College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 4, Problem 2PA

The

Data for the adjustments are as follows:

- a. Expired or used-up insurance, $800.

- b.

Depreciation expense on equipment, $2,700. - c. Wages accrued or earned since the last payday, $585 (owed and to be paid on the next payday).

- d. Supplies remaining at the end of month, $230.

Required

- 1. Complete a work sheet. (Skip this step if using CLGL.)

- 2. Journalize the

adjusting entries .

*If you are using CLGL, use the year 2020 when recording transactions.

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 4 Solutions

College Accounting (Book Only): A Career Approach

Ch. 4 - The __________ represents the sequence of steps in...Ch. 4 - The __________ is a working paper used by...Ch. 4 - On the work sheet, assets are recorded in which of...Ch. 4 - Rainy Day Services had 430 of supplies reported on...Ch. 4 - On the work sheet, Accumulated Depreciation,...Ch. 4 - The __________ requires that expenses be matched...Ch. 4 - Accumulated Depreciation, Equipment is reported a....Ch. 4 - What is the purpose of a work sheet?Ch. 4 - What is the purpose of adjusting entries?Ch. 4 - Prob. 3DQ

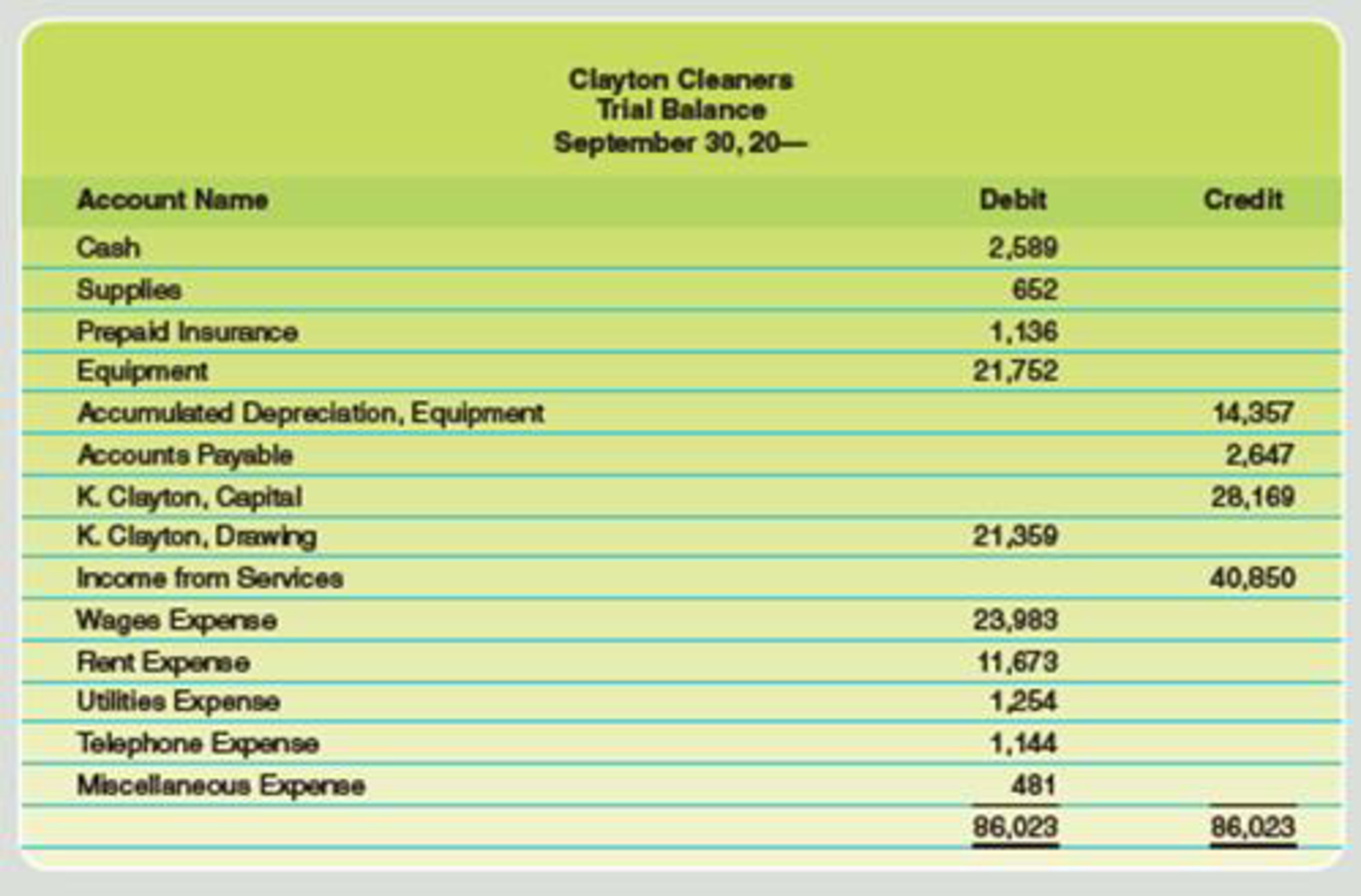

Ch. 4 - Prob. 4DQCh. 4 - Prob. 5DQCh. 4 - Define depreciation as it relates to a van you...Ch. 4 - Prob. 7DQCh. 4 - Why is it necessary to journalize and post...Ch. 4 - 1. List the following classifications of accounts...Ch. 4 - Classify each of the accounts listed below as...Ch. 4 - Place a check mark next to any account(s)...Ch. 4 - A partial work sheet for Marges Place is shown...Ch. 4 - Complete the work sheet for Ramey Company, dated...Ch. 4 - Journalize the adjusting entries from the partial...Ch. 4 - Journalize the adjusting entries from the partial...Ch. 4 - Journalize the following adjusting entries that...Ch. 4 - Determine on which financial statement each...Ch. 4 - Prob. 1PACh. 4 - The trial balance of Clayton Cleaners for the...Ch. 4 - The trial balance for Game Time on July 31 is as...Ch. 4 - The trial balance for Benner Hair Salon on March...Ch. 4 - The trial balance for Masons Insurance Agency as...Ch. 4 - The trial balance of The New Decors for the month...Ch. 4 - The trial balance for Harris Pitch and Putt on...Ch. 4 - The trial balance for Wilson Financial Services on...Ch. 4 - Prob. 1ACh. 4 - You are the bookkeeper for a small but thriving...Ch. 4 - Prob. 3ACh. 4 - Your client is preparing financial statements to...Ch. 4 - Prob. 1CP

Additional Business Textbook Solutions

Find more solutions based on key concepts

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (11th Edition)

Dave Nelson recently retired at age 48, courtesy of the numerous stock options he had been granted while presid...

Managerial Accounting: Creating Value in a Dynamic Business Environment

How would the decision to dispose of a segment of operations using a split-off rather than a spin-off impact th...

Advanced Financial Accounting

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (4th Edition)

Calculate profit margin on sales ratio. (LO 5). Suppose a firm had sales of $200,000 and net income of $7,000 f...

Financial Accounting

The amount that should be recorded by Company R for building under historical cost principle.

Financial Accounting (11th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The trial balance for Benner Hair Salon on March 31 is as follows: Data for month-end adjustments are as follows: a. Expired or used-up insurance, 300. b. Depreciation expense on equipment, 500. c. Wages accrued or earned since the last payday, 235 (owed and to be paid on the next payday). d. Supplies remaining at the end of the month, 65. Required 1. Complete a work sheet for the month. (Skip this step if using CLGL.) 2. Journalize the adjusting entries. 3. Prepare an income statement, a statement of owners equity, and a balance sheet. Assume that no additional investments were made during March.arrow_forwardThe trial balance of The New Decors for the month ended September 30 is as follows: Data for the adjustments are as follows: a. Expired or used-up insurance, 425. b. Depreciation expense on equipment, 2,750. c. Wages accrued or earned since the last payday, 475 (owed and to be paid on the next payday). d. Supplies remaining at end of month, 215. Required 1. Complete a work sheet. (Skip this step if using GL.) 2. Journalize the adjusting entries. If you are using CLGL, use the year 2020 when recording transactions.arrow_forwardThe account balances of Bryan Company as of June 30, the end of the current fiscal year, are as follows: Required 1. Data for the adjustments are as follows: a. Expired or used up insurance, 495 b. Depreciation expense on equipment, 670. c. Depreciation expense on the van, 1,190. d. Salary accrued (earned) since the last payday, 540 (owed and to be paid on the next payday). e. Supplies used during the period, 97. Your instructor may want you to use a work sheet for these adjustments. 2. Journalize the adjusting entries. 3. Prepare an income statement. 4. Prepare a statement of owners equity. Assume that there was an additional investment of 2,000 on June 10. 5. Prepare a balance sheet. 6. Journalize the closing entries using the four steps in the correct sequence. Check Figure Net Income, 13,627arrow_forward

- The trial balance for Harris Pitch and Putt on June 30 is as follows: Data for month-end adjustments are as follows: a. Expired or used-up insurance, 380. b. Depreciation expense on equipment, 1,950. c. Depreciation expense on repair equipment, 1,650. d. Wages accrued or earned since the last payday, 585 (owed and to be paid on the next payday). e. Supplies remaining at end of month, 120. Required 1. Complete a work sheet for the month. (Skip this step if using CLGL.) 2. Journalize the adjusting entries. 3. If using CLGL, prepare an adjusted trial balance. 4. Prepare an income statement, a statement of owners equity, and a balance sheet. Assume that no additional investments were made during June. If you are using CLGL, use the year 2020 when recording transactions.arrow_forwardThe trial balance for Game Time on July 31 is as follows: Data for month-end adjustments are as follows: Expired or used-up insurance, 480. Depreciation expense on equipment, 850. Depreciation expense on repair equipment, 120. Wages accrued or earned since the last payday, 525 (owed and to be paid on the next payday). Supplies used, 70. Required Complete a work sheet for the month. (Skip this step if using CLGL.) Journalize the adjusting entries. If using CLGL prepare an adjusted trial balance. Prepare an income statement, a statement of owners equity, and a balance sheet. Assume that no additional investments were made during July. If you are using CLGL, use the year 2020 when recording transactions and preparing reports.arrow_forwardAt the end of April, the first month of operations, the following selected data were taken from the financial statements of Shelby Crawford, an attorney: In preparing the financial statements, adjustments for the following data were overlooked: Supplies used during April, 2,750. Unbilled fees earned at April 30, 23,700. Depreciation of equipment for April, 1,800. Accrued wages at April 30, 1,400. Instructions 1. Journalize the entries to record the omitted adjustments. 2. Determine the correct amount of net income for April and the total assets, liabilities, and owners equity at April 30. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the following. The adjustment for supplies used is presented as an example.arrow_forward

- At the end of August, the first month of operations, the following selected data were taken from the financial statements of Tucker Jacobs, an attorney: In preparing the financial statements, adjustments for the following data were overlooked: Unbilled fees earned at August 31, 31,900. Depreciation of equipment for August, 7,500. Accrued wages at August 31, 5,200. Supplies used during August, 3,000. Instructions 1. Journalize the entries to record the omitted adjustments. 2. Determine the correct amount of net income for August and the total assets, liabilities, and owners equity at August 31. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the following. The first adjustment is presented as an example.arrow_forwardThe following accounts appear in the ledger of Celso and Company as of June 30, the end of this fiscal year. The data needed for the adjustments on June 30 are as follows: ab.Merchandise inventory, June 30, 54,600. c.Insurance expired for the year, 475. d.Depreciation for the year, 4,380. e.Accrued wages on June 30, 1,492. f.Supplies on hand at the end of the year, 100. Required 1. Prepare a work sheet for the fiscal year ended June 30. Ignore this step if using CLGL. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. 7. Journalize the reversing entry as of July 1, for the wages that were accrued in the June adjusting entry. Check Figure Net income, 14,066arrow_forwardThe unadjusted trial balance of La Mesa Laundry at August 31, 2016, the end of the fiscal year, follows: The data needed to determine year-end adjustments are as follows: a. Wages accrued but not paid at August 31 are 2,200. b. Depreciation of equipment during the year is 8,150. c. Laundry supplies on hand at August 31 are 2,000. d. Insurance premiums expired during the year are 5,300. Instructions 1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as Aug. 31 Bal. In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, Insurance Expense, and Income Summary. 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed. 3. Journalize and post the adjusting entries. Identify the adjustments by Adj. and the new balances as Adj. Bal. 4. Prepare an adjusted trial balance. 5. Prepare an income statement, a statement of owners equity (no additional investments were made during the year), and a balance sheet. 6. Journalize and post the closing entries. Identify the closing entries by Clos. 7. Prepare a post-closing trial balance.arrow_forward

- A partial work sheet for Marges Place is shown below. Prepare the following adjustments on this work sheet for the month ended June 30, 20. a. Expired or used-up insurance, 450. b. Depreciation expense on equipment, 750. c. Wages accrued or earned since the last payday, 380 (owed and to be paid on the next payday). d. Supplies used, 110.arrow_forwardThe trial balance of Wikki Cleaners at December 31, 2012, the end of the current fiscal year, is as follows: Information for the adjusting entries is as follows: a. Cleaning supplies on hand on December 31, 2012, 18,750. b. Insurance premiums expired during the year, 1,800. c. Depreciation on equipment during the year, 21,600. d. Wages accrued but not paid at December 31, 2012, 1,830. Suppose you discover that an assistant in your department had misunderstood your instructions and had provided you with the wrong information on two of the adjusting entries. Cleaning supplies consumed during the year should have been 18,750, and insurance premiums unexpired at year-end were 1,800. Make the corrections on your worksheet and save the corrected file as F1WORK4. Reprint the worksheet.arrow_forwardThe trial balance of Jillson Company as of December 31, the end of its current fiscal year, is as follows: Here are the data for the adjustments. ab. Merchandise Inventory at December 31, 54,845.00. c. Store supplies inventory (on hand), 488.50. d. Insurance expired, 680. e. Salaries accrued, 692. f. Depreciation of store equipment, 3,760. Required Complete the work sheet after entering the account names and balances onto the work sheet.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY