Concept explainers

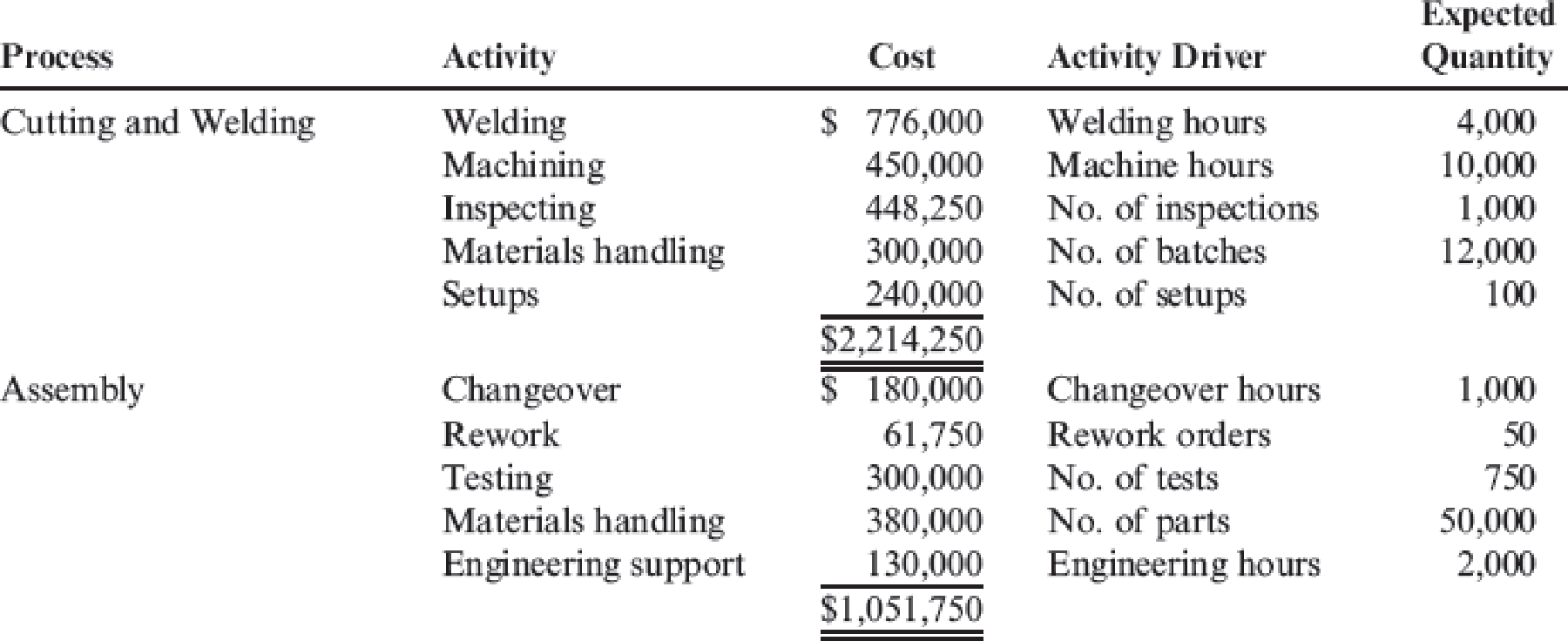

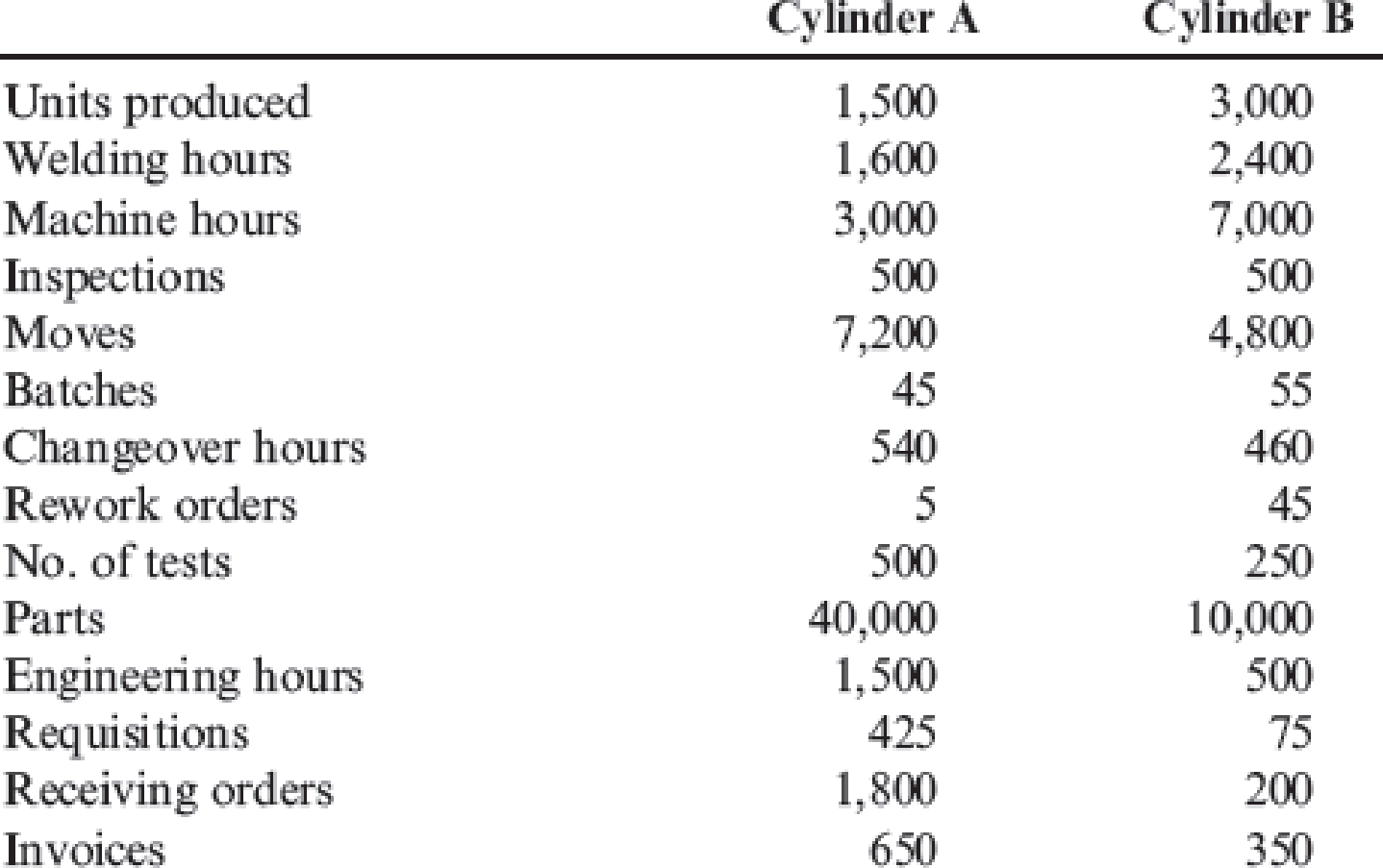

Reducir, Inc., produces two different types of hydraulic cylinders. Reducir produces a major subassembly for the cylinders in the Cutting and Welding Department. Other parts and the subassembly are then assembled in the Assembly Department. The activities, expected costs, and drivers associated with these two manufacturing processes are given below.

Note: In the assembly process, the materials-handling activity is a function of product characteristics rather than batch activity.

Other

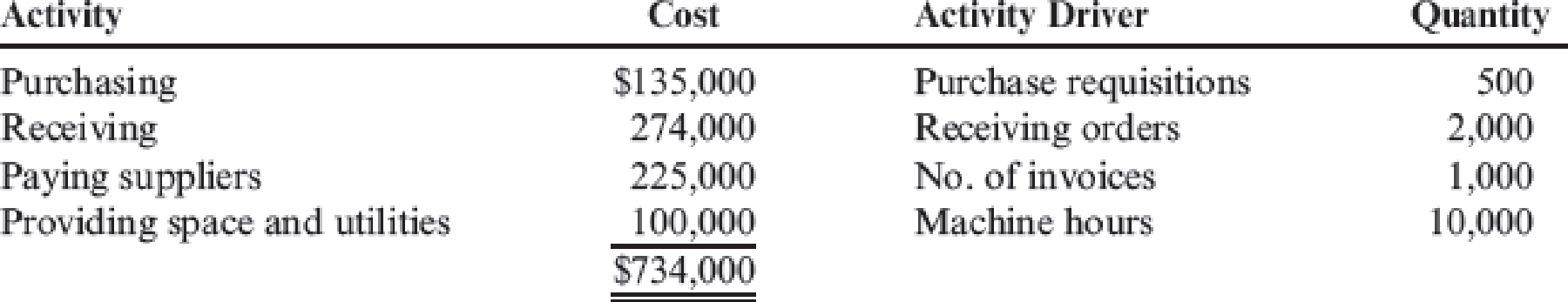

Other production information concerning the two hydraulic cylinders is also provided:

Required:

- 1. Using a plantwide rate based on machine hours, calculate the total overhead cost assigned to each product and the unit overhead cost.

- 2. Using activity rates, calculate the total overhead cost assigned to each product and the unit overhead cost. Comment on the accuracy of the plantwide rate.

- 3. Calculate the global consumption ratios.

- 4. Calculate the consumption ratios for welding and materials handling (Assembly) and show that two drivers, welding hours and number of parts, can be used to achieve the same ABC product costs calculated in Requirement 2. Explain the value of this simplification.

- 5. Calculate the consumption ratios for inspection and engineering, and show that the drivers for these two activities also duplicate the ABC product costs calculated in Requirement 2.

1.

Compute the total overhead cost assigned to each product and the unit overhead cost using a plantwide rate based on machine hours for incorporation R.

Explanation of Solution

Plantwide overhead rate: Plantwide overhead rate is the rate a company uses to allocate its manufacturing overhead costs to products and cost centres.

Step 1: Calculate plantwide overhead rate based on machine hours.

Step 2: Determine the total overhead cost assigned to each product and the unit overhead cost.

For cylinder A,

Therefore, the total overhead cost assigned and unit overhead cost for cylinder A is $1,200,000 and $800 respectively.

For cylinder B,

Therefore, the total overhead cost assigned and unit overhead cost for cylinder B is $2,800,000 and $933.33 respectively.

2.

Determine the total overhead cost assigned to each product and the unit overhead cost using an activity rate for incorporation R and provide comment on the accuracy of the plantwide rate.

Explanation of Solution

Activity rates: Activity rates are calculated by dividing the budgeted activity costs by the amount of activity output as measured by the activity driver.

Step 1: Calculate activity rates.

| Particulars | |

| Cost of welding | $ 776,000 |

| Divide: Welding hours | 4,000 hours |

| Activity rate | $194.00 per welding hour |

| Cost of machining | $ 450,000 |

| Divide: Machine hours | 10,000 hours |

| Activity rate | $45.00 per machine hour |

| Cost of inspecting | $ 448,250 |

| Divide: Number of inspections | 1,000 inspections |

| Activity rate | $448.25 per inspection |

| Cost of materials handling | $ 300,000 |

| Divide: Number of batches | 12,000 |

| Activity rate | $25.00 per move |

| Cost of setups | $ 240,000 |

| Divide: Number of setups | 100 |

| Activity rate | $2,400.00 per batch |

| Cost of changeover | $ 180,000 |

| Divide: change over hours | 1,000 change over hours |

| Activity rate | $180.00 per changeover hour |

| Cost of rework | $ 61,750 |

| Divide: Rework orders | 50 rework orders |

| Activity rate | $1,235.00 per rework order |

| Cost of testing | $ 300,000 |

| Divide: Number of tests | 750 tests |

| Activity rate | $400.00 per test |

| Cost of materials handling | $ 380,000 |

| Divide: Number of parts | 50,000 parts |

| Activity rate | $7.60 per part |

| Cost of engineering support | $ 130,000 |

| Divide: Engineering hours | 2,000 hours |

| Activity rate | $65.00 per engineering hour |

| Cost of purchasing | $ 135,000 |

| Divide: Purchase requisitions | 500 requisitions |

| Activity rate | $270.00 per requisition |

| Cost of receiving | $ 274,000 |

| Divide: Receiving orders | 2,000 receiving orders |

| Activity rate | $137.00 per receiving order |

| Cost of paying suppliers | $ 225,000 |

| Divide: Number of invoices | 1,000 invoices |

| Activity rate | $225.00 per invoice |

| Cost of providing space and utilities | $ 100,000 |

| Divide: Machine hours | 10,000 machine hours |

| Activity rate | $10.00 per machine hour |

Table (1)

Step 2: calculate the total overhead cost assigned to each product.

| Particulars | Cylinder A ($) | Cylinder B ($) |

| Welding | ||

| Activity rate × welding hours | ||

| $194 × 1,600 welding hours | $ 310,400 | |

| $194 × 2,400 welding hours | $ 465,600 | |

| Machining | ||

| Activity rate × machine hours | ||

| $45 × 3,000 machine hours | $ 135,000 | |

| $45 * 7,000 machine hours | $ 315,000 | |

| Inspecting | ||

| Activity rate × number of inspections | ||

| $448.25 × 500 inspections | $ 224,125 | |

| $448.25 × 500 inspections | $ 224,125 | |

| Materials handling | ||

| Activity rate × number of moves | ||

| $25 × 7,200 moves | $ 180,000 | |

| $25 × 4,800 moves | $ 120,000 | |

| Setups | ||

| Activity rate × number of batches | ||

| $2,400 × 45 batches | $ 108,000 | |

| $2,400 × 55 batches | $ 132,000 | |

| Change over | ||

| Activity rate × change over hours | ||

| $180 × 540 change over hours | $ 97,200 | |

| $180 × 460 change over hours | $ 82,800 | |

| Rework | ||

| Activity rate × rework orders | ||

| $1,235 × 5 rework orders | $ 6,175 | |

| $1,235 × 45 rework orders | $ 55,575 | |

| Testing | ||

| Activity rate × number of tests | ||

| $400 × 500 tests | $2,00,000 | |

| $400 × 250 tests | $1,00,000 | |

| Materials handling | ||

| Activity rate × number of tests | ||

| $7.60 × 40,000 parts | $ 304,000 | |

| $7.60 × 10,000 parts | $ 76,000 | |

| Engineering support | ||

| Activity rate × Engineering hours | ||

| $65 × 1,500 engineering hours | $ 97,500 | |

| $65 × 500 engineering hours | $ 32,500 | |

| Purchasing | ||

| Activity rate × number of purchase requisitions | ||

| $270 × 425 requisitions | $ 114,750 | |

| $270 × 75 requisitions | $ 20,250 | |

| Receiving | ||

| Activity rate × number of receiving orders | ||

| $137 × 1,800 receiving orders | $ 246,600 | |

| $137 × 200 receiving orders | $ 27,400 | |

| Paying suppliers | ||

| Activity rate × number of invoices | ||

| $225 × 650 invoices | $ 146,250 | |

| $225 × 350 invoices | $ 78,750 | |

| Providing space and utilities | ||

| Activity rate × machine hours | ||

| $10 × 3,000 machine hours | $ 30,000 | |

| $10 × 7,000 machine hours | $ 70,000 | |

| Total overhead costs | $ 2,200,000 | $ 1,800,000 |

| Divide: Units produced | 1,500 units | 3,000 units |

| Overhead per unit | $ 1,467 | $ 600 |

Table (2)

Thus, the overhead per unit for cylinder A and cylinder B is $1,467 and $600 respectively.

The overhead consumption patterns better than the machine hour pattern of the plantwide rate because, Cylinder B is overcosted, and Cylinder A is undercosted. The activity assignments obtain the cause-and-effect relationships.

3.

Compute global consumption ratio.

Explanation of Solution

Global consumption ratio: The global consumption ratio is the proportion of the total activity costs absorbed by a provided product or cost object.

Calculate global consumption ratio:

For Cylinder A:

For Cylinder B:

Therefore, the global consumption ratio for Cylinder A and Cylinder B is 0.55 and 0.45 respectively.

4.

Determine the consumption ratios for materials handling (Assembly) and welding and justify that two drivers, welding hours and several parts, can be used to achieve the same ABC product costs. Explain the value of this simplification.

Explanation of Solution

Overhead consumption ratio: The overhead consumption ratios simply estimate the proportion of each activity used by individual products. The overhead consumption ratio is mainly suitable to allocate the costs of a shared resource.

Compute the consumption ratios for materials handling (Assembly) and welding:

For Welding:

For Material handling (parts):

Set up two equations, where W’s represent the allocation rates:

Multiply second equation by -4:

By solving:

And thus,

Cost pools:

Activity rates:

Assign overhead for the two products:

| Particulars | Cylinder A | Cylinder B |

| Welding | ||

| Activity rate × welding hours | ||

| $625 × 1,600 welding hours | $ 1,000,000 | |

| $625 × 2,400 welding hours | $ 1,500,000 | |

| Material handling | ||

| Activity rate × Number of parts | ||

| $30 × 40,000 parts | $ 1,200,000 | |

| $30 × 10,000 parts | $ 300,000 | |

| Total overhead costs | $ 2,200,000 | $ 1,800,000 |

| Divide: Units produced | 1,500 units | 3,000 units |

| Overhead per unit | $1,467 (rounded) | $ 600 |

Table (3)

We can take a 14-driver system and decrease it to a two-driver system and obtain the same overhead cost assignments as the more complex system. This After-the-fact simplification has two major benefits:

(1) It assists nonfinancial managers to more easily read, understands, and interpret product cost reports

(2) The actual values only need to be obtained for two drivers instead of 14, producing considerable cost savings.

5.

Ascertain the consumption ratios for inspection and engineering, and prove that the drivers for these two activities also duplicate the ABC product costs.

Explanation of Solution

Compute the consumption ratios for inspection and engineering:

Construct two equations (w’s represent the allocation rates):

Subtract the second equation from the first:

And thus,

Cost pools:

Calculate the activity rates:

Therefore, the activity rate for inspection and engineering is $3,200 per inspection and $400 per hour respectively.

Assign the overhead for cylinder A and cylinder B:

| Particulars | Cylinder A | Cylinder B |

| Inspection | ||

| Activity rate × Number of inspections | ||

| $3,200 × 500 inspections | $ 1,600,000 | |

| $3,200 × 500inspections | $ 1,600,000 | |

| Engineering | ||

| Activity rate × Engineering hours | ||

| $400 × 1,500 engineering hours | $ 600,000 | |

| $400 × 500 engineering hours | $ 200,000 | |

| Total overhead costs | $ 2,200,000 | $ 1,800,000 |

| Divide: Units produced | 1,500 units | 3,000 units |

| Overhead per unit | $1,467.67 (rounded) | $ 600.00 |

Thus, the overhead per unit for Cylinder A and Cylinder B is $1,467.67 and $600 respectively.

Want to see more full solutions like this?

Chapter 4 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Lacy, Inc., produces a subassembly used in the production of hydraulic cylinders. The subassemblies are produced in three departments: Plate Cutting, Rod Cutting, and Welding. Materials are added at the beginning of the process. Overhead is applied using the following drivers and activity rates: Other data for the Plate Cutting Department are as follows: Required: 1. Prepare a physical flow schedule. 2. Calculate equivalent units of production for: a. Direct materials b. Conversion costs 3. Calculate unit costs for: a. Direct materials b. Conversion costs c. Total manufacturing 4. Provide the following information: a. The total cost of units transferred out b. The journal entry for transferring costs from Plate Cutting to Welding c. The cost assigned to units in ending inventoryarrow_forwardBenson Pharmaceuticals uses a process-costing system to compute the unit costs of the over-the-counter cold remedies that it produces. It has three departments: mixing, encapsulating, and bottling. In mixing, the ingredients for the cold capsules are measured, sifted, and blended (with materials assumed to be uniformly added throughout the process). The mix is transferred out in gallon containers. The encapsulating department takes the powdered mix and places it in capsules (which are necessarily added at the beginning of the process). One gallon of powdered mix converts into 1,500 capsules. After the capsules are filled and polished, they are transferred to bottling, where they are placed in bottles that are then affixed with a safety seal, lid, and label. Each bottle receives 50 capsules. During March, the following results are available for the first two departments: Overhead in both departments is applied as a percentage of direct labor costs. In the mixing department, overhead is 200% of direct labor. In the encapsulating department, the overhead rate is 150% of direct labor. Required: 1. Prepare a production report for the mixing department using the weighted average method. Follow the five steps outlined in the chapter. (Note: Round to two decimal places for the unit cost.) 2. Prepare a production report for the encapsulating department using the weighted average method. Follow the five steps outlined in the chapter. (Note: Round to four decimal places for the unit cost.) 3. CONCEPTUAL CONNECTION Explain why the weighted average method is easier to use than FIFO. Explain when weighted average will give about the same results as FIFO.arrow_forwardLarsen, Inc., produces two types of electronic parts and has provided the following data: There are four activities: machining, setting up, testing, and purchasing. Required: 1. Calculate the activity consumption ratios for each product. 2. Calculate the consumption ratios for the plantwide rate (direct labor hours). When compared with the activity ratios, what can you say about the relative accuracy of a plantwide rate? Which product is undercosted? 3. What if the machine hours were used for the plantwide rate? Would this remove the cost distortion of a plantwide rate?arrow_forward

- Hales Company produces a product that requires two processes. In the first process, a subassembly is produced (subassembly A). In the second process, this subassembly and a subassembly purchased from outside the company (subassembly B) are assembled to produce the final product. For simplicity, assume that the assembly of one final unit takes the same time as the production of subassembly A. Subassembly A is placed in a container and sent to an area called the subassembly stores (SB stores) area. A production Kanban is attached to this container. A second container, also with one subassembly, is located near the assembly line (called the withdrawal store). This container has attached to it a withdrawal Kanban. Required: 1. Explain how withdrawal and production Kanban cards are used to control the work flow between the two processes. How does this approach minimize inventories? 2. Explain how vendor Kanban cards can be used to control the flow of the purchased subassembly. What implications does this have for supplier relationships? What role, if any, do continuous replenishment and EDI play in this process?arrow_forwardThe management of Wheeler Company has decided to develop cost formulas for its major overhead activities. Wheeler uses a highly automated manufacturing process, and power costs are a significant manufacturing cost. Cost analysts have decided that power costs are mixed; thus, they must be broken into their fixed and variable elements so that the cost behavior of the power usage activity can be properly described. Machine hours have been selected as the activity driver for power costs. The following data for the past eight quarters have been collected: Required: 1. Prepare a scattergraph by plotting power costs against machine hours. Does the scatter-graph show a linear relationship between machine hours and power cost? 2. Using the high and low points, compute a power cost formula. 3. Use the method of least squares to compute a power cost formula. Evaluate the coefficient of determination. 4. Rerun the regression and drop the point (20,000; 26,000) as an outlier. Compare the results from this regression to those for the regression in Requirement 3. Which is better?arrow_forwardHercules Inc. manufactures elliptical exercise machines and treadmills. The products are produced in its Fabrication and Assembly production departments. In addition to production activities, several other activities are required to produce the two products. These activities and their associated activity rates are as follows: The activity-base usage quantities and units produced for each product were as follows: Use the activity rate and usage information to determine the total activity cost and activity cost per unit for each product.arrow_forward

- Healthway uses a process-costing system to compute the unit costs of the minerals that it produces. It has three departments: Mixing, Tableting, and Bottling. In Mixing, at the beginning of the process all materials are added and the ingredients for the minerals are measured, sifted, and blended together. The mix is transferred out in gallon containers. The Tableting Department takes the powdered mix and places it in capsules. One gallon of powdered mix converts to 1,600 capsules. After the capsules are filled and polished, they are transferred to Bottling where they are placed in bottles, which are then affixed with a safety seal and a lid and labeled. Each bottle receives 50 capsules. During July, the following results are available for the first two departments (direct materials are added at the beginning in both departments): Overhead in both departments is applied as a percentage of direct labor costs. In the Mixing Department, overhead is 200 percent of direct labor. In the Tableting Department, the overhead rate is 150 percent of direct labor. Required: 1. Prepare a production report for the Mixing Department using the weighted average method. Follow the five steps outlined in the chapter. Round unit cost to three decimal places. 2. Prepare a production report for the Tableting Department. Materials are added at the beginning of the process. Follow the five steps outlined in the chapter. Round unit cost to four decimal places.arrow_forwardTom Young, vice president of Dunn Company (a producer of plastic products), has been supervising the implementation of an activity-based cost management system. One of Toms objectives is to improve process efficiency by improving the activities that define the processes. To illustrate the potential of the new system to the president, Tom has decided to focus on two processes: production and customer service. Within each process, one activity will be selected for improvement: molding for production and sustaining engineering for customer service. (Sustaining engineers are responsible for redesigning products based on customer needs and feedback.) Value-added standards are identified for each activity. For molding, the value-added standard calls for nine pounds per mold. (Although the products differ in shape and function, their size, as measured by weight, is uniform.) The value-added standard is based on the elimination of all waste due to defective molds (materials is by far the major cost for the molding activity). The standard price for molding is 15 per pound. For sustaining engineering, the standard is 60 percent of current practical activity capacity. This standard is based on the fact that about 40 percent of the complaints have to do with design features that could have been avoided or anticipated by the company. Current practical capacity (the first year) is defined by the following requirements: 18,000 engineering hours for each product group that has been on the market or in development for five years or less, and 7,200 hours per product group of more than five years. Four product groups have less than five years experience, and 10 product groups have more. There are 72 engineers, each paid a salary of 70,000. Each engineer can provide 2,000 hours of service per year. There are no other significant costs for the engineering activity. For the first year, actual pounds used for molding were 25 percent above the level called for by the value-added standard; engineering usage was 138,000 hours. There were 240,000 units of output produced. Tom and the operational managers have selected some improvement measures that promise to reduce non-value-added activity usage by 30 percent in the second year. Selected actual results achieved for the second year are as follows: The actual prices paid per pound and per engineering hour are identical to the standard or budgeted prices. Required: 1. For the first year, calculate the non-value-added usage and costs for molding and sustaining engineering. Also, calculate the cost of unused capacity for the engineering activity. 2. Using the targeted reduction, establish kaizen standards for molding and engineering (for the second year). 3. Using the kaizen standards prepared in Requirement 2, compute the second-year usage variances, expressed in both physical and financial measures, for molding and engineering. (For engineering, explain why it is necessary to compare actual resource usage with the kaizen standard.) Comment on the companys ability to achieve its targeted reductions. In particular, discuss what measures the company must take to capture any realized reductions in resource usage.arrow_forwardBienestar Inc., has the following departmental structure for producing a well-known multivitamin: A consultant designed the following cellular manufacturing structure for the same product: The times above the processes represent the time required to process one unit of product. Required: 1. Calculate the time required to produce a batch of 15 bottles using a batch-processing departmental structure. 2. Calculate the time to process 15 units using cellular manufacturing. 3. How much manufacturing time will the cellular manufacturing structure save for a batch of 15 units?arrow_forward

- Anderson Company has the following departmental manufacturing structure for one of its products: After some study, the production manager of Anderson recommended the following revised cellular manufacturing approach: Required: 1. Calculate the total time it takes to produce a batch of 20 units using Andersons traditional departmental structure. 2. Using cellular manufacturing, how much time is saved producing the same batch of 20 units? Assuming the cell operates continuously, what is the production rate? Which process controls this production rate? 3. What if the processing times of molding, welding, and assembly are all reduced to six minutes each? What is the production rate now, and how long will it take to produce a batch of 20 units?arrow_forwardClassify the following cost drivers as structural, executional, or operational. a. Number of plants b. Number of moves c. Degree of employee involvement d. Capacity utilization e. Number of product lines f. Number of distribution channels g. Engineering hours h. Direct labor hours i. Scope j. Product configuration k. Quality management approach l. Number of receiving orders m. Number of defective units n. Employee experience o. Types of process technologies p. Number of purchase orders q. Type and efficiency of layout r. Scale s. Number of functional departments t. Number of planning meetingsarrow_forwardGolding Manufacturing, a division of Farnsworth Sporting Inc., produces two different models of bows and eight models of knives. The bow-manufacturing process involves the production of two major subassemblies: the limbs and the handles. The limbs pass through four sequential processes before reaching final assembly: layup, molding, fabricating, and finishing. In the layup department, limbs are created by laminating layers of wood. In the molding department, the limbs are heat-treated, under pressure, to form strong resilient limbs. In the fabricating department, any protruding glue or other processing residue is removed. Finally, in the finishing department, the limbs are cleaned with acetone, dried, and sprayed with the final finishes. The handles pass through two processes before reaching final assembly: pattern and finishing. In the pattern department, blocks of wood are fed into a machine that is set to shape the handles. Different patterns are possible, depending on the machines setting. After coming out of the machine, the handles are cleaned and smoothed. They then pass to the finishing department, where they are sprayed with the final finishes. In final assembly, the limbs and handles are assembled into different models using purchased parts such as pulley assemblies, weight-adjustment bolts, side plates, and string. Golding, since its inception, has been using process costing to assign product costs. A predetermined overhead rate is used based on direct labor dollars (80% of direct labor dollars). Recently, Golding has hired a new controller, Karen Jenkins. After reviewing the product-costing procedures, Karen requested a meeting with the divisional manager, Aaron Suhr. The following is a transcript of their conversation: Karen: Aaron, I have some concerns about our cost accounting system. We make two different models of bows and are treating them as if they were the same product. Now I know that the only real difference between the models is the handle. The processing of the handles is the same, but the handles differ significantly in the amount and quality of wood used. Our current costing does not reflect this difference in material input. Aaron: Your predecessor is responsible. He believed that tracking the difference in material cost wasnt worth the effort. He simply didnt believe that it would make much difference in the unit cost of either model. Karen: Well, he may have been right, but I have my doubts. If there is a significant difference, it could affect our views of which model is more important to the company. The additional bookkeeping isnt very stringent. All we have to worry about is the pattern department. The other departments fit what I view as a process-costing pattern. Aaron: Why dont you look into it? If there is a significant difference, go ahead and adjust the costing system. After the meeting, Karen decided to collect cost data on the two models: the Deluxe model and the Econo model. She decided to track the costs for one week. At the end of the week, she had collected the following data from the pattern department: a. There were a total of 2,500 bows completed: 1,000 Deluxe models and 1,500 Econo models. b. There was no BWIP; however, there were 300 units in EWIP: 200 Deluxe and 100 Econo models. Both models were 80% complete with respect to conversion costs and 100% complete with respect to materials. c. The pattern department experienced the following costs: d. On an experimental basis, the requisition forms for materials were modified to identify the dollar value of the materials used by the Econo and Deluxe models: Required: 1. Compute the unit cost for the handles produced by the pattern department, assuming that process costing is totally appropriate. Round unit cost to two decimal places. 2. Compute the unit cost of each handle, using the separate cost information provided on materials. Round unit cost to two decimal places. 3. Compare the unit costs computed in Requirements 1 and 2. Is Karen justified in her belief that a pure process-costing relationship is not appropriate? Describe the costing system that you would recommend. 4. In the past, the marketing manager has requested more money for advertising the Econo line. Aaron has repeatedly refused to grant any increase in this products advertising budget because its per-unit profit (selling price minus manufacturing cost) is so low. Given the results in Requirements 1 through 3, was Aaron justified in his position?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,