Accounting (Book Only): A Career Approach

Ch. 3 - A __________ is a book in which business...Ch. 3 - Transferring information from the journal to the...Ch. 3 - For a journal entry to be complete, it must...Ch. 3 - The __________ is used to determine where the...Ch. 3 - Prob. 5QYCh. 3 - A 250 payment for salaries expense was incorrectly...Ch. 3 - Prob. 1DQCh. 3 - How does the journal differ from the ledger?Ch. 3 - What is the purpose of providing a ledger account...Ch. 3 - List by account classification the order of the...

Ch. 3 - Arrange the following steps in the posting process...Ch. 3 - Prob. 6DQCh. 3 - Prob. 7DQCh. 3 - In the following two-column journal, the capital...Ch. 3 - Decor Services completed the following...Ch. 3 - Montoya Tutoring Service completed the following...Ch. 3 - Prob. 4ECh. 3 - Arrange the following steps in the posting process...Ch. 3 - The bookkeeper for Nevado Company has prepared the...Ch. 3 - Determine the effect of the following errors on a...Ch. 3 - Journalize correcting entries for each of the...Ch. 3 - The chart of accounts of the Barnes School is...Ch. 3 - Laras Landscaping Service has the following chart...Ch. 3 - Following is the chart of accounts of Sanchez...Ch. 3 - The chart of accounts of Ethan Academy is shown...Ch. 3 - Leanders Landscaping Service maintains the...Ch. 3 - Following is the chart of accounts of Smith...Ch. 3 - Why Does It Matter? ECOTOUR EXPEDITIONS, INC.,...Ch. 3 - What Would You Say? You are the new bookkeeper for...Ch. 3 - What Do You Think? You work as an accounting...Ch. 3 - What Would You Do?

You are responsible for...Ch. 3 - Prob. 1CP

Additional Business Textbook Solutions

Find more solutions based on key concepts

List five asset accounts, three liability accounts, and five expense accounts included in the acquisition and p...

Auditing and Assurance Services (16th Edition)

For each of the following transactions, state which special journal (Sales Journal, Cash Receipts Journal, Cash...

Principles of Accounting Volume 1

18. What is the calculation for return on assets (ROA)? Explain what ROA measures.

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Calculate profit margin on sales ratio. (LO 5). Suppose a firm had sales of $200,000 and net income of $7,000 f...

Financial Accounting

The managers of an organization are responsible for performing several broad functions. They are ______________...

Principles of Accounting Volume 2

(a) Standard costs are the expected total cost of completing a job. Is this correct? Explain, (b) A standard im...

Managerial Accounting: Tools for Business Decision Making

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume you are a newly-hired accountant for a local manufacturing firm. You have enjoyed working for the company and are looking forward to your first experience participating in the preparation of the companys financial statements for the year-ending December 31, the end of the companys fiscal year. As you are preparing your assigned journal entries, your supervisor approaches you and asks to speak with you. Your supervisor is concerned because, based on her preliminary estimates, the company will fall just shy of its financial targets for the year. If the estimates are true, this means that all 176 employees of the company will not receive year-end bonuses, which represent a significant portion of their pay. One of the entries that you will prepare involves the upcoming bond interest payment that will be paid on January 15 of the next year. Your supervisor has calculated that, if the journal entry is dated on January 1 of the following year rather than on December 31 of the current year, the company will likely meet its financial goals thereby allowing all employees to receive year-end bonuses. Your supervisor asks you if you will consider dating the journal entry on January 1 instead of December 31 of the current year. Assess the implications of the various stake holders and explain what your answer will be.arrow_forwardConsidering the following events, determine which month the revenue or expenses would be recorded using the accounting method specified. a. Gerber Company uses the cash basis of accounting. Gerber prepays cash in May for insurance that only covers the following month, (June). b. Matthews and Dudley Attorneys uses the accrual basis of accounting. Matthews and Dudley Attorneys receives cash from customers in June for services to be performed in July. c. Eckstein Company uses the accrual basis of accounting. Eckstein prepays cash in October for rent that covers the following month, (October). d. Gerbino Company uses the cash basis of accounting. Gerbino makes a sale to a customer in February but does not expect payment until March.arrow_forwardWhat Would You Do? You are responsible for preparing all of the journal entries for Regional Financial Services. You have correctly prepared the following entry for financial services provided on December 15: Your boss has asked you to change the date from December 15 to January 15 so that the business’s profit, and thus taxes, would be lower. Are you allowed to do this? What is your response to your boss? How should you handle this situation?arrow_forward

- Your friend Chris Stevick started a part-time business in June and has been keeping her own accounting records. She has been preparing monthly financial statements. At the end of August, she stopped by to show you her performance for the most recent month. She prepared the following income statement and balance sheet: Chris has also heard that there is a statement of owners equity, but she is not familiar with that statement. She asks if you can help her prepare one. After confirming that she has no assets other than cash, no liabilities, and made no additional investments in the business in August, you agree. REQUIRED 1. Prepare the statement of owners equity for your friends most recent month. 2. What suggestions might you give to Chris that would make her income statement more useful?arrow_forwardIn July of this year, M. Wallace established a business called Wallace Realty. The account headings are presented below. Transactions completed during the month follow. a. Wallace deposited 24,000 in a bank account in the name of the business. b. Paid the office rent for the current month, 650, Ck. No. 1000. c. Bought office supplies for cash, 375, Ck. No. 1001. d. Bought office equipment on account from Dellos Computers, 6,300. e. Received a bill from the City Crier for advertising, 455. f. Sold services for cash, 3,944. g. Paid on account to Dellos Computers, 1,500, Ck. No. 1002. h. Received and paid the bill for utilities, 340, Ck. No. 1003. i. Paid on account to the City Crier, 455, Ck. No. 1004. j. Paid truck expenses, 435, Ck. No. 1005. k. Wallace withdrew cash for personal use, 1,500, Ck. No. 1006. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardPrepare journal entries to record the following transactions for the month of July: A. on first day of the month, paid rent for current month, $2,000 B. on tenth day of month, paid prior month balance due on accounts, $3,100 C. on twelfth day of month, collected cash for services provided, $5,500 D. on twenty-first day of month, paid salaries to employees, $3,600 E. on thirty-first day of month, paid for dividends to shareholders, $800arrow_forward

- Assume you are a senior accountant and have been assigned the responsibility for making the entries to close the books for the year. You have prepared the following four entries and presented them to your boss, the chief financial officer of the company, along with the company CEO, in the weekly staff meeting: As the CEO was reviewing your work, he asked the question, What do these entries mean? Can we learn anything about the company from reviewing them? Provide an explanation to give to the CEO about what the entries reveal about the companys operations this year.arrow_forwardThis problem is designed to enable you to apply the knowledge you have acquired in the preceding chapters. In accounting, the ultimate test is being able to handle data in real-life situations. This problem will give you valuable experience. CHART OF ACCOUNTS You are to record transactions in a two-column general journal. Assume that the fiscal period is one month. You will then be able to complete all of the steps in the accounting cycle. When you are analyzing the transactions, think them through by visualizing the T accounts or by writing them down on scratch paper. For unfamiliar types of transactions, specific instructions for recording them are included. However, reason them out for yourself as well. Check off each transaction as it is recorded. Required 1. Journalize the transactions. (Start on page 1 of the general journal if using Excel or Working Papers.) 2. Post the transactions to the ledger accounts. (Skip this step if using CLGL.) 3. Prepare a trial balance. (If using a work sheet, use the first two columns.) 4. Data for the adjustments are as follows: a. Insurance expired during the month, 1,020. b. Depreciation of building for the month, 480. c. Depreciation of pool/slide facility for the month, 675. d. Depreciation of pool furniture for the month, 220. e. Wages accrued at July 31, 920. Your instructor may want you to use a work sheet for these adjustments. 5. Journalize adjusting entries. 6. Post adjusting entries to the ledger accounts. (Skip this step if using CLGL.) 7. Prepare an adjusted trial balance. 8. Prepare the income statement. 9. Prepare the statement of owners equity. 10. Prepare the balance sheet. 11. Journalize closing entries. 12. Post closing entries to the ledger accounts. (Skip this step if using CLGL.) 13. Prepare a post-closing trial balance. Check Figure Trial balance total, 601,941; net income, 16,293; post-closing trial balance total, 569,614arrow_forwardThis problem is designed to enable you to apply the knowledge you have acquired in the preceding chapters. In accounting, the ultimate test is being able to handle data in real life situations. This problem will give you valuable experience. CHART OF ACCOUNTS You are to record transactions in a two-column general journal. Assume that the fiscal period is one month. You will then be able to complete all of the steps in the accounting cycle. When you are analyzing the transactions, think them through by visualizing the T accounts or by writing them down on scratch paper. For unfamiliar types of transactions, specific instructions for recording them are included. However, reason them out for yourself as well. Check off each transaction as it is recorded. Required 1. Journalize the transactions. (Start on page 1 of the general journal if using Excel or Working Papers.) 2. Post the transactions to the ledger accounts. (Skip this step if using CLGL.) 3. Prepare a trial balance. (If using a work sheet, use the first two columns.) 4. Data for the adjustments are as follows: a. Insurance expired during the month, 1,000. b. Depreciation of pool structure for the month, 715. c. Depreciation of fan system for the month, 260. d. Depreciation of sailboats for the month, 900. e. Wages accrued at June 30, 810. Your instructor may want you to use a work sheet for these adjustments. 5. Journalize adjusting entries. 6. Post adjusting entries to the ledger accounts. (Skip this step if using CLGL.) 7. Prepare an adjusted trial balance 8. Prepare the income statement 9. Prepare the statement of owners equity. 10. Prepare the balance sheet. 11. Journalize closing entries. 12. Post closing entries to the ledger accounts. (Skip this step if using CLGL.) 13. Prepare a post-dosing trial balance. Check Figure Trial balance total, 281,858; net income, 7,143; post-dosing trial balance total, 263,341arrow_forward

- Piedmont Inc. has the following transactions for its first month of business: A. What are the individual account balances, and the total balance, in the accounts payable subsidiary ledger? B. What is the balance in the Accounts Payable general ledger account?arrow_forwardAs the bookkeeper of a new start-up company, you are responsible for keeping the chart of accounts up to date. At the end of each year, you analyze the accounts to verify that each account should be active for acumulation of costs, revenues, and expenses. In July, the accounts payable (A/P) clerk asked you to open an account named New Expenses. You know that an account name should be specific and well defined, and you're afraid the A/P clerk might charge some expenses to the account that are inappropriate. Respond to the following in a minimum of 175 words: *Why do you think the A/P clerk needs the New Expenses account? * Who needs to know this information and what action should you consider?arrow_forwardAs a bookkeeper of a new start-up company, you are responsible for keeping the chart of accounts up to date. At the end of each year, you analyze the accounts to verify that each account should be active for accumulation of costs, revenues and expenses. In July, the accounts payable clerk has asked you to open an account named “New Expenses”. You know that an account name should be specific and well defined. You feel that the A/P clerk might want to charge some expenses to that account that would not be appropriate. Why do you think the A/P clerk need this “New Expenses” account? Who needs to know this information and what action should you consider?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License