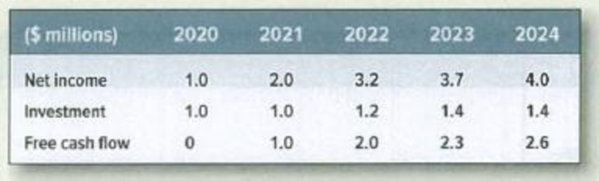

Valuing a business* Phoenix Corp. faltered in the recent recession but is recovering.

Phoenix’s recovery will be complete by 2024, and there will be no further growth in net income or free cash flow.

- a. Calculate the PV of free cash flow, assuming a

cost of equity of 9%. - b. Assume that Phoenix has 12 million shares outstanding. What is the price per share?

- c. Confirm that the expected

rate of return on Phoenix stock is exactly 9% in each of the years from 2020 to 2024.

a)

To determine: Present value of free cash flow

Explanation of Solution

Compute the present value of free cash flow:

Hence, the present value is $24.8 million.

b)

To determine: Price per share

Explanation of Solution

Note:

Assume no debt, the share price are as follows,

Hence, the price per share is $2.04.

c)

To confirm: The expected rate of return is 9%.

Explanation of Solution

Compute PV of the cash flows at various points in time:

Compute rate of return using the formula

Thus, the above calculation shows that the rate of return on Company P is exactly 9%.

Want to see more full solutions like this?

Chapter 4 Solutions

PRIN.OF CORPORATE FINANCE

Additional Business Textbook Solutions

Foundations of Finance (9th Edition) (Pearson Series in Finance)

Corporate Finance (The Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Fundamentals of Corporate Finance

Corporate Finance

Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

- CALCULATING THE WACC Here is the condensed 2019 balance sheet for Skye Computer Company (in thousands of dollars): Skyes earnings per share last year were 3.20. The common stock sells for 55.00. last years dividend (D0) was 2.10, and a flotation cost of 10% would be required to sell new common stock. Security analysts are projecting that the common dividend will grow at an annual rate of 9%. Skyes preferred stock pays a dividend of 3.30 per share, and its preferred stock sells for 30.00 per share. The firms before-lax cost of debt is 10%, and its marginal tax rate is 25%. The firms currently outstanding 10% annual coupon rate, long-term debt sells at par value. The market risk premium is 5%, the risk-free rate is 6%, and Skyes beta is 1.516. The firms total debt, which is the sum of the companys short-term debt and long-term debt, equals 1.2 million. a. Calculate the cost of each capital component, that is, the after-tax cost of debt, the cost of preferred stock, the cost of equity from retained earnings, and the cost of newly issued common stock. Use the DCF method to find the cost of common equity. b. Now calculate the cost of common equity from retained earnings, using the CAPM method. c. What is the cost of new common stock based on the CAPM? (Hint: Find the difference between r1 and rs as determined by the DCF method, and add that differential to the CAPM value for rs.) d. If Skye continues to use the same market-value capital structure, what is the firms WACC assuming that (1) it uses only retained earnings for equity and (2) if it expands so rapidly that it must issue new common stock?arrow_forwardALTERNATIVE DIVIDEND POLICIES In 2018, Keenan Company paid dividends totaling 3,600,000 on net income of 10.8 million. Note that 2018 was a normal year and that for the past 10 years, earnings have grown at a constant rate of 10%. However, in 2019, earnings are expected to jump to 14.4 million and the firm expects to have profitable investment opportunities of 8.4 million. It is predicted that Keenan will not be able to maintain the 2019 level of earnings growth because the high 2019 earnings level is attributable to an exceptionally profitable new product line introduced that year. After 2019, the company will return to its previous 10% growth rate. Keenans target capital structure is 40% debt and 60% equity. a. Calculate Keenans total dividends for 2019 assuming that it follows each of the following policies: 1. Its 2019 dividend payment is set to force dividends to grow at the long-run growth rate in earnings. 2. It continues the 2018 dividend payout ratio. 3. It uses a pure residual dividend policy (40% of the 8.4 million investment is financed with debt and 60% with common equity). 4. It employs a regular-dividend-plus-extras policy, with the regular dividend being based on the long-run growth rate and the extra dividend being set according to the residual dividend policy. b. Which of the preceding policies would you recommend? Restrict your choices to the ones listed but justify your answer. c. Assume that investors expect Keenan to pay total dividends of 9,000,000 in 2019 and to have the dividend grow at 10% after 2019. The stocks total market value is 180 million. What is the companys cost of equity? d. What is Keenans long-run average return on equity? [Hint: g = Retention rate ROE = (1.0 Payout rate)(ROE)] e. Does a 2019 dividend of 9,000,000 seem reasonable in view of your answers to parts c and d? If not, should the dividend be higher or lower? Explain your answer.arrow_forwardWACC Estimation On January 1, the total market value of the Tysseland Company was $60 million. During the year, the company plans to raise and invest $30 million in new projects. The firm’s present market value capital structure, shown here, is considered to be optimal. There is no short-term debt. New bonds will have an 8% coupon rate, and they will be sold at par. Common stock is currently selling at $30 a share. The stockholders’ required rate of return is estimated to be 12%, consisting of a dividend yield of 4% and an expected constant growth rate of 8%. (The next expected dividend is $1.20, so the dividend yield is $1.20/$30 = 4%.) The marginal tax rate is 40%. In order to maintain the present capital structure, how much of the new investment must be financed by common equity? Assuming there is sufficient cash flow for Tysseland to maintain its target capital structure without issuing additional shares of equity, what is its WACC? Suppose now that there is not enough internal cash flow and the firm must issue new shares of stock. Qualitatively speaking, what will happen to the WACC? No numbers are required to answer this question.arrow_forward

- Dividend Payout The Wei Corporation expects next year’s net income to be $15 million. The firm is currently financed with 40% debt. Wei has $12 million of profitable investment opportunities, and it wishes to maintain its existing debt ratio. According to the residual distribution model (assuming all payments are in the form of dividends), how large should Wei’s dividend payout ratio be next year?arrow_forwardConroy Consulting Corporation (CCC) has a current dividend of D0 = $2.5. Shareholders require a 12% rate of return. Although the dividend has been growing at a rate of 30% per year in recent years, this growth rate is expected to last only for another 2 years (g0,1 = g1,2 = 30%). After Year 2, the growth rate will stabilize at gL = 7%. What is CCC’s stock worth today? What is the expected stock price at Year 1? What is the Year 1 expected (1) dividend yield, (2) capital gains yield, and (3) total return? What is its expected dividend yield for the second year? The expected capital gains yield? The expected total return?arrow_forwardValue of Operations Kendra Enterprises has never paid a dividend. Free cash flow is projected to be $80,000 and $100,000 for the next 2 years, respectively; after the second year, FCF is expected to grow at a constant rate of 8%. The company’s weighted average cost of capital is 12%. What is the terminal, or horizon, value of operations? (Hint: Find the value of all free cash flows beyond Year 2 discounted back to Year 2.) Calculate the value of Kendra’s operations.arrow_forward

- Calculation of gL and EPS Spencer Suppliess stock is currently selling for 60 a share. The firm is expected to earn 5.40 per share this year and to pay a year-end dividend of 3.60. a. If investors require a 9% return, what rate of growth must be expected for Spencer? b. If Spencer reinvests earnings in projects with average returns equal to the stocks expected rate of return, then what will be next years EPS? [Hint: gL = ROE Retention ratio.)arrow_forwardOptimal Capital Structure with Hamada Beckman Engineering and Associates (BEA) is considering a change in its capital structure. BEA currently has $20 million in debt carrying a rate of 8%, and its stock price is $40 per share with 2 million shares outstanding. BEA is a zero-growth firm and pays out all of its earnings as dividends. The firm’s EBIT is $14,933 million, and it faces a 40% federal-plus-state tax rate. The market risk premium is 4%, and the risk-free rate is 6%. BEA is considering increasing its debt level to a capital structure with 40% debt, based on market values, and repurchasing shares with the extra money that it borrows. BEA will have to retire the old debt in order to issue new debt, and the rate on the new debt will be 9%. BEA has a beta of 1.0. What is BEA’s unlevered beta? Use market value D/S (which is the same as wd/ws when unlevering. What are BEA’s new beta and cost of equity if it has 40% debt? What are BEA’s WACC and total value of the firm with 40% debt?arrow_forwardNonconstant Growth Stock Valuation Simpkins Corporation does not pay any dividends because it is expanding rapidly and needs to retain all of its earnings. However, investors expect Simpkins to begin paying dividends, with the first dividend of 0.50 coming 3 years from today. The dividend should grow rapidlyat a rate of 80% per yearduring Years 4 and 5. After Year 5, the company should grow at a constant rate of 7% per year. If the required return on the stock is 16%, what is the value of the stock today (assume the market is in equilibrium with the required return equal to the expected return)?arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning