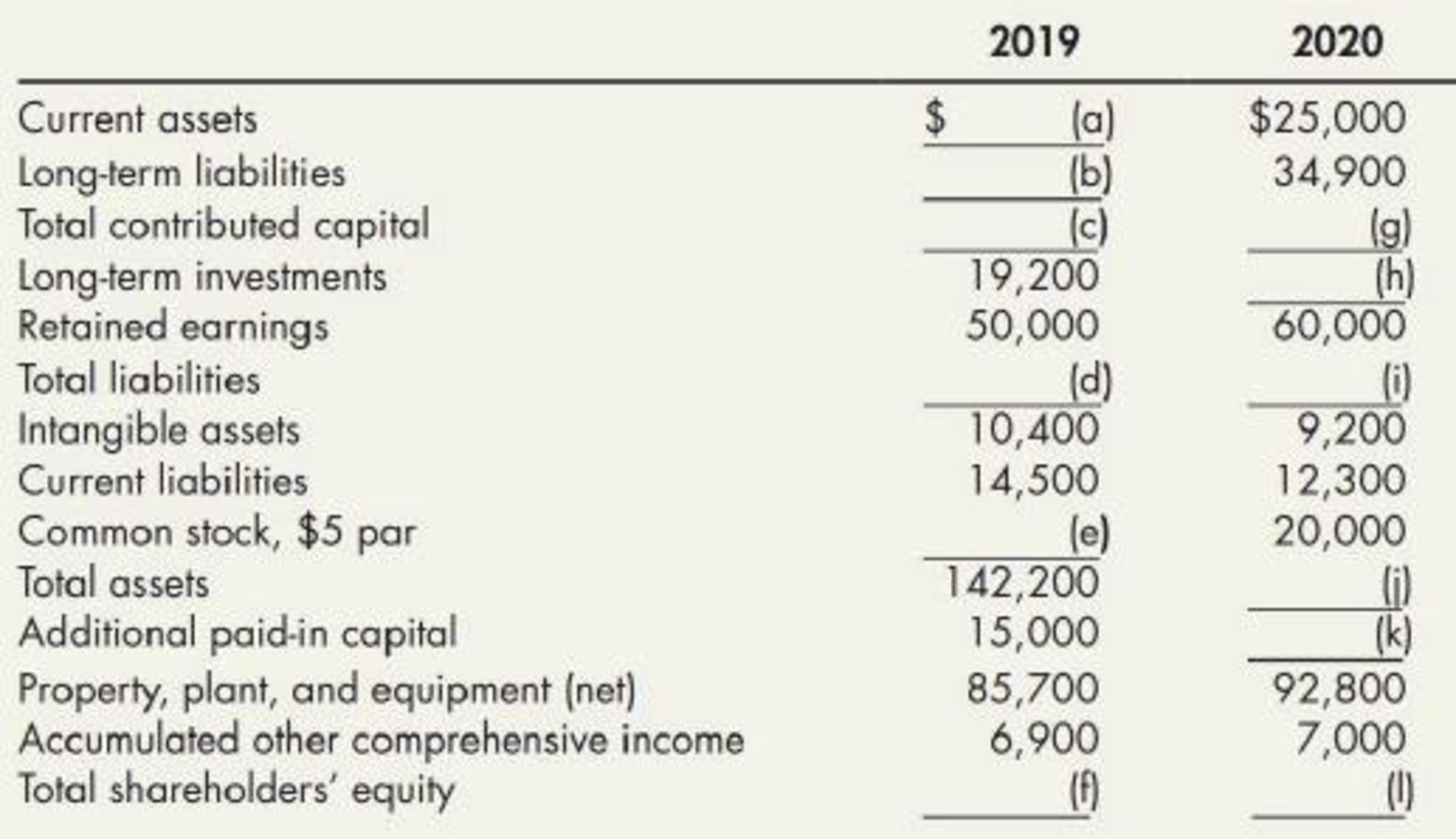

Additional information: The company did not issue any common stock during 2020.

Required:

Next Level Fill in the blanks labeled (a) through (l). All the necessary information is provided. (Hint: It is not necessary to calculate your answers in alphabetical order.)

Fill in the blanks labeled from (a) through (l).

Answer to Problem 8E

The balance sheet of D Company is prepared below:

| D Company | ||

| Balance Sheet | ||

| December 31 | ||

| 2019 | 2020 | |

| Current assets | 26,900 | 25,000 |

| Long-term investments | 19,200 | 22,200 |

| Property, plant and equipment (net) | 85,700 | 92,800 |

| Intangible assets | 10,400 | 9,200 |

| Total assets | $142,200 | $149,200 |

| Current liabilities | 14,500 | 12,300 |

| Long-term liabilities | 35,800 | 34,900 |

| Total liabilities | 50,300 | 47,200 |

| Common stock, $5 par | 20,000 | 20,000 |

| Additional paid-in capital | 15,000 | 15,000 |

| Total contributed capital | 35,000 | 35,000 |

| Retained earnings | 50,000 | 60,000 |

| Accumulated other comprehensive income | 6,900 | 7,000 |

| Total shareholders' equity | 91,900 | 102,000 |

| Total liabilities and shareholders' equity | $142,200 | $149,200 |

Table (1)

Explanation of Solution

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Calculate the amount of current assets (a) for 2019:

Hence, the amount of current assets for 2019 is $26,900.

Calculate the amount of common stock (e) for 2019:

Hence, the amount of common stock for 2019 is $20,000.

Note: As the company did not issue any common stock during 2020, the common stock of 2019 is equal to common stock of 2020.

Calculate the amount of total contributed capital (c) for 2019:

Hence, the amount of total contributed capital for 2019 is $35,000.

Calculate the amount of total stockholders’ equity (f) for 2019:

Hence, the amount of total stockholders’ equity for 2019 is $91,900.

Compute the amount of total liabilities (d) for 2019:

Hence, the amount of total liabilities for 2019 is $50,300.

Calculate the amount of long-term liabilities (b) for 2019:

Hence, the amount of long-term liabilities for 2019 is $35,800.

Calculate the amount of additional paid-in capital (k) for 2020:

Hence, the amount of additional paid in capital for 2020 is $15,000.

Note: As the company did not issue any common stock during 2020, the additional paid in capital of 2019 is equal to additional paid in capital of 2020.

Calculate the amount of total contributed capital (g) for 2020:

Hence, the amount of total contributed capital for 2020 is $35,000.

Calculate the amount of total stockholders’ equity (l) for 2020:

Hence, the amount of total stockholders’ equity for 2020 is $102,000.

Compute the amount of total liabilities (i) for 2020:

Hence, the amount of total liabilities for 2020 is $47,200.

Compute the amount of total assets (j) for 2020:

Hence, the amount of total assets for 2020 is $149,200.

Calculate the amount of long-term investments (h) for 2020:

Hence, the amount of long-term investments for 2020 is $22,200.

Want to see more full solutions like this?

Chapter 4 Solutions

Intermediate Accounting: Reporting And Analysis

- Comprehensive: Income Statement and Supporting Schedules The following s a partial list of the account balances, after adjustments, of Silvoso Company on December 31, 2019: The following information is also available: 1. The company declared and paid a 0.60 per share cash dividend on its common stock. The stock was outstanding the entire year. 2. A physical count determined that the December 31, 2019, ending inventory is 34,100. 3. A tornado destroyed a warehouse, resulting in a pretax loss of 12,000. The last tornado in this area had occurred 10 years earlier. 4. On May 1, 2019, the company sold an unprofitable division (R). From January through April, Division R (a major component of the company) had incurred a pretax operating loss of 8,700. Division R was sold at a pretax gain of 10,000. 5. The company is subject to a 30% income tax rate. Its income tax expense for 2019 totals 4,230. The breakdown is as follows: 6. The company had average shareholders equity of 150,000 during 2019. Required: 1. As supporting documents for Requirement 2, prepare separate supporting schedules for cost of goods sold, selling expenses, general and administrative expenses, and depreciation expense. 2. Prepare a 2019 multiple-step income statement for Silvoso. Include any related note to the financial statements. 3. Prepare a 2019 retained earnings statement. 4. Next Level What was Silvosos return on common equity for 2019? What is your evaluation of Silvosos return on common equity if last year it was 10%?arrow_forwardBalance Sheet Calculations Cornerstone Development Companys balance sheet information at the end of 2019 and 2020 is provided in random order, as follows: Additional information: At the end of 2019, (a) the amount of long-term liabilities is twice the amount of current liabilities and (b) there are 2,900 shares of common stock outstanding. During 2020, the company (a) issued 100 shares of common stock for 25 per share, (b) earned net income of 20,600, and (c) paid dividends of 1 per share on the common stock outstanding at year-end. Required: Next Level Fill in the blanks lettered (a) through (p). All of the necessary information is provided. (Hint: It is not necessary to calculate your answers in alphabetical order.)arrow_forwardNoren Company uses the balance sheet aging method to account for uncollectible debt on receivables. The following is the past-due category information for outstanding receivable debt for 2019. To manage earnings more favorably, Noren Company considers changing the past-due categories as follows. A. Complete each table by filling in the blanks. B. Determine the difference between totals uncollectible. C. Complete the following 2019 comparative income statements for 2019, showing net income changes as a result of the changes to the balance sheet aging method categories. D. Describe the categories change effect on net income and accounts receivable.arrow_forward

- Visual Inspection Noble Companys accounting records provided the following changes in account balances and other information for 2019: Additional information: Net income was 9,900. Dividends were declared and paid. Land was sold for 1,700. No land was purchased. A building was purchased for 23,000. No buildings and equipment were sold. Bonds payable were issued at the end of the year. Two hundred shares of stock were issued for 15 per share. The beginning cash balance was 4,800. Required: Using visual inspection, prepare a 2019 statement of cash flows for Noble.arrow_forwardElegant Linens uses the balance sheet aging method to account for uncollectible debt on receivables. The following is the past-due category information for outstanding receivable debt for 2019. To manage earnings more favorably, Elegant Linens considers changing the past-due categories as follows. A. Complete each table by filling in the blanks. B. Determine the difference between total uncollectible. C. Complete the following 2019 comparative income statements for 2019, showing net income changes as a result of the changes to the balance sheet aging method categories. D. Describe the categories change effect on net income and accounts receivable.arrow_forwardComprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)arrow_forward

- Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1,000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50,000 to retire bonds with a face value (and book value) of 50,000. e. On July 2, 2019, Farrell purchased equipment for 63,000 cash. f. On December 31, 2019. land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows.arrow_forwardA review of Anderson Corporations books indicates that the errors and omissions pertaining to the balance sheet accounts shown as follows had not been corrected during the applicable years. The net income per the books is: 2017, 10,000; 2018, 12,000; 2019, 15,000; and 2020, 20,000. No dividends were declared during these years and no adjustments were made to retained earnings. The Retained Earnings balance on December 31, 2020, is 50,000. Omissions Required: Determine the correct net income for the years 2017, 2018, 2019, and 2020, and the adjusted balance sheet accounts as of December 31, 2020. Ignore possible income tax effects.arrow_forwardGray Company lists the following shareholders equity items on its December 31, 2018, balance sheet: The following stock transactions occurred during 2019: Required: 1. Prepare journal entries to record the preceding transactions. 2. Prepare the December 31, 2019, shareholders equity section (assume that 2019 net income was 225,000).arrow_forward

- Included in the December 31, 2018, Jacobi Company balance sheet was the following shareholders equity section: The company engaged in the following stock transactions during 2019: Required: 1. Prepare journal entries to record the preceding transactions. 2. Prepare the December 31, 2019, shareholders equity section (assume that 2019 net income was 270,000).arrow_forwardSpreadsheet The following 2019 information is available for Payne Company: Partial additional information: The net income for 2019 totaled 1,600. During 2019, the company sold, for 390, equipment that cost 390 and had a book value of 300. The company sold land for 200, resulting in a loss of 40. The remaining change in the Land account resulted from the purchase of land through the issuance of common stock. Required: Making whatever additional assumptions that are necessary, prepare a spreadsheet to support the 2019 statement of cash flows for Payne.arrow_forwardBalance Sheet Baggett Companys balance sheet accounts and amounts as of December 31, 2019, are shown in random order as follows: Required: 1. Prepare a December 31, 2019, balance sheet for Baggett. 2. Compute the debt to-assets ratio.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College