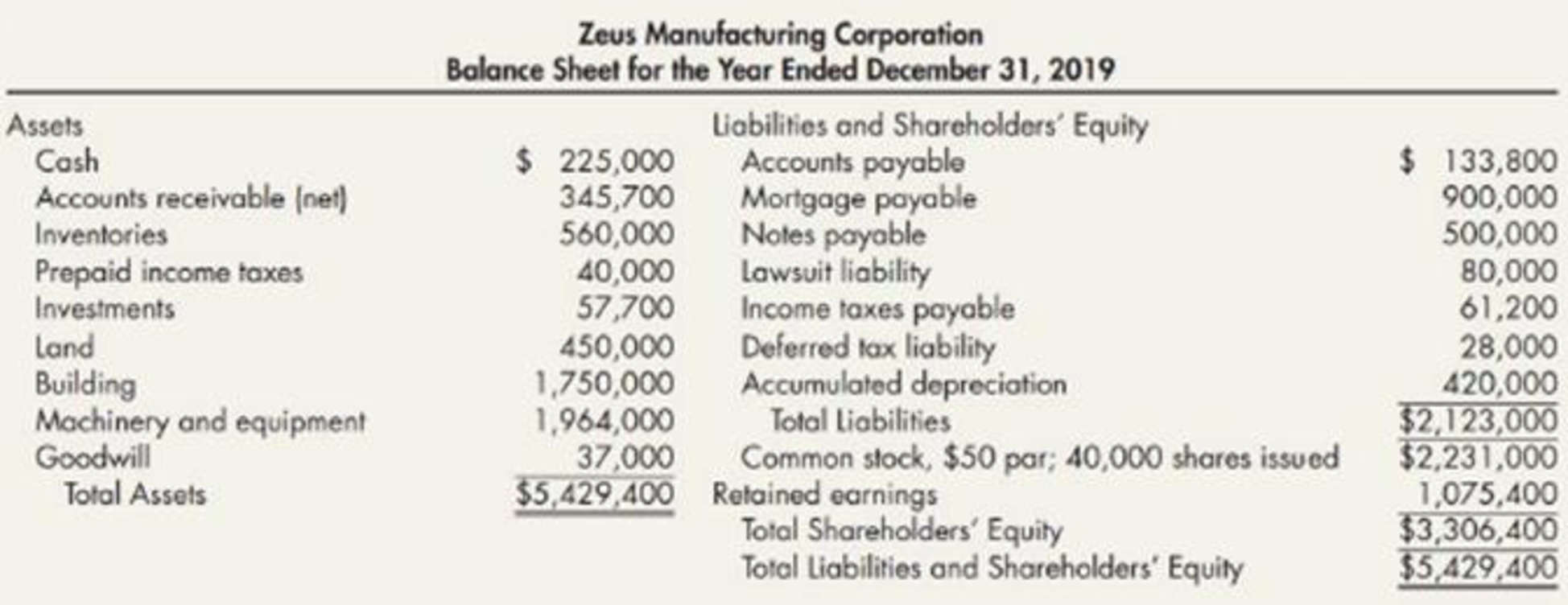

Complex Balance Sheet Presented below is the unaudited balance sheet as of December 31, 2019, prepared by Zeus Manufacturing Corporation’s bookkeeper.

Your company has been engaged to perform an audit, during which you discover the following information:

- 1. Checks totaling $14,000 in payment of accounts payable were mailed on December 31, 2019, but were not recorded until 2020. Late in December 2019, the bank returned a customer’s $2,000 check marked “NSF,” but no entry was made. Cash includes $100,000 restricted for building purposes.

- 2. Included in accounts receivable is a $30,000 note due on December 31, 2022, from Zeus’s president.

- 3. During 2019, Zeus purchased 500 shares of common stock of a major corporation that supplies Zeus with raw materials. Total cost of this stock was $51,300, and fair value on December 31, 2019, was $51,300. Zeus plans to hold these shares indefinitely.

- 4.

Treasury stock was recorded at cost when Zeus purchased 200 of its own shares for $32 per share in May 2019. This amount is included in investments. - 5. On December 31, 2019, Zeus borrowed $500,000 from a bank in exchange for a 10% note payable, manning December 31, 2024. Equal principal payments are due December 31 of each year beginning in 2020. This note is collateralized by a $250,000 tract of land acquired as a potential future building site, which is included in land.

- 6. The mortgage payable requires $50,000 principal payments, plus interest, at the end of each month. Payments were made on January 31 and February 28, 2020. The balance of this mortgage was due June 30, 2020. On March 1, 2020, prior to issuance of the audited financial statements, Zeus consummated a non-cancelable agreement with the lender to refinance this mortgage. The new terms require $100,000 annual principal payments, plus interest, on February 28 of each year, beginning in 2021. The final payment is due February 28, 2028.

- 7. The lawsuit liability will be paid in 2020.

- 8. Of the total

deferred tax liability ; $5,000 is considered a current liability. - 9. The current income tax expense reported in Zeus’s 2019 income statement was $61,200.

- 10. The company was authorized to issue 100,000 shares of $50 par value common stock.

Prepare a corrected classified balance sheet as of December 31, 2019.

Explanation of Solution

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Prepare a corrected classified balance sheet of Company Z:

| Company Z | |||

| Balance Sheet | |||

| December 31,2019 | |||

| Current Assets: | Amount ($) | Amount ($) | Amount ($) |

| Cash (1) | 109,000 | ||

| Accounts receivable (net) (2) | 317,700 | ||

| Inventories | 560,000 | ||

| Total current assets | 986,700 | ||

| Long-Term Investment, at fair value (3) | 51,300 | ||

| Property, Plant, and Equipment (at cost): | |||

| Land (4) | 200,000 | ||

| Building | 1,750,000 | ||

| Machinery and equipment | 1,964,000 | ||

| Total | 3,714,000 | ||

| Less: Accumulated depreciation | (420,000) | 3,294,000 | |

| Total property, plant, and equipment | 3,494,000 | ||

| Intangible Asset: | |||

| Goodwill | 37,000 | ||

| Other Assets: | |||

| Cash restricted for building purposes [ Refer working note (1) ] | 100,000 | ||

| Officer’s note receivable [ Refer working note (2) ] | 30,000 | ||

| Land held for future building site [ Refer working note (4) ] | 250,000 | 380,000 | |

| Total Assets | 4,949,000 | ||

| Liabilities | |||

| Current Liabilities: | |||

| Accounts payable (5) | 119,800 | ||

| Current instalments of long-term debt[ Refer working notes (6) & (7) ] | 200,000 | ||

| Lawsuit liability | 80,000 | ||

| Income taxes payable (8) | 21,200 | ||

| Deferred tax liability | 5,000 | ||

| Total current liabilities | 426,000 | ||

| Long-Term Debt: | |||

| Mortgage payable (6) | 800,000 | ||

| Notes payable (7) | 400,000 | ||

| Deferred tax liability | 23,000 | ||

| Total long-term debt | 1,223,000 | ||

| Total Liabilities | 1,649,000 | ||

| Shareholders’ Equity: | |||

| Contributed Capital: | |||

| Common stock, authorized 100,000 shares of $50 par value; issued 40,000 shares; outstanding 39,800 shares (9) | 2,000,000 | ||

| Additional paid-in capital [ Refer working note (9) ] | 231,000 | ||

| Total paid-in capital | 2,231,000 | ||

| Retained earnings | 1,075,400 | ||

| Total | 3,306,400 | ||

| Less: Cost of treasury stock capital [ Refer working note (3) ] | (6,400) | ||

| Total Shareholders’ Equity | 3,300,000 | ||

| Total Liabilities and Shareholders’ Equity | 4,949,000 | ||

Table (1)

Therefore, the total of assets and total liabilities and shareholders’ equity equals to $4,949,000.

Working notes:

(1) Calculate corrected amount of cash balance:

| Cash, per unaudited balance sheet | $225,000 |

| Less: Unrecorded checks in payment of accounts payable | ($14,000) |

| NSF check not recorded | ($2,000) |

| Cash restricted for building purposes (reported in other assets) | ($100,000) |

| Corrected balance | 109,000 |

Table (2)

(2) Calculate the corrected amount of accounts receivable:

| Accounts receivable (net), per unaudited balance sheet | $345,700 |

| Add charge-back for NSF check [refer working note (1)] | $2,000 |

| Less: Officer’s note receivable (reported in other assets) | ($30,000) |

| Corrected balance | $317,700 |

Table (3)

(3) Calculate the corrected amount of investments:

| Investments, per unaudited balance sheet | $57,700 |

| Less: Long-term investment [reported separately as an asset] | ($51,300) |

| Treasury stock [reported in shareholders’ equity] | ($6,400) |

| Corrected balance | $0 |

Table (4)

(4) Calculate the corrected amount of land:

| Land, per unaudited balance sheet | $450,000 |

| Less: Land acquired for future building site (reported in other assets) | ($250,000) |

| Corrected balance | $200,000 |

Table (5)

(5) Calculate the corrected amount of accounts payable:

| Accounts payable, per unaudited balance sheet | $133,800 |

| Less: Unrecorded payments [refer working note (1)] | ($14,000) |

| Corrected balance | $119,800 |

Table (6)

(6) Calculate the corrected amount of mortgage payable:

| Mortgage payable, per unaudited balance sheet | $900,000 |

| Less: Current portion | (100,000) |

| Refinanced as long-term mortgage payable | $800,000 |

Table (7)

(7) Calculate the corrected amount of long-term note payable:

| Notes payable, per unaudited balance sheet | $500,000 |

| Less: Current portion | ($100,000) |

| Long-term note payable | $400,000 |

Table (8)

(8) Calculate the corrected amount of income taxes payable:

| Income taxes payable, per unaudited balance sheet | $61,200 |

| Less: Prepaid income taxes | ($40,000) |

| Corrected balance | $21,200 |

Table (9)

(9) Calculate the corrected amount of common stock:

| Common stock, per unaudited balance sheet | $2,231,000 |

| Less: Additional paid-in capital in excess of par value | ($231,000) |

| Corrected balance | $2,000,000 |

Table (10)

Want to see more full solutions like this?

Chapter 4 Solutions

Intermediate Accounting: Reporting And Analysis

- It is February 16, 2020, and you are auditing Davenport Corporation's financial statements for 2019 (which will be issued in March 2020). You read in the newspaper that Travis Corporation, a major customer of Davenport, is in financial difficulty. Included in Davenports accounts receivable is 50,000 (a material amount) owed to it by Travis. You approach Jim Davenport, president, with this information and suggest that a reduction of accounts receivable and recognition of a loss for 2019 might be appropriate. Jim replies, Why should we make an adjustment? Ted Travis, the president of Travis Corporation, is a friend of mine; he will find a way to pay us, one way or another. Furthermore, this occurred in 2020, so lets wait and see what happens; we can always make an adjustment later this year. Our 2019 income and year-end working capital are not that high; our creditors and shareholders wouldnt stand for lower amounts than they already are. Required: From financial reporting and ethical perspectives, prepare a response to Jim Davenport regarding this issue.arrow_forwardRefer to RE6-8. On April 23, 2020, McKinncy Co. receives a check, from Mangold Corporation for 8,500. Prepare the journal entry for McKinncy to record the collection of the account previously written off.arrow_forwardAnalyzing Accounts Receivable Upham Companys June 30, 2019, balance sheet included the following information: Required: 1. Prepare the journal entries necessary for Upham to record the preceding transactions. 2. Prepare an analysis and schedule that shows the amounts of the accounts receivable, allowance for doubtful accounts, notes receivable, and notes receivable dishonored accounts that will be disclosed on Uphams June 30, 2020, balance sheet.arrow_forward

- Blue Company, an architectural firm, has a bookkeeper who maintains a cash receipts and disbursements journal. At the end of the year (2019), the company hires you to convert the cash receipts and disbursements into accrual basis revenues and expenses. The total cash receipts are summarized as follows. The accounts receivable from customers at the end of the year are 120,000. You note that the accounts receivable at the beginning of the year were 190,000. The cash sales included 30,000 of prepayments for services to be provided over the period January 1, 2019, through December 31, 2021. a. Compute the companys accrual basis gross income for 2019. b. Would you recommend that Blue use the cash method or the accrual method? Why? c. The company does not maintain an allowance for uncollectible accounts. Would you recommend that such an allowance be established for tax purposes? Explain.arrow_forwardYou were able to gather the following from the December 31, 2020 trial balance of Should Corporationin connection with your audit of the company:Cash on hand372.000Petty cash fundBPI current accountSecurity Bank current account No. 01Security Bank current account No. 02PB savings accountPB time deposit10,000950.0001.280.000(40,000)500.000300.000Cash on hand includes the following items:a. Customer's check for P60,000 returned by bank on December 26, 2020 due to insufficient fundbut subsequently redeposited and cleared by the bank on January 8, 2021.b. Customer's check for P30,000 dated January 2. 2021, received on December 29. 2020.c. Postal money orders received from customers, P36,000.The petty cash fund consisted of the following items as of December 31, 2020.Currency and coinsEmployees' valesCurrency in an envelope marked "collections for charity" with namesP 2.1001.600attachedUnreplenished petty cash vouchersCheck drawn by Should Corporation, payable to the petty…arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT