Concept explainers

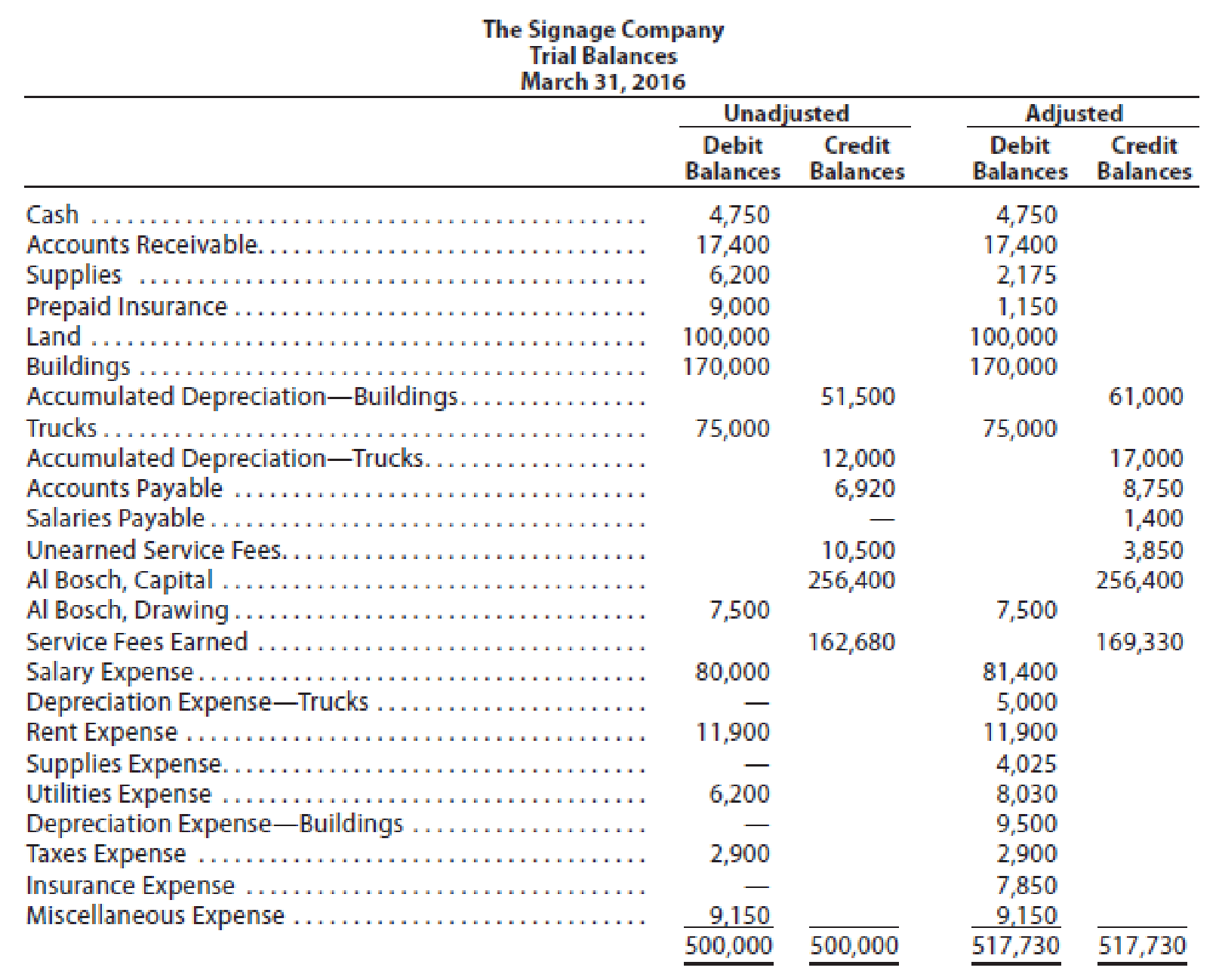

The Signage Company specializes in the maintenance and repair of signs, such as billboards. On March 31, 2016, the accountant for The Signage Company prepared the following

Instructions

Journalize the seven entries that adjusted the accounts at March 31. None of the accounts were affected by more than one

Prepare the adjusting entries in the books of Company S at the end of the year.

Explanation of Solution

Adjusting entries: Adjusting entries refers to the entries that are made at the end of an accounting period in accordance with revenue recognition principle, and expenses recognition principle. All adjusting entries affect at least one income statement account (revenue or expense), and one balance sheet account (asset or liability).

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and owner’s equities.

- Credit, all increase in liabilities, revenues, and owners’ equities, all decrease in assets, expenses.

An adjusting entry for Supplies expenses:

In this case, Company S recognized the supplies expenses at the end of the year. So, the necessary adjusting entry that the Company S should record to recognize the supplies expense is as follows:

| Date | Description |

Post Ref. | Debit ($) | Credit ($) | |

| 2019 | Supplies expenses (1) | 4,025 | |||

| March | 31 | Supplies | 4,025 | ||

| (To record the supplies expenses incurred at the end of the year) | |||||

Table (1)

- Supplies expense decreased the value of owner’s equity by $4,025; hence debit the supplies expenses for $4,025.

- Supplies are an asset, and it decreased the value of asset by $4,025, hence credit the supplies for $4,025.

Working note (1):

Calculate the value of supplies expense.

An adjusting entry for insurance expenses:

In this case, Company S recognized the insurance expenses at the end of the year. So, the necessary adjusting entry that the Company S should record to recognize the prepaid expense is as follows:

| Date | Description |

Post Ref. | Debit ($) | Credit ($) | |

| 2019 | Insurance expenses (2) | 7,850 | |||

| March | 31 | Prepaid insurance | 7,850 | ||

| (To record the insurance expenses incurred at the end of the year) | |||||

Table (2)

- Insurance expense decreased the value of owner’s equity by $7,850; hence debit the insurance expenses for $7,850.

- Prepaid insurance is an asset, and it decreased the value of asset by $7,850, hence credit the prepaid insurance for $7,850.

Working note (2):

Calculate the value of insurance expense.

An adjusting entry for depreciation expenses-Buildings:

In this case, Company S recognized the depreciation expenses on buildings at the end of the year. So, the necessary adjusting entry that the Company S should record to recognize the accrued expense is as follows:

| Date | Description |

Post Ref. | Debit ($) | Credit ($) | |

| 2019 | Depreciation expenses –Buildings (3) | 9,500 | |||

| March | 31 | Accumulated depreciation-Buildings | 9,500 | ||

| (To record the depreciation expenses incurred at the end of the year) | |||||

Table (3)

- Depreciation expense decreased the value of owner’s equity by $9,500; hence debit the depreciation expenses for $9,500.

- Accumulated depreciation is a contra-asset account, and it decreased the value of asset by $9,500, hence credit the accumulated depreciation for $9,500.

Working note (3):

Calculate the value of depreciation expense-Equipment.

An adjusting entry for depreciation expenses-Trucks:

In this case, Company S recognized the depreciation expenses on trucks at the end of the year. So, the necessary adjusting entry that the Company S should record to recognize the accrued expense is as follows:

| Date | Description |

Post Ref. | Debit ($) | Credit ($) | |

| 2019 | Depreciation expenses –Trucks(4) | 5,000 | |||

| March | 31 | Accumulated depreciation-Trucks | 5,000 | ||

| (To record the depreciation expenses incurred at the end of the year) | |||||

Table (4)

- Depreciation expense decreased the value of owner’s equity by $5,000; hence debit the depreciation expenses for $5,000.

- Accumulated depreciation is a contra-asset account, and it decreased the value of asset by $5,000, hence credit the accumulated depreciation for $5,000.

Working note (4):

Calculate the value of depreciation expense-Trucks.

An adjusting entry for utilities expenses:

In this case, Company S recognized the utilities expenses at the end of the year. So, the necessary adjusting entry that the Company S should record to recognize the accrued expense is as follows:

| Date | Description |

Post Ref. | Debit ($) | Credit ($) | |

| 2019 | Utilities expenses (5) | 1,830 | |||

| March | 31 | Accounts payable | 1,830 | ||

| (To record the utilities expenses incurred at the end of the year) | |||||

Table (5)

- Utilities expense decreased the value of owner’s equity by $1,830; hence debit the utilities expenses for $1,830.

- Accounts payable is a liability, and it increased the value of liability by $1,830, hence credit the accounts payable for $1,830.

Working note (5):

Calculate the value of utilities expense.

An adjusting entry for salaries expenses:

In this case, Company S recognized the salaries expenses at the end of the year. So, the necessary adjusting entry that the Company S should record to recognize the accrued expense is as follows:

| Date | Description |

Post Ref. | Debit ($) | Credit ($) | |

| 2019 | Salaries expenses (6) | 1,400 | |||

| March | 31 | Salaries payable | 1,400 | ||

| (To record the salaries expenses incurred at the end of the year) | |||||

Table (6)

- Salaries expense decreased the value of owner’s equity by $1,400; hence debit the salaries expenses for $1,400.

- Salaries payable is a liability, and it increased the value of liability by $1,400, hence credit the salaries payable for $1,400.

Working note (6):

Calculate the value of salaries expense.

An adjusting entry for unearned service fees:

In this case, Company S received cash in advance before the service provided to customer. So, the necessary adjusting entry that the Company S should record for the unearned fees revenue at the end of the year is as follows:

| Date | Description |

Post Ref. | Debit ($) | Credit ($) | |

| 2019 | Unearned service fees | 6,650 | |||

| March | 31 | Service fees earned (7) | 6,650 | ||

| (To record the unearned service fees at the end of the year) | |||||

Table (7)

- Unearned service fees are a liability, and it decreased the value of liability by $6,650, hence debit the unearned service fees for $6,650.

- Service fees earned increased owner’s equity by $6,650; hence credit the service fees earned for $6,650

Working note (7):

Calculate the value of service fees earned.

Want to see more full solutions like this?

Chapter 3 Solutions

Financial Accounting

- Good Note Company specializes in the repair of music equipment and is owned and operated by Robin Stahl. On November 30, 2016, the end of the current year, the accountant for Good Note Company prepared the following trial balances: Instructions Journalize the seven entries that adjusted the accounts at November 30. None of the accounts were affected by more than one adjusting entry.arrow_forwardThe trial balance of Wikki Cleaners at December 31, 2012, the end of the current fiscal year, is as follows: Information for the adjusting entries is as follows: a. Cleaning supplies on hand on December 31, 2012, 18,750. b. Insurance premiums expired during the year, 1,800. c. Depreciation on equipment during the year, 21,600. d. Wages accrued but not paid at December 31, 2012, 1,830. Suppose you discover that an assistant in your department had misunderstood your instructions and had provided you with the wrong information on two of the adjusting entries. Cleaning supplies consumed during the year should have been 18,750, and insurance premiums unexpired at year-end were 1,800. Make the corrections on your worksheet and save the corrected file as F1WORK4. Reprint the worksheet.arrow_forwardGood Note Company specializes in the repair of music equipment and is owned and operated by Robin Stahl. On November 30, 2019, the end of the current year, the accountant for Good Note prepared the following trial balances: Instructions Journalize the seven entries that adjusted the accounts at November 30. None of the accounts were affected by more than one adjusting entry.arrow_forward

- Reece Financial Services Co., which specializes in appliance repair services, is owned and operated by Joni Reece. Reece Financial Services Co.s accounting clerk prepared the following unadjusted trial balance at July 31, 2016: The data needed to determine year-end adjustments are as follows: a. Depreciation of building for the year, 6,400. b. Depreciation of equipment for the year, 2,800. c. Accrued salaries and wages at July 31, 900. d. Unexpired insurance at July 31, 1,500. e. Fees earned but unbilled on July 31, 10,200. f. Supplies on hand at July 31, 615. g. Rent unearned at July 31, 300. Instructions 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depreciation ExpenseBuilding; Depreciation ExpenseEquipment; and Supplies Expense. 2. Determine the balances of the accounts affected by the adjusting entries and preparean adjusted trial balance.arrow_forwardOn December 31, 2001, a bookkeeper prepared a trial balance before adjusting entries were made and omitted the balance of the following accounts: Rent, Insurance, Interest Earned, Salaries, Rent Income. The Accountant prepared the financial statements from the ledger which was correct and complete. On the Statement of Income for 2001 in the appropriate sections, the following appeared: Rent $3,600, Insurance $375, Interest Earned $116, Salaries $7,462, Rent Income $480. On the Balance Sheet of 12/31/01, the following appeared: Prepaid Rent $300, Prepaid Insurance $110, Interest Accrued on Notes Receivable $22, Salaries Accrued $400, Rent Prepaid by Sub-Tenants $40. Balance of Salaries Account:arrow_forwardOn December 31, 2001, a bookkeeper prepared a trial balance before adjusting entries were made and omitted the balance of the following accounts: Rent, Insurance, Interest Earned, Salaries, Rent Income. The Accountant prepared the financial statements from the ledger which was correct and complete. On the Statement of Income for 2001 in the appropriate sections, the following appeared: Rent $3,600, Insurance $375, Interest Earned $116, Salaries $7,462, Rent Income $480. On the Balance Sheet of 12/31/01, the following appeared: Prepaid Rent $300, Prepaid Insurance $110, Interest Accrued on Notes Receivable $22, Salaries Accrued $400, Rent Prepaid by Sub-Tenants $40. what is the Balance of Salaries Account , and the balance should be debited or credited to income statement or balance sheet?arrow_forward

- On December 31, 2001, a bookkeeper prepared a trial balance before adjusting entries were made and omitted the balance of the following accounts: Rent, Insurance, Interest Earned, Salaries, Rent Income. The Accountant prepared the financial statements from the ledger which was correct and complete. On the Statement of Income for 2001 in the appropriate sections, the following appeared: Rent $3,600, Insurance $375, Interest Earned $116, Salaries $7,462, Rent Income $480. On the Balance Sheet of 12/31/01, the following appeared: Prepaid Rent $300, Prepaid Insurance $110, Interest Accrued on Notes Receivable $22, Salaries Accrued $400, Rent Prepaid by Sub-Tenants $40. Balance of Insurance Account: How much and the entry should be debit/ credit to Income statement or Credit/debit on the balance sheet ?arrow_forwardThe trial balance of Wikki Cleaners at December 31, 2012, the end of the current fiscal year, is as follows: Information for the adjusting entries is as follows: a. Cleaning supplies on hand on December 31, 2012, 18,750. b. Insurance premiums expired during the year, 1,800. c. Depreciation on equipment during the year, 21,600. d. Wages accrued but not paid at December 31, 2012, 1,830. As the accountant for Wikki Cleaners, you have been asked to prepare financial statements for the year. A file called F1WORK has been provided to assist you in this assignment. As you review this file, it should be noted that columns H and I will automatically change when you enter values in columns E or G.arrow_forwardSpeedy Sewing Services, owned by T. Nguyen, hired a new bookkeeper who is not entirely familiar with the process of preparing a trial balance. All of the accounts have normal balances. Find the errors and prepare a corrected trial balance for December 31 of this year.arrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning