Concept explainers

Ledger accounts,

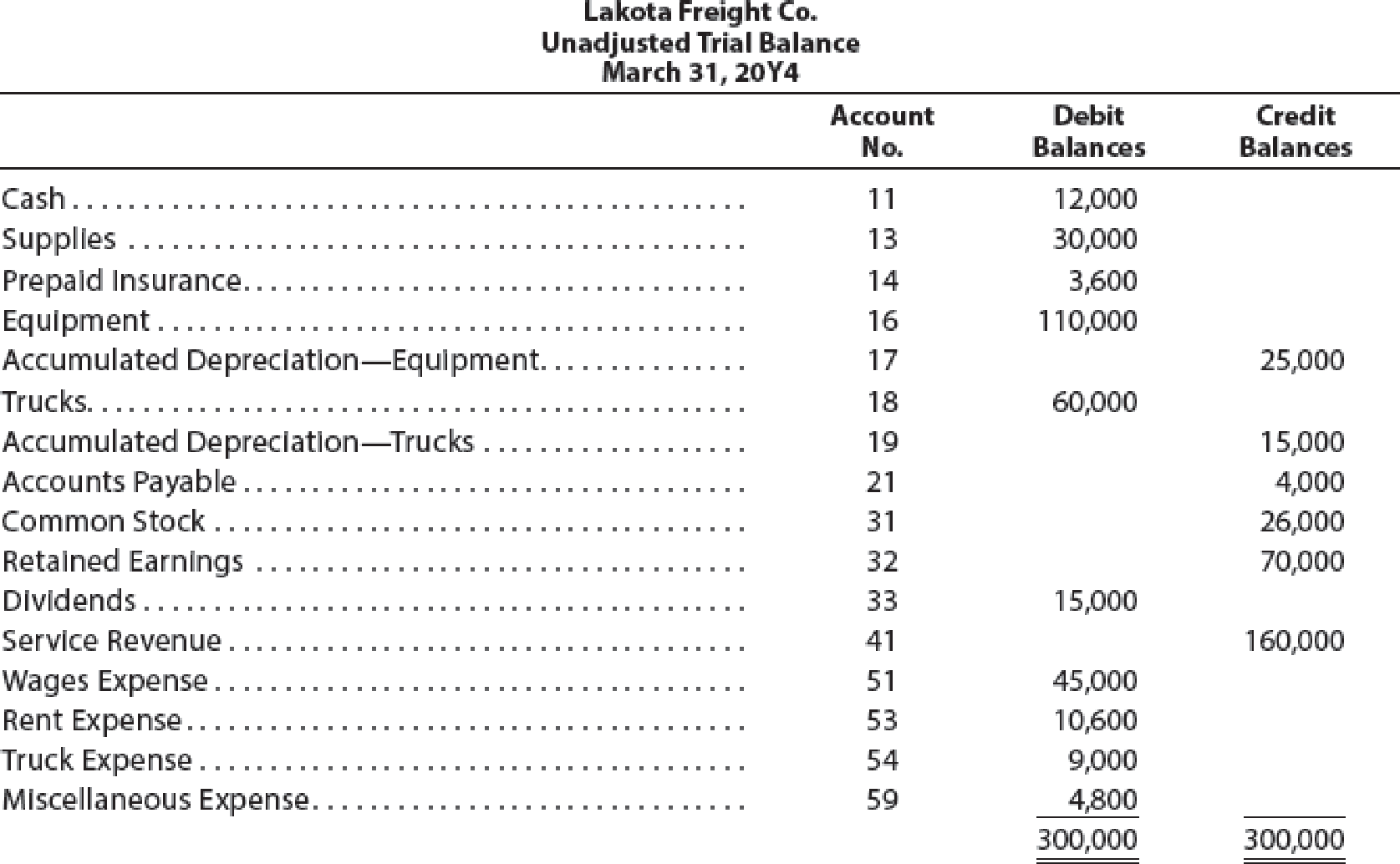

The unadjusted

The data needed to determine year-end adjustments are as follows:

- (a) Supplies on hand at March 31 are $7,500.

- (b) Insurance premiums expired during year are $1,800.

- (c)

Depreciation of equipment during year is $8,350. - (d) Depreciation of trucks during year is $6,200.

- (e) Wages accrued but not paid at March 31 are $600.

Instructions

- 1. For each account listed in the trial balance, enter the balance in the appropriate Balance column of a four-column account and place a check mark (✓) in the Posting Reference column.

- 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (3) as needed.

- 3. Journalize and post the adjusting entries, inserting balances in the accounts affected. Record the adjusting entries on Page 26 of the journal. The following additional accounts from Lakota Freight Co.’s chart of accounts should be used: Wages Payable, 22; Supplies Expense, 52; Depreciation Expense—Equipment, 55; Depreciation Expense—Trucks, 56; Insurance Expense, 57.

- 4. Prepare an adjusted trial balance.

- 5. Prepare an income statement, a statement of stockholders’ equity, and a balance sheet. During the year ended March 31, 20Y4, additional common stock of $6,000 was issued.

- 6. Journalize and

post the closing entries. Record the closing entries on Page 27 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. - 7. Prepare a post-closing trial balance.

1, 3 and 6.

Prepare the T-accounts.

Explanation of Solution

T-account:

T-account is the form of the ledger account, where the journal entries are posted to this account. It is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.

The components of the T-account are as follows:

a) The title of the account

b) The left or debit side

c) The right or credit side

Prepare the T-accounts:

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance | ✓ | 12,000 | |||

| Account: Supplies Account no. 13 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance | ✓ | 30,000 | |||

| 31 | Adjusting | 26 | 22,500 | 7,500 | |||

| Account: Prepaid Insurance Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance | ✓ | 3,600 | |||

| 31 | Adjusting | 26 | 1,800 | 1,800 | |||

| Account: Equipment Account no. 16 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance | ✓ | 110,000 | |||

| Account: Accumulated Depreciation-Office equipment Account no. 17 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance | ✓ | 25,000 | |||

| 31 | Adjusting | 26 | 8,350 | 33,350 | |||

| Account: Trucks Account no. 18 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance | ✓ | 60,000 | |||

| Account: Accumulated Depreciation- Truck Account no. 19 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance | ✓ | 15,000 | |||

| 31 | Adjusting | 26 | 6,200 | 21,200 | |||

| Account: Accounts Payable Account no. 21 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance | ✓ | 4,000 | |||

| Account: Wages Payable Account no. 22 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Adjusting | 26 | 600 | 600 | ||

| Account: Common Stock Account no. 31 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance |

| 26,000 | 26,000 | ||

| Account: Retained Earnings Account no. 32 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance | ✓ | 70,000 | |||

| 31 | Closing | 27 | 51,150 | 121,150 | |||

| 31 | Closing | 27 | 15,000 | 106,150 | |||

| Account: Dividends Account no. 33 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance |

| 15,000 | |||

| 31 | Closing | 27 | 15,000 | ||||

| Account: Income Summary Account no. 34 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Closing | 27 | 160,000 | 160,000 | ||

| 31 | Closing | 27 | 108,850 | 51,150 | |||

| 31 | Closing | 27 | 51,150 | ||||

| Account: Service revenue Account no. 41 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance | ✓ | 160,000 | |||

| 31 | Closing | 27 | 160,000 | ||||

| Account: Wages expense Account no. 51 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance | ✓ | 45,000 | |||

| 31 | Adjusting | 26 | 600 | 45,600 | |||

| 31 | Closing | 27 | 45,600 | ||||

| Account: Supplies Expense Account no. 52 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Adjusting | 26 | 22,500 | 22,500 | ||

| 31 | Closing | 27 | 22,500 | ||||

| Account: Rent expense Account no. 53 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance | ✓ | 10,600 | |||

| 31 | Closing | 27 | 10,600 | ||||

| Account: Truck Expense Account no. 54 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Balance | ✓ | 9,000 | |||

| 31 | Closing | 27 | 9,000 | ||||

| Account: Depreciation Expense- Equipment Account no. 55 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Adjusting | 26 | 8,350 | 8,350 | ||

| 31 | Closing | 27 | 8,350 | ||||

| Account: Depreciation Expense- Equipment Account no. 55 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Adjusting | 26 | 8,350 | 8,350 | ||

| 31 | Closing | 27 | 8,350 | ||||

| Account: Depreciation Expense- Trucks Account no. 56 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y4 | |||||||

| March | 31 | Adjusting | 26 | 6,200 | 6,200 | ||

| 31 | Closing | 27 | 6,200 | ||||

| Account: Insurance expense Account no. 57 | |||||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||||

| Debit ($) | Credit ($) | ||||||||

| 20Y4 | |||||||||

| March | 31 | Adjusting | 26 | 1,800 | 1,800 | ||||

| 31 | Closing | 27 | 1,800 | ||||||

| Account: Miscellaneous expense Account no. 59 | |||||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||||

| Debit ($) | Credit ($) | ||||||||

| 20Y4 | |||||||||

| March | 31 | Balance | ✓ | 4,800 | |||||

| 31 | Closing | 27 | 4,800 | ||||||

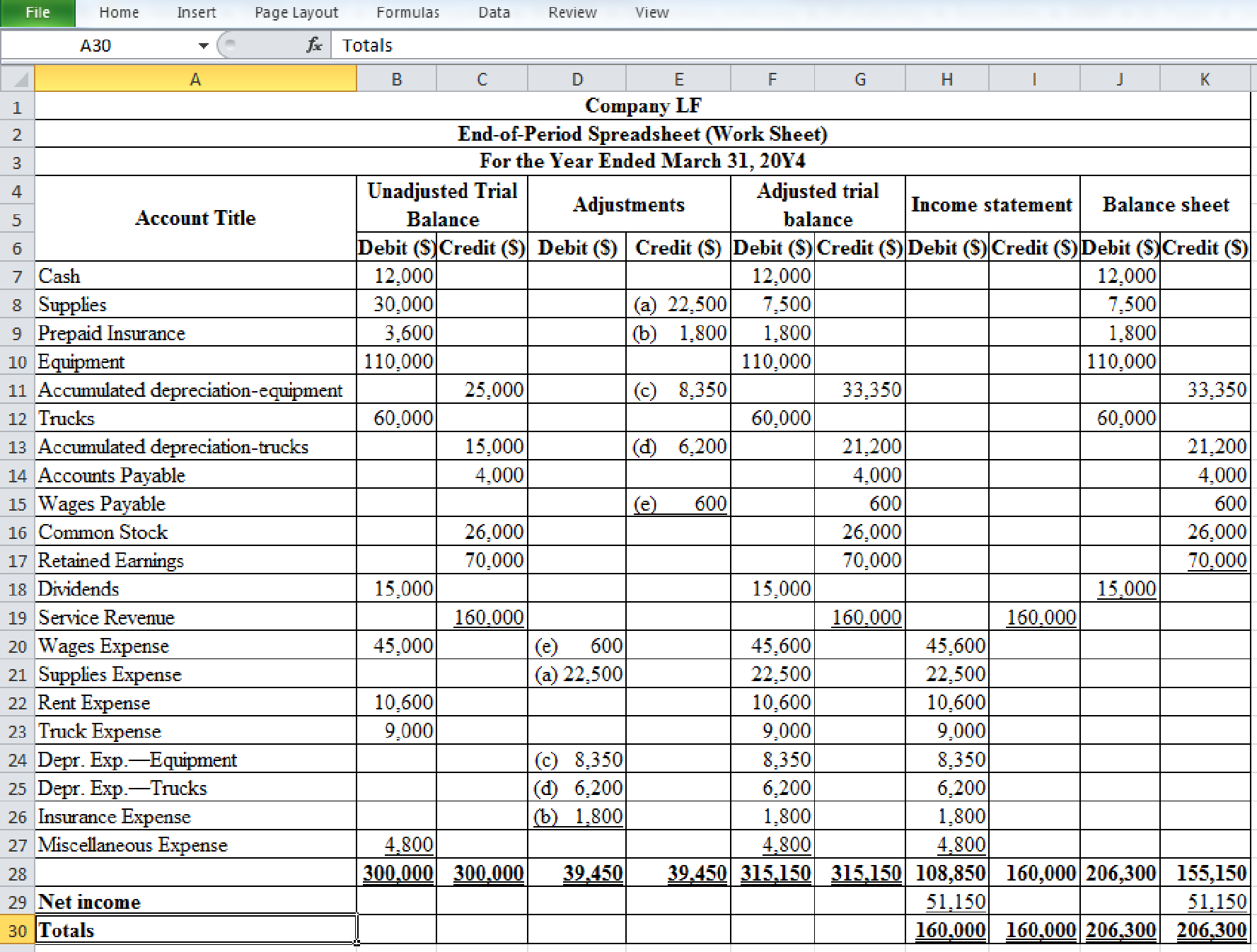

2.

Enter the unadjusted trial balance on an end of period spreadsheet and complete the spread sheet.

Explanation of Solution

Spreadsheet: A spreadsheet is a worksheet. It is used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Prepare the end of period spreadsheet and enter the unadjusted trial balance:

Table (1)

3.

Prepare the adjusting entries and post it into the T-accounts.

Explanation of Solution

Adjusting entries:

Adjusting entries refers to the entries that are made at the end of an accounting period in accordance with revenue recognition principle, and expenses recognition principle. All adjusting entries affect at least one income statement account (revenue or expense), and one balance sheet account (asset or liability).

Prepare the adjusting entries:

| Date | Account title and explanation |

Post. Ref. | Debit ($) | Credit ($) | |

| 20Y4 | Adjusting Entries | ||||

| March 31 | Supplies Expense | 52 | 22,500 | ||

| Supplies | 13 | 22,500 | |||

| (To record the supplies expense used) | |||||

| 20Y4 | Insurance Expense | 57 | 1,800 | ||

| March 31 | Prepaid Insurance | 14 | 1,800 | ||

| (To record the insurance expense) | |||||

| 20Y4 | Depreciation Expense-Equipment | 55 | 8,350 | ||

| March 31 | Accumulated Depreciation-Equipment | 17 | 8,350 | ||

| (To record the depreciation expense for equipment) | |||||

| 20Y4 | Depreciation Expense-Trucks | 56 | 6,200 | ||

| March 31 | Accumulated Depreciation-Trucks | 19 | 6,200 | ||

| (To record the depreciation expense for trucks) | |||||

| 20Y4 | Wages Expense | 51 | 600 | ||

| March 31 | Wages Payable | 22 | 600 | ||

| (To record the wages expense) | |||||

Table (2)

4.

Prepare an adjusted trial balance as of March 31, 20Y4.

Explanation of Solution

Adjusted trial balance:

Adjusted trial balance is a summary of all the ledger accounts, and it contains the balances of all the accounts after the adjustment entries are journalized, and posted.

Prepare an adjusted trial balance as of March 31, 20Y4:

| Company LF | |||

| Adjusted Trial Balance | |||

| As of March 31, 20Y4 | |||

| Account titles | Account No. | Debit balances | Credit balances |

| Cash | 11 | $12,000 | |

| Supplies | 13 | $7,500 | |

| Prepaid Insurance | 14 | $1,800 | |

| Equipment | 16 | $110,000 | |

| Accumulated Depreciation-Equipment | 17 | $33,350 | |

| Trucks | 18 | $60,000 | |

| Accumulated Depreciation-Trucks | 19 | $21,200 | |

| Accounts Payable | 21 | $4,000 | |

| Wages Payable | 22 | $600 | |

| Common Stock | 31 | $26,000 | |

| Retained Earnings | 32 | $70,000 | |

| Dividends | 33 | $15,000 | |

| Service Revenue | 41 | $160,000 | |

| Wages Expense | 51 | $45,600 | |

| Supplies Expense | 52 | $22,500 | |

| Rent Expense | 53 | $10,600 | |

| Truck Expense | 54 | $9,000 | |

| Depreciation Expense-Equipment | 55 | $8,350 | |

| Depreciation Expense-Trucks | 56 | $6,200 | |

| Insurance Expense | 57 | $1,800 | |

| Miscellaneous Expense | 59 | $4,800 | |

| Totals | $315,150 | $315,150 | |

Table (3)

5.

Prepare an income statement, a statement of stockholders, equity and a balance sheet for the year ended March 31, 20Y4.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement for the year ended March 31, 20Y4:

| Company LF | ||

| Income Statement | ||

| For the Year Ended March 31, 20Y4 | ||

| Particulars | Amount ($) | Amount ($) |

| Service revenue | $160,000 | |

| Expenses: | ||

| Wages expense | $45,600 | |

| Supplies expense | $22,500 | |

| Rent expense | $10,600 | |

| Truck expense | $9,000 | |

| Depreciation expense-equipment | $8,350 | |

| Depreciation expense-trucks | $6,200 | |

| Insurance expense | $1,800 | |

| Miscellaneous expense | $4,800 | |

| Total expenses | ($108,850) | |

| Net income | $51,150 | |

Table (4)

Statement of stockholders’ equity: The statement which reports the changes in stock, paid-in capital, retained earnings, and treasury stock, during the year is referred to as statement of stockholders’ equity.

Prepare a statement of stockholders’ equity for the year ended March 31, 20Y4:

| Company LF | |||

| Statement of Stockholders’ Equity | |||

| For the Year Ended March 31, 20Y4 | |||

| Particulars | Common stock | Retained earnings | Total |

| Beginning balances, April 1, 20Y3 | $ 20,000 | $ 70,000 | $ 90,000 |

| Issued common stock | $ 6,000 | $ 0 | $ 6,000 |

| Net income | $ 0 | $ 51,150 | $ 51,150 |

| Dividends | $ 0 | ($ 15,000) | ($ 15,000) |

| Ending balances, March 31, 20Y4 | $ 26,000 | $ 106,150 | $ 132,150 |

Table (5)

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Prepare the balance sheet as of March 31, 20Y4:

| Company LF | |||

| Balance Sheet | |||

| As of March 31, 20Y4 | |||

| Particulars | Amount ($) | Amount ($) | Amount ($) |

| Assets | |||

| Current assets: | |||

| Cash | $12,000 | ||

| Supplies | $7,500 | ||

| Prepaid insurance | $1,800 | ||

| Total current assets | $21,300 | ||

| Property, plant, and equipment: | |||

| Equipment | $110,000 | ||

| Accumulated depreciation-equipment | ($33,350) | ||

| Book value-equipment | $76,650 | ||

| Trucks | $60,000 | ||

| Accumulated depreciation-trucks | ($21,200) | ||

| Book value-trucks | $38,800 | ||

| Total property, plant, and equipment | $115,450 | ||

| Total assets | $136,750 | ||

| Liabilities | |||

| Current liabilities: | |||

| Accounts payable | $4,000 | ||

| Wages payable | $600 | ||

| Total liabilities | $4,600 | ||

| Stockholders’ Equity | |||

| Common stock | $26,000 | ||

| Retained earnings | $106,150 | ||

| Total stockholders’ equity | $132,150 | ||

| Total liabilities and stockholders’ equity | $136,750 | ||

Table (6)

6.

Prepare the closing entries.

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to Retained Earnings account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Closing entry for revenue, expense accounts and dividend account:

| Date | Account title and explanation | Post ref | Debit ($) | Credit ($) |

| 20Y4 | Service Revenue | 41 | 160,000 | |

| March 31 | Wages Expense | 51 | 45,600 | |

| Supplies Expense | 52 | 22,500 | ||

| Rent Expense | 53 | 10,600 | ||

| Truck Expense | 54 | 9,000 | ||

| Depreciation Expense-Equipment | 55 | 8,350 | ||

| Depreciation Expense-Trucks | 56 | 6,200 | ||

| Insurance Expense | 57 | 1,800 | ||

| Miscellaneous Expense | 59 | 4,800 | ||

| Retained Earnings | 32 | 51,150 | ||

| (To close the revenue account and expense account to retained earnings account) | ||||

| 20Y4 | Retained Earnings | 32 | 15,000 | |

| March 31 | Dividends | 33 | 15,000 | |

| (To close the dividends accounts to retained earnings account) |

Table (7)

7.

Prepare a post-closing trial balance as of March 31, 20Y4.

Explanation of Solution

Post-closing trial balance:

The post-closing trial balance is a summary of all ledger accounts, and it shows the debit and the credit balances after the closing entries are journalized and posted. The post-closing trial balance contains only permanent (balance sheet) accounts, and the debit and the credit balances of permanent accounts should agree.

Prepare a post-closing trial balance as of March 31, 20Y4:

| Company LF | |||

| Post-Closing Trial Balance | |||

| As of March 31, 20Y4 | |||

| Account title | Account No. | Debit balance | Credit balance |

| Cash | 11 | $12,000 | |

| Supplies | 13 | $7,500 | |

| Prepaid Insurance | 14 | $1,800 | |

| Equipment | 16 | $110,000 | |

| Accumulated Depreciation-Equipment | 17 | $33,350 | |

| Trucks | 18 | $60,000 | |

| Accumulated Depreciation-Trucks | 19 | $21,200 | |

| Accounts Payable | 21 | $4,000 | |

| Wages Payable | 22 | $600 | |

| Common Stock | 31 | $26,000 | |

| Retained Earnings | 32 | $106,150 | |

| Total | $191,300 | $191,300 | |

Table (8)

Want to see more full solutions like this?

Chapter 4 Solutions

Financial And Managerial Accounting

- Ledger accounts, adjusting entries, financial statements, and closing entries; optional end-of-period spreadsheet The unadjusted trial balance of Recessive Interiors at January 31, 20Y2, the end of the year, follows: The data needed to determine year-end adjustments are as follows: (a) Supplies on hand at January 31 are 2,850. (b) Insurance premiums expired during the year are 3,150. (c) Depreciation of equipment during the year is 5,250. (d) Depreciation of trucks during the year is 4,000. (e) Wages accrued but not paid at January 31 are 900. Instructions 1. For each account listed in the unadjusted trial balance, enter the balance in the appropriate Balance column of a four-column account and place a check mark () in the Posting Reference column. 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (3) as needed. 3. Journalize and post the adjusting entries, inserting balances in the accounts affected. Record the adjusting entries on Page 26 of the journal. The following additional accounts from Recessive Interiors chart of accounts should be used: Wages Payable, 22; Depreciation Expense Equipment, 54; Supplies Expense, 55; Depreciation ExpenseTrucks, 56; Insurance Expense, 57. 4. Prepare an adjusted trial balance. 5. Prepare an income statement, a statement of stockholders equity, and a balance sheet. During the year ended January 31, 20Y2, additional common stock of 7,500 was issued. 6. Journalize and post the closing entries. Record the closing entries on Page 27 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. 7. Prepare a post-closing trial balance.arrow_forwardPrepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. supplies actual count at year end, $6,500 B. remaining unexpired insurance, $6,000 C. remaining unearned service revenue, $1,200 D. salaries owed to employees, $2,400 E. depreciation on property plant and equipment, $18,000arrow_forwardT accounts, adjusting entries, financial statements, and closing entries; optional end-of-period spreadsheet The unadjusted trial balance of La Mesa Laundry at August 31, 20Y5, the end of the fiscal year, follows: The data needed to determine year-end adjustments are as follows: (a) Wages accrued but not paid at August 31 are 2,200. (b) Depreciation of equipment during the year is 8,150. (c) Laundry supplies on hand at August 31 are 2,000. (d) Insurance premiums expired during the year are 5,300. Instructions 1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as Aug. 31 Bal. In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, and Insurance Expense. 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed. 3. Journalize and post the adjusting entries. Identify the adjustments by Adj. and the new balances as Adj. Bal. 4. Prepare an adjusted trial balance. 5. Prepare an income statement, a statement of stockholders equity, and a balance sheet. During the year ended August 31, 20Y5, common stock of 3,000 was issued. 6. Journalize and post the closing entries. Identify the closing entries by Clos. 7. Prepare a post-closing trial balance.arrow_forward

- The balances of the ledger accounts of Beldren Home Center as of December 31, the end of its fiscal year, are as follows: Data for the adjustments are as follows: ab. Merchandise Inventory at December 31, 102,765. c. Wages accrued at December 31, 1,834. d. Supplies inventory (on hand) at December 31, 645. e. Depreciation of store equipment, 5,782. f. Depreciation of office equipment, 1,791. g. Insurance expired during the year, 845. h. Rent earned, 2,500. Required 1. Complete the work sheet after entering the account names and balances onto the work sheet. Ignore this step if using CLGL. 2. Journalize the adjusting entries. If using manual working papers, record adjusting entries on journal page 16.arrow_forwardThe following accounts appear in the ledger of Sheldon Company on January 31, the end of this fiscal year. The data needed for adjustments on January 31 are as follows: ab.Merchandise inventory, January 31, 55,750. c.Insurance expired for the year, 1,285. d.Depreciation for the year, 5,482. e.Accrued wages on January 31, 1,556. f.Supplies used during the year 1,503. Required 1. Prepare a work sheet for the fiscal year ended January 31. Ignore this step if using QuickBooks or general ledger. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. Ignore this step if using CLGL. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. Check Figure Net loss, 1,737arrow_forwardThe trial balance of Jillson Company as of December 31, the end of its current fiscal year, is as follows: Here are the data for the adjustments. ab. Merchandise Inventory at December 31, 54,845.00. c. Store supplies inventory (on hand), 488.50. d. Insurance expired, 680. e. Salaries accrued, 692. f. Depreciation of store equipment, 3,760. Required Complete the work sheet after entering the account names and balances onto the work sheet.arrow_forward

- T accounts, adjusting entries, financial statements, and closing entries; optional end-of-period spreadsheet The unadjusted trial balance of Epicenter Laundry at June 30, 20Y6, the end of the fiscal year, follows: The data needed to determine year-end adjustments are as follows: (a) Laundry supplies on hand at June 30 are 8,600. (b) Insurance premiums expired during the year are 5,700. (c) Depreciation of laundry equipment during the year is 6,500. (d) Wages accrued but not paid at June 30 are 1,100. Instructions 1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as June 30 Bal. In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, and Insurance Expense. 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed. 3. Journalize and post the adjusting entries. Identify the adjustments by Adj. and the new balances as Adj. Bal. 4. Prepare an adjusted trial balance. 5. Prepare an income statement, a statement of stockholders equity, and a balance sheet. During the year ended June 30, 20Y6, additional common stock of 7,500 was issued. 6. Journalize and post the closing entries. Identify the closing entries by Clos. 7. Prepare a post-closing trial balance.arrow_forwardPrepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. amount due for employee salaries, $4,800 B. actual count of supplies inventory, $ 2,300 C. depreciation on equipment, $3,000arrow_forwardAdjusting entries and adjusted trial balances Reece Financial Services Co., which specializes in appliance repair services, is owned and operated by Joni Reece. Reece Financial Services accounting clerk prepared the following unadjusted trial balance at July 31, 20Y9: The data needed to determine year-end adjustments are as follows: Depreciation of building for the year, 6,400. Depreciation of equipment for the year, 2,800. Accrued salaries and wages at July 31, 900. Unexpired insurance at July 31, 1,500. Fees earned but unbilled on July 31, 10,200. Supplies on hand at July 31, 615. Rent unearned at July 31, 300. Instructions 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depreciation ExpenseBuilding; Depreciation Expense Equipment; and Supplies Expense. 2. Determine the balances of the accounts affected by the adjusting entries, and prepare an adjusted trial balance.arrow_forward

- The trial balance of Hadden Company as of December 31, the end of its current fiscal year, is as follows: Here are the data for the adjustments. ab.Merchandise Inventory at December 31, 64,742.80. c.Store supplies inventory (on hand), 420.20. d.Insurance expired, 738. e.Salaries accrued, 684.50. f.Depreciation of store equipment, 3,620. Required Complete the work sheet after entering the account names and balances onto the work sheet.arrow_forwardPrepare journal entries to record the business transaction and related adjusting entry for the following: A. March 1, paid cash for one year premium on insurance contract, $18,000 B. December 31, remaining unexpired balance of insurance, $3,000arrow_forwardAdjusting entries Trident Repairs Service, an electronics repair store, prepared the following unadjusted trial balance at the end of its first year of operations: For preparing the adjusting entries, the following data were assembled: Fees earned but unbilled on November 30 were 7,000. Supplies on hand on November 30 were 1,300. Depreciation of equipment was estimated to be 7,200 for the year. The balance in unearned fees represented the November 1 receipt in advance for services to be provided. During November, 13,500 of the services were provided. Unpaid wages accrued on November 30 were 4,800. Instructions 1. Journalize the adjusting entries necessary on November 30, 20Y3. 2. Determine the revenues, expenses, and net income of Trident Repairs Service before the adjusting entries. 3. Determine the revenues, expense, and net income of Trident Repairs Service after the adjusting entries. 4. Determine the effect of the adjusting entries on Retained Earnings.arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage