Concept explainers

Cost Flows

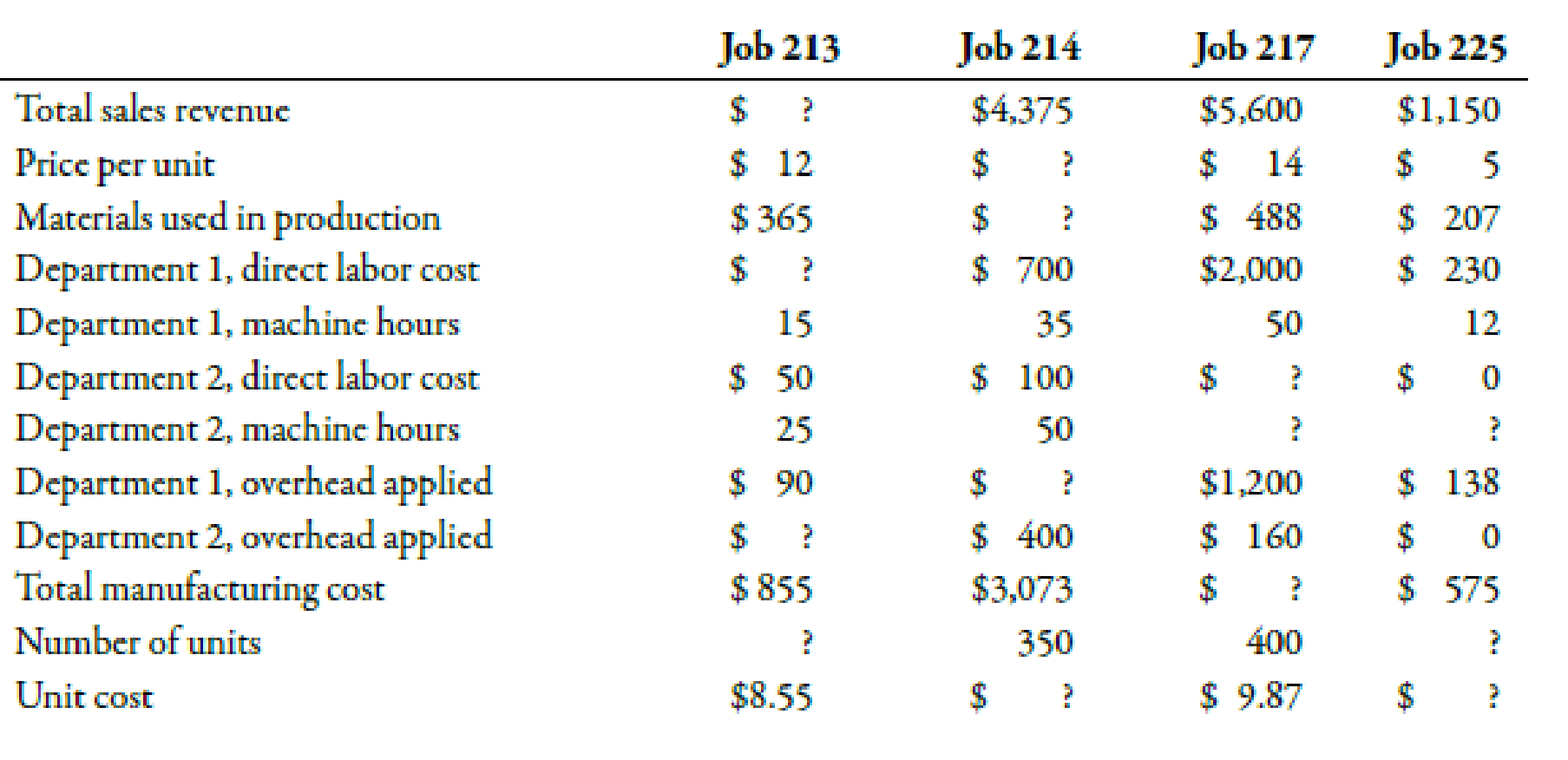

Consider the following independent jobs.

Direct labor wages average $10 per hour in each department.

Required:

Fill in the missing data for each job.

Complete the table by finding the missing amounts.

Explanation of Solution

Cost Flow:

A method which describes the way of accounting costs from the time of their occurrence to the time of their recognition as an expense on the income statement is known as cost flow.

| Job 213 | Job 214 | Job 217 | Job 225 | |

| Total sales revenue | $1,200 | $4,375 | $5,600 | $1,150 |

| Price per unit | $12 | $8.78 | $14 | $5 |

| Materials used in production | $365 | $1,453 | $488 | $207 |

| Department 1, direct labor cost | $150 | $700 | $2,000 | $230 |

| Department 1, machine hours | 15 | 35 | 50 | 12 |

| Department 2, direct labor cost | $50 | $100 | $100 | $0 |

| Department 2, machine hours | 25 | 50 | 20 | 0 |

| Department 1, overhead applied | $90 | $420 | $1,200 | $138 |

| Department 2, overhead applied | $200 | $400 | $160 | $0 |

| Total manufacturing cost | $855 | $3,073 | $3,948 | $575 |

| Number of units | 100 | 350 | 400 | 230 |

| Unit cost | $8.55 | $12.50 | $9.87 | $2.50 |

Table (1)

Working Note:

1. Job 213:

Calculation of number of units

Calculation of total sales revenue:

Calculation of department 1, direct labor hours:

Calculation of department 1, direct labor cost:

Calculation of department 2, overhead applied:

2. Job 214:

Calculation of price per unit:

Calculation of department 1, direct labor hours:

Calculation of department 1, overhead applied:

Calculation of material used:

Calculation of unit cost:

3. Job 217:

Calculation of department 2, machine hours:

Calculation of manufacturing cost:

Calculation of department 2, labor cost:

4. Job 225:

Calculation of number of units:

Calculation of unit cost:

Calculation of department 2, machine hours:

Want to see more full solutions like this?

Chapter 4 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Minor Co. has a job order cost system and applies overhead based on departmental rates. Service Department 1 has total budgeted costs of 168,000 for next year. Service Department 2 has total budgeted costs of 280,000 for next year. Minor allocates service department costs solely to the producing departments. Service Department 1 cost is allocated to producing departments on the basis of machine hours. Service Department 2 cost is allocated to producing departments on the basis of direct labor hours. Producing Department 1 has budgeted 8,000 machine hours and 12,000 direct labor hours. Producing Department 2 has budgeted 2,000 machine hours and 12,000 direct labor hours. What is the total cost allocation from the two service departments to Producing Department 1? a. 173,600 b. 140,000 c. 134,400 d. 274,400arrow_forwardRipley, Inc., costs products using a normal costing system. The following data are available for last year: Overhead is applied on the basis of direct labor hours. Required: 1. What was the predetermined overhead rate? 2. What was the applied overhead for last year? 3. Was overhead over- or underapplied, and by how much? 4. What was the total cost per unit produced (carry your answer to four significant digits)?arrow_forwardRefer to the data in Exercise 7.20. The company has decided to use the sequential method of allocation instead of the direct method. The support departments are ranked in order of highest cost to lowest cost. Required: 1. Allocate the overhead costs to the producing departments using the sequential method. (Take allocation ratios out to four significant digits. Round allocated costs to the nearest dollar.) 2. Using machine hours, compute departmental overhead rates. (Round the overhead rates to the nearest cent.)arrow_forward

- Please use the information from this problem for these calculations. After grouping cost pools and estimating overhead and activities, Box Springs determined these rates: Box Springs estimates there will be four orders in the next year, and those jobs will involve: What is the total cost of the jobs?arrow_forwardRefer to the data in Exercise 7.18. When the capacity of the HR Department was originally established, the normal usage expected for each department was 20,000 direct labor hours. This usage is also the amount of activity planned for the two departments in Year 1 and Year 2. Required: 1. Allocate the costs of the HR Department using the direct method and assuming that the purpose is product costing. 2. Allocate the costs of the HR Department using the direct method and assuming that the purpose is to evaluate performance.arrow_forwardLansing. Inc., provided the following data for its two producing departments: Machine hours are used to assign the overhead of the Molding Department, and direct labor hours are used to assign the overhead of the Polishing Department. There are 30,000 units of Form A produced and sold and 50,000 of Form B. Required: 1. Calculate the overhead rates for each department. 2. Using departmental rates, assign overhead to live two products and calculate the overhead cost per unit. How does this compare with the plantwide rate unit cost, using direct labor hours? 3. What if the machine hours in Molding were 1,200 for Form A and 3,800 for Form B and the direct labor hours used in Polishing were 5,000 and 15,000, respectively? Calculate the overhead cost per unit for each product using departmental rates, and compare with the plantwide rate unit costs calculated in Requirement 2. What can you conclude from this outcome?arrow_forward

- Please use the information from this problem for these calculations. After grouping cost pools and estimating overhead and activities, Box Springs determined these rates: It estimates there will be five orders in the next year, and those jobs will involve: What is the total cost of the jobs?arrow_forwardDetermining job costcalculation of predetermined rate for applying overhead by direct labor cost and direct labor hour methods Beemer Products Inc. has its factory divided into three departments, with individual factory overhead rates for each department. In each department, all the operations are sufficiently alike for the department to be regarded as a cost center. The estimated monthly factory overhead for the departments is as follows: Forming, 64,000; Shaping, 36,000; and Finishing, 10,080. The estimated production data include the following: The job cost ledger shows the following data for X6, which was completed during the month: Required: Determine the cost of X6. Assume that the factory overhead is applied to production orders, based on the following: 1. Direct labor cost 2. Direct labor hours (Hint: You must first determine overhead rates for each department, rounding rates to the nearest cent.)arrow_forwardJob order cost sheets show the following costs assigned to each job: The company assigns overhead at $1.25 for each direct labor dollar spent. What is the total cost for each of the jobs?arrow_forward

- The management of Gwinnett County Chrome Company, described in Problem 1A, now plans to use the multiple production department factory overhead rate method. The total factory overhead associated with each department is as follows: Instructions 1. Determine the multiple production department factory overhead rates, using direct labor hours for the Stamping Department and machine hours for the Plating Department. 2. Determine the product factory overhead costs, using the multiple production department rates in (1).arrow_forwardA manufacturing company has two service and two production departments. Building Maintenance and Factory Office are the service departments. The production departments are Assembly and Machining. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The building maintenance department services all departments of the company, and its costs are allocated using floor space occupied, while factory office costs are allocable to Assembly and Machining on the basis of direct labor hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardNutts management is very concerned about the cost of overhead on its jobs. When jobs are complete, overhead costs should be between 15% and 20% of total costs. For example, the labor cost on Job 8958 is 25% of total costs, higher than the norm. Open Job 8961 and click the Chart sheet tab. A pie chart appears showing the cost components on that job. Record the labor cost percentage in the space provided. Repeat this for each of the jobs worked on in August. Did Nutt maintain good cost control on all its jobs? Explain. Worksheet. During September, Job 8963 required two additional material requisitions to complete the job. Open JOB8963 and modify the job cost sheet to include an area for four direct material requisition entries instead of three. Then enter the following two materials requisitions onto the worksheet: Preview the printout to make sure it will print neatly on one page, and then print the worksheet. Save the completed worksheet as JOBT. Chart. Open JOB8964 and click the Chart sheet tab. Prepare a bar chart for JOB8964 showing the amount of material, labor, and overhead required to complete the job. Use the Chart Data Table found in rows 4246 as a basis for preparing the chart. Enter your name somewhere on the chart. Save the file again as J0B8964. Print the chart.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning