Concept explainers

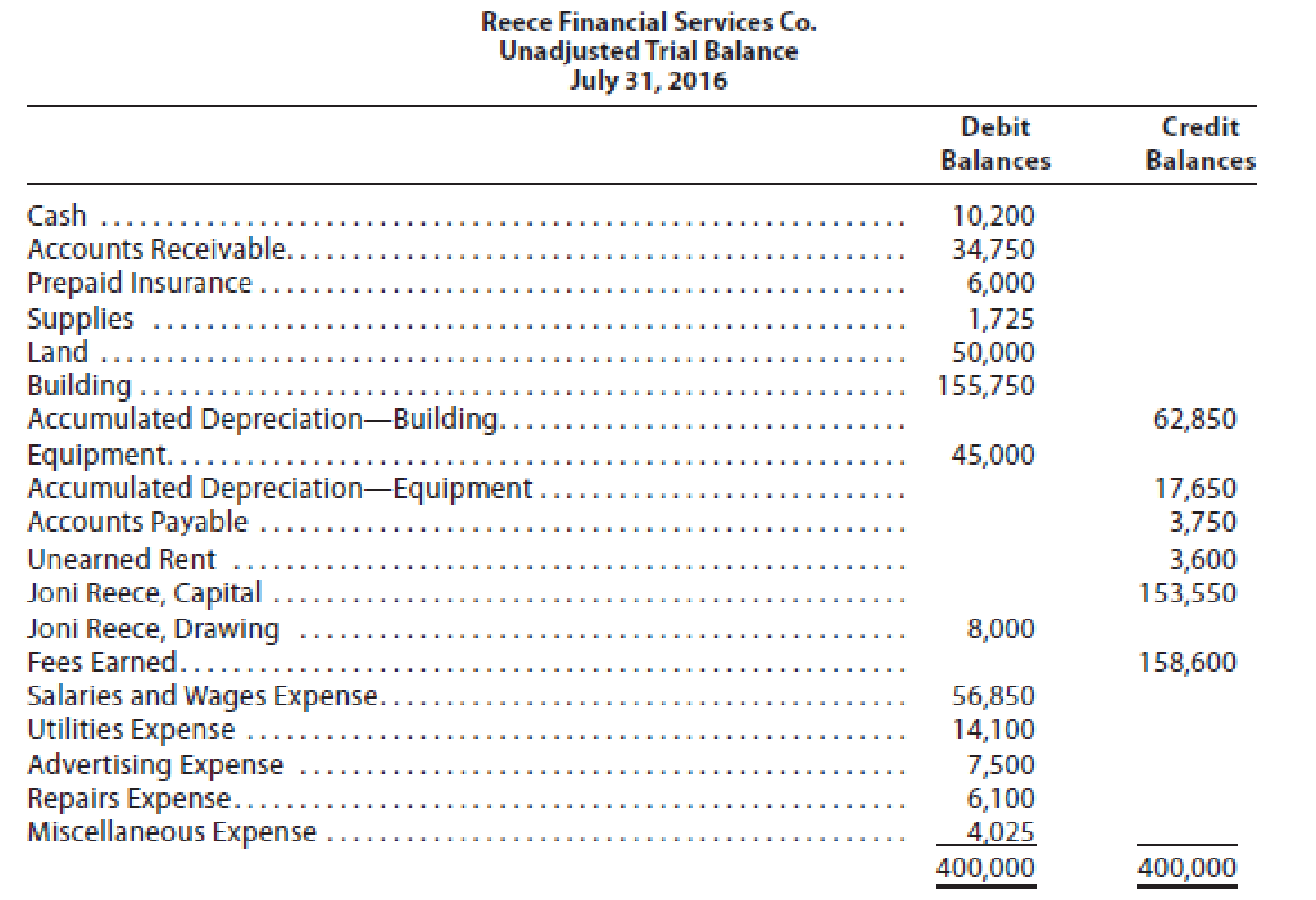

Reece Financial Services Co., which specializes in appliance repair services, is owned and operated by Joni Reece. Reece Financial Services Co.’s accounting clerk prepared the following unadjusted

The data needed to determine year-end adjustments are as follows:

- a.

Depreciation of building for the year, $6,400. - b. Depreciation of equipment for the year, $2,800.

- c. Accrued salaries and wages at July 31, $900.

- d. Unexpired insurance at July 31, $1,500.

- e. Fees earned but unbilled on July 31, $10,200.

- f. Supplies on hand at July 31, $615.

- g. Rent unearned at July 31, $300.

Instructions

- 1. Journalize the

adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depreciation Expense—Building; Depreciation Expense—Equipment; and Supplies Expense. - 2. Determine the balances of the accounts affected by the adjusting entries and preparean adjusted trial balance.

(1)

Record the adjusting entries on July 31, 2016 of Company RFS.

Explanation of Solution

Adjusting Entries

Adjusting entries indicates those entries, which are passed in the books of accounts at the end of one accounting period. These entries are passed in the books of accounts as per the revenue recognition principle and the expenses recognition principle to adjust the revenue, and the expenses of a business in the period of their occurrence.

Rule of Debit and Credit:

Debit - Increase in all assets, expenses & dividends, and decrease in all liabilities and stockholders’ equity.

Credit - Increase in all liabilities and stockholders’ equity, and decrease in all assets & expenses.

The adjusting entries of Company RFS are as follows:

Depreciation expense-Building

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| 2016 | Depreciation expense | 6,400 | |

| July, 31 | Accumulated Depreciation- building | 6,400 | |

| (To record the depreciation on building for the current year.) |

Table (1)

The impact on the accounting equation for the above referred adjusting entry is as follows:

- Depreciation expense is component of stockholders’ equity and decreased it, so debit depreciation expense by $6,400.

- Accumulated depreciation is a contra asset account, and it decreases the asset value by $6,400. So credit accumulated depreciation by $6,400.

Depreciation expense-Equipment

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| 2016 | Depreciation expense | 2,800 | |

| July, 31 | Accumulated Depreciation- equipment | 2,800 | |

| (To record the depreciation on equipment for the current year.) |

Table (2)

The impact on the accounting equation for the above referred adjusting entry is as follows:

- Depreciation expense is component of stockholders’ equity and decreased it, so debit depreciation expense by $2,800.

- Accumulated depreciation is a contra asset account, and it decreases the asset value by $2,800. So credit accumulated depreciation by $2,800.

Salary and wages expense:

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| 2016 | Salary and wages expense | 900 | |

| July, 31 | Wages Payable | 900 | |

| (To record the salary and wages accrued but not paid at the end of the accounting period.) |

Table (3)

The impact on the accounting equation for the above referred adjusting entry is as follows:

- Salary and wages expense is a component of Stockholders ‘equity, and it decreased it by $900. So debit wage expense by $900.

- Salary and wages payable is a liability, and it is increased by $900. So credit Salary and wages payable by $900.

Unexpired insurance:

| Date | Description |

Post. Ref |

Debit ($) |

Credit ($) |

| 2016 | Insurance expense (1) | 4,500 | ||

| July 31 | Prepaid insurance | 4,500 | ||

| (To record the insurance expense incurred at the end of the year) |

Table (4)

The impact on the accounting equation for the above referred adjusting entry is as follows:

Working note (1):

Calculate the value of insurance expense at the end of the year.

- Insurance expense is a component of owners’ equity, and decreased it by $4,500 hence debit the insurance expense for $4,500.

- Prepaid insurance is an asset, and it decreases the value of asset by $4,500, hence credit the prepaid insurance for $4,500.

Accrued fees unearned on July 31

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| 2016 | Accounts Receivable | 10,200 | |

| July 31 | Fees earned | 10,200 | |

| (To record the accounts receivable at the end of the year.) |

Table (5)

The impact on the accounting equation for the above referred adjusting entry is as follows:

- Accounts Receivable is an asset, and it is increased by $10,200. So debit Accounts receivable by $10,200.

- Fees earned are component of stockholders’ equity, and it increased it by $10,200. So credit fees earned by $10,200.

Supplies expenses on July 31

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| 2016 | Supplies Expense (2) | 1,110 | |

| July 31 | Supplies | 1,110 | |

| (To record the supplies expense at the end of the accounting period) |

Table (6)

The impact on the accounting equation for the above referred adjusting entry is as follows:

- Supplies expense is a component of stockholders’ equity, and it decreased the stockholders’ equity by $1,110. So debit supplies expense by $1,110.

- Supplies are an asset for the business, and it is decreased by $1,110. So credit supplies by $1,110.

Working Note (2):

Calculate Supplies expense for the accounting period.

Unearned Rent on July 31:

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| 2016 | Unearned Rent | 3,300 | |

| July 31 | Rent revenue (3) | 3,300 | |

| (To record the Rent revenue from services at the end of the accounting period.) |

Table (7)

The impact on the accounting equation for the above referred adjusting entry is as follows:

- Unearned Rent is a liability, and it is decreased by $3,300. So debit unearned rent by $3,300.

- Rent revenue is a component of Stockholders’ equity, and it is increased by $3,300. So credit rent revenue by $3,300.

Working Note (3):

Calculation of Rent Revenue for the accounting period

(2)

Prepare the adjusted trial balance of the Company RFS on July 31, 2016.

Explanation of Solution

Adjusted Trial Balance

Adjusted trial balance is a trial balance prepared at the end of a financial period, after all the adjusting entries are journalized and posted. It is prepared to prove the equality of the total debit and credit balances.

The adjusted trial balance of the Company RFS is as follows:

| Company RFS | ||

| Trial Balance after Adjustments | ||

| July 31, 2016 | ||

| Particulars | Debit $ | Credit $ |

| Cash | 10,200 | |

| Accounts Receivable(8) | 44,950 | |

| Prepaid Insurance | 1,500 | |

| Supplies | 615 | |

| Land | 50,000 | |

| Building | 155,750 | |

| Accumulated Depreciation - Building(4) | 69,250 | |

| Equipment | 45,000 | |

| Accumulated Depreciation - Equipment(5) | 20,450 | |

| Accounts Payable | 3,750 | |

| Unearned Rent | 300 | |

| Salaries and Wages Payable | 900 | |

| Capital | 153,550 | |

| Drawing | 8,000 | |

| Fees earned | 168,800 | |

| Rent Revenue (10) | 3,300 | |

| Salaries and Wages Expense (6) | 57,750 | |

| Utilities Expense | 14,100 | |

| Advertising Expense | 7,500 | |

| Repairs Expense | 6,100 | |

| Depreciation Expense - building | 6,400 | |

| Depreciation Expense - equipment | 2,800 | |

| Insurance Expense (7) | 4,500 | |

| Supplies Expense (9) | 1,110 | |

| Miscellaneous Expense | 4,025 | |

| 420,300 | 420,300 | |

Table (8)

Working Note (4):

Calculate accumulated depreciation- building.

Working Note (5):

Calculate of accumulated depreciation- equipment.

Working Note (6):

Calculate Salaries and Wages expenses.

Working Note (7):

Calculate the value of insurance expense at the end of the year.

Working Note (8):

Calculate accounts receivable

Working Note (9):

Calculate Supplies expense for the accounting period.

Working Note (10):

Calculate rent revenue

Hence, the total of debit and credit column of the adjusted trial balance matches and they have a total balance of $420,300.

Want to see more full solutions like this?

Chapter 3 Solutions

Financial Accounting

- Reece Financial Services Co., which specializes in appliance repair services, is owned and operated by Joni Reece. Reece Financial Services accounting clerk prepared the following unadjusted trial balance at July 31, 2019: The data needed to determine year-end adjustments are as follows: Depreciation of building for the year, 6,400. Depreciation of equipment for the year, 2,800. Accrued salaries and wages at July 31, 900. Unexpired insurance at July 31, 1,500. Fees earned but unbilled on July 31, 10,200. Supplies on hand at July 31, 615. Rent unearned at July 31, 300. Instructions 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable, Rent Revenue, Insurance Expense, Depreciation ExpenseBuilding, Depreciation ExpenseEquipment, and Supplies Expense. 2. Determine the balances of the accounts affected by the adjusting entries and prepare an adjusted trial balance.arrow_forwardThe unadjusted trial balance of La Mesa Laundry at August 31, 2016, the end of the fiscal year, follows: The data needed to determine year-end adjustments are as follows: a. Wages accrued but not paid at August 31 are 2,200. b. Depreciation of equipment during the year is 8,150. c. Laundry supplies on hand at August 31 are 2,000. d. Insurance premiums expired during the year are 5,300. Instructions 1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as Aug. 31 Bal. In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, Insurance Expense, and Income Summary. 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed. 3. Journalize and post the adjusting entries. Identify the adjustments by Adj. and the new balances as Adj. Bal. 4. Prepare an adjusted trial balance. 5. Prepare an income statement, a statement of owners equity (no additional investments were made during the year), and a balance sheet. 6. Journalize and post the closing entries. Identify the closing entries by Clos. 7. Prepare a post-closing trial balance.arrow_forwardGood Note Company specializes in the repair of music equipment and is owned and operated by Robin Stahl. On November 30, 2016, the end of the current year, the accountant for Good Note Company prepared the following trial balances: Instructions Journalize the seven entries that adjusted the accounts at November 30. None of the accounts were affected by more than one adjusting entry.arrow_forward

- At the end of April, the first month of operations, the following selected data were taken from the financial statements of Shelby Crawford, an attorney: In preparing the financial statements, adjustments for the following data were overlooked: Supplies used during April, 2,750. Unbilled fees earned at April 30, 23,700. Depreciation of equipment for April, 1,800. Accrued wages at April 30, 1,400. Instructions 1. Journalize the entries to record the omitted adjustments. 2. Determine the correct amount of net income for April and the total assets, liabilities, and owners equity at April 30. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the following. The adjustment for supplies used is presented as an example.arrow_forwardThe trial balance of Wikki Cleaners at December 31, 2012, the end of the current fiscal year, is as follows: Information for the adjusting entries is as follows: a. Cleaning supplies on hand on December 31, 2012, 18,750. b. Insurance premiums expired during the year, 1,800. c. Depreciation on equipment during the year, 21,600. d. Wages accrued but not paid at December 31, 2012, 1,830. Suppose you discover that an assistant in your department had misunderstood your instructions and had provided you with the wrong information on two of the adjusting entries. Cleaning supplies consumed during the year should have been 18,750, and insurance premiums unexpired at year-end were 1,800. Make the corrections on your worksheet and save the corrected file as F1WORK4. Reprint the worksheet.arrow_forwardThe account balances of Bryan Company as of June 30, the end of the current fiscal year, are as follows: Required 1. Data for the adjustments are as follows: a. Expired or used up insurance, 495 b. Depreciation expense on equipment, 670. c. Depreciation expense on the van, 1,190. d. Salary accrued (earned) since the last payday, 540 (owed and to be paid on the next payday). e. Supplies used during the period, 97. Your instructor may want you to use a work sheet for these adjustments. 2. Journalize the adjusting entries. 3. Prepare an income statement. 4. Prepare a statement of owners equity. Assume that there was an additional investment of 2,000 on June 10. 5. Prepare a balance sheet. 6. Journalize the closing entries using the four steps in the correct sequence. Check Figure Net Income, 13,627arrow_forward

- At the end of August, the first month of operations, the following selected data were taken from the financial statements of Tucker Jacobs, an attorney: In preparing the financial statements, adjustments for the following data were overlooked: Unbilled fees earned at August 31, 31,900. Depreciation of equipment for August, 7,500. Accrued wages at August 31, 5,200. Supplies used during August, 3,000. Instructions 1. Journalize the entries to record the omitted adjustments. 2. Determine the correct amount of net income for August and the total assets, liabilities, and owners equity at August 31. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the following. The first adjustment is presented as an example.arrow_forwardThe Signage Company specializes in the maintenance and repair of signs, such as billboards. On March 31, 2016, the accountant for The Signage Company prepared the following trial balances: Instructions Journalize the seven entries that adjusted the accounts at March 31. None of the accounts were affected by more than one adjusting entry.arrow_forwardThe following accounts appear in the ledger of Celso and Company as of June 30, the end of this fiscal year. The data needed for the adjustments on June 30 are as follows: ab.Merchandise inventory, June 30, 54,600. c.Insurance expired for the year, 475. d.Depreciation for the year, 4,380. e.Accrued wages on June 30, 1,492. f.Supplies on hand at the end of the year, 100. Required 1. Prepare a work sheet for the fiscal year ended June 30. Ignore this step if using CLGL. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. 7. Journalize the reversing entry as of July 1, for the wages that were accrued in the June adjusting entry. Check Figure Net income, 14,066arrow_forward

- The trial balance of Wikki Cleaners at December 31, 2012, the end of the current fiscal year, is as follows: Information for the adjusting entries is as follows: a. Cleaning supplies on hand on December 31, 2012, 18,750. b. Insurance premiums expired during the year, 1,800. c. Depreciation on equipment during the year, 21,600. d. Wages accrued but not paid at December 31, 2012, 1,830. As the accountant for Wikki Cleaners, you have been asked to prepare financial statements for the year. A file called F1WORK has been provided to assist you in this assignment. As you review this file, it should be noted that columns H and I will automatically change when you enter values in columns E or G.arrow_forwardThe balances of the ledger accounts of Pelango Furniture as of December 31, the end of its fiscal year, are as follows: Data for the adjustments are as follows: ab. Merchandise Inventory at December 31, 104,565. c. Wages accrued at December 31, 934. d. Supplies inventory (on hand) at December 31, 755. e. Depreciation of store equipment, 4,982. f. Depreciation of office equipment, 1,531. g. Insurance expired during the year, 935. h. Rent earned, 2,450. Required 1. Complete the work sheet after entering the account names and balances onto the work sheet. Ignore this step if using CLGL. 2. Journalize the adjusting entries. If using manual working papers, record adjusting entries on journal page 16.arrow_forwardGood Note Company specializes in the repair of music equipment and is owned and operated by Robin Stahl. On November 30, 2019, the end of the current year, the accountant for Good Note prepared the following trial balances: Instructions Journalize the seven entries that adjusted the accounts at November 30. None of the accounts were affected by more than one adjusting entry.arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning