Concept explainers

Comprehensive: Income Statement and

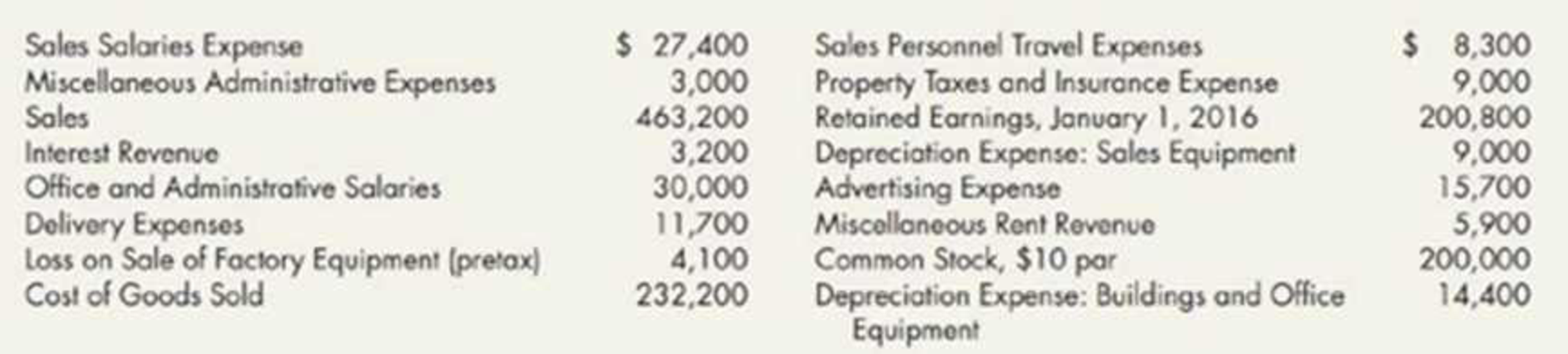

The following information is also available but is not reflected in the preceding accounts:

- a. The company sold Division E (a major component of the company) on August 2, 2019. During 2019, Division E had incurred a pretax loss from operations of $16,000. However, because the acquiring company could vertically integrate Division E into its facilities, Milwaukee Manufacturing was able to recognize a $42,000 pretax gain on the sale.

- b. On January 2, 2019, without warning, a foreign country expropriated a factory of Milwaukee Manufacturing which had been operating in that country. As a result of that expropriation, the company has incurred a pretax loss of $30,000.

- c. The common stock was outstanding for the entire year. A cash dividend of $1.20 per share was declared and paid in 2019.

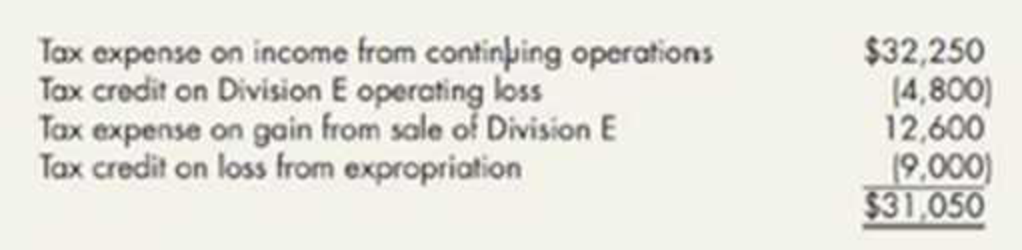

- d. The 2019 income tax expense totals $31,050 and consists of the following:

Required:

- 1. As supporting documents for Requirement 2, prepare separate supporting schedules for selling expenses and for general and administrative expenses (include

depreciation expense where applicable in these schedules). - 2. Prepare а 2019 multiple-step income statement for Milwaukee Manufacturing.

- 3. Prepare a 2019 retained earnings statement.

- 4. Next Level What was Milwaukee Manufacturing’s return on common equity for 2019 if its average shareholders’ equity during 2019 was $500,000? What is your evaluation of this return on common equity if its “target” for 2019 was 15%?

- 5. Next Level Discuss how Milwaukee Manufacturing’s income statement in Requirement 2 might be different if it used IFRS.

1.

Prepare a separate schedule for both selling and general and administrative expenses of Company M for the year ended December 31, 2019.

Explanation of Solution

Expenses: Expenses are costs incurred for the operations of a business. The costs incurred for generating revenues are rent expense, depreciation expense, general and administrative expenses, selling expenses, and utilities expense.

Prepare a separate schedule for both selling and general and administrative expenses of Company M for the year ended December 31, 2019 as follows:

| Company M | |

| For Year Ended December 31, 2019 | |

| Schedule 1: Selling Expenses | |

| Particulars | Amounts ($) |

| Sales salaries expense | $27,400 |

| Delivery expenses | 11,700 |

| Sales personnel travel expenses | 8,300 |

| Depreciation expense: sales equipment | 9,000 |

| Advertising expense | 15,700 |

| Total selling expenses | $72,100 |

| Schedule 2: General and Administrative Expenses | |

| Depreciation expense: buildings and office equipment | $14,400 |

| Office and administrative salaries | 30,000 |

| Property taxes and insurance expense | 9,000 |

| Miscellaneous administrative expenses | 3,000 |

| Total general and administrative expenses | $56,400 |

Table (1)

2.

Prepare a multi-step income statement of Company M for the year ended December 31, 2019.

Explanation of Solution

Multi-step income statement: The income statement represented in multi-steps with several subtotals, to report the income from principal operations, and separate the other expenses and revenues which affect net income, is referred to as multi-step income statement.

Prepare a multi-step income statement of Company M for the year ended December 31, 2019 as follows:

| Company M | ||

| Income Statement | ||

| For Year Ended December 31, 2019 | ||

| Particulars | Amounts ($) | Amounts ($) |

| Sales | 463,200 | |

| Less: Cost of goods sold | (232,200) | |

| Gross profit | 231,000 | |

| Less: Operating expenses: | ||

| Selling expenses (Schedule 1) | 72,100 | |

| General and administrative expenses (Schedule 2) | 56,400 | |

| Total operating expenses | (128,500) | |

| Operating income | 102,500 | |

| Less: Other items: | ||

| Interest revenue | 3,200 | |

| Miscellaneous rent revenue | 5,900 | |

| Loss from expropriation | (30,000) | |

| Loss on sale of factory equipment | (4,100) | (25,000) |

| Pretax income from continuing operations | 77,500 | |

| Less: Income tax expense (1) | (23,250) | |

| Income from continuing operations | 54,250 | |

| Results from discontinued operations: | ||

| Loss from operations of discontinued Division E (2) | (11,200) | |

| Gain on sale of Division E (3) | 29,400 | 18,200 |

| Net income (a) | 72,450 | |

| Number of common shares (b) | 20,000 shares | |

| Earnings per Common Share | $3.62 | |

Table (2)

Working note (1):

Compute the amount of income tax expense:

Working note (2):

Compute the loss from operations of discontinued Division E:

Working note (3):

Compute the Gain on sale of Division E:

3.

Prepare a retained earnings statement of Company M for the year ended December 31, 2019.

Explanation of Solution

Retained earnings: Retained earnings are that portion of profits which are earned by a company but not distributed to stockholders in the form of dividends. These earnings are retained for various purposes like expansion activities, or funding any future plans.

Prepare a retained earnings statement of Company M for the year ended December 31, 2019 as follows:

| Statement of Retained Earnings | |

| For Year Ended December 31, 2019 | |

| Particulars | Amount ($) |

| Retained earnings as on January 1,2019 | $200,800 |

| Add: Net income | 72,450 |

| 273,250 | |

| Less: Cash dividends (4) | (24,000) |

| Retained earnings as on December 31, 2019 | $249,250 |

Table (3)

Working note (4):

Compute the amount of cash dividend:

4.

Ascertain the return on common equity of Company M for 2019 and comment.

Explanation of Solution

Return on equity (ROE): This financial ratio evaluates a company’s efficiency in using stockholders’ equity to generate net income. So, ROE is a tool used to measure the performance of a company.

Ascertain the return on common equity of Company M for 2019 as follows:

Working note (5):

Compute the average shareholder’s equity:

The return on shareholders’ equity of Company M for the year 2019 is 17.0%, which is above the target of 15%. However, Company M had results from discontinued operations in 2019. The target return falls short to 12.8%

5.

State the manner in which the income statement of Company M given in requirement 2 gets differs, if it uses IFRS.

Explanation of Solution

The presentation and the content of the income statement might differ as follows:

- Either the single-step or multiple-step format could have been used.

- The term “Turnover” could have been used instead of sales.

- The expenses might be classified by their nature rather than their function.

- To adjust the depreciation expense, if it has revalued its property.

Want to see more full solutions like this?

Chapter 5 Solutions

Intermediate Accounting: Reporting And Analysis

- Income Statement and Retained Earnings Huff Company presents the following items derived from its December 31, 2019, adjusted trial balance: The following information is also available for 2019 and is not reflected in the preceding accounts: 1. The common stock has been outstanding all year. A cash dividend of 1.28 per share was declared and paid. 2. Land was sold at a pretax gain of 6,300. 3. Division X (a major component of the company) was sold at a pretax gain of 4,700. It had incurred a 9,500 pretax operating loss during 2019. 4. A tornado, which is an unusual event in the area, caused a 5,400 pretax loss. 5. The income tax rate on all items of income is 30%. 6. The average shareholders equity is 90,000. Required: 1. Prepare a 2019 multiple-step income statement for Huff. 2. Prepare a 2019 retained earnings statement. 3. Compute the 2019 return on common equity (Net Income 4 Average Shareholders Equity).arrow_forwardEthics and Sale of Operating Component It is the end of 2019, and, as an accountant for Newell Company, you are preparing its 2019 financial statements. On December 29, 2019, Newells management decided to sell one of its major divisions, subject to some legal work that is expected to be completed during the first week in April 2020 after the 2019 financial statements have been issued). During 2019, the division earned a small operating income that is just enough for the company to report record earnings for the year. However, the estimated fair value of the division at the end of 2019 is less than its net book value, so that management anticipates the component will be sold at a loss. Newells president stops by your office and says, You have been doing a fine job. Keep up the good work because you are heading for a promotion in early 2021. Once we report the record earnings for 2019, our shareholders and creditors will be happy. Then I think our earnings for 2020 will be high enough so that the loss we expect to report in 2020 on the sale of the division will not look so bad. After the president leaves your office, you continue preparing the 2019 financial statements. Required: From financial reporting and ethical perspectives, what information, if any, will you include about the upcoming sale of the division in the 2019 financial statements?arrow_forwardComprehensive: Income Statement and Supporting Schedules The following s a partial list of the account balances, after adjustments, of Silvoso Company on December 31, 2019: The following information is also available: 1. The company declared and paid a 0.60 per share cash dividend on its common stock. The stock was outstanding the entire year. 2. A physical count determined that the December 31, 2019, ending inventory is 34,100. 3. A tornado destroyed a warehouse, resulting in a pretax loss of 12,000. The last tornado in this area had occurred 10 years earlier. 4. On May 1, 2019, the company sold an unprofitable division (R). From January through April, Division R (a major component of the company) had incurred a pretax operating loss of 8,700. Division R was sold at a pretax gain of 10,000. 5. The company is subject to a 30% income tax rate. Its income tax expense for 2019 totals 4,230. The breakdown is as follows: 6. The company had average shareholders equity of 150,000 during 2019. Required: 1. As supporting documents for Requirement 2, prepare separate supporting schedules for cost of goods sold, selling expenses, general and administrative expenses, and depreciation expense. 2. Prepare a 2019 multiple-step income statement for Silvoso. Include any related note to the financial statements. 3. Prepare a 2019 retained earnings statement. 4. Next Level What was Silvosos return on common equity for 2019? What is your evaluation of Silvosos return on common equity if last year it was 10%?arrow_forward

- Income Statement, Lower Portion Cunningham Company reports a retained earnings balance of 365,200 at the beginning of 2019. For the year ended December 31, 2019, the company reports pretax income from continuing operations of 150,500. The following information is also available pertaining to 2019: 1. The company declared and paid a 0.72 cash dividend per share on the 30,000 shares of common stock that were outstanding the entire year. 2. The company incurred a pretax 21,000 loss as a result of an earthquake, which is not unusual for the area. This is included in the 150,500 income from continuing operations. 3. The company sold Division P (a component of the company) in May. From January through May, Division P had incurred a pretax loss from operations of 33,000. A pretax gain of 15,000 was recognized on the sale of Division P. Required: Assuming that all the pretax items are subject to a 30% income tax rate: 1. Complete the lower portion of Cunningham's 2019 income statement beginning with Pretax Income from Continuing Operations. Include any related note to the financial statements. 2. Prepare an accompanying retained earnings statement.arrow_forwardComprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)arrow_forwardComprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1,000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50,000 to retire bonds with a face value (and book value) of 50,000. e. On July 2, 2019, Farrell purchased equipment for 63,000 cash. f. On December 31, 2019. land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows.arrow_forward

- Reinhardt Company reported revenues of $122,000 and expenses of $83,000 on its 2019 income statement. In addition, Reinhardt paid of dividends during 2019. On December 31, 2019, Reinhardt prepared closing entries. The net effect of the closing entries on retained earnings was a(n): a. decrease of $4,000. b. increase of $35,000. c. increase of $39,000. d. decrease of $87,000.arrow_forwardFisafolia Corporation has gross income from operations of $210,000 and operating expenses of $160,000 for 2019. The corporation also has $30,000 in dividends from publicly traded domestic corporations in which the ownership percentage was 45 percent. Calculate the corporation's dividends received deduction for 2019. $_____________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $135,000. Calculate the corporation's dividends received deduction for 2019. $___________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $158,000. Calculate the corporation's dividends received deduction for 2019. $_____________arrow_forwardShannon Corporation began operations on January 1, 2019. Financial statements for the years ended December 31, 2019 and 2020, contained the following errors: In addition, on December 31, 2020, fully depreciated machinery was sold for 10,800 cash, but the sale was not recorded until 2021. There were no other errors during 2019 or 2020, and no corrections have been made for any of the errors. Refer to the information for Shannon Corporation above. Ignoring income taxes, what is the total effect of the errors on the amount of working capital (current assets minus current liabilities) at December 31, 2020? a. working capital overstated by 4,200 b. working capital understated by 5,800 c. working capital understated by 6,000 d. working capital understated by 9,800arrow_forward

- Prince Corporations accounts provided the following information at December 31, 2019: What should be the current balance of retained earnings? a. 520,000 b. 580,000 c. 610,000 d. 670,000arrow_forwardMultiple-Step and Single-Step Income Statements, and Statement of Comprehensive Income On December 31, 2019, Opgenorth Company listed the following items in its adjusted trial balance: Additional data: 1. Seven thousand shares of common stock have been outstanding the entire year. 2. The income tax rate is 30% on all items of income. Required: 1. Prepare a 2019 multiple-step income statement. 2. Prepare a 2019 single-step income statement. 3. Prepare a 2019 statement of comprehensive income.arrow_forwardNet Income and Comprehensive Income At the beginning of 2019, JR Companys shareholders equity was as follows: During 2019, the following events and transactions occurred: 1. JR recognized sales revenues of 108,000. It incurred cost of goods sold of 62,000 and operating expenses of 12,000, 2. JR issued 1,000 shares of its 5 par common stock for 14 per share. 3. JR invested 30,000 in available-for-sale securities. At the end of the year, the securities had a fair value of 35,000. 4. JR paid dividends of 6,000. The income tax rate on all items of income is 30%. Required: 1. Prepare a 2019 income statement for JR which includes net income and comprehensive income ignore earnings per share). 2. For 2016 prepare a separate (a) income statement (ignore earnings per share) and (b) statement of comprehensive income.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning