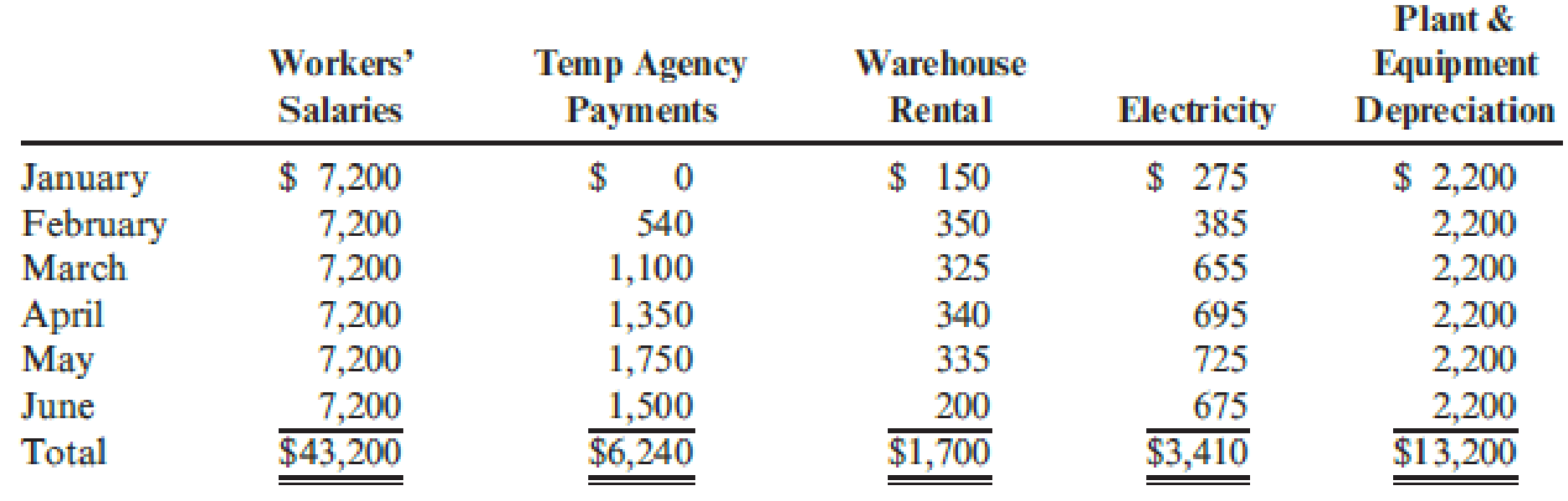

Darnell Poston, owner of Poston Manufacturing, Inc., wants to determine the cost behavior of labor and overhead. Darnell pays his workers a salary; during busy times, everyone works to get the orders out. Temps (temporary workers hired through an agency) may be hired to pack and prepare completed orders for shipment. During slower times, Darnell catches up on bookkeeping and administrative tasks while the salaried workers do preventive maintenance, clean the lines and building, etc. Temps are not hired during slow times. Darnell found that workers’ salaries, temp agency payments, rentals, utilities, and plant and equipment

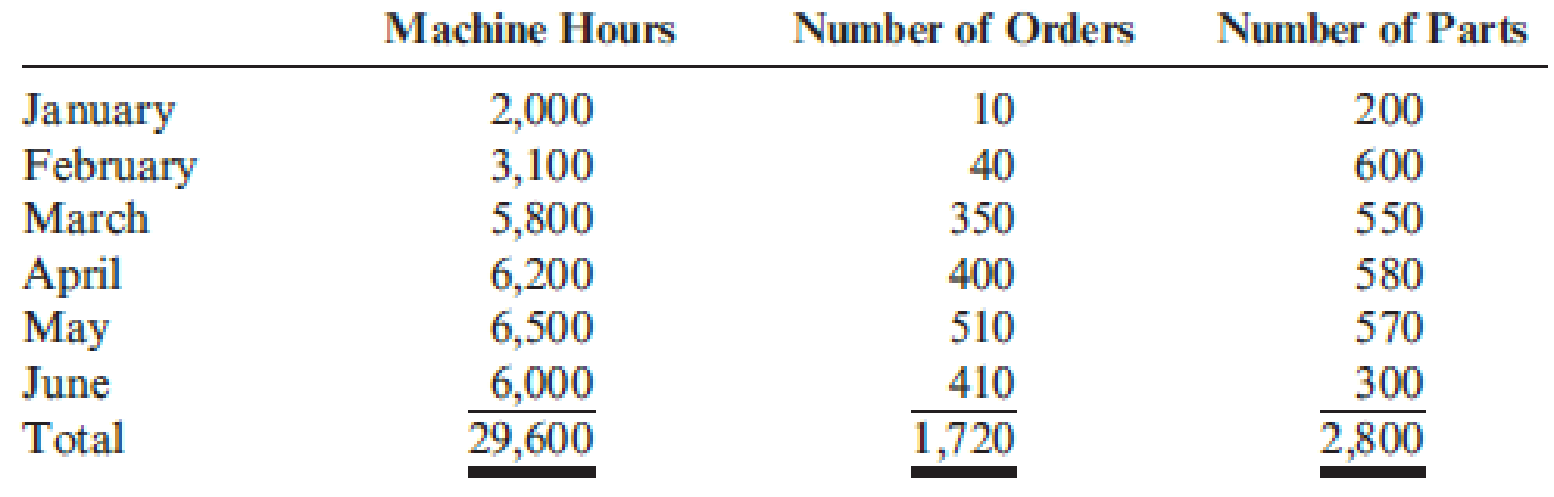

Information on number of machine hours, orders, and parts for the six-month period follows:

Required:

- 1. Calculate the monthly average account balance for each account. Calculate the average monthly amount for each of the three drivers.

- 2. Calculate fixed monthly cost and the variable rates for temp agency payments, warehouse rent, and electricity. Express the results in the form of an equation for total cost.

- 3. In July, Darnell predicts there will be 420 orders, 250 parts, and 5,900 machine hours. What is the total labor and overhead cost for July?

- 4. What if Darnell buys a new machine in July for $24,000? The machine is expected to last 10 years and will have no salvage value at the end of that time. What part of the cost equation will be affected? How? What is the new expected cost in July?

1.

Calculate the monthly average account balance for each account. Calculate the average monthly amount for each of the three drivers.

Explanation of Solution

Cost estimation: Cost estimation is the process of ascertaining the behavior of particular cost.

Calculate monthly average account balance for each account.

| Account | Workings | Amount |

| Average workers' salaries | ($43,200 ÷ 6) | $7,200 |

| Average temp agency payment | ($6,240 ÷ 6) | $1,040 |

| Average warehouse rental | ($1,700 ÷ 6) | $283 |

| Average electricity | ($3,410 ÷ 6) | $568 |

| Average depreciation | ($13,200 ÷ 6) | $2,200 |

Table (1)

Calculate the average monthly amount for each of the three drivers.

| Account | Workings | Amount |

| Average machine hours | ($29,600 ÷ 6) | $4,933 |

| Average number of orders | ($1,720÷ 6) | $287 |

| Average number of parts | ($2,800 ÷ 6) | $467 |

Table (2)

2.

Calculate fixed monthly cost and the variable rates for temp agency payments, warehouse rent, and electricity. Express the results in the form of an equation for total cost.

Explanation of Solution

Calculate monthly fixed cost.

Calculate variable rate for temp agency.

Calculate variable rate for warehouse rental.

Calculate variable rate for electricity.

Monthly cost equation is

3.

Calculate the total labor and overhead cost for July.

Explanation of Solution

Calculate the total labor and overhead cost for July.

4.

State whether, Person D buys a new machine in July for $24,000, if the machine is expected to last 10 years and will have no salvage value at the end of that time. And identify the part of the cost equation will be affected, and identify the new expected cost in July.

Explanation of Solution

Calculate new machine depreciation per month.

Calculate new total cost for July month.

Want to see more full solutions like this?

Chapter 3 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- The following describes the job responsibilities of two employees of Barney Manufacturing. Joan Dennison, Cost Accounting Manager. Joan is responsible for measuring and collecting costs associated with the manufacture of the garden hose product line. She is also responsible for preparing periodic reports that compare the actual costs with planned costs. These reports are provided to the production line managers and the plant manager. Joan helps to explain and interpret the reports. Steven Swasey, Production Manager. Steven is responsible for the manufacture of the high-quality garden hose. He supervises the line workers, helps to develop the production schedule, and is responsible for seeing that production quotas are met. He is also held accountable for controlling manufacturing costs. Required: CONCEPTUAL CONNECTION Identify Joan and Steven as line or staff and explain your reasons.arrow_forwardSameerah is trying to determine the standard hours to make one unit. She has studied the manufacturing process and is trying to determine what portion of the employees time should be included in the Standard time to make the product. She knows that the actual time the worker is assembling, cutting, and painting should be part of the standard hours. She is questioning whether setup, down time, rest periods, and cleanup should be part of the standard hours. Explain why you would or would not include these times.arrow_forwardStan is opening a coffee shop next to Big State University. He knows that controlling his costs will be important to the success of the shop. He will not be able to work all the hours the shop is open, so the employees will need some guidelines to perform their jobs correctly. After talking to an accounting professor, he decides he needs a standard cost system for his shop. Describe the process Stan should follow in setting his standards for materials and labor.arrow_forward

- Nutts management is very concerned about the cost of overhead on its jobs. When jobs are complete, overhead costs should be between 15% and 20% of total costs. For example, the labor cost on Job 8958 is 25% of total costs, higher than the norm. Open Job 8961 and click the Chart sheet tab. A pie chart appears showing the cost components on that job. Record the labor cost percentage in the space provided. Repeat this for each of the jobs worked on in August. Did Nutt maintain good cost control on all its jobs? Explain. Worksheet. During September, Job 8963 required two additional material requisitions to complete the job. Open JOB8963 and modify the job cost sheet to include an area for four direct material requisition entries instead of three. Then enter the following two materials requisitions onto the worksheet: Preview the printout to make sure it will print neatly on one page, and then print the worksheet. Save the completed worksheet as JOBT. Chart. Open JOB8964 and click the Chart sheet tab. Prepare a bar chart for JOB8964 showing the amount of material, labor, and overhead required to complete the job. Use the Chart Data Table found in rows 4246 as a basis for preparing the chart. Enter your name somewhere on the chart. Save the file again as J0B8964. Print the chart.arrow_forwardTonya Martin, CMA and controller or the Parts Division of Gunderson Inc., was meeting with Doug Adams, manager of the division. The topic of discussion was the assignment of overhead costs to jobs and their impact on the divisions pricing decisions. Their conversation was as follows: Tonya: Doug, as you know, about 25% of our business is based on government contracts, with the other 75% based on jobs from private sources won through bidding. During the last several years, our private business has declined. We have been losing more bids than usual. After some careful investigation, I have concluded that we are overpricing some jobs because of improper assignment of overhead costs. Some jobs are also being underpriced. Unfortunately, the jobs being overpriced are coming from our higher-volume, labor-intensive products, so we are losing business. Dong: I think I understand. Jobs associated with our high-volume products are being assigned more overhead than they should be receiving. Then when we add our standard 40% markup, we end up with a higher price than our competitors, who assign costs more accurately. Tonya: Exactly. We have two producing departments, one labor-intensive and the other machine-intensive. The labor-intensive department generates much less overhead than the machine-intensive department. Furthermore, virtually all of our high-volume jobs are labor-intensive. We have been using a plantwide rate based on direct labor hours to assign overhead to all jobs. As a result, the high-volume, labor-intensive jobs receive a greater share of the machine-intensive departments overhead than they deserve. This problem can be greatly alleviated by switching to departmental overhead rates. For example, an average high-volume job would be assigned 100,000 of overhead using a plantwide rate and only 70,000 using departmental rates. The change would lower our bidding price on high-volume jobs by an average of 42,000 per job. By increasing the accuracy of our product costing, we can make better pricing decisions and win back much of our private-sector business. Doug: Sounds good. When can you implement the change in overhead rates? Tonya: It wont take long. I can have the new system working within four to six weekscertainly by the start of the new fiscal year. Doug: Hold it. I just thought of a possible complication. As I recall, most of our government contract work is done in the labor-intensive department. This new overhead assignment scheme will push down the cost on the government jobs, and we will lose revenues. They pay us full cost plus our standard markup. This business is not threatened by our current costing procedures, but we cant switch our rates for only the private business. Government auditors would question the lack of consistency in our costing procedures. Tonya: You do have a point. I thought of this issue also. According to my estimates, we will gain more revenues from the private sector than we will lose from our government contracts. Besides, the costs of our government jobs are distorted. In effect, we are overcharging the government. Doug: They dont know that and never would unless we switch our overhead assignment procedures. I think I have the solution. Officially, lets keep our plantwide overhead rate. All of the official records will reflect this overhead costing approach for both our private and government business. Unofficially. I want you to develop a separate set of books that can be used to generate the information we need to prepare competitive bids for our private-sector business. Required: 1. Do you believe that the solution proposed by Doug is ethical? Explain. 2. Suppose that Tonya decides that Dougs solution is not right and objects strongly. Further suppose that, despite Tonyas objections, Doug insists strongly on implementing the action. What should Tonya do?arrow_forwardYou are a management accountant for Time Treasures Company, whose company has recently signed an outsourcing agreement with Spotless. Inc., a janitorial service company. Spotless will provide all of Time Treasures janitorial services, including sweeping floors, hauling trash, washing windows, stocking restrooms, and performing minor repairs. Time Treasures will be billed at an hourly rate based on the type of service performed. The work of common laborers (sweeping, hauling trash) is to be billed at $8 per hour. More skilled (repairs) and more dangerous work (washing outside windows on the 23rd floor) are to be billed at $18 per hour. Supervisory time is to be billed at $20 per hour. Spotless will submit monthly invoices, which will show the number and types of hours for which Time Treasures is being charged. The outsourcing contract is simple and straightforward. A. What are some of the internal control problems you foresee as a result of our sourcing the janitorial service with this contract? B. Explain recommendations to control risk that would you suggest after reviewing the contract.arrow_forward

- Vargas, Inc., produces industrial machinery. Vargas has a machining department and a group of direct laborers called machinists. Each machinist is paid 25,000 and can machine up to 500 units per year. Vargas also hires supervisors to develop machine specification plans and to oversee production within the machining department. Given the planning and supervisory work, a supervisor can oversee three machinists, at most. Vargass accounting and production history reveal the following relationships between units produced and the costs of direct labor and supervision (measured on an annual basis): Required: 1. Prepare two graphs: one that illustrates the relationship between direct labor cost and units produced, and one that illustrates the relationship between the cost of supervision and units produced. Let cost be the vertical axis and units produced the horizontal axis. 2. How would you classify each cost? Why? 3. Suppose that the normal range of activity is between 2,400 and 2,450 units and that the exact number of machinists is currently hired to support this level of activity. Further suppose that production for the next year is expected to increase by an additional 400 units. How much will the cost of direct labor increase (and how will this increase be realized)? Cost of supervision?arrow_forwardSan Mateo Optics, Inc., specializes in manufacturing lenses for large telescopes and cameras used in space exploration. As the specifications for the lenses are determined by the customer and vary considerably, the company uses a job-order costing system. Manufacturing overhead is applied to jobs on the basis of direct labor hours, utilizing the absorption- or full-costing method. San Mateos predetermined overhead rates for 20x1 and 20x2 were based on the following estimates. Jim Cimino, San Mateos controller, would like to use variable (direct) costing for internal reporting purposes as he believes statements prepared using variable costing are more appropriate for making product decisions. In order to explain the benefits of variable costing to the other members of San Mateos management team, Cimino plans to convert the companys income statement from absorption costing to variable costing. He has gathered the following information for this purpose, along with a copy of San Mateos 20x1 and 20x2 comparative income statement. San Mateo Optics, Inc. Comparative Income Statement For the Years 20x1 and 20x2 San Mateos actual manufacturing data for the two years are as follows: The companys actual inventory balances were as follows: For both years, all administrative expenses were fixed, while a portion of the selling expenses resulting from an 8 percent commission on net sales was variable. San Mateo reports any over-or underapplied overhead as an adjustment to the cost of goods sold. Required: 1. For the year ended December 31, 20x2, prepare the revised income statement for San Mateo Optics, Inc., utilizing the variable-costing method. Be sure to include the contribution margin on the revised income statement. 2. Describe two advantages of using variable costing rather than absorption costing. (CMA adapted)arrow_forwardVentana Window and Wall Treatments Company provides draperies, shades, and various window treatments. Ventana works with the customer to design the appropriate window treatment, places the order, and installs the finished product. Direct materials and direct labor costs are easy to trace to the jobs. Ventanas income statement for last year is as follows: Ventana wants to find a markup on cost of goods sold that will allow them to earn about the same amount of profit on each job as was earned last year. Required: 1. What is the markup on cost of goods sold (COGS) that will maintain the same profit as last year? (Round the percentage to two significant digits.) 2. A customer orders draperies and shades for a remodeling job. The job will have the following costs: What is the price that Ventana will quote given the markup percentage calculated in Requirement 1? (Round the price to the nearest dollar.) 3. What if Ventana wants to calculate a markup on direct materials cost, since it is the largest cost of doing business? What is the markup on direct materials cost that will maintain the same profit as last year? (Round the percentage to two significant digits.) What is the bid price Ventana will use for the job given in Requirement 2 if the markup percentage is calculated on the basis of direct materials cost? (Round to the nearest dollar.)arrow_forward

- Big Mikes, a large hardware store, has gathered data on its overhead activities and associated costs for the past 10 months. Nizam Sanjay, a member of the controllers department, believes that overhead activities and costs should be classified into groups that have the same driver. He has decided that unloading incoming goods, counting goods, and inspecting goods can be grouped together as a more general receiving activity, since these three activities are all driven by the number of receiving orders. The 10 months of data shown below have been gathered for the receiving activity. Required: 1. Prepare a scattergraph, plotting the receiving costs against the number of purchase orders. Use the vertical axis for costs and the horizontal axis for orders. 2. Select two points that make the best fit, and compute a cost formula for receiving costs. 3. Using the high-low method, prepare a cost formula for the receiving activity. 4. Using the method of least squares, prepare a cost formula for the receiving activity. What is the coefficient of determination?arrow_forwardWhat factors would you consider in deciding whether to use direct labor dollars or direct labor hours in charging overhead to jobs in a service firm?arrow_forwardRIRA Company makes attachments such as backhoes and grader and bulldozer blades for construction equipment. The company uses a job order cost system. Management is concerned about cost performance and evaluates the job cost sheets to learn more about the cost effectiveness of the operations. To facilitate a comparison, the job cost sheets for Job 206 (for 50 backhoe buckets completed in October) and Job 228 (for 75 backhoe buckets completed in December) were pulled and presented as follows: Management is concerned about the increase in unit costs over the months from October to December. To understand what has occurred, management interviewed the purchasing manager and quality manager. Purchasing Manager: Prices have been holding steady for our raw materials during the first half of the year. I found a new supplier for our bulk steel that was willing to offer a better price than we received in the past. I saw these lower steel prices and jumped on them, knowing that a reduction in steel prices would have a very favorable impact on our costs. Quality Manager: Something happened around mid-year. All of a sudden, we were experiencing problems with respect to the quality of our steel. As a result, weve been having all sorts of problems on the shop floor in our foundry and welding operation. a. Analyze the two job cost sheets and identify why the unit costs have changed for the backhoe buckets. Complete the following schedule to help in your analysis: b. How would you interpret what has happened in light of your analysis and the interviews?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning