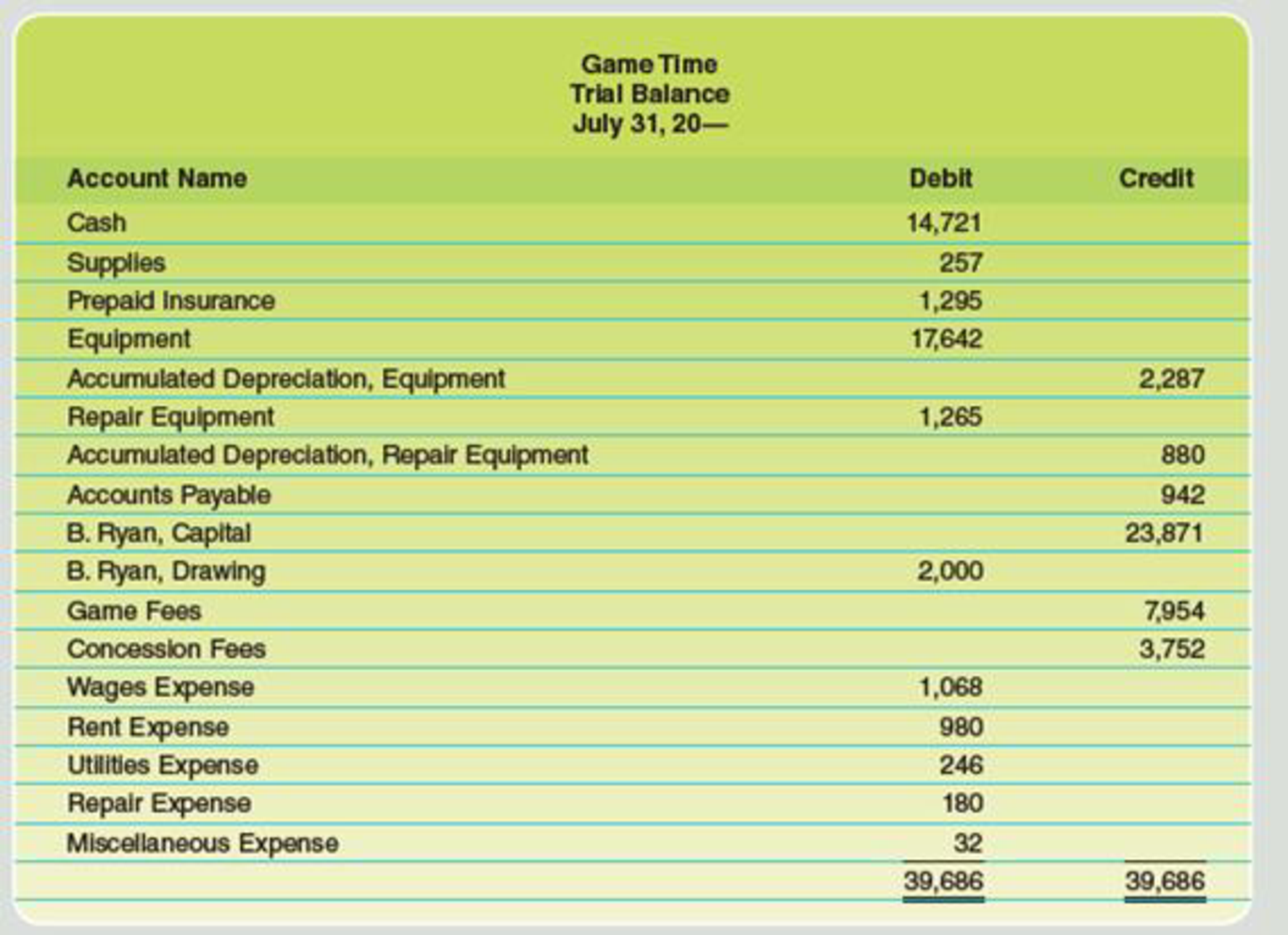

Concept explainers

The

Data for month-end adjustments are as follows:

- Expired or used-up insurance, $480.

Depreciation expense on equipment, $850.- Depreciation expense on repair equipment, $120.

- Wages accrued or earned since the last payday, $525 (owed and to be paid on the next payday).

- Supplies used, $70.

Required

- Complete a work sheet for the month. (Skip this step if using CLGL.)

- Journalize the

adjusting entries . - If using CLGL prepare an adjusted trial balance.

- Prepare an income statement, a statement of owner’s equity, and a balance sheet. Assume that no additional investments were made during July.

*If you are using CLGL, use the year 2020 when recording transactions and preparing reports.

1.

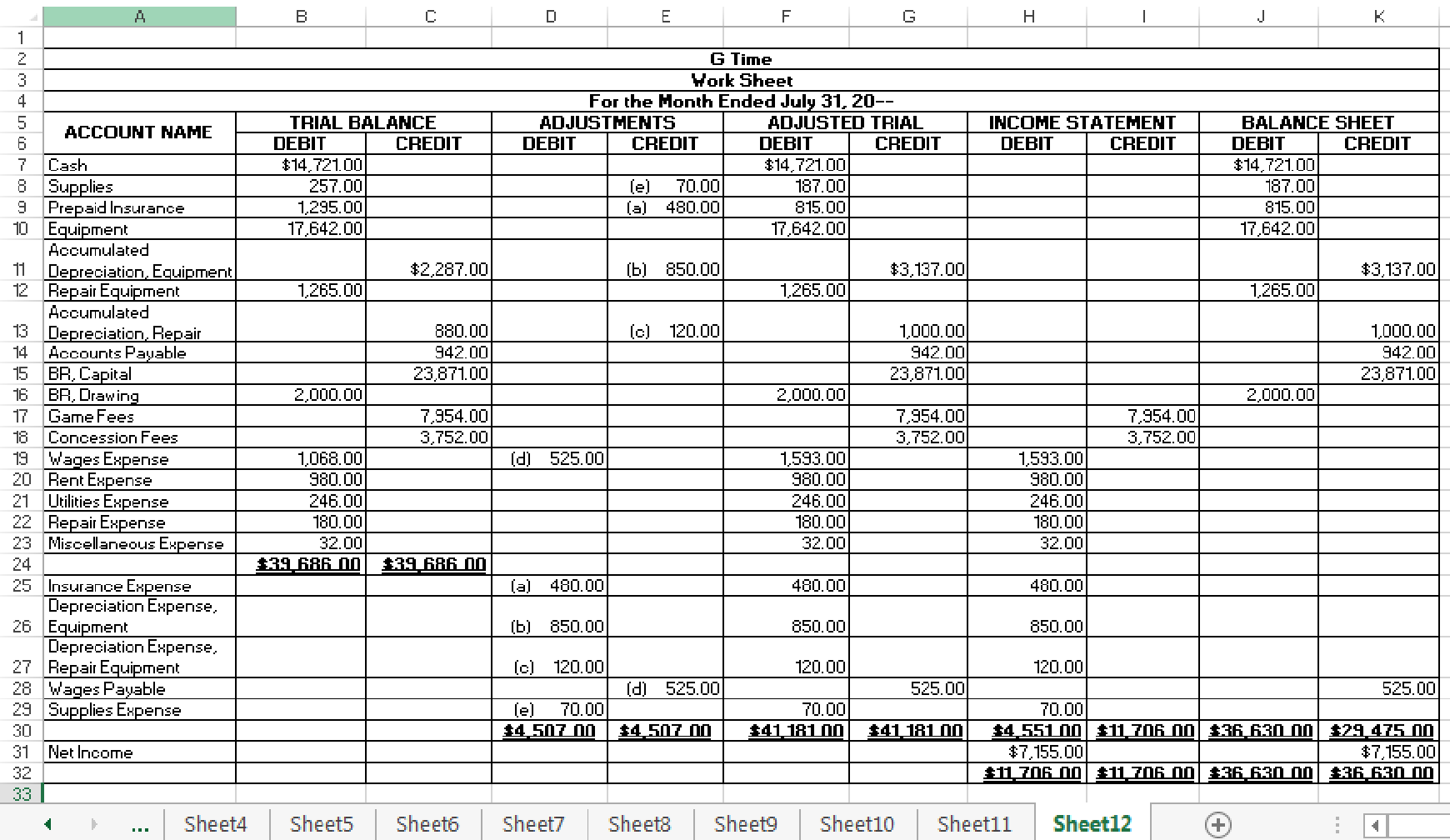

Indicate the given adjustments and complete the worksheet for G Time for the month ended July 31, 20--.

Explanation of Solution

Worksheet: Worksheet is an accounting tool that help accountants to record adjustments and up-date balances required to prepare financial statements. Worksheet is a central place where trial balance, adjustments, adjusted trial balance, income statement, and balance sheet are presented.

Indicate the given adjustments and complete the worksheet for G Time for the month ended July 31, 20--.

Table (1)

2.

Prepare adjusting journal entries for G Time.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and owners’ or stockholders’ equity) to maintain the records according to accrual basis principle and matching concept.

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare adjusting journal entries for G Time.

Adjusting entry for the prepaid insurance:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| July | 31 | Insurance Expense | 480 | |||

| Prepaid Insurance | 480 | |||||

| (Record part of prepaid insurance expired) | ||||||

Table (2)

Description:

- Insurance Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Prepaid Insurance is an asset account. Since amount of insurance is expired, asset account decreased, and a decrease in asset is credited.

Adjusting entry for the depreciation expense, equipment:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| July | 31 | Depreciation Expense, Equipment | 850 | |||

| Accumulated Depreciation, Equipment | 850 | |||||

| (Record depreciation expense) | ||||||

Table (3)

Description:

- Depreciation Expense, Equipment is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Accumulated Depreciation, Equipment is a contra-asset account, and contra-asset accounts would have a normal credit balance, hence, the account is credited.

Adjusting entry for the depreciation expense, repair equipment:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| July | 31 | Depreciation Expense, Repair Equipment | 120 | |||

| Accumulated Depreciation, Repair Equipment | 120 | |||||

| (Record depreciation expense) | ||||||

Table (4)

Description:

- Depreciation Expense, Repair Equipment is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Accumulated Depreciation, Repair Equipment is a contra-asset account, and contra-asset accounts would have a normal credit balance, hence, the account is credited.

Adjusting entry for the wages expense:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| July | 31 | Wages Expense | 525 | |||

| Wages Payable | 525 | |||||

| (Record accrued wages expenses) | ||||||

Table (5)

Description:

- Wages Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Wages Payable is a liability account. Since amount of payables has increased, liability decreased, and an increase in liability is credited.

Adjusting entry for the supplies expense:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| July | 31 | Supplies Expense | 70 | |||

| Supplies | 70 | |||||

| (Record part of supplies consumed) | ||||||

Table (6)

Description:

- Supplies Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Supplies is an asset account. Since amount of supplies is used, asset account decreased, and a decrease in asset is credited.

3.

Prepare an adjusted trial balance for G Time at July 31, 20--.

Explanation of Solution

Adjusted trial balance: Adjusted trial balance is a summary of all the ledger accounts, and it contains the balances of all the accounts after the adjustment entries are journalized, and posted.

Prepare an adjusted trial balance for G Time at July 31, 20--.

| G Time | |||

| Adjusted Trial Balance | |||

| July 31, 20-- | |||

| Particulars | AccountNo. | Debit $ | Credit $ |

| Cash | $14,721.00 | ||

| Supplies | 187.00 | ||

| Prepaid Insurance | 815.00 | ||

| Equipment | 17,642.00 | ||

| Accumulated Depreciation, Equipment | $3,137.00 | ||

| Repair Equipment | 1,265.00 | ||

| Accumulated Depreciation, Repair Equipment | 1,000.00 | ||

| Accounts payable | 942.00 | ||

| Wages payable | 525.00 | ||

| BR, Capital | 23,871.00 | ||

| BR, Drawing | 2,000.00 | ||

| Game Fees | 7,954.00 | ||

| Concession Fees | 3,752.00 | ||

| Depreciation Expense, Equipment | 850.00 | ||

| Depreciation Expense, Repair Equipment | 120.00 | ||

| Wages Expense | 1,593.00 | ||

| Rent Expense | 980.00 | ||

| Supplies Expense | 70.00 | ||

| Insurance Expense | 480.00 | ||

| Utilities Expense | 246.00 | ||

| Repair Expense | 180.00 | ||

| Miscellaneous Expense | 32.00 | ||

| $41,181.00 | $41,181.00 | ||

Table (7)

The debit column and credit column of the adjusted trial balance are agreed, both having the balance of $41,181.

4.

Prepare income statement, statement of owners’ equity, and balance sheet for G Time.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations, and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement of G Time for the month ended July 31, 20--.

| G Time | ||

| Income Statement | ||

| For the Month Ended July 31, 20-- | ||

| Revenues: | ||

| Game Fees | $7,954 | |

| Concession Fees | 3,752 | |

| Total Revenue | $11,706 | |

| Expenses: | ||

| Wages Expense | $1,593 | |

| Rent Expense | 980 | |

| Depreciation Expense, Equipment | 850 | |

| Depreciation Expense, Repair Equipment | 120 | |

| Supplies Expense | 70 | |

| Insurance Expense | 480 | |

| Utilities Expense | 246 | |

| Repair Expense | 180 | |

| Miscellaneous Expense | 32 | |

| Total expenses | 4,551 | |

| Net income | $7,155 | |

Table (8)

Statement of owners’ equity: This statement reports the beginning owner’s equity and all the changes which led to ending owners’ equity. Additional capital, net income from income statement is added to, and drawings is deducted from beginning owner’s equity to arrive at the end result, ending owner’s equity.

Prepare a statement of owners’ equity for G Time for the month ended July 31, 20--.

| G Time | ||

| Statement of Owners’ Equity | ||

| For the Month Ended July 31, 20-- | ||

| BR, Capital, July 1, 20-- | $23,871 | |

| Investments during July | $0 | |

| Net income for July | 7,155 | |

| 7,155 | ||

| Less: Withdrawals for July | 2,000 | |

| Increase in capital | 5,155 | |

| BR, Capital, July 31, 20-- | $29,026 | |

Table (9)

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and owners (owners’ equity) over those resources. The resources of the company are assets which include money contributed by owners and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and owners’ equity.

Prepare the balance sheet for G Time as at July 31, 20--.

| G Time | ||

| Balance Sheet | ||

| July 31, 20-- | ||

| Assets | ||

| Cash | $14,721 | |

| Supplies | 187 | |

| Prepaid Insurance | 815 | |

| Equipment | $17,642 | |

| Less: Accumulated Depreciation | 3,317 | 14,505 |

| Repair Equipment | $1,265 | |

| Less: Accumulated Depreciation | 1,000 | 265 |

| Total Assets | $30,493 | |

| Liabilities | ||

| Accounts Payable | $942 | |

| Wages Payable | 525 | |

| Total Liabilities | $1,467 | |

| Owners’ Equity | ||

| BR, Capital | 29,026 | |

| Total Liabilities and Owners’ Equity | $30,493 | |

Table (10)

Want to see more full solutions like this?

Chapter 4 Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Intermediate Accounting

Financial Accounting: Information for Decisions

Financial Accounting, Student Value Edition (4th Edition)

Cost Accounting (15th Edition)

Auditing and Assurance Services (16th Edition)

- The trial balance for Wilson Financial Services on January 31 is as follows: Data for month-end adjustments are as follows: a. Expired or used-up insurance, 750. b. Depreciation expense on equipment, 300. c. Wages accrued or earned since the last payday, 1,055 (owed and to be paid on the next payday). d. Supplies used, 535. Required 1. Complete a work sheet for the month. (Skip this step if using CLGL.) 2. Journalize the adjusting entries. 3. If using CLGL, prepare an adjusted trial balance. 4. Prepare an income statement, a statement of owners equity, and a balance sheet. Assume that no additional investments were made during January.arrow_forwardThe trial balance of The New Decors for the month ended September 30 is as follows: Data for the adjustments are as follows: a. Expired or used-up insurance, 425. b. Depreciation expense on equipment, 2,750. c. Wages accrued or earned since the last payday, 475 (owed and to be paid on the next payday). d. Supplies remaining at end of month, 215. Required 1. Complete a work sheet. (Skip this step if using GL.) 2. Journalize the adjusting entries. If you are using CLGL, use the year 2020 when recording transactions.arrow_forwardThe trial balance for Benner Hair Salon on March 31 is as follows: Data for month-end adjustments are as follows: a. Expired or used-up insurance, 300. b. Depreciation expense on equipment, 500. c. Wages accrued or earned since the last payday, 235 (owed and to be paid on the next payday). d. Supplies remaining at the end of the month, 65. Required 1. Complete a work sheet for the month. (Skip this step if using CLGL.) 2. Journalize the adjusting entries. 3. Prepare an income statement, a statement of owners equity, and a balance sheet. Assume that no additional investments were made during March.arrow_forward

- A partial work sheet for Marges Place is shown below. Prepare the following adjustments on this work sheet for the month ended June 30, 20. a. Expired or used-up insurance, 450. b. Depreciation expense on equipment, 750. c. Wages accrued or earned since the last payday, 380 (owed and to be paid on the next payday). d. Supplies used, 110.arrow_forwardThe trial balance of Clayton Cleaners for the month ended September 30 is as follows: Data for the adjustments are as follows: a. Expired or used-up insurance, 800. b. Depreciation expense on equipment, 2,700. c. Wages accrued or earned since the last payday, 585 (owed and to be paid on the next payday). d. Supplies remaining at the end of month, 230. Required 1. Complete a work sheet. (Skip this step if using CLGL.) 2. Journalize the adjusting entries. If you are using CLGL, use the year 2020 when recording transactions.arrow_forwardThe account balances of Bryan Company as of June 30, the end of the current fiscal year, are as follows: Required 1. Data for the adjustments are as follows: a. Expired or used up insurance, 495 b. Depreciation expense on equipment, 670. c. Depreciation expense on the van, 1,190. d. Salary accrued (earned) since the last payday, 540 (owed and to be paid on the next payday). e. Supplies used during the period, 97. Your instructor may want you to use a work sheet for these adjustments. 2. Journalize the adjusting entries. 3. Prepare an income statement. 4. Prepare a statement of owners equity. Assume that there was an additional investment of 2,000 on June 10. 5. Prepare a balance sheet. 6. Journalize the closing entries using the four steps in the correct sequence. Check Figure Net Income, 13,627arrow_forward

- At the end of April, the first month of operations, the following selected data were taken from the financial statements of Shelby Crawford, an attorney: In preparing the financial statements, adjustments for the following data were overlooked: Supplies used during April, 2,750. Unbilled fees earned at April 30, 23,700. Depreciation of equipment for April, 1,800. Accrued wages at April 30, 1,400. Instructions 1. Journalize the entries to record the omitted adjustments. 2. Determine the correct amount of net income for April and the total assets, liabilities, and owners equity at April 30. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the following. The adjustment for supplies used is presented as an example.arrow_forwardAt the end of August, the first month of operations, the following selected data were taken from the financial statements of Tucker Jacobs, an attorney: In preparing the financial statements, adjustments for the following data were overlooked: Unbilled fees earned at August 31, 31,900. Depreciation of equipment for August, 7,500. Accrued wages at August 31, 5,200. Supplies used during August, 3,000. Instructions 1. Journalize the entries to record the omitted adjustments. 2. Determine the correct amount of net income for August and the total assets, liabilities, and owners equity at August 31. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the following. The first adjustment is presented as an example.arrow_forwardComplete the work sheet for Ramey Company, dated December 31, 20, through the adjusted trial balance using the following adjustment information: a. Expired or used-up insurance, 460. b. Depreciation expense on equipment, 870. (Remember to credit the Accumulated Depreciation account for equipment, not Equipment.) c. Wages accrued or earned since the last payday, 120 (owed and to be paid on the next payday). d. Supplies remaining, 80.arrow_forward

- The unadjusted trial balance of La Mesa Laundry at August 31, 2016, the end of the fiscal year, follows: The data needed to determine year-end adjustments are as follows: a. Wages accrued but not paid at August 31 are 2,200. b. Depreciation of equipment during the year is 8,150. c. Laundry supplies on hand at August 31 are 2,000. d. Insurance premiums expired during the year are 5,300. Instructions 1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as Aug. 31 Bal. In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, Insurance Expense, and Income Summary. 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed. 3. Journalize and post the adjusting entries. Identify the adjustments by Adj. and the new balances as Adj. Bal. 4. Prepare an adjusted trial balance. 5. Prepare an income statement, a statement of owners equity (no additional investments were made during the year), and a balance sheet. 6. Journalize and post the closing entries. Identify the closing entries by Clos. 7. Prepare a post-closing trial balance.arrow_forwardThe following accounts appear in the ledger of Celso and Company as of June 30, the end of this fiscal year. The data needed for the adjustments on June 30 are as follows: ab.Merchandise inventory, June 30, 54,600. c.Insurance expired for the year, 475. d.Depreciation for the year, 4,380. e.Accrued wages on June 30, 1,492. f.Supplies on hand at the end of the year, 100. Required 1. Prepare a work sheet for the fiscal year ended June 30. Ignore this step if using CLGL. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. 7. Journalize the reversing entry as of July 1, for the wages that were accrued in the June adjusting entry. Check Figure Net income, 14,066arrow_forwardA partial work sheet for Marge's Place is shown below. Prepare the following adjustments on this work sheet for the month ended June 30, 20--. Expired or used-up insurance, $570. Depreciation expense on equipment, $720 (Remember to credit the Accumulated Depreciation account for equipment, not Equipment). Wages accrued or earned since the last payday, $1,410 (owed and to be paid on the next payday). Supplies used, $110. If no amount is required, enter 0. Marge's Place Work Sheet For Month Ended June 30, 20-- TRIAL BALANCE ADJUSTMENTS ACCOUNT NAME DEBIT CREDIT DEBIT CREDIT 1 Cash 4,577 1 2 Supplies 250 2 3 Prepaid Insurance 1,800 3 4 Equipment 4,880 4 5 Accumulated Depreciation, Equipment 1,350 5 6 Accounts Payable 2,539 6 7 M. Benson, Capital 4,751 7 8 M. Benson, Drawing 2,000 8 9 Income from Services 6,937 9 10 Rent Expense 1,086 10 11 Supplies Expense…arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning