Concept explainers

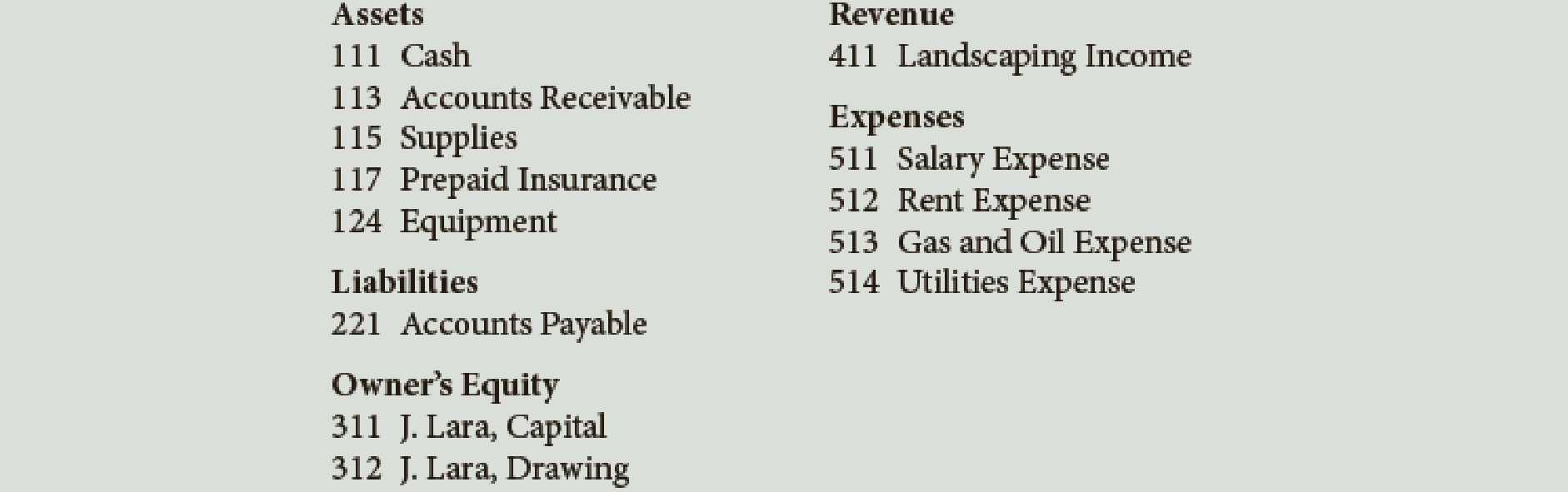

Lara’s Landscaping Service has the following chart of accounts:

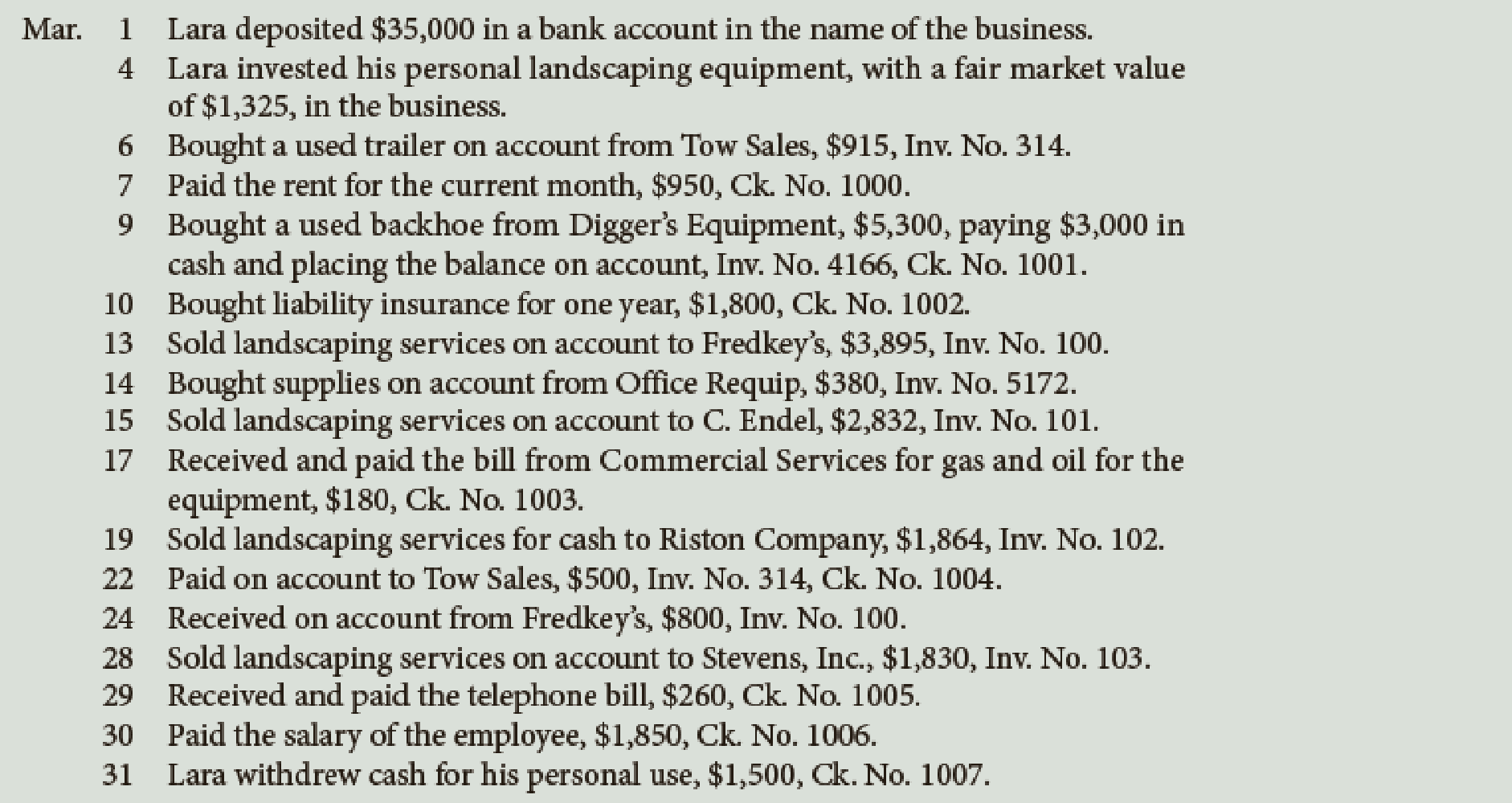

The following transactions were completed by Lara’s Landscaping Service:

Required

- 1. Journalize the transactions in the general journal. Provide a brief explanation for each entry.

- 2. If you are using working papers, write the name of the owner on the Capital and Drawing accounts. (Skip this step if you are using CLGL.)

- 3.

Post the journal entries to the general ledger accounts. (Skip this step if you are using CLGL.) - 4. Prepare a

trial balance dated March 31, 20–.

*If you are using CLGL, use the year 2020 when recording transaction! and preparing reports.

1.

Prepare journal entries for the given transactions.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- ■ Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- ■ Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare journal entries for the given transactions.

Transaction on March 1:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| March | 1 | Cash | 111 | 35,000 | ||

| JL, Capital | 311 | 35,000 | ||||

| (Record cash invested in the business by JL) | ||||||

Table (1)

Description:

- ■ Cash is an asset account. Since cash is invested in the business, asset account increased, and an increase in asset is debited.

- ■ JL, Capital is an equity account. Since cash is contributed as capital by the owner, equity value increased, and an increase in equity is credited.

Transaction on March 4:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| March | 4 | Equipment | 124 | 1,325 | ||

| JL, Capital | 311 | 1,325 | ||||

| (Record equipment invested in the business by JL) | ||||||

Table (2)

Description:

- ■ Equipment is an asset account. Since equipment is invested in the business, asset account increased, and an increase in asset is debited.

- ■ JL, Capital is an equity account. Since equipment is contributed as capital by the owner, equity value increased, and an increase in equity is credited.

Transaction on March 6:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| March | 6 | Equipment | 124 | 915 | ||

| Accounts Payable | 221 | 915 | ||||

| (Record purchase of equipment) | ||||||

Table (3)

Description:

- ■ Equipment is an asset account. Since equipment is bought, asset account increased, and an increase in asset is debited.

- ■ Accounts Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on March 7:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| March | 7 | Rent Expense | 512 | 950 | ||

| Cash | 111 | 950 | ||||

| (Record payment of rent expense) | ||||||

Table (4)

Description:

- ■ Rent Expense is an expense account. An increase in expense reduces the equity value, and a decrease in equity is debited.

- ■ Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Transaction on March 9:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| March | 9 | Equipment | 124 | 5,300 | ||

| Cash | 111 | 3,000 | ||||

| Accounts Payable | 221 | 2,300 | ||||

| (Record purchase of equipment) | ||||||

Table (5)

Description:

- ■ Equipment is an asset account. Since equipment is bought, asset account increased, and an increase in asset is debited.

- ■ Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

- ■ Accounts Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on March 10:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| March | 10 | Prepaid Insurance | 117 | 1,800 | ||

| Cash | 111 | 1,800 | ||||

| (Record payment of insurance in advance) | ||||||

Table (6)

Description:

- ■ Prepaid Insurance is an asset account. Since insurance is paid in advance, it is recorded as asset until it is consumed. So, asset value is increased, and an increase in asset is debited.

- ■ Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Transaction on March 13:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| March | 13 | Accounts Receivable | 113 | 2,832 | ||

| Landscaping Income | 411 | 2,832 | ||||

| (Record services performed on account) | ||||||

Table (7)

Description:

- ■ Accounts Receivable is an asset account. The amount is increased because amount to be received increased, and an increase in asset is debited.

- ■ Landscaping Income is a revenue account. Since gains and revenues increase equity, and an increase in equity is credited, Landscaping Income account is credited.

Transaction on March 14:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| March | 14 | Supplies | 113 | 380 | ||

| Accounts Payable | 411 | 380 | ||||

| (Record supplies bought on account) | ||||||

Table (8)

Description:

- ■ Supplies is an asset account. Since store supplies are bought, asset account increased, and an increase in asset is debited.

- ■ Accounts Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on March 15:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| March | 15 | Accounts Receivable | 113 | 2,832 | ||

| Landscaping Income | 411 | 2,832 | ||||

| (Record services performed on account) | ||||||

Table (9)

Description:

- ■ Accounts Receivable is an asset account. The amount is increased because amount to be received increased, and an increase in asset is debited.

- ■ Landscaping Income is a revenue account. Since gains and revenues increase equity, and an increase in equity is credited, Landscaping Income account is credited.

Transaction on March 17:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| March | 17 | Gas and Oil Expense | 513 | 180 | ||

| Cash | 111 | 180 | ||||

| (Record payment of oil and gas expense) | ||||||

Table (10)

Description:

- ■ Gas and Oil Expense is an expense account. An increase in expense reduces the equity value, and a decrease in equity is debited.

- ■ Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Transaction on March 19:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| March | 19 | Cash | 111 | 1,864 | ||

| Landscaping Income | 411 | 1,864 | ||||

| (Record revenue earned and received) | ||||||

Table (11)

Description:

- ■ Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- ■ Landscaping Income is a revenue account. Since gains and revenues increase equity, and an increase in equity is credited, Landscaping Income account is credited.

Transaction on March 22:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| March | 22 | Accounts Payable | 221 | 500 | ||

| Cash | 111 | 500 | ||||

| (Record cash paid on account) | ||||||

Table (12)

Description:

- ■ Accounts Payable is a liability account. Since the payable decreased, the liability decreased, and a decrease in liability is debited.

- ■ Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Transaction on March 24:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| March | 24 | Cash | 111 | 800 | ||

| Accounts Receivable | 113 | 800 | ||||

| (Record cash received on account) | ||||||

Table (13)

Description:

- ■ Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- ■ Accounts Receivable is an asset account. Since amount to be received has decreased, asset account decreased, and a decrease in asset is credited.

Transaction on March 28:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| March | 28 | Accounts Receivable | 113 | 1,400 | ||

| Landscaping Income | 411 | 1,400 | ||||

| (Record services performed on account) | ||||||

Table (14)

Description:

- ■ Accounts Receivable is an asset account. The amount is increased because amount to be received increased, and an increase in asset is debited.

- ■ Landscaping Income is a revenue account. Since gains and revenues increase equity, and an increase in equity is credited, Landscaping Income account is credited.

Transaction on March 29:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| March | 29 | Utilities Expense | 514 | 260 | ||

| Cash | 111 | 260 | ||||

| (Record payment of utilities expense) | ||||||

Table (15)

Description:

- ■ Utilities Expense is an expense account. An increase in expense reduces the equity value, and a decrease in equity is debited.

- ■ Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Transaction on March 30:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| March | 30 | Salary Expense | 511 | 1,850 | ||

| Cash | 111 | 1,850 | ||||

| (Record payment of salary expense) | ||||||

Table (16)

Description:

- ■ Salary Expense is an expense account. An increase in expense reduces the equity value, and a decrease in equity is debited.

- ■ Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Transaction on March 31:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| March | 31 | JL, Drawing | 312 | 1,500 | ||

| Cash | 111 | 1,500 | ||||

| (Record cash withdrawn by JL for personal use) | ||||||

Table (17)

Description:

- ■ JL, Drawing is a contra-capital account. The contra-capital accounts decrease the equity value, and a decrease in equity is debited.

- ■ Cash is an asset account. Since cash is withdrawn, asset account decreased, and a decrease in asset is credited.

2.

Indicate the names of owner above the Capital and Drawing accounts.

Explanation of Solution

Owners’ equity: The financial interest of the owners to invest in the business is referred to as owners’ equity or capital. Owners’ equity comprises of capital, drawings, revenues and expenses.

Write the name of owner, JL before the capital and drawings terms and name those accounts as JL, Capital account and JL, Drawing account.

3.

Post the journalized transactions in the ledger accounts.

Explanation of Solution

Ledger: Ledger is a book in which the accounts are summarized and grouped from the transactions recorded in the journal.

Post the journalized transactions in the ledger accounts.

| ACCOUNT Cash ACCOUNT NO. 111 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| March | 1 | 1 | 35,000 | 35,000 | |||

| 7 | 1 | 950 | 34,050 | ||||

| 9 | 1 | 3,000 | 31,050 | ||||

| 10 | 1 | 1,800 | 29,250 | ||||

| 17 | 1 | 180 | 29,070 | ||||

| 19 | 1 | 1,864 | 30,934 | ||||

| 22 | 1 | 500 | 30,434 | ||||

| 24 | 1 | 800 | 31,234 | ||||

| 29 | 1 | 260 | 30,974 | ||||

| 30 | 1 | 1,850 | 29,124 | ||||

| 31 | 1 | 1,500 | 27,624 | ||||

Table (18)

| ACCOUNT Accounts Receivable ACCOUNT NO. 113 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| March | 13 | 1 | 3,895 | 3,895 | |||

| 15 | 1 | 2,832 | 6,727 | ||||

| 24 | 1 | 800 | 5,927 | ||||

| 28 | 1 | 1,830 | 7,757 | ||||

Table (19)

| ACCOUNT Supplies ACCOUNT NO. 115 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| March | 14 | 1 | 380 | 380 | |||

Table (20)

| ACCOUNT Prepaid Insurance ACCOUNT NO. 117 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| March | 10 | 1 | 1,800 | 1,800 | |||

Table (21)

| ACCOUNT Equipment ACCOUNT NO. 124 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| March | 4 | 1 | 1,325 | 1,325 | |||

| 6 | 1 | 915 | 2,240 | ||||

| 9 | 1 | 5,300 | 7,540 | ||||

Table (22)

| ACCOUNT Accounts Payable ACCOUNT NO. 221 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| March | 6 | 1 | 915 | 915 | |||

| 9 | 1 | 2,300 | 3,215 | ||||

| 14 | 1 | 380 | 3,595 | ||||

| 22 | 1 | 500 | 3,095 | ||||

Table (23)

| ACCOUNT JL, Capital ACCOUNT NO. 311 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| March | 1 | 1 | 35,000 | 35,000 | |||

| 4 | 1 | 1,325 | 36,325 | ||||

Table (24)

| ACCOUNT JL, Drawing ACCOUNT NO. 312 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| March | 31 | 1 | 1,500 | 1,500 | |||

Table (25)

| ACCOUNT Landscaping Income ACCOUNT NO. 411 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| March | 13 | 1 | 3,895 | 3,895 | |||

| 15 | 1 | 2,832 | 6,727 | ||||

| 19 | 1 | 1,864 | 8,591 | ||||

| 28 | 1 | 1,830 | 10,421 | ||||

Table (26)

| ACCOUNT Salary Expense ACCOUNT NO. 511 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| March | 30 | 1 | 1,850 | 1,850 | |||

Table (27)

| ACCOUNT Rent Expense ACCOUNT NO. 512 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| March | 7 | 1 | 950 | 950 | |||

Table (28)

| ACCOUNT Gas and Oil Expense ACCOUNT NO. 513 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| March | 17 | 1 | 180 | 180 | |||

Table (29)

| ACCOUNT Utilities Expense ACCOUNT NO. 514 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| March | 29 | 1 | 260 | 260 | |||

Table (30)

4.

Prepare the trial balance for L’s Landscaping Service as at March 31, 20--.

Explanation of Solution

Trial balance: Trial balance is a summary of all the asset, liability, and equity accounts and their balances.

Prepare the trial balance for L’s Landscaping Service as at March 31, 20--.

| L’s Landscaping Service | ||

| Trial Balance | ||

| March 31, 20-- | ||

| Account Title | Debit ($) | Credit ($) |

| Cash | $27,624 | |

| Accounts Receivable | 7,757 | |

| Supplies | 380 | |

| Prepaid Insurance | 1,800 | |

| Equipment | 7,540 | |

| Accounts Payable | $3,095 | |

| JL, Capital | 36,325 | |

| JL, Drawing | 1,500 | |

| Landscaping Income | 10,421 | |

| Salary Expense | 1,850 | |

| Rent Expense | 950 | |

| Gas and Oil Expense | 180 | |

| Miscellaneous Expense | 260 | |

| Total | $49,841 | $49,841 |

Table (31)

Hence, the debit and credit total of trial balance of L’s Landscaping Service at March 31, 20-- is 49,841.

Want to see more full solutions like this?

Chapter 3 Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

Introduction To Managerial Accounting

Intermediate Accounting (2nd Edition)

PRINCIPLES OF TAXATION F/BUS.+INVEST.

Managerial Accounting: Creating Value in a Dynamic Business Environment

Auditing And Assurance Services

Managerial Accounting: Tools for Business Decision Making

- Leanders Landscaping Service maintains the following chart of accounts: The following transactions were completed by Leander: Required 1. Journalize the transactions in the general journal. Prepare a brief explanation for each entry. 2. If you are using working papers, write the name of the owner on the Capital and Drawing accounts. 3. Post the journal entries to the general ledger accounts. (Skip this step if you are using CLGL.) 4. Prepare a trial balance dated April 30, 20. If you are using CLGL, use the year 2020 when recording transactions and preparing reports.arrow_forwardThe partial work sheet for Ho Consulting for May follows: Required If you are using working papers, complete the following: 1. a.Write the owners name on the Capital and Drawing T accounts. b.Record the account balances in the T accounts for owners equity, revenue, and expenses. 2. Journalize the closing entries using the four steps in correct order. Number the closing entries 1 through 4. 3. Post the closing entries to the T accounts immediately after you journalize each one to see the effect of the closing entries. Number the closing entries 1 through 4. Check Figure Debit to Income Summary, second entry, 5,840arrow_forwardThe partial work sheet for Emil Consulting for June is as follows: Required If you are using Working Papers, complete the following: 1. a.Write the owners name on the Capital and Drawing T accounts. b.Record the account balances in the T accounts for owners equity, revenue, and expenses. 2. Journalize the closing entries using the four steps in correct order. Number the closing entries 1 through 4. 3. Post the closing entries to the T accounts immediately after you journalize each one to see the effect of the closing entries. Number closing entries 1 through 4. Check Figure Debit to Income Summary, second entry, 4,930arrow_forward

- Prepare general journal entries for the following transactions of a new company called Pose-for-Pics. Use the following (partial) chart of accounts: Cash; Office Supplies; Prepaid Insurance; Photography Equipment; M. Harris, Capital; Photography Fees Earned; and Utilities Expense.arrow_forwardPlease complete the cycle up to preparing trial balance, Income Statement, Statement of Owner's equity, and Balance Sheet. In order to do so, Journal Entry and T-account set up must be done. Can you help me with the Journal Entry and T account, please?arrow_forwardPrepare general journal entries to record the transactions below for Spade Company by using the following accounts: Cash; Accounts Receivable; Office Supplies; Office Equipment; Accounts Payable; K. Spade, Capital; K. Spade, Withdrawals; Fees Earned; and Rent Expense. Use the letters beside eachtransaction to identify entries. After recording the transactions, post them to T-accounts, which serve as the general ledger for this assignment. Determine the ending balance of each T-account.arrow_forward

- Use the following information to answer Exercises E2-18 and E2-19. The following transactions occurred for Wilke Technology Solutions: Analyzing and journalizing transactions Journalize the transactions of Wilke Technology Solutions. Include an explanation with each journal entry. Use the following accounts: Cash; Accounts Receivable; Office Supplies; Prepaid Advertising; Land; Building; Accounts Payable; Unearned Revenue; Common Stock; Service Revenue; Rent Expense; and Salaries Expense.arrow_forwardUse T-accounts to record all business transactions: The accounts and transactions of Conner McAllister, Counselor and Attorney at Law, follow. Instructions Analyze the transactions a - c (typed here) and d - s (in the image). Record each in the appropriate T accounts. Use plus and minus signs in front of the amounts to show the increases and decreases. Indentify each entry in the T accounts by writing the letter of the transaction next to the entry. Assets Cash Accounts Receivable Office Furniture Office Equipment Automobile Liabilities Accounts Payable Owner's Equity Conner McAllister, Capital Conner McAllister, Drawing Revenue Fees Income Expenses Automobile Expense Rent Expense Utilities Expense Salaries Expense Telephone Expense a. Conner McAllister invested $140,000 in cash to start the business. b. Paid $7,800 for the current month's rent c. Bought a used automobile for the firm for $38,500 in cash d. - s. in the image All of the transactions (typed a. - c. and…arrow_forwardJanis Engle has prepared the following list of statements about the accounting cycle. 1. “Journalize the transactions” is the first step in the accounting cycle. 2. Reversing entries are a required step in the accounting cycle. 3. Correcting entries do not have to be part of the accounting cycle. 4. If a worksheet is prepared, some steps of the accounting cycle are incorporated into the worksheet. 5. The accounting cycle begins with the analysis of business transactions and ends with the preparation of a post-closing trial balance. 6. All steps of the accounting cycle occur daily during the accounting period. 7. The step of “post to the ledger accounts” occurs before the step of “journalize the transactions.” 8. Closing entries must be prepared before financial statements can be prepared. Instructions Identify each statement as true or false. If false, indicate how to correct the statement. Please answer it with proper explanationarrow_forward

- The general ledger of Jay Consulting shows the following balances at July 31: Jay has asked you to develop a worksheet that will serve as a trial balance (file name PTB). Use the data provided as input for your model. Review the Model-Building Problem Checklist on page 154 to ensure that your worksheet is complete. Print the worksheet when done. Check figure: Total debits, 17,731. To test your model, use the following balances at August 31: Print the worksheet when done. Check figure: Total debits, 18,810. CHART (optional) Using the test data worksheet, prepare a pie chart showing the percentage of each asset to total assets. Print the chart when done.arrow_forwardThis problem is designed to enable you to apply the knowledge you have acquired in the preceding chapters. In accounting, the ultimate test is being able to handle data in real-life situations. This problem will give you valuable experience. CHART OF ACCOUNTS You are to record transactions in a two-column general journal. Assume that the fiscal period is one month. You will then be able to complete all of the steps in the accounting cycle. When you are analyzing the transactions, think them through by visualizing the T accounts or by writing them down on scratch paper. For unfamiliar types of transactions, specific instructions for recording them are included. However, reason them out for yourself as well. Check off each transaction as it is recorded. Required 1. Journalize the transactions. (Start on page 1 of the general journal if using Excel or Working Papers.) 2. Post the transactions to the ledger accounts. (Skip this step if using CLGL.) 3. Prepare a trial balance. (If using a work sheet, use the first two columns.) 4. Data for the adjustments are as follows: a. Insurance expired during the month, 1,020. b. Depreciation of building for the month, 480. c. Depreciation of pool/slide facility for the month, 675. d. Depreciation of pool furniture for the month, 220. e. Wages accrued at July 31, 920. Your instructor may want you to use a work sheet for these adjustments. 5. Journalize adjusting entries. 6. Post adjusting entries to the ledger accounts. (Skip this step if using CLGL.) 7. Prepare an adjusted trial balance. 8. Prepare the income statement. 9. Prepare the statement of owners equity. 10. Prepare the balance sheet. 11. Journalize closing entries. 12. Post closing entries to the ledger accounts. (Skip this step if using CLGL.) 13. Prepare a post-closing trial balance. Check Figure Trial balance total, 601,941; net income, 16,293; post-closing trial balance total, 569,614arrow_forwardThis problem is designed to enable you to apply the knowledge you have acquired in the preceding chapters. In accounting, the ultimate test is being able to handle data in real life situations. This problem will give you valuable experience. CHART OF ACCOUNTS You are to record transactions in a two-column general journal. Assume that the fiscal period is one month. You will then be able to complete all of the steps in the accounting cycle. When you are analyzing the transactions, think them through by visualizing the T accounts or by writing them down on scratch paper. For unfamiliar types of transactions, specific instructions for recording them are included. However, reason them out for yourself as well. Check off each transaction as it is recorded. Required 1. Journalize the transactions. (Start on page 1 of the general journal if using Excel or Working Papers.) 2. Post the transactions to the ledger accounts. (Skip this step if using CLGL.) 3. Prepare a trial balance. (If using a work sheet, use the first two columns.) 4. Data for the adjustments are as follows: a. Insurance expired during the month, 1,000. b. Depreciation of pool structure for the month, 715. c. Depreciation of fan system for the month, 260. d. Depreciation of sailboats for the month, 900. e. Wages accrued at June 30, 810. Your instructor may want you to use a work sheet for these adjustments. 5. Journalize adjusting entries. 6. Post adjusting entries to the ledger accounts. (Skip this step if using CLGL.) 7. Prepare an adjusted trial balance 8. Prepare the income statement 9. Prepare the statement of owners equity. 10. Prepare the balance sheet. 11. Journalize closing entries. 12. Post closing entries to the ledger accounts. (Skip this step if using CLGL.) 13. Prepare a post-dosing trial balance. Check Figure Trial balance total, 281,858; net income, 7,143; post-dosing trial balance total, 263,341arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning