Concept explainers

Equivalent Unit; Assigning Costs; Cost Reconciliation-Weighted-Average Method

Superior Micro products uses the weighted-average method in its

Required:

- Compute the equivalent units of materials, labor, and overhead in the ending work in process inventory for the month.

- Compute the cost of ending work in process inventory for materials, labor, overhead, and in total for January.

- Compute the cost of the units transferred to the next department for materials, labor, overhead, and in total for January.

- Prepare a cost reconciliation for January. (Note: Your will not be able to break the cost to be accounted for into the cost of beginning work in process inventory and costs added during the month.)

Computation of equivalent units for each element of cost, cost per equivalent unit and total cost of ending inventory and completed units describes the steps taken for computation of total units completed and equivalents units of each element of cost. The total cost of ending work in process and completed and transferred out shall be determined based on equivalent units and cost per equivalent units. The total units completed are computed by considering the total units in process and ending work in process units. The reconciliation statement of total cost to account and accounted has to be reconciled.

Requirement1:

TheEquivalent number units of each element of cost shall be determined.

Answer to Problem 12E

Solution: The total units completed and transferred out from process shall be as under:

| UNITS TO BE ACCOUNTED FOR: | ||

| Units Completed during the month

Ending Work in Process Total Units to be accounted for: | 25,000

3,000 | |

| 28,000 | ||

After computing the units of completed and transferred out, the equivalent units of each element of cost shall be computed as under:

| Equivalent Units: | |||||||

| Material | Labour and Overhead | ||||||

| % Completion | Units | % Completion | Units | ||||

| Units Completed

Ending Work in Process Total Equivalent units | 100%

80% | 25,000

2,400 | 100%

60% | 25,000

1,800 | |||

| 27,400 | 26,800 | ||||||

Explanation of Solution

The computation of total units completed and transferred out shall be based on the total units in the process during the year. The total units to account for in the process is sum of beginning units of work in process and units started in the process during the year. The Ending units of work in process which is still in process at the end of the year shall be deducted from the total to find out the units completed and transferred out.

For computing the total equivalent units of each element of cost, the units completed and transferred out shall be regarded as 100% complete as regards to all elements. Therefore, the equivalent units of completed units shall be same as that of completed units. The ending work in process inventory is not finished and the degree of completion of the inventory is given as regards to each element. The equivalent units of work in process shall be computed accordingly.

The total equivalent units of each element is sum total of equivalent units of respective element in both completed units and ending work in process units.

Requirement2:

To conclude, it must be said that the equivalent units in each inventory shall multiplied with respective cost per equivalent unit and cost of each element is added up to arrive at the total cost of ending work in process and completed units.

The Cost of Ending work in process inventory in respect of material, conversion and in total shall be determined.

Answer to Problem 12E

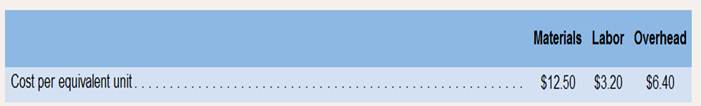

Solution: The

statement showing the cost of ending work in process is as under:

| Ending Work in Process (3,000 units) | |||||

| Equivalent unit | Cost per EU | Total Cost | |||

| Material

Labour Overheads | 2,400

1,800 1800 | 12.5

3.2 6.4 | 30000

5760 11520 | ||

| Total cost of Ending Work in process: | 47,280 | ||||

Explanation of Solution

The total cost of ending work in process shall be computed by multiplying the equivalent units of each element in ending work in process by cost per equivalent unit of respective element. The Summation of each element cost is the total cost of ending work in process.

Requirement3:

The Cost of goods completed and transferred out shall be determined.

Answer to Problem 12E

Solution: The statement showing the cost of units completed and transferred out shall be as under:

| Units Completed and Transferred Out (25,000 units) | |||||

| Equivalent unit | Cost per EU | Total Cost | |||

| Material

Labour Overheads | 25,000

25,000 25000 | 12.5

3.2 6.4 | 312500

80000 160000 | ||

| Total cost of Ending Work in process: | 552,500 | ||||

Explanation of Solution

The total cost of units completed and transferred out shall be computed by multiplying the equivalent units of each element in units completed (which is equal to completed units only) by cost per equivalent unit of respective element. The Summation of each element cost is the total cost of ending work in process.

Requirement4:

The reconciliation statement showing the cost to account for and cost accounted for to be reconciled.

Answer to Problem 12E

Solution: The reconciliation statement showing the cost to account for and accounted in ending work in process and completed units is as follows:

| RECONCILIATION STATEMENT | |||||

| TOTAL COST TO ACCOUNT FOR: | |||||

| Total Cost to account for: | 599,780 | ||||

| TOTAL COST ACCOUNTED FOR: | |||||

| Units Completed and Transferred out (25,000 units) | |||||

| Equivalent unit | Cost per EU | Total Cost | |||

| Material

Labour Conversion Cost | 25,000

25,000 | 12.5

3.2 | 312500

80000 160000 | ||

| 25,000 | 6.4 | ||||

| Total Cost of Units completed and transferred out: | 552500 | ||||

| Ending Work in Process (3,000 units) | |||||

| Equivalent unit | Cost per EU | Total Cost | |||

| Material

Labour Conversion Cost | 2,400

1,800 1800 | 12.5

3.2 6.4 | 30000

5760 11520 | ||

| Total cost of Ending Work in process: | 47,280 | ||||

| Total Cost Accounted for: | 599,780 | ||||

| Difference (Total cost to account for-Total cost accounted) | Nil | ||||

Explanation of Solution

The total cost to account for is the total cost of beginning work in process and cost added during the period in the process. The total cost accounted for is the cost assigned to ending work in process and units completed and transferred out.

The reconciliation means there shall be not be any difference between the total cost to account for and total accounted in the period.

To conclude, it must be said that the equivalent units in each inventory shall multiplied with respective cost per equivalent unit and cost of each element is added up to arrive at the total cost of ending work in process and completed units.

Want to see more full solutions like this?

Chapter 5 Solutions

Introduction To Managerial Accounting

- Holmes Products, Inc., produces plastic cases used for video cameras. The product passes through three departments. For April, the following equivalent units schedule was prepared for the first department: Costs assigned to beginning work in process: direct materials, 90,000; conversion costs, 33,750. Manufacturing costs incurred during April: direct materials, 75,000; conversion costs, 220,000. Holmes uses the weighted average method. Required: 1. Compute the unit cost for April. 2. Determine the cost of ending work in process and the cost of goods transferred out.arrow_forwardThe Converting Department of Tender Soft Tissue Company uses the weighted average method and had 1,900 units in work in process that were 60% complete at the beginning of the period. During the period, 15,800 units were completed and transferred to the Packing Department. There were 1,200 units in process that were 30% complete at the end of the period. a. Determine the number of whole units to be accounted for and to be assigned costs for the period. b. Determine the number of equivalent units of production for the period. Assume that direct materials are placed in process during production.arrow_forwardUsing the same data found in Exercise 6.22, assume the company uses the FIFO method. Required: Prepare a schedule of equivalent units, and compute the unit cost for the month of December. Fordman Company has a product that passes through two processes: Grinding and Polishing. During December, the Grinding Department transferred 20,000 units to the Polishing Department. The cost of the units transferred into the second department was 40,000. Direct materials are added uniformly in the second process. Units are measured the same way in both departments. The second department (Polishing) had the following physical flow schedule for December: Costs in beginning work in process for the Polishing Department were direct materials, 5,000; conversion costs, 6,000; and transferred in, 8,000. Costs added during the month: direct materials, 32,000; conversion costs, 50,000; and transferred in, 40,000.arrow_forward

- The Converting Department of Worley Company had 2,400 units in work in process at the beginning of the period, which were 35% complete. During the period, 10,800 units were completed and transferred to the Packing Department. There were 1,900 units in process at the end of the period, which were 60% complete. Direct materials are placed into the process at the beginning of production. Determine the number of equivalent units of production with respect to direct materials and conversion costs.arrow_forwardK-Briggs Company uses the FIFO method to account for the costs of production. For Crushing, the first processing department, the following equivalent units schedule has been prepared: The cost per equivalent unit for the period was as follows: The cost of beginning work in process was direct materials, 40,000; conversion costs, 30,000. Required: 1. Determine the cost of ending work in process and the cost of goods transferred out. 2. Prepare a physical flow schedule.arrow_forwardSeacrest Company uses a process-costing system. The company manufactures a product that is processed in two departments: A and B. As work is completed, it is transferred out. All inputs are added uniformly in Department A. The following summarizes the production activity and costs for November: Required: 1. Using the weighted average method, prepare the following for Department A: (a) a physical flow schedule, (b) an equivalent unit calculation, (c) calculation of unit costs (Note: Round to four decimal places.), (d) cost of EWIP and cost of goods transferred out, and (e) a cost reconciliation. 2. CONCEPTUAL CONNECTION Prepare journal entries that show the flow of manufacturing costs for Department A. Use a conversion cost control account for conversion costs. Many firms are now combining direct labor and overhead costs into one category. They are not tracking direct labor separately. Offer some reasons for this practice.arrow_forward

- Equivalent units and related costs; cost of production report; entries Dover Chemical Company manufactures specialty chemicals by a series of three processes, all materials being introduced in the Distilling Department. From the Distilling Department, the materials pass through the Reaction and Filling departments, emerging as finished chemicals. The balance in the account Work in ProcessFilling was as follows on January 1: The following costs were charged to Work in ProcessFilling during January: During January, 53,000 units of specialty chemicals were completed. Work in ProcessFilling Department on January 31 was 2,700 units, 30% completed. Instructions 1. Prepare a cost of production report for the Filling Department for January. 2. Journalize the entries for costs transferred from Reaction to Filling and the costs transferred from Filling to Finished Goods. 3. Determine the increase or decrease in the cost per equivalent unit from December to January for direct materials and conversion costs. 4. Discuss the uses of the cost of production report and the results of part (3).arrow_forwardProteger Company manufactures insect repellant lotion. The Mixing Department, the first process department, mixes the chemicals required for the repellant. The following data are for the current year: Direct materials are added at the beginning of the process. Ending inventory is 95 percent complete with respect to direct labor and overhead. The cost of goods transferred out for the year is: a. 4,471,200 b. 3,571,200 c. 3,780,000 d. 3,024,000arrow_forwardSonoma Products Inc. manufactures a liquid product in one department. Due to the nature of the product and the process, units are regularly lost during production. Materials and conversion costs are added evenly throughout the process. The following summaries were prepared for March: Calculate the unit cost for materials, labor, and factory overhead for March and show the costs of units transferred to finished goods and to ending work in process inventory.arrow_forward

- Calculating unit costs; units lost in production Gray Brothers Products Inc. manufactures a liquid product in one department. Due to the nature of the product and the process, units are regularly lost at the beginning of production. Materials and labor and overhead costs are added evenly throughout the process. The following summaries were prepared for the month of January: Calculate the unit cost for materials, labor, and factory overhead for January and show the costs of units transferred to finished goods and of the ending work in process inventory.arrow_forwardHeap Company manufactures a product that passes through two processes: Fabrication and Assembly. The following information was obtained for the Fabrication Department for September: a. All materials are added at the beginning of the process. b. Beginning work in process had 80,000 units, 30 percent complete with respect to conversion costs. c. Ending work in process had 17,000 units, 25 percent complete with respect to conversion costs. d. Started in process, 95,000 units. Required: 1. Prepare a physical flow schedule. 2. Compute equivalent units using the weighted average method. 3. Compute equivalent units using the FIFO method.arrow_forwardUse the following information for Problems 6-62 and 6-63: Millie Company produces a product that passes through an assembly process and a finishing process. All manufacturing costs are added uniformly for both processes. The following information was obtained for the assembly department for June: a. WIP, June 1, had 24,000 units (60% completed) and the following costs: b. During June, 70,000 units were completed and transferred to the finishing department, and the following costs were added to production: c. On June 30, there were 10,000 partially completed units in process. These units were 70% complete. 6-62 Weighted Average Method, Single-Department Analysis Refer to the information for Millie Company above. Required: Prepare a production report for the assembly department for June using the weighted average method of costing. The report should disclose the physical flow of units, equivalent units, and unit costs and should track the disposition of manufacturing costs.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College