Concept explainers

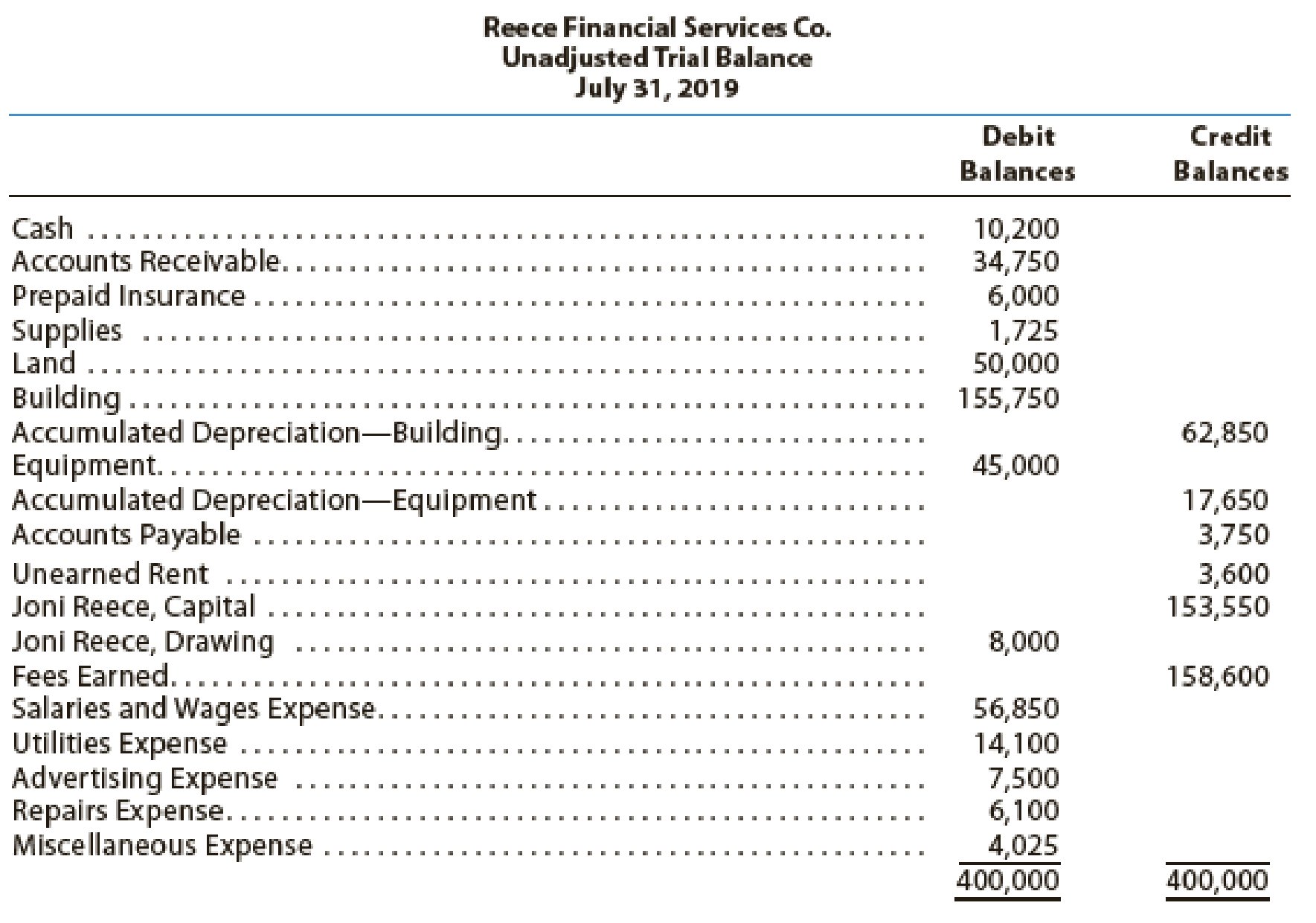

Reece Financial Services Co., which specializes in appliance repair services, is owned and operated by Joni Reece. Reece Financial Services’ accounting clerk prepared the following unadjusted

The data needed to determine year-end adjustments are as follows:

- •

Depreciation of building for the year, $6,400. - • Depreciation of equipment for the year, $2,800.

- • Accrued salaries and wages at July 31, $900.

- • Unexpired insurance at July 31, $1,500.

- • Fees earned but unbilled on July 31, $10,200.

- • Supplies on hand at July 31, $615.

- • Rent unearned at July 31, $300.

Instructions

- 1. Journalize the

adjusting entries using the following additional accounts: Salaries and Wages Payable, Rent Revenue, Insurance Expense, Depreciation Expense—Building, Depreciation Expense—Equipment, and Supplies Expense. - 2. Determine the balances of the accounts affected by the adjusting entries and prepare an adjusted trial balance.

(1)

Record the adjusting entries on July 31, 2019 of Company RFS.

Answer to Problem 5PB

The adjusting entry for recording depreciation is as follows:

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| July 31 | Depreciation expense | 6,400 | |

| Accumulated Depreciation- building | 6,400 | ||

| (To record the depreciation on building for the current year.) |

Table (1)

The impact on the accounting equation for the above referred adjusting entry is as follows:

Explanation of Solution

Description of journal entry

- Depreciation expense is component of stockholders’ equity and decreased it, so debit depreciation expense by $6,400.

- Accumulated depreciation is a contra asset account, and it decreases the asset value by $6,400. So credit accumulated depreciation by $6,400.

The adjusting entry for recording depreciation is as follows:

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| July 31 | Depreciation expense | 2,800 | |

| Accumulated Depreciation- equipment | 2,800 | ||

| (To record the depreciation on equipment for the current year.) |

Table (2)

The impact on the accounting equation for the above referred adjusting entry is as follows:

Description of journal entry

- Depreciation expense is component of stockholders’ equity and decreased it, so debit depreciation expense by $2,800.

- Accumulated depreciation is a contra asset account, and it decreases the asset value by $2,800. So credit accumulated depreciation by $2,800.

The following entry shows the adjusting entry for Salary and wages expense on July 31.

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| July 31 | Salary and wages expense | 900 | |

| Wages Payable | 900 | ||

| (To record the salary and wages accrued but not paid at the end of the accounting period.) |

Table (3)

The impact on the accounting equation for the above referred adjusting entry is as follows:

Description of journal entry

- Salary and wages expense is a component of Stockholders ‘equity, and it decreased it by $900. So debit wage expense by $900.

- Salary and wages payable is a liability, and it is increased by $900. So credit Salary and wages payable by $900.

The following entry shows the adjusting entry for unexpired insurance on July 31.

| Date | Description |

Post. Ref |

Debit ($) |

Credit ($) |

| July 31 | Insurance expense (1) | 4,500 | ||

| Prepaid insurance | 4,500 | |||

| (To record the insurance expense incurred at the end of the year) |

Table (4)

The impact on the accounting equation for the above referred adjusting entry is as follows:

Working note 1: Calculate the value of insurance expense at the end of the year

Description of journal entry

- Insurance expense is a component of owners’ equity, and decreased it by $4,500 hence debit the insurance expense for $4,500.

- Prepaid insurance is an asset, and it decreases the value of asset by $4,500, hence credit the prepaid insurance for $4,500.

The following entry shows the adjusting entry for accrued fees unearned on July 31.

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| July 31 | Accounts Receivable | 10,200 | |

| Fees earned | 10,200 | ||

| (To record the accounts receivable at the end of the year.) |

Table (1)

The impact on the accounting equation for the above referred adjusting entry is as follows:

Description of journal entry

- Accounts Receivable is an asset, and it is increased by $10,200. So debit Accounts receivable by $10,200.

- Fees earned are component of stockholders’ equity, and it increased it by $10,200. So credit fees earned by $10,200.

The following entry shows the adjusting entry for supplies on July 31.

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| July 31 | Supplies Expense (2) | 1,110 | |

| Supplies | 1,110 | ||

| (To record the supplies expense at the end of the accounting period) |

Table (2)

The impact on the accounting equation for the above referred adjusting entry is as follows:

Description of journal entry

- Supplies expense is a component of stockholders’ equity, and it decreased the stockholders’ equity by $1,110. So debit supplies expense by $1,110.

- Supplies are an asset for the business, and it is decreased by $1,110. So credit supplies by $1,110.

Working Note 2: Calculation of Supplies expense for the accounting period

The following entry shows the adjusting entry for Unearned Rent on July 31.

| Date | Account Titles and Explanation | Debit ($) | Credit ($) |

| July 31 | Unearned Rent | 3,300 | |

| Rent revenue (3) | 3,300 | ||

| (To record the Rent revenue from services at the end of the accounting period.) |

Table (4)

The impact on the accounting equation for the above referred adjusting entry is as follows:

- Unearned Rent is a liability, and it is decreased by $3,300. So debit unearned rent by $3,300.

- Rent revenue is a component of Stockholders’ equity, and it is increased by $3,300. So credit rent revenue by $3,300.

Working Notes 3: Calculation of Rent Revenue for the accounting period

(2)

Prepare adjusted trial balance of the Company RFS on July 31, 2019

Answer to Problem 5PB

The adjusted trial balance of the Company RFS is as follows:

| Company RFS | ||

| Trial Balance after Adjustments | ||

| July 31, 2019 | ||

| Particulars | Debit $ | Credit $ |

| Cash | 10,200 | |

| Accounts Receivable(5) | 44,950 | |

| Prepaid Insurance | 1,500 | |

| Supplies | 615 | |

| Land | 50,000 | |

| Building | 155,750 | |

| Accumulated Depreciation - Building(1) | 69,250 | |

| Equipment | 45,000 | |

| Accumulated Depreciation - Equipment(2) | 20,450 | |

| Accounts Payable | 3,750 | |

| Unearned Rent | 300 | |

| Salaries and Wages Payable | 900 | |

| Capital | 153,550 | |

| Drawing | 8,000 | |

| Fees earned | 168,800 | |

| Rent Revenue (7) | 3,300 | |

| Salaries and Wages Expense (3) | 57,750 | |

| Utilities Expense | 14,100 | |

| Advertising Expense | 7,500 | |

| Repairs Expense | 6,100 | |

| Depreciation Expense - building | 6,400 | |

| Depreciation Expense - equipment | 2,800 | |

| Insurance Expense (4) | 4,500 | |

| Supplies Expense (6) | 1,110 | |

| Miscellaneous Expense | 4,025 | |

| 420,300 | 420,300 | |

Explanation of Solution

Working Notes:

1. Calculation of accumulated depreciation- building

2. Calculation of accumulated depreciation- equipment

3. Calculation of Salaries and Wages expenses

4. Calculate the value of insurance expense at the end of the year

5. Calculation of accounts receivable

6. Calculation of Supplies expense for the accounting period

7. Calculation of rent revenue

Hence, the total of debit and credit column of the adjusted trial balance matches and they have a total balance of $420,300.

Want to see more full solutions like this?

Chapter 3 Solutions

Financial Accounting

- Reece Financial Services Co., which specializes in appliance repair services, is owned and operated by Joni Reece. Reece Financial Services Co.s accounting clerk prepared the following unadjusted trial balance at July 31, 2016: The data needed to determine year-end adjustments are as follows: a. Depreciation of building for the year, 6,400. b. Depreciation of equipment for the year, 2,800. c. Accrued salaries and wages at July 31, 900. d. Unexpired insurance at July 31, 1,500. e. Fees earned but unbilled on July 31, 10,200. f. Supplies on hand at July 31, 615. g. Rent unearned at July 31, 300. Instructions 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depreciation ExpenseBuilding; Depreciation ExpenseEquipment; and Supplies Expense. 2. Determine the balances of the accounts affected by the adjusting entries and preparean adjusted trial balance.arrow_forwardGood Note Company specializes in the repair of music equipment and is owned and operated by Robin Stahl. On November 30, 2019, the end of the current year, the accountant for Good Note prepared the following trial balances: Instructions Journalize the seven entries that adjusted the accounts at November 30. None of the accounts were affected by more than one adjusting entry.arrow_forwardThe unadjusted trial balance of Recessive Interiors at January 31, 2019, the end of the year, follows: The data needed to determine year-end adjustments are as follows: a. Supplies on hand at January 31 are 2,850. b. Insurance premiums expired during the year are 3,150. c. Depreciation of equipment during the year is 5,250. d. Depreciation of trucks during the year is 4,000. e. Wages accrued but not paid at January 31 are 900. Instructions 1. For each account listed in the unadjusted trial balance, enter the balance in the appropriate Balance column of a four-column account and place a check mark () in the Posting Reference column. 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (3) as needed. 3. Journalize and post the adjusting entries, inserting balances in the accounts affected. Record the adjusting entries on Page 26 of the journal. The following additional accounts from Recessive Interiors chart of accounts should be used: Wages Payable, 22; Depreciation ExpenseEquipment, 54; Supplies Expense, 55; Depreciation ExpenseTrucks, 56; Insurance Expense, 57. 4. Prepare an adjusted trial balance. 5. Prepare an income statement, a statement of owners equity (no additional investments were made during the year), and a balance sheet. 6. Journalize and post the closing entries. Record the closing entries on Page 27 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. 7. Prepare a post-closing trial balance.arrow_forward

- Worksheet Victoria Company has the following account balances on December 31, 2019, prior to any adjustments: Additional adjustment information: (a) depreciation on buildings, 1,100; on equipment, 600; (b) bad debts expense, 240; (c) interest accumulated but not paid: on note payable, 50; on mortgage payable, 530 (this interest is due during the next accounting period); (d) insurance expired, 175; (e) salaries accrued but not paid 370; (f) rent was collected in advance and the performance obligation is now satisfied, 800; (g) office supplies cm hand at year-end, 230 (expensed when originally purchased earlier in the year); and (h) the income tax rate is 30% on current income and is payable in the first quarter of 2020. Required: 1. Transfer the account balances to a 10-column worksheet and prepare a trial balance. 2. Prepare the adjusting entries in the general journal and complete the worksheet. 3. Prepare the companys income statement, retained earnings statement, and balance sheet. 4. Prepare closing entries in the general journal.arrow_forwardValley Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on July 31, 2019, follows: The following business transactions were completed by Valley Realty during August 2019: Aug. 1. Purchased office supplies on account, 3,150. 2.Paid rent on office for month, 7,200. 3.Received cash from clients on account, 83,900. 5.Paid insurance premiums, 12,000. 9.Returned a portion of the office supplies purchased on August 1, receiving full credit for their cost, 400. Analyzing Transactions Aug. 17. Paid advertising expense, 8,000. 23.Paid creditors on account, 13,750. Enter the following transactions on Page 19 of the two-column journal: 29.Paid miscellaneous expenses, 1,700. 30.Paid automobile expense (including rental charges for an automobile), 2,500. 31.Discovered an error in computing a commission during July; received cash from the salesperson for the overpayment, 2,000. 31.Paid salaries and commissions for the month, 53,000. 31.Recorded revenue earned and billed to clients during the month, 183,500. 31.Purchased land for a future building site for 75,000, paying 7,500 in cash and giving a note payable for the remainder. 31.Withdrew cash for personal use, 1,000. 31.Rented land purchased on August 31 to a local university for use as a parking lot during football season (September, October, and November); received advance payment of 5,000. Instructions 1. Record the August 1 balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark () in the Posting Reference column. 2. Journalize the transactions for August in a two-column journal beginning on Page 18. Journal entry explanations may be omitted. 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance of the ledger as of August 31, 2019. 5. Assume that the August 31 transaction for Cindy Getmans cash withdrawal should have been 10,000. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide?arrow_forwardWe-Sell Realty, organized August 1, 2019, is owned and operated by Omar Farah. How many errors can you find in the following statements for We-Sell Realty, prepared after its first month of operations?arrow_forward

- Prepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. supplies actual count at year end, $6,500 B. remaining unexpired insurance, $6,000 C. remaining unearned service revenue, $1,200 D. salaries owed to employees, $2,400 E. depreciation on property plant and equipment, $18,000arrow_forwardElite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on March 31, 2019, follows: The following business transactions were completed by Elite Realty during April 2019: Apr. 1. Paid rent on office for month, 6,500. 2.Purchased office supplies on account, 2,300. 5.Paid insurance premiums, 6,000. 10.Received cash from clients on account, 52,300. 15.Purchased land for a future building site for 200,000, paying 30,000 in cash and giving a note payable for the remainder. 17.Paid creditors on account, 6,450. 20.Returned a portion of the office supplies purchased on April 2, receiving full credit for their cost, 325. 23.Paid advertising expense, 4,300. Enter the following transactions on Page 19 of the two-column journal: 27.Discovered an error in computing a commission; received cash from the salesperson for the overpayment, 2,500. 28.Paid automobile expense (including rental charges for an automobile), 1,500. 29.Paid miscellaneous expenses, 1,400. 30.Recorded revenue earned and billed to clients during the month, 57,000. 30.Paid salaries and commissions for the month, 11,900. 30.Withdrew cash for personal use, 4,000. 30.Rented land purchased on April 15 to local merchants association for use as a parking lot in May and June, during a street rebuilding program; received advance payment of 10,000. Instructions 1. Record the April 1, 2019, balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark () in the Posting Reference column. 2. Journalize the transactions for April in a two-column journal beginning on Page 18. Journal entry explanations may be omitted. 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance of the ledger as of April 30, 2019. 5. Assume that the April 30 transaction for salaries and commissions should have been 19,100. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide?arrow_forwardThe account balances of Bryan Company as of June 30, the end of the current fiscal year, are as follows: Required 1. Data for the adjustments are as follows: a. Expired or used up insurance, 495 b. Depreciation expense on equipment, 670. c. Depreciation expense on the van, 1,190. d. Salary accrued (earned) since the last payday, 540 (owed and to be paid on the next payday). e. Supplies used during the period, 97. Your instructor may want you to use a work sheet for these adjustments. 2. Journalize the adjusting entries. 3. Prepare an income statement. 4. Prepare a statement of owners equity. Assume that there was an additional investment of 2,000 on June 10. 5. Prepare a balance sheet. 6. Journalize the closing entries using the four steps in the correct sequence. Check Figure Net Income, 13,627arrow_forward

- Soon after December 31, 2019, the auditor requested a depreciation schedule for trucks of Jarrett Trucking Company, showing the additions, retirements, depreciation, and other data affecting the income of the company in the 4-year period 2016 to 2019, inclusive. The following data were in the Trucks account as of January 1, 2016: The Accumulated DepreciationTrucks account, previously adjusted to January 1,2016, and duly entered in the ledger, had a balance on that date of 16,460. This amount represented the straight-line depreciation on the four trucks from the respective dates of purchase, based on a 5-year life and no residual value. No debits had been made to this account prior to January 1, 2016. Transactions between January 1,2017, and December 31, 2019, and their record in the ledger were as follows: 1. July 1, 2016: Truck no. 1 was sold for 1,000 cash. The entry was a debit to Cash and a credit to Trucks, 1,000. 2. January 1, 2017: Truck no. 3 was traded for a larger one (no. 5) with a 5-year life. The agreed purchase price was 12,000. Jarrett paid the other company 1,780 cash on the transaction. The entry was a debit to Trucks, 1,780, and a credit to Cash, 1,780. 3. July 1, 2018: Truck no. 4 was damaged in a wreck to such an extent that it was sold as junk for 50 cash. Jarrett received 950 from the insurance company. The entry made by the bookkeeper was a debit to Cash, 1,000, and credits to Miscellaneous Revenue, 50, and Trucks, 950, 4. July 1, 2018: A new truck (no. 6) was acquired for 20,000 cash and debited at that amount to the Trucks account. The truck has a 5-year life. Entries for depreciation had been made at the close of each year as follows: 2016, 8,840; 2017, 5,436; 2018, 4,896; 2019, 4,356. Required: 1. Next Level For each of the 4 years, calculate separately the increase or decrease in earnings arising from the companys errors in determining or entering depreciation or in recording transactions affecting trucks. 2. Prove your work by one compound journal entry as of December 31, 2019; the adjustment of the Trucks account is to reflect the correct balances, assuming that the books have not been closed for 2019.arrow_forwardThe unadjusted trial balance of La Mesa Laundry at August 31, 2016, the end of the fiscal year, follows: The data needed to determine year-end adjustments are as follows: a. Wages accrued but not paid at August 31 are 2,200. b. Depreciation of equipment during the year is 8,150. c. Laundry supplies on hand at August 31 are 2,000. d. Insurance premiums expired during the year are 5,300. Instructions 1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as Aug. 31 Bal. In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, Insurance Expense, and Income Summary. 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed. 3. Journalize and post the adjusting entries. Identify the adjustments by Adj. and the new balances as Adj. Bal. 4. Prepare an adjusted trial balance. 5. Prepare an income statement, a statement of owners equity (no additional investments were made during the year), and a balance sheet. 6. Journalize and post the closing entries. Identify the closing entries by Clos. 7. Prepare a post-closing trial balance.arrow_forwardAt the end of 2019, Framber Company received 8,000 as a prepayment for renting a building to a tenant during 2020. The company erroneously recorded the transaction by debiting Cash and crediting Rent Revenue in 2019 instead of 2020. Upon discovery of this error in 2020, what correcting journal entry will Framber make? Ignore income taxes.arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College