Corporate Financial Accounting

14th Edition

ISBN: 9781305653535

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 4.1APR

Financial statements and closing entries

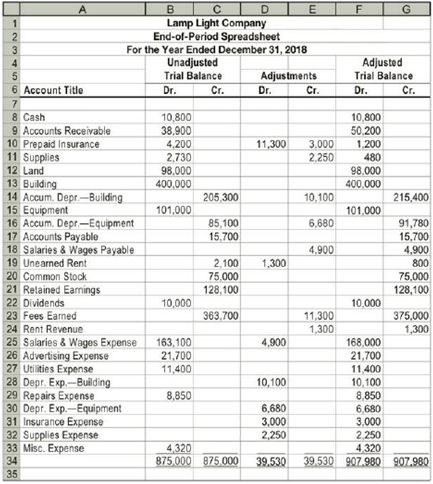

Lamp Light Company maintains and repairs warning lights, such as those found on radio towers and lighthouses. Lamp Light prepared the following end-of-period spreadsheet at December 31, 2018, the end of the fiscal year:

Instructions

1. Prepare an income statement for the year ended December 31.

2. Prepare a

3. Prepare a

4. Based upon the end-of-period spreadsheet, journalize the closing entries.

5. Prepare a post-closing

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 4 Solutions

Corporate Financial Accounting

Ch. 4 - Prob. 1DQCh. 4 - Describe the nature of the assets that compose the...Ch. 4 - Prob. 3DQCh. 4 - Prob. 4DQCh. 4 - Why are closing entries required at the end of an...Ch. 4 - Prob. 6DQCh. 4 - What is the purpose of the post-closing trial...Ch. 4 - Prob. 8DQCh. 4 - What is the natural business year?Ch. 4 - Recent fiscal years for several well-known...

Ch. 4 - Flow of accounts into financial statements The...Ch. 4 - Retained earnings statement Blake Knudson owns and...Ch. 4 - Classified balance sheet The following accounts...Ch. 4 - Prob. 4.4BECh. 4 - Accounting cycle From the following list of steps...Ch. 4 - Flow of accounts into financial statements The...Ch. 4 - Classifying accounts Balances for each of the...Ch. 4 - Financial statements from the end-of-period...Ch. 4 - Financial statements from the end-of-period...Ch. 4 - Income statement The following account balances...Ch. 4 - Income statement; net loss The following revenue...Ch. 4 - Income statement FedEx Corporation had the...Ch. 4 - Retained earnings statement Climate Control...Ch. 4 - Retained earnings statement; net loss Selected...Ch. 4 - Classifying assets Identify each of the following...Ch. 4 - Balance sheet classification At the balance sheet...Ch. 4 - Balance sheet Dynamic Weight Loss Co. offers...Ch. 4 - Prob. 4.13EXCh. 4 - Identifying accounts to be closed From the list...Ch. 4 - Closing entries Prior to its closing, Income...Ch. 4 - Closing entries with net income After all revenue...Ch. 4 - Closing entries with net loss Rainbow Services Co....Ch. 4 - Identifying permanent accounts Which of the...Ch. 4 - Post-closing trial balance An accountant prepared...Ch. 4 - Steps in the accounting cycle Rearrange the...Ch. 4 - Appendix 1 Completing an end-of-period spreadsheet...Ch. 4 - Prob. 4.22EXCh. 4 - Appendix 1 Completing an end-of-period spreadsheet...Ch. 4 - Prob. 4.24EXCh. 4 - Prob. 4.25EXCh. 4 - Prob. 4.26EXCh. 4 - Appendix 2 Reversing entry The following adjusting...Ch. 4 - Appendix 2 Adjusting and reversing entries On the...Ch. 4 - Appendix 2 Adjusting and reversing entries On the...Ch. 4 - Appendix 2 Entries posted to wages expense account...Ch. 4 - Appendix 2 Entries posted to wages expense account...Ch. 4 - Financial statements and closing entries Lamp...Ch. 4 - Financial statements and closing entries Foxy...Ch. 4 - T accounts, adjusting entries, financial...Ch. 4 - Ledger accounts, adjusting entries, financial...Ch. 4 - Complete accounting cycle For the past several...Ch. 4 - Financial statements and closing entries Last...Ch. 4 - Financial statements and closing entries The...Ch. 4 - Prob. 4.3BPRCh. 4 - Ledger accounts, adjusting entries, financial...Ch. 4 - Complete accounting cycle For the past several...Ch. 4 - The unadjusted trial balance of PS Music as of...Ch. 4 - Kelly Pitney began her consulting business, Kelly...Ch. 4 - Continuing Company Analysis- Amazon: Working...Ch. 4 - Under Armour: Current ratio The following year-end...Ch. 4 - Prob. 4.3ADMCh. 4 - Google and Microsoft: Current ratio Google, Inc....Ch. 4 - Prob. 4.1TIFCh. 4 - Communication Your friend, Daniel Nat, recently...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ledger accounts, adjusting entries, financial statements, and closing entries; optional spreadsheet The unadjusted trial balance of Lakota Freight Co. at March 31, 20Y4, the end of the year, follows: The data needed to determine year-end adjustments are as follows: (a) Supplies on hand at March 31 are 7,500. (b) Insurance premiums expired during year are 1,800. (c) Depreciation of equipment during year is 8,350. (d) Depreciation of trucks during year is 6,200. (e) Wages accrued but not paid at March 31 are 600. Instructions 1. For each account listed in the trial balance, enter the balance in the appropriate Balance column of a four-column account and place a check mark () in the Posting Reference column. 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (3) as needed. 3. Journalize and post the adjusting entries, inserting balances in the accounts affected. Record the adjusting entries on Page 26 of the journal. The following additional accounts from Lakota Freight Co.s chart of accounts should be used: Wages Payable, 22; Supplies Expense, 52; Depreciation ExpenseEquipment, 55; Depreciation ExpenseTrucks, 56; Insurance Expense, 57. 4. Prepare an adjusted trial balance. 5. Prepare an income statement, a statement of stockholders equity, and a balance sheet. During the year ended March 31, 20Y4, additional common stock of 6,000 was issued. 6. Journalize and post the closing entries. Record the closing entries on Page 27 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. 7. Prepare a post-closing trial balance.arrow_forwardRecurring and Adjusting Entries Following are Butler Realty Corporations accounts, identified by number. The company has been in the real estate business for ten years and prepares financial statements monthly. Following the list of accounts is a series of transactions entered into by Butler. For each transaction, enter the number(s) of the account(s) to be debited and credited.arrow_forwardThe Income Statement columns of the work sheet of Cederblom Company for the fiscal year ended December 31 follow. During the year, S. Cederblom withdrew 17,000. Journalize the closing entries.arrow_forward

- FINANCIAL STATEMENTS The adjusted trial balance columns of Braiden Company’s spreadsheet are shown on the next page. Additional information needed to prepare the financial statements is as follows: Required Prepare an income statement and a schedule of cost of goods manufactured for the year ended December 31, 20--. Prepare a statement of retained earnings for the year ended December 31, 20--. Prepare a balance sheet as of December 31, 20--.arrow_forwardThe following accounts appear in the ledger of Sheldon Company on January 31, the end of this fiscal year. The data needed for adjustments on January 31 are as follows: ab.Merchandise inventory, January 31, 55,750. c.Insurance expired for the year, 1,285. d.Depreciation for the year, 5,482. e.Accrued wages on January 31, 1,556. f.Supplies used during the year 1,503. Required 1. Prepare a work sheet for the fiscal year ended January 31. Ignore this step if using QuickBooks or general ledger. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. Ignore this step if using CLGL. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. Check Figure Net loss, 1,737arrow_forwardFINANCIAL STATEMENTS The adjusted trial balance columns of Wen Companys spreadsheet are shown on the next page. Additional information needed to prepare the financial statements is as follows: REQUIRED 1. Prepare an income statement and a schedule of cost of goods manufactured for the year ended December 31, 20--. 2. Prepare a statement of retained earnings for the year ended December 31, 20--. 3. Prepare a balance sheet as of December 31,20--.arrow_forward

- Toms Catering Services prepared the following work sheet for the year ended December 31, 20--. Required 1. Complete the work sheet. (Skip this step if using CLGL.) 2. Prepare an income statement. 3. Prepare a statement of owners equity. Assume that there was an additional investment of 2,500 on December 1. 4. Prepare a balance sheet 5. Journalize the closing entries with the four steps in the correct sequence. 6. Prepare a post-closing trial balance. Check Figure Post-closing trial balance total, 31,665arrow_forwardClosing entries On July 31, the close of the fiscal year, the balances of the accounts appearing in the ledger of Serbian Interiors Company, a furniture retailer, are as follows: Prepare the July 31 closing entries for Serbian Interiors Company.arrow_forwardSelected accounts and related amounts for Clairemont Co. for the fiscal year ended May 31, 2016, are presented in Problem 6-5A. Instructions 1. Prepare a single-step income statement in the format shown in Exhibit 11. 2. Prepare a statement of owners equity. 3. Prepare an account form of balance sheet, assuming that the current portion of the note payable is 50,000. 4. Prepare closing entries as of May 31, 2016.arrow_forward

- As of December 31, the end of the current year, the ledger of Harris Company contained the following account balances after adjustment. All accounts have normal balances. Journalize the closing entries.arrow_forwardThe Income Statement columns of the work sheet of Redfax Company for the fiscal year ended December 31 follow. During the year, D. Redfax withdrew 12,000. Journalize the closing entries.arrow_forwardSelected accounts and related amounts for Kanpur Co. for the fiscal year ended June 30, 2016, are presented in Problem 6-5B. Instructions 1. Prepare a single-step income statement in the format shown in Exhibit 11. 2. Prepare a statement of owners equity. 3. Prepare an account form of balance sheet, assuming that the current portion of the note payable is 7,000. 4. Prepare closing entries as of June 30, 2016.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License