Concept explainers

Ledger accounts,

The unadjusted

| Recessive Interiors Unadjusted Trial Balance January 31, 2018 | |||

| Account No. | Debit Balances | Credit Balances | |

| Cash..................................................... | 11 | 13,100 | |

| Supplies................................................. | 13 | 8,000 | |

| Prepaid Insurance......................................... | 14 | 7,500 | |

| Equipment............................................... | 16 | 113,000 | |

| 17 | 12,000 | ||

| Trucks.................................................... | 18 | 90,000 | |

| Accumulated Depreciation—Trucks........................ | 19 | 27,100 | |

| Accounts Payable......................................... | 21 | 4,500 | |

| Common Stock........................................... | 31 | 30,000 | |

| 32 | 96,400 | ||

| Dividends................................................ | 33 | 3,000 | |

| Service Revenue.......................................... | 41 | 155,000 | |

| Wages Expense........................................... | 51 | 72,000 | |

| Rent Expense............................................. | 52 | 7,600 | |

| Truck Expense............................................ | 53 | 5,350 | |

| Miscellaneous Expense.................................... | 59 | 5,450 | |

| 325,000 | 325,000 | ||

The data needed to determine year-end adjustments are as follows:

(A) Supplies on hand at January 31 are $2,850.

(B) Insurance premiums expired during the year are $3,1 SO.

(C) Depreciation of equipment during the year is $5,250.

(D) Depreciation of trucks during the year is $4,000.

(E) Wages accrued but not paid at January 31 are $900.

Instructions

1. For each account listed in the unadjusted trial balance, enter the balance in the appropriate Ba lance column of a four-column account and place a check mark (✓) in the Posting Reference column.

2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (3) as needed.

3. Journalize and post the adjusting entries, inserting balances in the accounts affected. Record the adjusting entries on Page 26 of the journal. The following additional accounts from Recessive Interiors’ chart of accounts should be used: Wages Payable, 22; Depreciation Expense—Equipment, 54; Supplies Expense, 55; Depreciation Expense—Trucks, 56; Insurance Expense, 57.

4. Prepare an adjusted trial balance.

5. Prepare an income statement, a retained earnings statement, and a

6. Journalize and

7. Prepare a post-closing trial balance.

1.

Journal:

Journal is the book of original entry. Journal consists of the day-to-day financial transactions in a chronological order. The journal has two aspects; they are debit aspect and the credit aspect.

T-Accounts:

T-accounts are referred as T-account because its format represents the letter “T”. The T-accounts consists of the following:

- The title of accounts.

- The debit side (Dr) and,

- The credit side (Cr).

Adjusted trial balance:

The unadjusted trial balance is the summary of all the ledger accounts that appears on the ledger accounts before making adjusting journal entries.

Adjusting entries:

An adjusting entry is prepared when the trial balance is not up-to-date, and complete, and they are usually prepared at the end of the accounting period. This adjusting entry is essential for preparing the financial statements of the business.

Spreadsheet:

A spreadsheet is a worksheet. It is used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Statement of owners’ equity:

This statement reports the beginning owner’s equity and all the changes, which led to ending owners’ equity. Additional capital, net income from income statement is added to and drawing is deducted from beginning owner’s equity to arrive at the end result, ending owner’s equity.

Income statement:

An income statement is one of the financial statements which shows the revenues, and expenses of the company. The income statement is prepared to ascertain the net income/loss of the company, by deducting the expenses from the revenues.

Balance sheet:

A balance sheet is a financial statement consists of the assets, liabilities, and the stockholder’s equity of the company. The balance of the assets account must be equal to that of the liabilities and the stockholder’s equity account.

Closing entries:

Closing entries are recorded in order to close the temporary accounts such as incomes and expenses by transferring them to the permanent accounts. It is passed at the end of the accounting period, to transfer the final balance.

Post-Closing Trial Balance:

After passing all the journal entries and the closing entries of the permanent accounts and then further posting them to each of the respective accounts, a post-closing trial balance is prepared which consists of a list of all the permanent accounts. A post-closing trial balance serves as an evidence to prove that the balance of the permanent accounts is equal.

To prepare: The T-accounts.

Explanation of Solution

Record the transactions directly in their respective T-accounts, and determine their balances.

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| January | 31 | Balance | ✓ | 13,100 | |||

| Account: Supplies Account no. 13 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| January | 31 | Balance | ✓ | 8,000 | |||

| 31 | Adjusting | 26 | 5,150 | 2,850 | |||

| Account: Prepaid Insurance Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| January | 31 | Balance | ✓ | 7,500 | |||

| 31 | Adjusting | 26 | 3,150 | 4,350 | |||

| Account: Equipment Account no. 16 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| January | 31 | Balance | ✓ | 113,000 | |||

| Account: Accumulated Depreciation-Office equipment Account no. 17 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| January | 31 | Balance | ✓ | 12,000 | |||

| 31 | Adjusting | 26 | 5,250 | 17,250 | |||

| Account: Trucks Account no. 18 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| January | 31 | Balance | ✓ | 90,000 | |||

| Account: Accumulated Depreciation- Truck Account no. 19 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| January | 31 | Balance | ✓ | 27,100 | |||

| 31 | Adjusting | 26 | 4,000 | 31,100 | |||

| Account: Accounts Payable Account no. 21 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| January | 31 | Balance | ✓ | 4,500 | |||

| Account: Wages Payable Account no. 22 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| January | 31 | Adjusting | 26 | 900 | 900 | ||

| Account: Common Stock Account no. 31 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| January | 31 | Balance | ✓ | 900 | 30,000 | ||

| Account: Retained Earnings Account no. 32 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| January | 31 | Balance | ✓ 1 | 96,400 | |||

| 31 | Closing | 27 | 46,150 | 142,550 | |||

| 31 | Closing | 27 | 3,000 | 139,550 | |||

| Account: Dividends Account no. 33 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| January | 31 | Balance | ✓ | 3,000 | |||

| 31 | Closing | 27 | 3,000 | ||||

| Account: Income Summary Account no. 34 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| January | 31 | Closing | 27 | 155,000 | 155,000 | ||

| 31 | Closing | 27 | 108,850 | 46,150 | |||

| 31 | Closing | 27 | 46,150 | ||||

| Account: Service revenue Account no. 41 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| January | 31 | Balance | ✓ | 155,000 | |||

| 31 | Closing | 27 | 155,000 | ||||

| Account: Wages expense Account no. 51 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| January | 1 | Balance | ✓ | 72,000 | |||

| 31 | Adjusting | 26 | 900 | 72,900 | |||

| 31 | Closing | 27 | 72,900 | ||||

| Account: Rent expense Account no. 52 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| January | 31 | Balance | ✓ | 7,600 | |||

| 31 | Closing | 27 | 7,600 | ||||

| Account: Truck Expense Account no. 53 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| January | 31 | Balance | ✓ | 5,350 | |||

| 31 | Closing | 27 | 5,350 | ||||

| Account: Depreciation Expense- Equipment Account no. 54 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| January | 31 | Adjusting | 26 | 5,250 | 5,250 | ||

| 31 | Closing | 27 | 5,250 | ||||

| Account: Supplies Expenses Account no. 55 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| January | 31 | Adjusting | 26 | 5,150 | 5,150 | ||

| 31 | Closing | 27 | 5,150 | ||||

| Account: Depreciation Expense- Trucks Account no. 56 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| January | 31 | Adjusting | 26 | 4,000 | 4,000 | ||

| 31 | Closing | 27 | 4,000 | ||||

| Account: Insurance expense Account no. 57 | ||||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | |||

| Debit ($) | Credit ($) | |||||||

| 2018 | ||||||||

| January | 31 | Adjusting | 26 | 3,150 | 3,150 | |||

| 31 | Closing | 27 | 3,150 | |||||

| Account: Miscellaneous expense Account no. 59 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| January | 1 | Balance | ✓ | 5,450 | |||

| 31 | Closing | 27 | 5,450 | ||||

2.

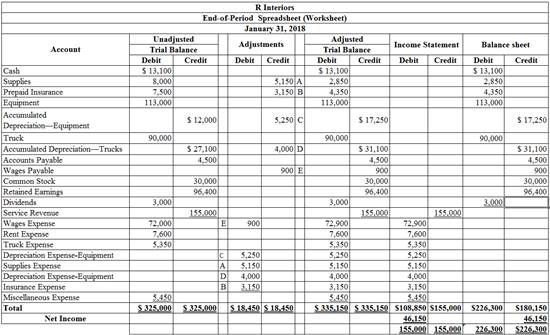

To enter: The unadjusted trial balance on an end-of-period spreadsheet, and complete the spreadsheet.

Explanation of Solution

The unadjusted trial balance on an end-of-period spreadsheet is prepared as follows:

Table (1)

Hence, the unadjusted trial balance on an end-of-period spreadsheet is prepared and completed.

3.

To Journalize and post: The adjusting entries.

Explanation of Solution

The adjusting entries are journalized as follows:

| Date | Description |

Post Ref. |

Debit ($) | Credit ($) | |

| 2018 | Wages expense | 51 | 900 | ||

| January | 31 | Wages payable | 22 | 900 | |

| (To record the wages accrued) | |||||

Table (2)

- Wages expense is an expense account, and it is increased. Hence, debit the wages expense account by $900.

- Wages payable is a liability account, and it is increased. Hence, credit the wages payable account by $900.

| Date | Description |

Post Ref. |

Debit ($) | Credit ($) | |

| 2018 | Depreciation expense-Equipment | 54 | 5,250 | ||

| January | 31 | Accumulated depreciation- Equipment | 17 | 5,250 | |

| (To record the equipment depreciation) | |||||

Table (3)

- Depreciation expense is an expense account, and it is increased. Hence, debit the wages expense account by $5,250.

- Accumulated depreciation is a contra asset account, and it is increased. Hence, credit the accumulated depreciation account by $5,250.

| Date | Description |

Post Ref. |

Debit ($) | Credit ($) | |

| 2018 | Depreciation expense-Truck | 56 | 4,000 | ||

| January | 31 | Accumulated depreciation- Truck | 19 | 4,000 | |

| (To record the truck depreciation) | |||||

Table (4)

- Depreciation expense is an expense account, and it is increased. Hence, debit the wages expense account by $4,000.

- Accumulated depreciation is a contra asset account, and it is increased. Hence, credit the accumulated depreciation account by $4,000.

| Date | Description |

Post Ref. |

Debit ($) | Credit ($) | |

| 2018 | Supplies expense | 55 | 5,150 | ||

| January | 31 | Supplies

|

13 | 5,150 | |

| (To record the supplies used) | |||||

Table (5)

- Supplies expense is an expense account, and it is increased. Hence, debit the supplies expense account by $5,150.

- Supplies are the asset account, and it is increased. Hence, credit the supplies account by $5,150.

| Date | Description |

Post Ref. |

Debit ($) | Credit ($) | |

| 2018 | Insurance expense | 57 | 3,150 | ||

| January | 31 | Prepaid insurance | 14 | 3,150 | |

| (To record the insurance expense) | |||||

Table (6)

- Insurance expense is an expense account, and it is increased. Hence, debit the insurance expense account by $3,150.

- Prepaid insurance is an asset account, and it is decreased. Hence, credit the prepaid insurance account by $3,150.

4.

To prepare: An adjusted trial balance for R interiors, as of January 31, 2018.

Explanation of Solution

Prepare an adjusted trial balance for R interiors, as of January 31, 2018.

| R interiors | |||

| Adjusted Trial Balance | |||

| January 31, 2018 | |||

| Accounts | Account Number | Debit Balances | Credit Balances |

| Cash | 11 | 13,100 | |

| Supplies | 13 | 2,850 | |

| Prepaid Insurance | 14 | 4,350 | |

| Equipment | 16 | 113,000 | |

| Accumulated depreciation- Equipment | 17 | 17,250 | |

| Trucks | 18 | 90,000 | |

| Accumulated depreciation- Trucks | 19 | 31,100 | |

| Accounts payable | 21 | 4,500 | |

| Wages Payable | 22 | 900 | |

| Common Stock | 31 | 30,0 00 | |

| Retained earnings | 32 | 96,400 | |

| Dividends | 33 | 3,000 | |

| Service revenue | 41 | 155,000 | |

| Wages expense | 51 | 72,900 | |

| Rent expense | 52 | 7,600 | |

| Truck Expense | 53 | 5,350 | |

| Depreciation Expense- Equipment | 54 | 5,250 | |

| Supplies expense | 55 | 5,150 | |

| Depreciation Expense- Trucks | 56 | 4,000 | |

| Insurance Expense | 57 | 3,150 | |

| Miscellaneous Expense | 59 | 5,450 | |

| 335,150 | 335,150 | ||

Table (7)

The debit column and credit column of the adjusted trial balance are agreed, both having balance of $335,150.

5.

The net income or net loss of R interiors for the month of January.

Explanation of Solution

The net income of R interiors for the month of January is $46,150.

| R interiors | ||

| Income Statement | ||

| For the year ended January 31, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenue: | ||

| Laundry revenue | $155,000 | |

| Expenses: | ||

| Wages Expense | $72,900 | |

| Rent Expense | 7,600 | |

| Truck Expense | 5,350 | |

| Depreciation Expense-Equipment | 5,250 | |

| Supplies Expense | 5,150 | |

| Depreciation Expense-Trucks | 4,000 | |

| Insurance Expense | 3,150 | |

| Miscellaneous Expense | 5,450 | |

| Total Expenses | 108,850 | |

| Net Income | $46,150 | |

Table (8)

Hence, the net income of R interiors for the year ended January 31, 2018 is $46,150.

To Prepare: The statement of retained earnings for the year ended January 31, 2018.

Explanation of Solution

The statement of retained earnings for the year ended January 31, 2018 is as follows:

| R interiors | ||

| Statement of retained earnings | ||

| For the Year Ended January 30, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Retained earnings, February1, 2017 | $96,400 | |

| Net income | $46,150 | |

| Dividends | (3,000) | |

| Change in retained earnings | 43,150 | |

| Retained earnings, January 31, 2018 | $139,550 | |

Table (9)

Hence, owners’ equity for the year ended January 31, 2018 is $139,550.

To Prepare: The balance sheet of R interiors at January 31, 2018.

Explanation of Solution

Prepare the balance sheet of R interiors at January 31, 2018.

| R interiors | |||

| Balance Sheet | |||

| For the year ended January 31, 2018 | |||

| Assets | |||

| Current Assets: | |||

| Cash | $13,100 | ||

| Supplies | 2,850 | ||

| Prepaid Insurance | 4,350 | ||

| Total Current Assets | $20,300 | ||

| Property, plant and equipment: | |||

| Equipment | $113,000 | ||

| Less: Accumulated Depreciation- Equipment | 17,250 | 95,750 | |

| Trucks | 90,000 | ||

| Less: Accumulated Depreciation- Trucks | 31,100 | 58,900 | |

| Total property, plant, and equipment | 154,650 | ||

| Total Assets | $174,950 | ||

| Liabilities | |||

| Current Liabilities: | |||

| Accounts Payable | $4,500 | ||

| Wages Payable | 900 | ||

| Total Liabilities | $5,400 | ||

| Stock holder’s Equity | |||

| Common Stock | 30,000 | ||

| Retained earnings | 139,550 | ||

| Total Stock holder’s Equity | 169,550 | ||

| Total Liabilities and Owners’ Equity | $174,950 | ||

Table (10)

It is one of the financial statements, which shows the assets, liabilities, and stockholders’ equity of a company at a particular point of time. It reveals the financial health of a company. Thus, this statement is also called as the Statement of Financial Position. It helps the users to know about the creditworthiness of a company as to whether the company has enough assets to pay off its liabilities.

Therefore, the total assets and total liabilities plus stockholders’ equity of R interiors at January 31, 2018 is $174,950.

6.

To Journalize: The closing entries for R interiors.

Explanation of Solution

Closing entry for revenue and expense accounts:

| Journal Page 27 | ||||

| Date | Accounts title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 31, 2018 | Service Revenue | 41 | 155,000 | |

| Income Summary | 34 | 155,000 | ||

| (To record the closure of revenues account ) | ||||

| January 31 | Income Summary | 34 | 108,850 | |

| Wages Expense | 51 | 72,900 | ||

| Rent Expense | 52 | 7,600 | ||

| Truck Expense | 53 | 5,350 | ||

| Depreciation Expense-Equipment | 54 | 5,250 | ||

| Supplies Expense | 55 | 5,150 | ||

| Depreciation Expense-Truck | 56 | 4,000 | ||

| Insurance Expense | 57 | 3,150 | ||

| Miscellaneous Expense | 59 | 5,450 | ||

| (To close the revenues and expenses account. Then the balance amount are transferred to income summary account) | ||||

| January 31 | Income Summary | 34 | 46,150 | |

| Retained earnings | 32 | 46,150 | ||

| (To record the closure of net income from income summary to retained earnings) | ||||

| January 31 | Retained earnings | 32 | 3,000 | |

| Dividends | 33 | 3,000 | ||

| (To record the closure of dividend to retained earnings) | ||||

Table (11)

Service revenue account has a normal credit balance of $155,000 in total, now to close this account, the service revenue account must be debited with $155,000 and, income summary account must be credited with $155,000.

- In this closing entry, the fees earned account balance is being transferred to the income summary account, to bring the revenues account balance to zero.

- Thereby, the income summary account balance gets increased by $155,000 and, the revenue account balance gets decreased by $155,000.

All expenses accounts have a normal debit balance, the total of expenses are $108,850 have to be closed by transferring these account balances to the income summary account. All expenses account must be credited, and the income summary account must be debited with $108,850.

- In this closing entry, all the expenses account balances are transferred to the income summary account, to bring the expenses account balances to zero.

- Thereby, both the income summary account, and the expenses account balances get decreased by $108,850.

Determined amount balance of income summary is $46,150, which has to be closed by debiting the income summary account with $46,150, and crediting the retained earnings account with $46,150.

- In this closing entry, the income summary account balance is being transferred to the retained earnings account, to bring the income summary account balance to zero.

- Thereby, the income summary account gets decreased, and the retained earnings account balance gets increased by $46,150.

Dividends account has a normal debit balance of $3,000, now to close this account, retained earnings account must be debited with $3,000 and, dividend account must be credited with $3,000.

- In this closing entry, the dividend account balance is being transferred to the retained earnings account, to bring the dividend account balance to zero.

- Thereby, the retained earnings account balance gets increased by $3,000 and, the dividend account balance gets decreased by $3,000.

7.

To prepare: The post–closing trial balance of R interiors for the month ended January 31, 2018.

Explanation of Solution

Prepare a post–closing trial balance of R interiors for the month ended January 31, 2018 as follows:

|

R interiors Post-closing Trial Balance January 31, 2018 |

|||

| Particulars |

Account Number |

Debit $ | Credit $ |

| Cash | 11 | 13,100 | |

| Supplies | 13 | 2,850 | |

| Prepaid insurance | 14 | 4,350 | |

| Equipment | 16 | 113,000 | |

| Accumulated depreciation- Equipment | 17 | 17,250 | |

| Trucks | 18 | 90,000 | |

| Accumulated depreciation- Trucks | 19 | 31,100 | |

| Accounts payable | 21 | 4,500 | |

| Wages payable | 22 | 900 | |

| Common Stock | 31 | 30,000 | |

| Retained earnings | 32 | 139,550 | |

| Total | 223,300 | 223,300 | |

Table (12)

The debit column and credit column of the post–closing trial balance are agreed, both having balance of $223,300

Want to see more full solutions like this?

Chapter 4 Solutions

Corporate Financial Accounting

- Balance Sheet without Amounts The following is an alphabetical list of all of While Limnology Companys adjusted trial balance accounts as of December 31, 2019: Required: Prepare White Limnologys balance sheet (without amounts) in proper format.arrow_forwardAdjusting Entries The following partial list of accounts and account balances has been taken from the trial balance and the adjusted trial balance of Baye Company: Required: Next Level Prepare the adjusting entry that caused the change in each account balance.arrow_forwardA trial balance: lists only revenue and expense accounts; lists all accounts and their balances. will help detect omitted journal entries. detects all errors that could be made during the journalizing or posting steps of the accounting cycle.arrow_forward

- Prepare journal entries to record the following transactions. Create a T-account for Unearned Revenue, post any entries that affect the account, tally ending balance for the account (assume Unearned Revenue beginning balance of $12,500). A. May 1, collected an advance payment from client, $15,000 B. December 31, remaining unearned advances, $7,500arrow_forwardCorrection of Balance Sheet On December 31, 2019, Stevens Companys bookkeeper prepared the following balance sheet with items erroneously classified. Required: Next Level You determine that the account balances listed on the balance sheet are correct but, in certain cases, incorrectly classified. Prepare a properly classified balance sheet for Stevens as of December 31, 2019.arrow_forwardThe unadjusted trial balance of PS Music as of July 31, 2018, along with the adjustment data for the two months ended July 31, 2018, are shown in Chapter 3. Based upon the adjustment data, the following adjusted trial balance was prepared: PS Music Adjusted Trial Balance July 31, 2018 Account No. Debit Balances Credit Balances Cash................................................. 11 9,945 Accounts Receivable................................... 12 4,150 Supplies.............................................. 14 275 Prepaid Insurance..................................... 15 2,475 Office Equipment..................................... 17 7,500 Accumulated DepreciationOffice Equipment.......... 18 50 Accounts Payable..................................... 21 8,350 Wages Payable........................................ 22 140 Unearned Revenue.................................... 23 3,600 Common Stock....................................... 31 9,000 Dividends............................................ 33 1,750 Fees Earned........................................... 41 21,200 Music Expense........................................ 54 3,610 Wages Expense....................................... 50 2,940 Office Rent Expense................................... 51 2,550 Advertising Expense................................... 55 1,500 Equipment Rent Expense.............................. 52 1,375 Utilities Expense...................................... 53 1,215 Supplies Expense...................................... 56 925 Insurance Expense.................................... 57 225 Depreciation Expense................................. 58 50 Miscellaneous Expense................................ 59 1,855 42,340 42,340 Instructions 1. (Optional) Using the data from Chapter 3, prepare an end-of-period spreadsheet. 2. Prepare an income statement, a retained earnings statement, and a balance sheet. 3. Journalize and post the closing entries. The retained earnings account is #33 and the income summary account is #34 in the ledger of PS Music. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. 4. Prepare a post-dosing trial balance.arrow_forward

- For each of the following accounts, identify whether it would be closed at year-end (yes or no) and on which financial statement the account would be reported (Balance Sheet, Income Statement, or Retained Earnings Statement). A. Accounts Payable B. Accounts Receivable C. Cash D. Dividends E. Fees Earned Revenue F. Insurance Expense G. Prepaid Insurance H. Suppliesarrow_forwardADJUSTING, CLOSING, AND REVERSING ENTRIES Prepare entries for (a), (b), and (c) listed below using two methods. First, prepare the entries without making a reversing entry. Second, prepare the entries with the use of a reversing entry. Use T-accounts to assist your analysis. (a)Wages paid during 20-1 are 20,080. (b)Wages earned but not paid (accrued) as of December 31, 20-1, are 280. (c)On January 3, 20-2, payroll of 840 is paid, which includes the 280 of wages earned but not paid in December.arrow_forwardUNCOLLECTIBLE ACCOUNTSALLOWANCE METHOD Lewis Warehouse used the allowance method to record the following transactions, adjusting entries, and closing entries during the year ended December 31, 20--: Selected accounts and beginning balances on January 1, 20--, are as follows: REQUIRED 1. Open the three selected general ledger accounts. 2. Enter the transactions and the adjusting and closing entries in a general journal (page 6). After each entry, post to the appropriate selected accounts. 3. Determine the net realizable value as of December 31, 20--.arrow_forward

- POSTING ADJUSTING ENTRIES Two adjusting entries are in the following general journal. Post these adjusting entries to the four general ledger accounts. The following account numbers were taken from the chart of accounts: 141, Supplies; 219, Wages Payable; 511, Wages Expense; and 523, Supplies Expense. If you are not using the working papers that accompany this text, enter the following balances before posting the entries: Supplies, 200 Debit; and Wages Expense, 1,200 Debit.arrow_forwardPrepare an adjusted trial balance from the adjusted account balances; solve for the one missing account balance: Cash (assume accounts have normal balances).arrow_forwardWhich transaction would require adjustment at December 31? a. The sale of merchandise for cash on December 30. b. Common stock was issued on November 30. c. Salaries were paid to employees on December 31 for work performed in December. d. A I-year insurance policy (which took effect immediately) was purchased on December 1.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning