Concept explainers

(Appendix 4B) Sequential Method of Support Department Cost Allocation

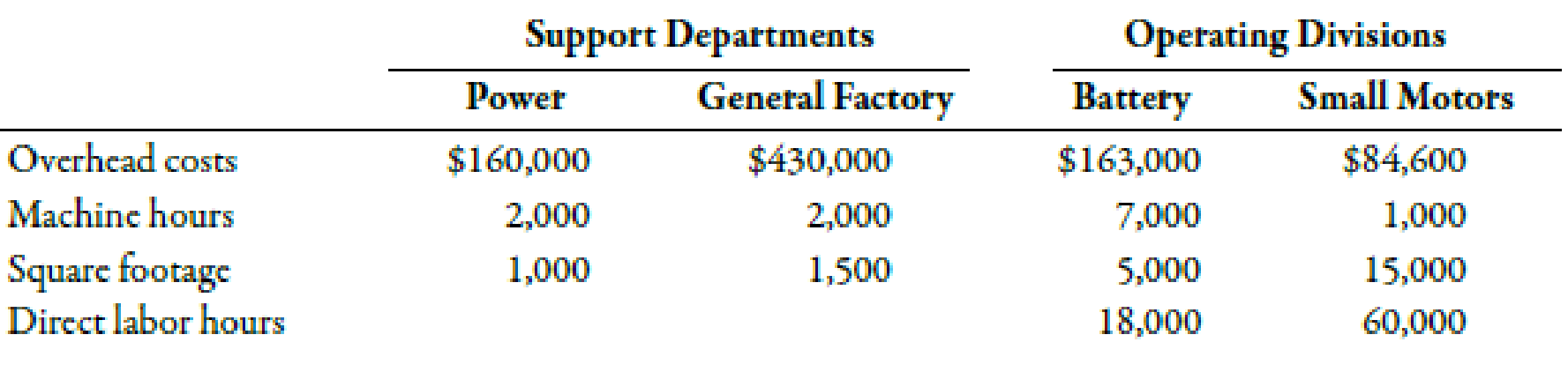

Refer to Exercise 4-51 for data. Now assume that Stevenson uses the sequential method to allocate support department costs to the operating divisions. General Factory is allocated first in the sequential method for the company.

Required:

- 1. Calculate the allocation ratios for Power and General Factory. (Note: Carry these calculations out to four decimal places.)

- 2. Allocate the support service costs to the operating divisions. (Note: Round all amounts to the nearest dollar.)

- 3. Assume divisional overhead rates are based on direct labor hours. Calculate the overhead rate for the Battery Division and for the Small Motors Division. (Note: Round overhead rates to the nearest cent.)

1.

Computeallocation ratios for power and general factory under the sequential method.

Explanation of Solution

Sequential Method:

Sequential method recognizes that there is possible interaction between the support departments. However, it does notaccount for such interaction in full which makes it more accurate as compared to the direct method.

Use the following formula to calculate allocation ratios for general factory on the basis of number of square footage:

Power:

Substitute 1,000 for number of square footage in power and 21,000 for total square footage in the above formula.

Therefore, the cost assignment ratio for S2 is 0.0476.

Battery:

Substitute 5,000 for number ofsquare footage in battery and 21,000 for total square footage in the above formula.

Therefore, the cost assignment ratio for battery is 0.2381.

Small motors:

Substitute 15,000 for number ofsquare footage in small motors and 21,000 for total square footage in the above formula.

Therefore, the cost assignment ratio for painting department is 0.7143.

Use the following formula to calculate cost assignment ratios for power on the basis of number of machine hours:

Battery:

Substitute 7,000 for number of machine hoursofbattery and 8,000 for total machine hours ofoperating department in the above formula.

Therefore, the assignment ratio for assembly department is 0.8750.

Small motors:

Substitute 1,000 for number of machine hours of painting and 8,000 for total machine hours of operating department in the above formula.

Therefore, the assignment ratio for painting department is 0.1250.

2.

Apportion the support service costs to the operating divisions by using the sequential method:

Explanation of Solution

Allocation:

Allocation can be defined as the process of assigning the indirect costs to the cost object with the help of a convenient and reasonable method. It is essential to allocate indirect costs to the cost objects.

| Support departments | Operating departments | |||

| Power($) | General factory($) | Battery($) | Small motors($) | |

| Direct costs | 160,000 | 430,000 | 163,000 | 84,600 |

| Allocate: | ||||

| Power | 20,468 | (430,000) | 102,383 | 307,149 |

| General factory | (180,468) | 157,910 | 22,559 | |

| Total | 0 | 0 | 423,293 | 414,308 |

Table (1)

Working Note:

#. Allocation of support service costs to power:

1. Allocation of support servicecost to battery:

For power cost:

For general factory cost:

2. Allocation of support service cost to small motors:

For power cost:

For general factory cost:

3.

Compute overhead rate of battery and small motors divisions.

Answer to Problem 52E

The overhead rate of battery and small motors divisions is $23.52 and $6.91 respectively.

Explanation of Solution

Overhead Rate:

The amount which is calculate at the beginning of the accounting year for a related activity by dividing the total estimated annual overhead by estimated annual activity level is known as the overhead rate.

Use the following formula to calculate overhead rate for battery division:

Substitute $423,293 for estimated annual overhead and 18,000 DLH for estimated annual activity level in the above formula.

Therefore, overhead rate is $23.52.

Use the following formula to calculate overhead rate for small motors division:

Substitute $414,308 for estimated annual overhead and 60,000 DLH for estimated annual activity level in the above formula.

Therefore, overhead rate is $6.91.

Want to see more full solutions like this?

Chapter 4 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Refer to the data in Exercise 7.22. The company has decided to simplify its method of allocating support service costs by switching to the direct method. Required: 1. Allocate the costs of the support departments to the producing departments using the direct method. (Round allocation ratios to four significant digits. Round allocated costs to the nearest dollar.) 2. Using direct labor hours, compute departmental overhead rates. (Round to the nearest cent.)arrow_forwardRefer to the data in Exercise 7.20. The company has decided to use the sequential method of allocation instead of the direct method. The support departments are ranked in order of highest cost to lowest cost. Required: 1. Allocate the overhead costs to the producing departments using the sequential method. (Take allocation ratios out to four significant digits. Round allocated costs to the nearest dollar.) 2. Using machine hours, compute departmental overhead rates. (Round the overhead rates to the nearest cent.)arrow_forwardRefer to the data in Exercise 7.22. The support departments are ranked in order of highest cost to lowest cost. Required: 1. Allocate the costs of the support departments using the sequential method. (Round allocation ratios to four significant digits. Round allocated costs to the nearest dollar.) 2. Using direct labor hours, compute departmental overhead rates. (Round to the nearest cent.)arrow_forward

- Refer to Cornerstone Exercise 7.3. Now assume that Valron Company uses the reciprocal method to allocate support department costs. Required: 1. Calculate the allocation ratios (rounded to four significant digits) for the four departments using the reciprocal method. 2. Develop a simultaneous equations system of total costs for the support departments. Solve for the total reciprocated costs of each support department. (Round reciprocated total costs to the nearest dollar.) 3. Using the reciprocal method, allocate the costs of the Human Resources and General Factory departments to the Fabricating and Assembly departments. (Round all allocated costs to the nearest dollar.) 4. What if the square footage in Fabricating were 13,300 and the square footage in Assembly were 5,700. How would that affect the allocation of support department costs?arrow_forwardA manufacturing company has two service and two production departments. Human Resources and Machine Repair are the service departments. The production departments are Grinding and Polishing. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The human resources department services all departments of the company, and its costs are allocated using the numbers of employees within each department, while machine repair costs are allocable to Grinding and Polishing on the basis of machine hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardA manufacturing company has two service and two production departments. Building Maintenance and Factory Office are the service departments. The production departments are Assembly and Machining. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The building maintenance department services all departments of the company, and its costs are allocated using floor space occupied, while factory office costs are allocable to Assembly and Machining on the basis of direct labor hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forward

- Using the data from Exercise 6.18, compute the equivalent units of production for each of the four departments using the FIFO method. The following data are for four independent process-costing departments. Inputs are added continuously.arrow_forwardRefer to the data in Exercise 7.18. When the capacity of the HR Department was originally established, the normal usage expected for each department was 20,000 direct labor hours. This usage is also the amount of activity planned for the two departments in Year 1 and Year 2. Required: 1. Allocate the costs of the HR Department using the direct method and assuming that the purpose is product costing. 2. Allocate the costs of the HR Department using the direct method and assuming that the purpose is to evaluate performance.arrow_forwardThe following data are for four independent process-costing departments. Inputs are added continuously. Required: Compute the equivalent units of production for each of the preceding departments using the weighted average method.arrow_forward

- Rocky Mountain Airlines Inc. has two divisions organized as profit centers, the Passenger Division and the Cargo Division. The following divisional income statements were prepared: The support department allocation rates for the support department costs were based on revenues. Because the revenues of the two divisions were the same, the support department allocations to each division were also the same. The following additional information is available: a.Does the operating income (loss) for the two divisions accurately measure performance? Explain. b.Correct the divisional income statements, using appropriate support department cost drivers.arrow_forwardCebu Pacific has two operating departments, Freight and Passenger, and two service centers, maintenance and Administration. The following data are available for the period just ended: Table is below Administration is allocated first using labor hours as the basis of allocation followed by Maintenance using number of employees as the basis. 1. If the step method is used to allocate service costs, the maintenance cost allocated to Freight Department is __________. 2. If simultaneous method is used to allocate service costs, the total service costs allocated to Freight Department is _________.arrow_forwardYolksbaggin has one cost pool (General Plant), one service department (Sanitation), and two production departments (Collection and Packaging), plus it uses the STEP (sequential) method of cost allocation to allocate costs (in the order that they are mentioned above) to the two production departments. General plant, Sanitation, Collection, and Packaging, have departmental costs before allocation of $80,000, $192,000, $600,000, and $900,000 respectively. General plant costs are allocated on the basis of number of direct labor hours worked. Sanitation, Collection, and Packaging worked 2000, 8000, and 10,000 direct labor hours respectively this period. Sanitation costs are allocated on the basis of square footage occupied by a department. The entire factory is 220,000 square feet with Sanitation occupying the first 20,000 square feet of that total, while Collection and Packaging each occupy half of the remaining square footage.1. How much of the General Plant cost should be allocated to…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning