Extensions of the CVP Analysis—Taxes

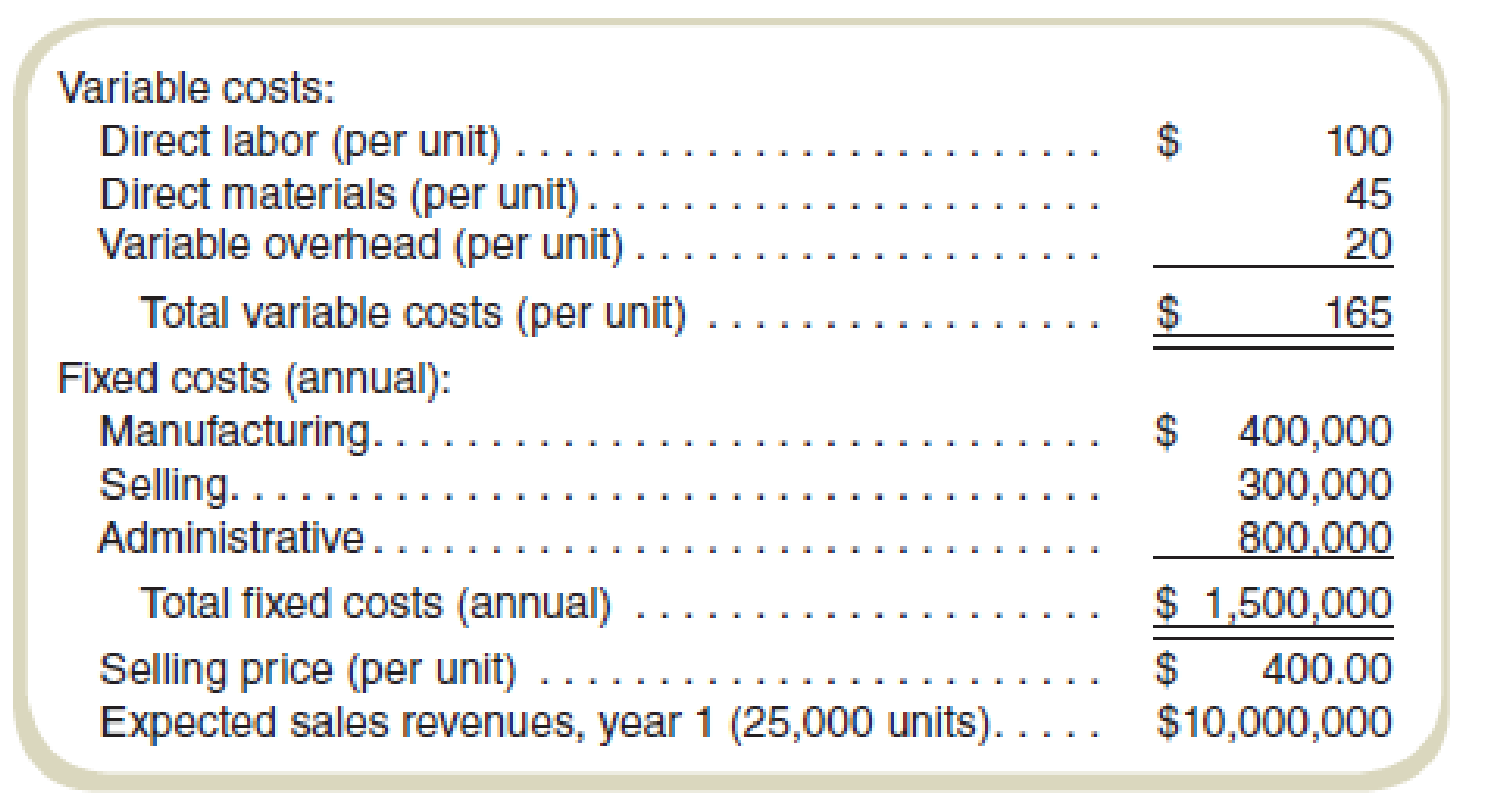

Eagle Company makes the MusicFinder, a sophisticated satellite radio. Eagle has experienced a steady growth in sales for the past five years. However, Ms. Luray, Eagle’s CEO, believes that to maintain the company’s present growth will require an aggressive advertising campaign next year. To prepare for the campaign, the company’s accountant, Mr. Bednarik, has prepared and presented to Ms. Luray the following data for the current year, year 1:

Eagle has an income tax rate of 35 percent.

Ms. Luray has set the sales target for year 2 at a level of $11,200,000 (or 28,000 radios).

Required

- a. What is the projected after-tax operating profit for year 1?

- b. What is the break-even point in units for year 1?

- c. Ms. Luray believes that to attain the sales target (28,000 radios) will require additional selling expenses of $300,000 for advertising in year 2, with all other costs remaining constant. What will be the after-tax operating profit for year 2 if the firm spends the additional $300,000?

- d. What will be the break-even point in sales dollars for year 2 if the firm spends the additional $300,000 for advertising?

- e. If the firm spends the additional $300,000 for advertising in year 2, what is the sales level in dollars required to equal the year 1 after-tax operating profit?

- f. At a sales level of 28,000 units, what is the maximum amount the firm can spend on advertising to earn an after-tax operating profit of $750,000?

a.

Calculate the projected after-tax operating profit for year 1.

Answer to Problem 62P

The projected after-tax operating profit for year 1 is $2,843,750.

Explanation of Solution

Target volume: the level of sales which need to be achieved during a particular period of time is termed as target volume.

Target profit: the amount of profit which needs to be achieved during a particular period of time on a particular level of sales is termed as target profit.

Total fixed costs and variable costs:

| Particulars | Amount |

| Variable cost (per unit): | |

| Direct labor | $100 |

| Direct material | $45 |

| Variable overhead | $20 |

| Total variable cost: | $165 |

| Fixed cost: | |

| Manufacturing | $400,000 |

| Selling | $300,000 |

| Administration | $800,000 |

| Total fixed costs (annual) | $1,500,000 |

| Selling price | $400 |

| Expected sales revenue, year 1 (25,000 units) | $10,000,000 |

Table: (1)

Compute the projected after-tax operating profit for year 1:

Compute the after-tax profit, when the tax rate is 35%:

Thus, the projected after-tax operating profit for year 1 is $2,843,750

Working note 1:

Compute the profit:

b.

Calculate the break-even point in units for year 1.

Answer to Problem 62P

The break-even point in units for year 1 is $6,383.

Explanation of Solution

Breakeven point (BEP): The breakeven point or BEP is that level of output at which the total revenue is equal to the total cost. The BEP means there are no operating income and no operating losses. The management keeps an eye on the breakeven point in order to avoid the operating losses in order to avoid losses.

Compute the break-even point in units for year 1:

Thus, the break-even point for the drones is 6,383 units.

Working note 2:

Compute the contribution margin:

c.

Calculate after-tax operating profit for year 2 if the firm spends the additional $300,000.

Answer to Problem 62P

After tax operating profit for year 2 will be $3,107,000,

Explanation of Solution

Target volume: the level of sales which need to be achieved during a particular period of time is termed as target volume.

Target profit: the amount of profit which needs to be achieved during a particular period of time on a particular level of sales is termed as target profit.

Compute the projected after-tax operating profit for year 1:

Compute the after-tax profit:

Thus, the projected after-tax operating profit for year 1 is $3,107,000.

Working note 3:

Compute the profit:

Working note 4:

Compute the revised fixed cost:

d.

Calculate the break-even point if the firm spends the additional $300,000 for advertising.

Answer to Problem 62P

If a firm spends the additional $300,000 for advertising, the break-even point will be $3,063,000.

Explanation of Solution

Breakeven point (BEP): The breakeven point or BEP is that level of output at which the total revenue is equal to the total cost. The BEP means there are no operating income and no operating losses. The management keeps an eye on the breakeven point in order to avoid the operating losses in order to avoid losses.

Compute the break-even point in sales dollar for year 1:

Thus, if a firm spends the additional $300,000 for advertising, the break-even point will be $3,063,000.

Working note 5:

Compute the break-even point in units for year 1:

Thus, the break-even point for the drones is 7,659 units.

e.

Calculate the dollar sales to maintain the year 1 after-tax operating profit if the firm spends the additional $300,000 for advertising.

Answer to Problem 62P

The dollar sales to maintain the year 1 after-tax operating profit if the firm spends the additional $300,000 for advertising is $10,510,638.

Explanation of Solution

Breakeven point (BEP): The breakeven point or BEP is that level of output at which the total revenue is equal to the total cost. The BEP means there are no operating income and no operating losses. The management keeps an eye on the breakeven point in order to avoid the operating losses in order to avoid losses.

Dollars sales to maintain the year 1 level of profit:

Working note 6:

Compute the dollar sales to maintain the year 1 after-tax operating profit if the firm spends the additional $300,000 for advertising:

f.

Calculate the maximum amount the firm can spend on advertising to earn the after-tax operating profit of $750,000 at a sales level of 28,000 units.

Answer to Problem 62P

The maximum amount the firm can spend on advertising to earn the after-tax operating profit of $750,000 at a sales level of 28,000 units is $4,226,154.

Explanation of Solution

Compute the the maximum amount the firm can spend on advertising to earn the after-tax operating profit of $750,000 at a sales level of 28,000 units is $4,226,154:

Thus, the maximum amount the firm can spend on advertising to earn the after-tax operating profit of $750,000 at a sales level of 28,000 units is $4,226,154.

Working note 7:

Compute the operating profit before tax:

Working note 8:

Compute the contribution margin in dollar sales:

Working note 9:

Compute the total fixed cost:

Working note 10:

Compute the maximum amount the firm can spend on advertising:

Total fixed cost other than advertising:

| Particulars | Amount |

| Fixed cost: | |

| Manufacturing | $400,000 |

| Administration | $800,000 |

| Total fixed costs (annual) | $1,200,000 |

Table: (7)

Want to see more full solutions like this?

Chapter 3 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- D'LEON INC., PART Il FINANCIAL STATEMENTS AND TAXES Part I of this case, presented in Chapter 3, discussed the situation of D'Leon Inc., a regional snack foods producer, after an expansion program. D'Leon had increased plant capacity and undertaken a major marketing campaign in an attempt to "go national." Thus far, sales have not been up to the forecasted level, costs have been higher than were projected, and a large loss occurred in 2018 rather than the expected profit. As a result, its managers, directors, and investors are concerned about the firm's survival Donna Jamison was brought in as assistant to Fred Campo, D'Leon's chairman, who had the task of getting the company back into a sound financial position. D'Leon's 2017 and 2018 balance sheets and income statements, together with projections for 2019, are given in Tables IC 4.1 and IC 4.2. In addition, Table IC 4.3 gives the company's 2017 and 2018 financial ratios, together with industry average data. The 2019 projected…arrow_forwardReed plc is considering how to improve its debtor collection policy. The following information is available. Current Credit Sales: £912,000 Average debtor collection period (days): 94 days Wishing to introduce a new policy of payment within (days): 60 days Anticipated reduction in sales per year: £40,000 Increased collection costs per yer: £2,000 Short-term cost of borrowing (%): 30% Sales contribution to profit: 20% Required What will be the net benefit if Reed successfully enforces the new policy? When a corporation raises finance, there are two options: long-term debt finance (bank loan or corporate bonds) and equity finance (ordinary shares). The two approaches have fundamental consequences to the corporation. What are the main differences between the two approaches?arrow_forwardConsider each part below independently. Ignore income taxes. 1. The Walton Daily News is investigating the purchase of a new auxiliary press that has a projected life of 18 years. It is estimated that the new press will save $30,000 per year in cash operating costs. If the new press costs $217,500, what is its internal rate of return? Is the press an acceptable investment if the company’s required rate of return is 16%? Explain.arrow_forward

- A market research firm with current sales of $750 does not expect any growth in sales for the next two years. The company, however, anticipates that expenses, currently at $160, will increase to $240 next year and to $270 the year after. Assuming a tax rate of 34%, determine the firm’s cash flow in year two. Assume straight line depreciation of $50 each year. Select one: a. ($333.80) b. $389.40 c. ($389.40) d. $333.80 e. $366.00 Clear my choicearrow_forwardAllegience Insurance Company’s management is considering an advertising program that would require an initial expenditure of $177,085 and bring in additional sales over the next five years. The projected additional sales revenue in year 1 is $82,000, with associated expenses of $28,500. The additional sales revenue and expenses from the advertising program are projected to increase by 10 percent each year. Allegience’s tax rate is 30 percent. (Hint: The $177,085 advertising cost is an expense.)Required:1. Compute the payback period for the advertising program.2. Calculate the advertising program’s net present value, assuming an after-tax hurdle rate of 10 percent. (Round your intermediate calculations and final answer to the nearest whole dollar.)arrow_forwardPavlovich Instruments, Inc., a maker of precision telescopes, expects to report pretax income of $436,000 this year. The company's financial manager is considering the timing of a purchase of new computerized lens grinders. The grinders will have an installed cost of $76,000 and a cost recovery period of 5 years. They will be depreciated using the MACRS schedule and Corporate tax rates are given. (attached) a. If the firm purchases the grinders before year-end, what depreciation expense will it be able to claim this year? b. If the firm reduces its reported income by the amount of the depreciation expense calculated in part a, what tax savings will result?arrow_forward

- Global Corp. expects sales to grow by 7% next year. Using the percent of sales method and the data provided in the given tables LOADING... , forecast: a. Costs except depreciation b. Depreciation c. Net income d. Cash e. Accounts receivable f. Inventory g. Property, plant, and equipment h. Accounts payable (Note: Interest expense will not change with a change in sales. Tax rate is 26%.) The Tax Cuts and Jobs Act of 2017 temporarily allows 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter and in these problems in anticipation of the return of standard depreciation practices during your career. Income Statement Net Sales 185.3Costs Except Depreciation -175.4EBITDA 9.9Depreciation and Amortization -1.2EBIT 8.7Interest Income (expense) -7.7Pretax Income 1Taxes (26%) -0.3Net Income 0.7 Balance Sheet Assets Cash 23.4Accounts…arrow_forwardA market research firm with current sales of $750 does not expect any growth in sales for the next two years. The company, however, anticipates that expenses, currently at $160, will increase to $240 next year and to $270 the year after. Assuming a tax rate of 34%, determine the firm’s cash flow in year two. Assume straight line depreciation of $50 each year. Select one: a. ($333.80) b. $389.40 c. ($389.40) d. $333.80 e. $366.00arrow_forwardThe finance staff at Millcreek Company have constructed a forecast of the company’s net income.The chief executive officer (CEO) of Millcreek wonders why the forecast of next year’s interestexpense is the same as this year’s interest expense, whereas next year’s sales are expected toincrease by 20% over this year’s sales. What is the most likely explanation?a) Millcreek is expected to be more aggressive at minimizing its income tax expense next yearb) Millcreek expects its operating expenses to increase by 20% next year, the same as the expectedincrease in salesc) Millcreek is not expected to obtain any new loans next year, not repay any old loansd) Millcreek expects its operating expenses to increase by more than 20% increase in salesexpected next yeararrow_forward

- The president of United Semiconductor Corporation made this statement in thecompany’s annual report:“United’s primary goal is to increase the value of thecommon stockholders’equity over time.”Later in the report, the following announcements were made: a.The company contributed $1.5 million to the symphony orchestra in SanFrancisco, its headquarters city. b.United is spending $500 million to open a new plant in Mexico. No revenueswill be produced by the plant for four years, so earnings will be depressedduring this period versus what they would have been had the company notopened the new plant. c.The company is increasing its relative use of debt. Assets were formerlyfinanced with 35 percent debt and 65 percent equity; henceforth, the financ-ing mix will be 50–50. d.The company uses a great deal of electricity in its manufacturing operations,and it generates most of this power itself. United plans to utilize nuclear fuelrather than coal to produce electricity in the future. e.The…arrow_forwardTo estimate Missed Places Inc.'s (MP) external financing needs, the CFO needs to figure out how much equity her firm will have at the end of next year. At the end of the most recent fiscal year, MP's retained earnings were $158,000. The Controller has estimated that over the next year, gross profits will be $360,700, earnings after tax will total $21,400, and MP will pay $12,400 in dividends. What are the estimated retained earnings at the end of next year? (Please show work and explain) Intellus has long-term debt of $5 million, owners' equity of $7.75 million, current assets of $1 million, gross fixed assets of $20 million, and accumulated depreciation of $7 million. What is the firm’s net working capital? (Please show work and explain)arrow_forwardA software company that installs systems for inventory control using RFID technology spent $600,000 per year for the past 3 years in developing their latest product. The company wants to recover its investment in 5 years beginning now. If the company signed a contract that will pay $250,000 now and amounts increasing by a uniform amount each year through year 5, how much must the increase be each year? Use an interest rate of 15% per year.arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning