Fundamentals of Financial Management (MindTap Course List)

14th Edition

ISBN: 9781285867977

Author: Eugene F. Brigham, Joel F. Houston

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 15P

The new owner thinks that inventories are excessive and can be lowered to the point where the current ratio is equal to the industry average, 25×, without affecting sales or net income. If inventories are sold and not replaced (thus reducing the current ratio to 25×); if the funds generated are used to reduce common equity (stock can be repurchased at book value); and if no other changes occur, by how much will the ROE change? What will be the firm’s new quick ratio?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

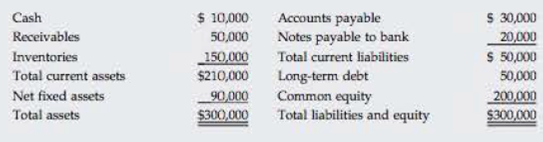

RETURN ON EQUITY AND QUICK RATIO Lloyd Inc. has sales of $200,000, a net income of $15,000, and the following balance sheet:

REFER IMAGE

The new owner thinks that inventories are excessive and can be lowered to the point where the current ratio is equal to the industry average, 25×, without affecting sales or net income. If inventories are sold and not replaced (thus reducing the current ratio to 25×); if the funds generated are used to reduce common equity (stock can be repurchased at bookvalue); and if no other changes occur, by how much will the ROE change? What will be the firm’s new quick ratio?

Calculate Zumwalt’s net profit margin and debt ratio. Earth’s Best Company has sales of $200,000, a net income of $15,000, and the following balance sheet:

. The company’s new owner thinks that inventories are excessive and can be lowered to the point where the current ratio is equal to the industry average, 2.5, without affecting either sales or net income. If inventories are sold off and not replaced so as to reduce the current ratio to 2.5, if the funds generated are used to reduce common equity (stock can be repurchased at book value), and if no other changes occur, by how much will the ROE change? b. Now suppose we wanted to take this problem and modify it for use on an exam—that is, to create a new problem that you have not seen to test yourknowledge of this type of problem. How would your answer change if we made the following changes: (1) We doubled all of the dollar amounts? (2) We stated that the target current ratio was 3.0? (3) We said that the company had 10,000 shares of…

JunJun & Co. has debt ratio of 0.50, a total asset turnover of 0.25 and a profit margin of 10%. The president is unhappy with the current return on equity, and he thinks it could be doubled. This could be accomplished (1) by increasing the profit margin to 14% and (2) by increasing debt utilization. Total assets turnover will not change. What new debt ratio, along with the 14% profit margin, is required to double the return on equity? (SHOW SOLUTION)

a. 0.75

b. 0.70

c. 0.65

d. 0.55

Chapter 4 Solutions

Fundamentals of Financial Management (MindTap Course List)

Ch. 4 - Financial ratio analysis is conducted by three...Ch. 4 - Prob. 2QCh. 4 - Over the past year, M.D. Ryngaert Co. had an...Ch. 4 - Profit margins and turnover ratios vary from one...Ch. 4 - How does inflation distort ratio analysis...Ch. 4 - Prob. 6QCh. 4 - Give some examples that illustrate how (a)...Ch. 4 - Why is it sometimes misleading to compare a...Ch. 4 - Suppose you were comparing a discount merchandiser...Ch. 4 - Prob. 10Q

Ch. 4 - Differentiate between ROE and ROIC.Ch. 4 - Prob. 12QCh. 4 - DAYS SALES OUTSTANDING Baker Brothers has a DSO of...Ch. 4 - DEBT TO CAPITAL RATIO Bartley Barstools has a...Ch. 4 - DuPONT ANALYSIS Doublewide Dealers has an ROA of...Ch. 4 - MARKET/BOOK RATIO Jaster Jets has 10 billion in...Ch. 4 - PRICE/EARNINGS RATIO A company has an EPS of 2.00,...Ch. 4 - DuPONT AND ROE A firm has a profit margin of 2%...Ch. 4 - Prob. 7PCh. 4 - DuPONT AND NET INCOME Ebersoll Mining has 6...Ch. 4 - BEP, ROE, AND ROIC Duval Manufacturing recently...Ch. 4 - M/B AND SHARE PRICE You are given the following...Ch. 4 - RATIO CALCULATIONS Assume the following...Ch. 4 - RATIO CALCULATIONS Graser Trucking has 12 billion...Ch. 4 - TIE AND ROIC RATIOS The H.R. Pickett Corp. has...Ch. 4 - Prob. 14PCh. 4 - RETURN ON EQUITY AND QUICK RATIO Lloyd Inc. has...Ch. 4 - Prob. 16PCh. 4 - CONCEPTUAL: RETURN ON EQUITY Which of the...Ch. 4 - TIE RATIO AEI Incorporated has 5 billion in...Ch. 4 - CURRENT RATIO The Petry Company has 1312,500 in...Ch. 4 - DSO AND ACCOUNTS RECEIVABLE Harrelson Inc....Ch. 4 - P/E AND STOCK PRICE Fontaine Inc. recently...Ch. 4 - BALANCE SHEET ANALYSIS Complete the balance sheet...Ch. 4 - RATIO ANALYSIS Data for Barry Computer Co. and its...Ch. 4 - DUPONT ANALYSIS A firm has been experiencing low...Ch. 4 - RATIO ANALYSIS The Corrigan Corporations 2014 and...Ch. 4 - Prob. 26ICCh. 4 - Conducting a Financial Ratio Analysis on HP INC....Ch. 4 - Conducting a Financial Ratio Analysis on HP INC....Ch. 4 - Prob. 3TCLCh. 4 - Conducting a Financial Ratio Analysis on HP INC....Ch. 4 - Conducting a Financial Ratio Analysis on HP INC....Ch. 4 - Conducting a Financial Ratio Analysis on HP INC....Ch. 4 - Conducting a Financial Ratio Analysis on HP INC....Ch. 4 - Conducting a Financial Ratio Analysis on HP INC....

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Payne Products had $1.6 million in sales revenues in the most recent year and expects sales growth to be 25% this year. Payne would like to determine the effect of various current assets policies on its financial performance. Payne has $1 million of fixed assets and intends to keep its debt ratio at its historical level of 60%. Payne’s debt interest rate is currently 8%. You are to evaluate three different current asset policies: (1) a restricted policy in which current assets are 45% of projected sales, (2) a moderate policy with 50% of sales tied up in current assets, and (3) a relaxed policy requiring current assets of 60% of sales. Earnings before interest and taxes are expected to be 12% of sales. Payne’s tax rate is 40%. What is the expected return on equity under each current asset level? In this problem, we have assumed that the level of expected sales is independent of current asset policy. Is this a valid assumption? Why or why not? How would the overall risk of the firm vary under each policy?arrow_forwardValue of Equity after Recapitalization Nichols Corporations value of operations is equal to 500 million after a recapitalization (the firm had no debt before the recap). It raised 200 million in new debt and used this to buy back stock. Nichols had no short-term investments before or after the recap. After the recap, Wd = 40%. What is S (the value of equity after the recap)?arrow_forwardMicolash Industries plans to reduce the use of debt financing and increase the use of equity financing (for example, move from a 70% Debt-to-Capital Ratio to 50%). Assume that the company, which does not pay any dividends, takes this action, and that total assets, operating income (EBIT), and its tax rate (say 40%) all remain constant. Which of the following would occur? Group of answer choices The company’s interest expense would remain constant. The company would have less common equity than before. The company’s taxable income (EBT) would fall. The company would have to pay more taxes. The company’s net income would decrease.arrow_forward

- Rowe and Company has a debt ratio of 0.50, a total assets turnover of 0.25, and a profit margin of 10 percent. The president is unhappy with the current return on equity, and he thinks it could be doubled. This could be accomplished (1) by increasing the profit margin to 14 percent and (2) by increasing debt utilization. Total assets turnover will not change. What new debt ratio, along with the 14 percent profit margin, is required to double the return on equity?arrow_forwardConsider a retail firm with a net profit margin of 3.94%, a total asset turnover of 1.84, total assets of $44.9 million, and a book value of equity of $18.3 million. a. What is the firm's current ROE? b. If the firm increased its net profit margin to 4.83%, what would be its ROE? c. If, in addition, the firm increased its revenues by 23% (maintaining this higher profit margin and without changing its assets or liabilities), what would be its ROE? **round to one decimal place**arrow_forwardBob's Inc has the following balance sheet and income statement data see image... The new CFO thinks that inventory are excessive and could be lowered to cause the current ratio to equal industry average 3.00 w/o affecting either sales or net income. assuming that inventories are sold off and not replaced to get the current ratio to the target level and that the funds generated are used to buy back common stock at book value, by how much would the ROE change?arrow_forward

- The Diamond Corporation has the following ratios: A0*/S0 = 1.6; L0*/S0 = 0.4; Profit Margin = 0.10; and Dividend Payout Ratio = 0.45, or 45%. Sales last year were $100 million, suppose Diamond’s financial consultants report (1) that the Inventory Turnover Ratio (sales/inventory) is 3, compared with an Industry Average of 4, and (2) that Diamond could reduce inventories and thus raise its Turnover Ratio to 4 without affecting its Sales, Profit Margin, or other Asset Turnover Ratios. A. Under these conditions, use the AFN equation to determine the amount of additional funds Diamond would require during the 1st year if sales grow at a rate of 20% per year. B. Under these conditions, use the AFN equation to determine the amount of additional funds Diamond would require during the 2nd year if sales grow at a rate of 20% per year.arrow_forwardCurrent and Quick Ratios The Nelson Company has $1,248,000 in current assets and $480,000 in current liabilities. Its initial inventory level is $330,000, and it will raise funds as additional notes payable and use them to increase inventory. How much can Nelson's short-term debt (notes payable) increase without pushing its current ratio below 2.2? Do not round intermediate calculations. Round your answer to the nearest dollar. $ What will be the firm's quick ratio after Nelson has raised the maximum amount of short-term funds? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forward(Financing decisions) Brussels Electronics, Inc, has total assets of $64 million and total debt of $45 million. The company also has operating profits of $23 millions with interest expenses of $7 million. a. What is Brussels Electronic's debt ratio? b. What is Brussels Electronic's time interest earned? c. Based on the information above, would you recommend to Brussels Electron-ics's management that the firm is in a strong enough position to assume more debt and increase interest expense to $9 million?arrow_forward

- The Barnsdale Corporation has the following ratios: A0*/S0 = 1.6; L0*/S0 = 0.4; profit margin = 0.10; and dividend payout ratio = 0.45, or 45%. Sales last year were $100 million. suppose Barnsdale’s financial consultants report (1) that the inventory turnover ratio (sales/inventory) is 3, compared with an industry average of 4, and (2) that Barnsdale could reduce inventories and thus raise its turnover ratio to 4 without affecting its sales, profit margin, or other asset turnover ratios. Requirement: a. Under these conditions, use the AFN equation to determine the amount of additional funds Barnsdale would require during the 1st year if sales grow at a rate of 20% per year. Sample format: 1,111,111 b. Under these conditions, use the AFN equation to determine the amount of additional funds Barnsdale would require during the 2nd year if sales grow at a rate of 20% per year. Sample format: 1,111,111arrow_forwardPayne Products had $1.6 million in sales revenues in the most recent year and expects sales growth to be 25% this year. Payne would like to determine the effect of various current assets policies on its financial performance. Payne has $1 million of fixed assets and intends to keep its debt ratio at its historical level of 40%. Payne’s debt interest rate is currently 8%. You are to evaluate three different current asset policies: (1) a restricted policy in which current assets are 45% of projected sales, (2) a moderate policy with 50% of sales tied up in current assets, and (3) a relaxed policy requiring current assets of 60% of sales. Earnings before interest and taxes are expected to be 12% of sales. Payne’s tax rate is 25%. What is the expected return on equity under each current asset level? In this problem, we have assumed that the level of expected sales is independent of current asset policy. Is this a valid assumption? Why or why not? How would the overall risk of…arrow_forward(Liquidity analysis) Airspot Motors, Inc. has $2,172,500 in current assets and $869,000 in current liabilities. The company's managers want to increase the firm's inventory, which will be financed using short-term debt. How much can the firm increase its inventory without its current ratio falling below 2.1 (assuming all other current assets and current liabilities remain constant)?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781285065137

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781285867977

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

FIN 300 Lab 1 (Ryerson)- The most Important decision a Financial Manager makes (Managerial Finance); Author: AllThingsMathematics;https://www.youtube.com/watch?v=MGPGMWofQp8;License: Standard YouTube License, CC-BY

Working Capital Management Policy; Author: DevTech Finance;https://www.youtube.com/watch?v=yj-XbIabmFE;License: Standard Youtube Licence