The new owner thinks that inventories are excessive and can be lowered to the point where the current ratio is equal to the industry average, 25×, without affecting sales or net income. If inventories are sold and not replaced (thus reducing the current ratio to 25×); if the funds generated are used to reduce common equity (stock can be repurchased at book value); and if no other changes occur, by how much will the ROE change? What will be the firm’s new quick ratio?

To identify: The change in return on equity and new quick ratio.

Quick Ratio: A part of liquidity ratios, quick ratio reflects the ability to oblige the short term debts of a company. It is calculated based on the liquid assets and current liabilities; a company has in an accounting period.

Return on Equity: Return on equity represents the amount earned as return by equity share holders; it can be calculated by dividing earnings available for equity share holders to total equity capital.

Explanation of Solution

Computation of return on equity

Items required for the calculation of return on equity are net income and common equity.

Given,

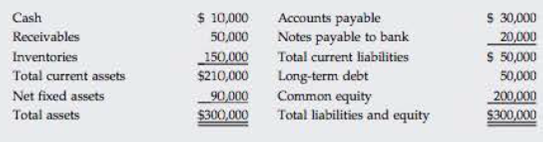

Net income is $15,000.

Common equity is $200,000.

Formula to calculate return on equity ratio,

Where,

- ROE is return on equity.

Substitute $15,000 for net income and $200,000 for common equity in the above formula,

Hence, the return on equity is 0.075 or 7.5%.

Compute the quick ratio

Given,

The current assets are $210,000.

The inventories are $150,000.

The current liabilities are $50,000.

Formula to compute quick ratio,

Substitute $210,000 for current assets, $150,000 for inventories and $50,000 for current liabilities in the above formula,

The quick ratio is 1.2 times.

In order to compute new quick ratio, old current ratio, new current assets and new return on equity need to calculate.

Computation of old current ratio

The items required for the calculation of current ratio are current liabilities and current assets.

Given,

Current assets are $210,000.

Current liabilities are $50,000.

Formula to calculate current ratio,

Substitute $210,000 for current assets and $50,000 for current liabilities in the above formula,

Hence, old current ratio is 4.2 times.

The new current ratio which is required to take is 2.5 times.

Compute the change in assets due to the current ratio as 2.5 times.

The current liabilities are $50,000. (Given)

The current ratio is 2.5 times.

Formula to calculate new current assets derives from the formula of current ratio,

Substitute $50,000 for current liabilities and 2.5 for current ratio in the above formula,

The new current assets are $125,000.

The difference between the currents assets refers the value of sold inventory.

Compute the sold inventory due to change in current assets

The current assets are $210,000. (Given)

The new current assets are $125,000. (Calculated)

Formula to calculate the sold inventory,

Substitute $210,000 for old current assets and $125,000 for new current assets in the above formula,

The value of inventor is curtailed by the $85,000.

Compute the balance inventory

The total inventory is $150,000. (Given)

The sold inventory is $85,000. (Calculated)

Formula to calculate the balance inventory,

Substitute $150,000 for inventory and $85,000 for sold inventory in the above formula,

The balanced inventory is $65,000.

Due to the sale the cash balance would also decrease by 65,000.

Computation of cash balance after the sale of inventory

Cash balance is $10,000.

The sale of inventory is $65,000.

Formula to calculate the new cash balance,

Substitute $10,000 for old balance and $65,000 for sold inventory in the above formula,

The cash balance after the sale of inventory is $55,000.

From the cash balance after sale of inventory, equity can be bought back. So the level of cash balance will reduce and equity will reduce by $65,000.

Compute the reduced equity:

The equity balance is $200,000. (Given)

The buyback equity share is $65,000. (Calculated)

Formula to calculate the reduced capital,

Substitute $200,000 for total equity shares and $65,000 for buyback shares in the above formula,

The reduced equity shares are $135,000.

Compute the new return on equity

The net income is $15,000. (Given)

The equity value is $135,000. (Calculated)

Formula to calculate the return on equity,

Where,

- ROE is return on equity.

Substitute $15,000 for net income and $135,000 for common equity in the above formula,

Hence, the return on equity is 0.1111 or 11.11%.

Compute the new quick ratio

The new current assets are $125,000.

The new inventories are $65,000.

The current liabilities are $50,000.

Formula to calculate quick ratio,

Substitute $125,000 for current assets, $65,000 for inventories and $50,000 for current liabilities in the above formula,

The new quick ratio is 1.2 times.

Quick ratio has remained same as there is no other current asset has changed except inventory and inventory is not the part of the terms used for the calculation of quick ratio.

Hence, the change in return on equity is 11.11% and there is no change in quick ratio and it is 1.2 times.

Want to see more full solutions like this?

Chapter 4 Solutions

Fundamentals of Financial Management, Concise Edition (MindTap Course List)

- Payne Products had $1.6 million in sales revenues in the most recent year and expects sales growth to be 25% this year. Payne would like to determine the effect of various current assets policies on its financial performance. Payne has $1 million of fixed assets and intends to keep its debt ratio at its historical level of 60%. Payne’s debt interest rate is currently 8%. You are to evaluate three different current asset policies: (1) a restricted policy in which current assets are 45% of projected sales, (2) a moderate policy with 50% of sales tied up in current assets, and (3) a relaxed policy requiring current assets of 60% of sales. Earnings before interest and taxes are expected to be 12% of sales. Payne’s tax rate is 40%. What is the expected return on equity under each current asset level? In this problem, we have assumed that the level of expected sales is independent of current asset policy. Is this a valid assumption? Why or why not? How would the overall risk of the firm vary under each policy?arrow_forwardValue of Equity after Recapitalization Nichols Corporations value of operations is equal to 500 million after a recapitalization (the firm had no debt before the recap). It raised 200 million in new debt and used this to buy back stock. Nichols had no short-term investments before or after the recap. After the recap, Wd = 40%. What is S (the value of equity after the recap)?arrow_forwardMicolash Industries plans to reduce the use of debt financing and increase the use of equity financing (for example, move from a 70% Debt-to-Capital Ratio to 50%). Assume that the company, which does not pay any dividends, takes this action, and that total assets, operating income (EBIT), and its tax rate (say 40%) all remain constant. Which of the following would occur? Group of answer choices The company’s interest expense would remain constant. The company would have less common equity than before. The company’s taxable income (EBT) would fall. The company would have to pay more taxes. The company’s net income would decrease.arrow_forward

- Rowe and Company has a debt ratio of 0.50, a total assets turnover of 0.25, and a profit margin of 10 percent. The president is unhappy with the current return on equity, and he thinks it could be doubled. This could be accomplished (1) by increasing the profit margin to 14 percent and (2) by increasing debt utilization. Total assets turnover will not change. What new debt ratio, along with the 14 percent profit margin, is required to double the return on equity?arrow_forwardConsider a retail firm with a net profit margin of 3.94%, a total asset turnover of 1.84, total assets of $44.9 million, and a book value of equity of $18.3 million. a. What is the firm's current ROE? b. If the firm increased its net profit margin to 4.83%, what would be its ROE? c. If, in addition, the firm increased its revenues by 23% (maintaining this higher profit margin and without changing its assets or liabilities), what would be its ROE? **round to one decimal place**arrow_forwardBob's Inc has the following balance sheet and income statement data see image... The new CFO thinks that inventory are excessive and could be lowered to cause the current ratio to equal industry average 3.00 w/o affecting either sales or net income. assuming that inventories are sold off and not replaced to get the current ratio to the target level and that the funds generated are used to buy back common stock at book value, by how much would the ROE change?arrow_forward

- The Diamond Corporation has the following ratios: A0*/S0 = 1.6; L0*/S0 = 0.4; Profit Margin = 0.10; and Dividend Payout Ratio = 0.45, or 45%. Sales last year were $100 million, suppose Diamond’s financial consultants report (1) that the Inventory Turnover Ratio (sales/inventory) is 3, compared with an Industry Average of 4, and (2) that Diamond could reduce inventories and thus raise its Turnover Ratio to 4 without affecting its Sales, Profit Margin, or other Asset Turnover Ratios. A. Under these conditions, use the AFN equation to determine the amount of additional funds Diamond would require during the 1st year if sales grow at a rate of 20% per year. B. Under these conditions, use the AFN equation to determine the amount of additional funds Diamond would require during the 2nd year if sales grow at a rate of 20% per year.arrow_forwardCurrent and Quick Ratios The Nelson Company has $1,248,000 in current assets and $480,000 in current liabilities. Its initial inventory level is $330,000, and it will raise funds as additional notes payable and use them to increase inventory. How much can Nelson's short-term debt (notes payable) increase without pushing its current ratio below 2.2? Do not round intermediate calculations. Round your answer to the nearest dollar. $ What will be the firm's quick ratio after Nelson has raised the maximum amount of short-term funds? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forward(Financing decisions) Brussels Electronics, Inc, has total assets of $64 million and total debt of $45 million. The company also has operating profits of $23 millions with interest expenses of $7 million. a. What is Brussels Electronic's debt ratio? b. What is Brussels Electronic's time interest earned? c. Based on the information above, would you recommend to Brussels Electron-ics's management that the firm is in a strong enough position to assume more debt and increase interest expense to $9 million?arrow_forward

- The Barnsdale Corporation has the following ratios: A0*/S0 = 1.6; L0*/S0 = 0.4; profit margin = 0.10; and dividend payout ratio = 0.45, or 45%. Sales last year were $100 million. suppose Barnsdale’s financial consultants report (1) that the inventory turnover ratio (sales/inventory) is 3, compared with an industry average of 4, and (2) that Barnsdale could reduce inventories and thus raise its turnover ratio to 4 without affecting its sales, profit margin, or other asset turnover ratios. Requirement: a. Under these conditions, use the AFN equation to determine the amount of additional funds Barnsdale would require during the 1st year if sales grow at a rate of 20% per year. Sample format: 1,111,111 b. Under these conditions, use the AFN equation to determine the amount of additional funds Barnsdale would require during the 2nd year if sales grow at a rate of 20% per year. Sample format: 1,111,111arrow_forwardPayne Products had $1.6 million in sales revenues in the most recent year and expects sales growth to be 25% this year. Payne would like to determine the effect of various current assets policies on its financial performance. Payne has $1 million of fixed assets and intends to keep its debt ratio at its historical level of 40%. Payne’s debt interest rate is currently 8%. You are to evaluate three different current asset policies: (1) a restricted policy in which current assets are 45% of projected sales, (2) a moderate policy with 50% of sales tied up in current assets, and (3) a relaxed policy requiring current assets of 60% of sales. Earnings before interest and taxes are expected to be 12% of sales. Payne’s tax rate is 25%. What is the expected return on equity under each current asset level? In this problem, we have assumed that the level of expected sales is independent of current asset policy. Is this a valid assumption? Why or why not? How would the overall risk of…arrow_forward(Liquidity analysis) Airspot Motors, Inc. has $2,172,500 in current assets and $869,000 in current liabilities. The company's managers want to increase the firm's inventory, which will be financed using short-term debt. How much can the firm increase its inventory without its current ratio falling below 2.1 (assuming all other current assets and current liabilities remain constant)?arrow_forward

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning