Concept explainers

This problem is designed to enable you to apply the knowledge you have acquired in the preceding chapters. In accounting, the ultimate test is being able to handle data in real-life situations. This problem will give you valuable experience.

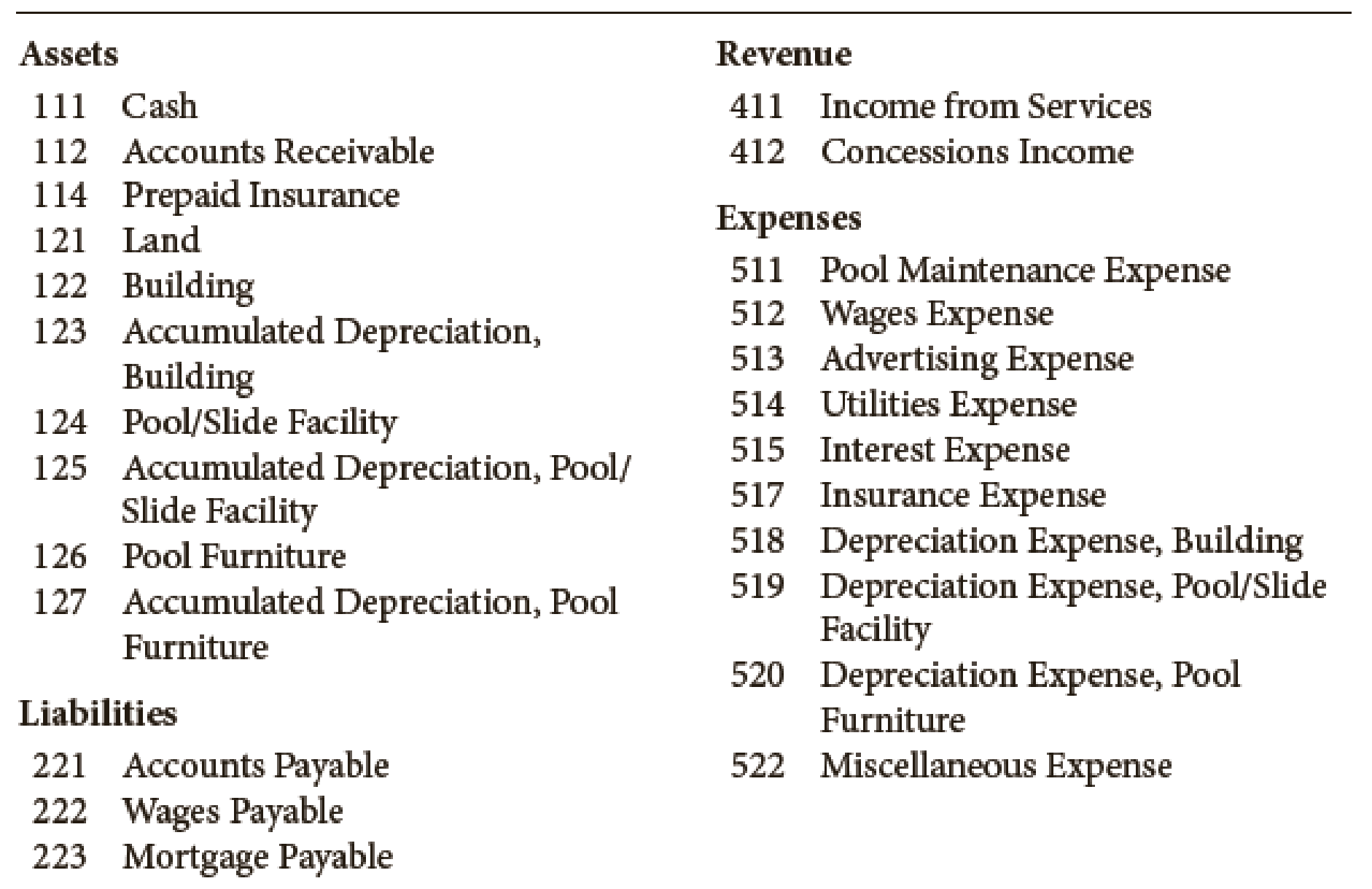

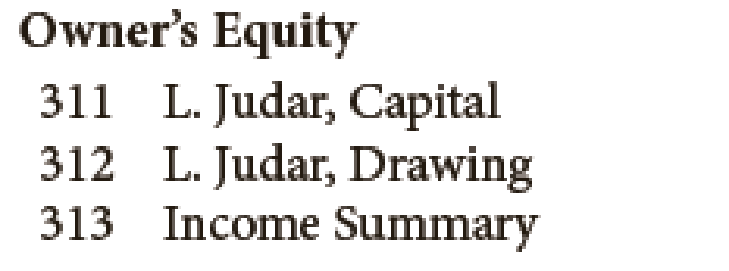

CHART OF ACCOUNTS

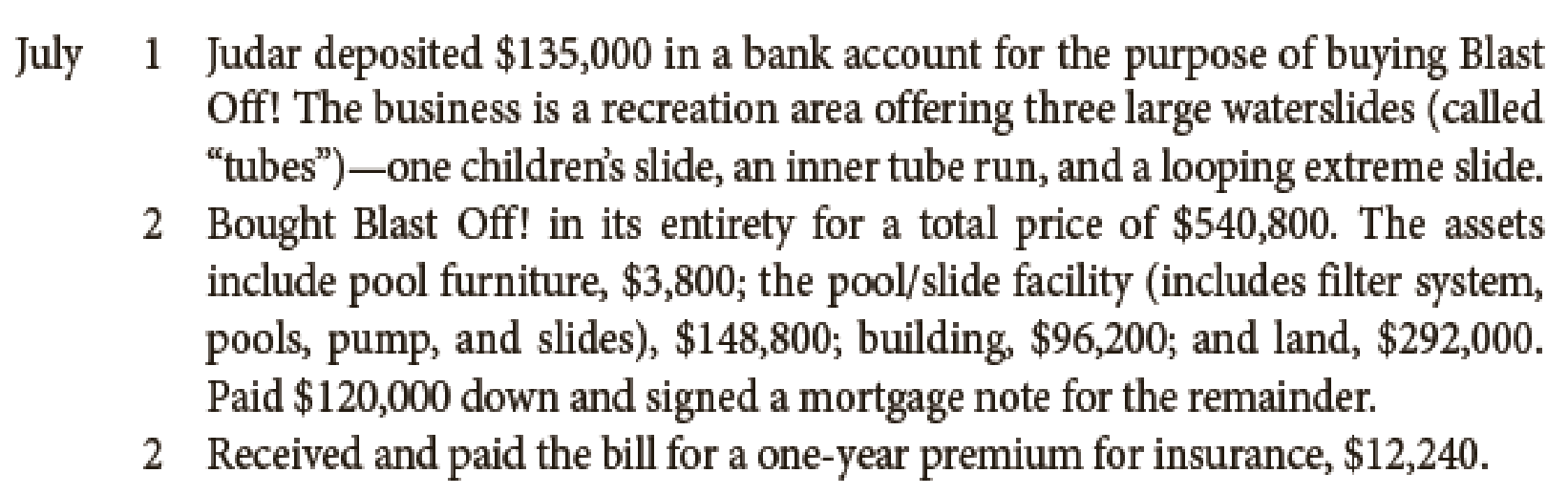

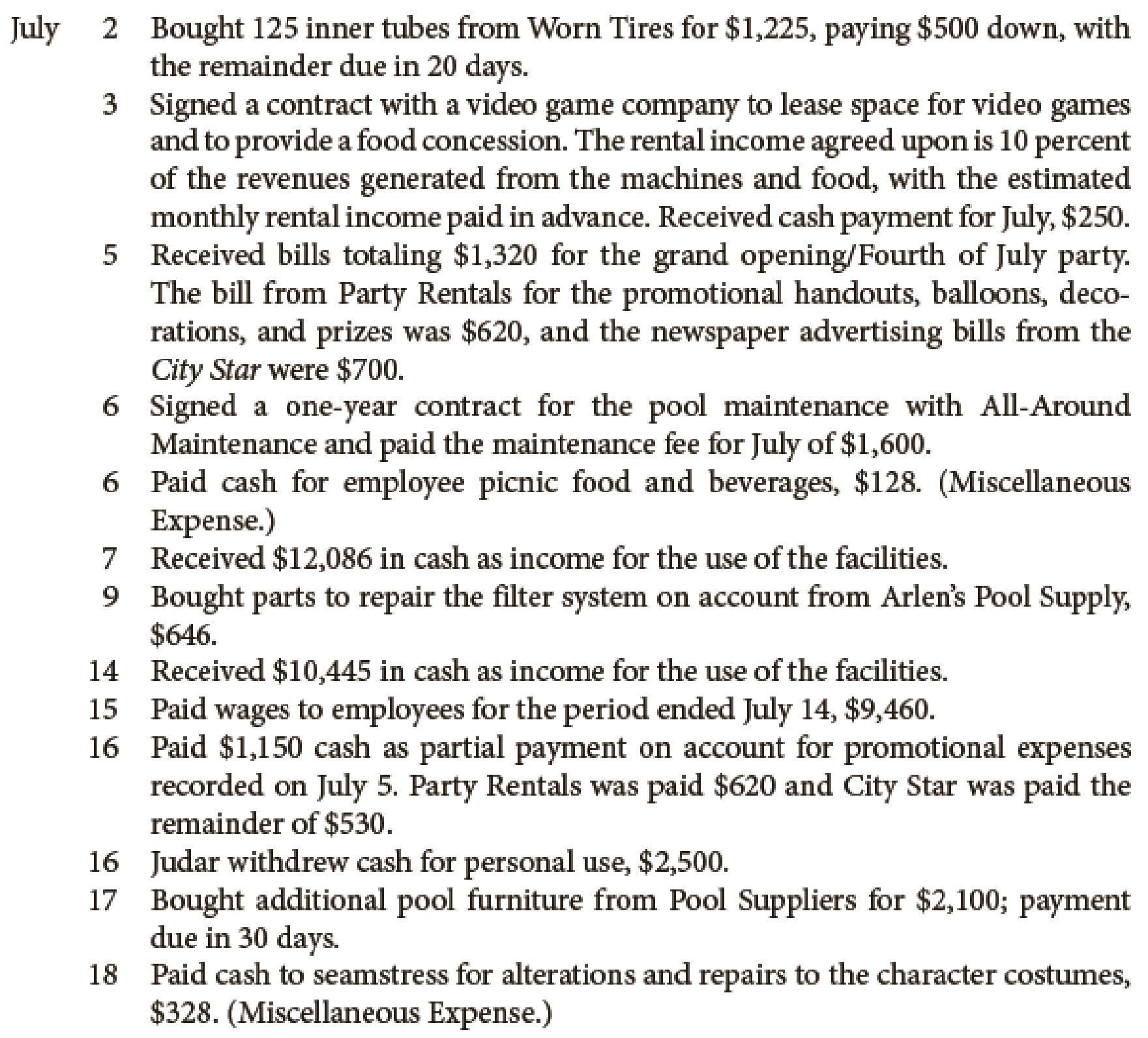

You are to record transactions in a two-column general journal. Assume that the fiscal period is one month. You will then be able to complete all of the steps in the accounting cycle.

When you are analyzing the transactions, think them through by visualizing the T accounts or by writing them down on scratch paper. For unfamiliar types of transactions, specific instructions for recording them are included. However, reason them out for yourself as well. Check off each transaction as it is recorded.

Required

- 1. Journalize the transactions. (Start on page 1 of the general journal if using Excel or Working Papers.)

- 2. Post the transactions to the ledger accounts. (Skip this step if using CLGL.)

- 3. Prepare a

trial balance . (If using a work sheet, use the first two columns.) - 4. Data for the adjustments are as follows:

- a. Insurance expired during the month, $1,020.

- b.

Depreciation of building for the month, $480. - c. Depreciation of pool/slide facility for the month, $675.

- d. Depreciation of pool furniture for the month, $220.

- e. Wages accrued at July 31, $920.

Your instructor may want you to use a work sheet for these adjustments.

- 5. Journalize

adjusting entries . - 6. Post adjusting entries to the ledger accounts. (Skip this step if using CLGL.)

- 7. Prepare an adjusted trial balance.

- 8. Prepare the income statement.

- 9. Prepare the statement of owner’s equity.

- 10. Prepare the balance sheet.

- 11. Journalize closing entries.

- 12.

Post closing entries to the ledger accounts. (Skip this step if using CLGL.) - 13. Prepare a post-closing trial balance.

Check Figure

Trial balance total, $601,941; net income, $16,293; post-closing trial balance total, $569,614

1.

Prepare journal entries for the given transactions for Company BO.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare journal entries for the given transactions for Company BO.

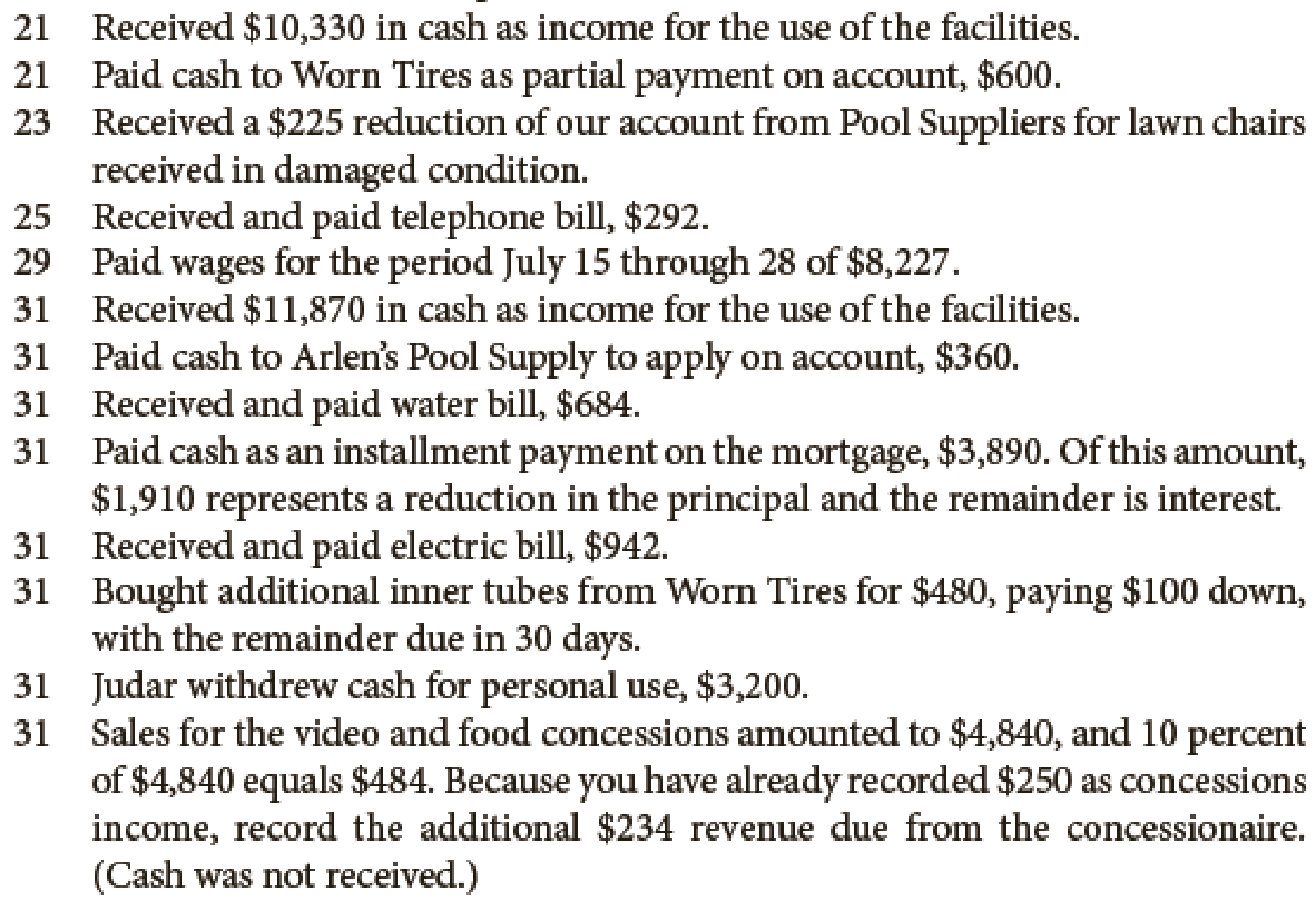

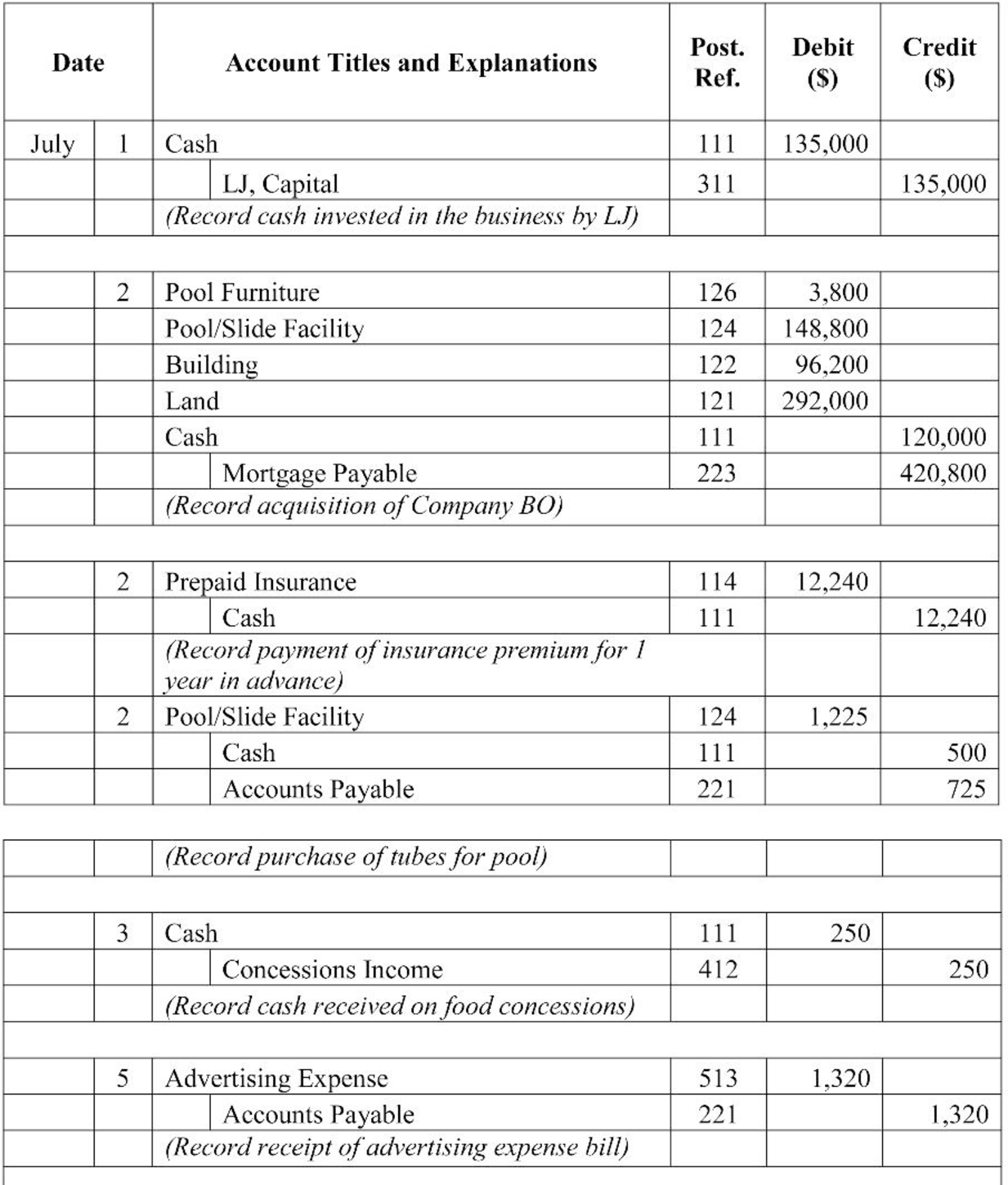

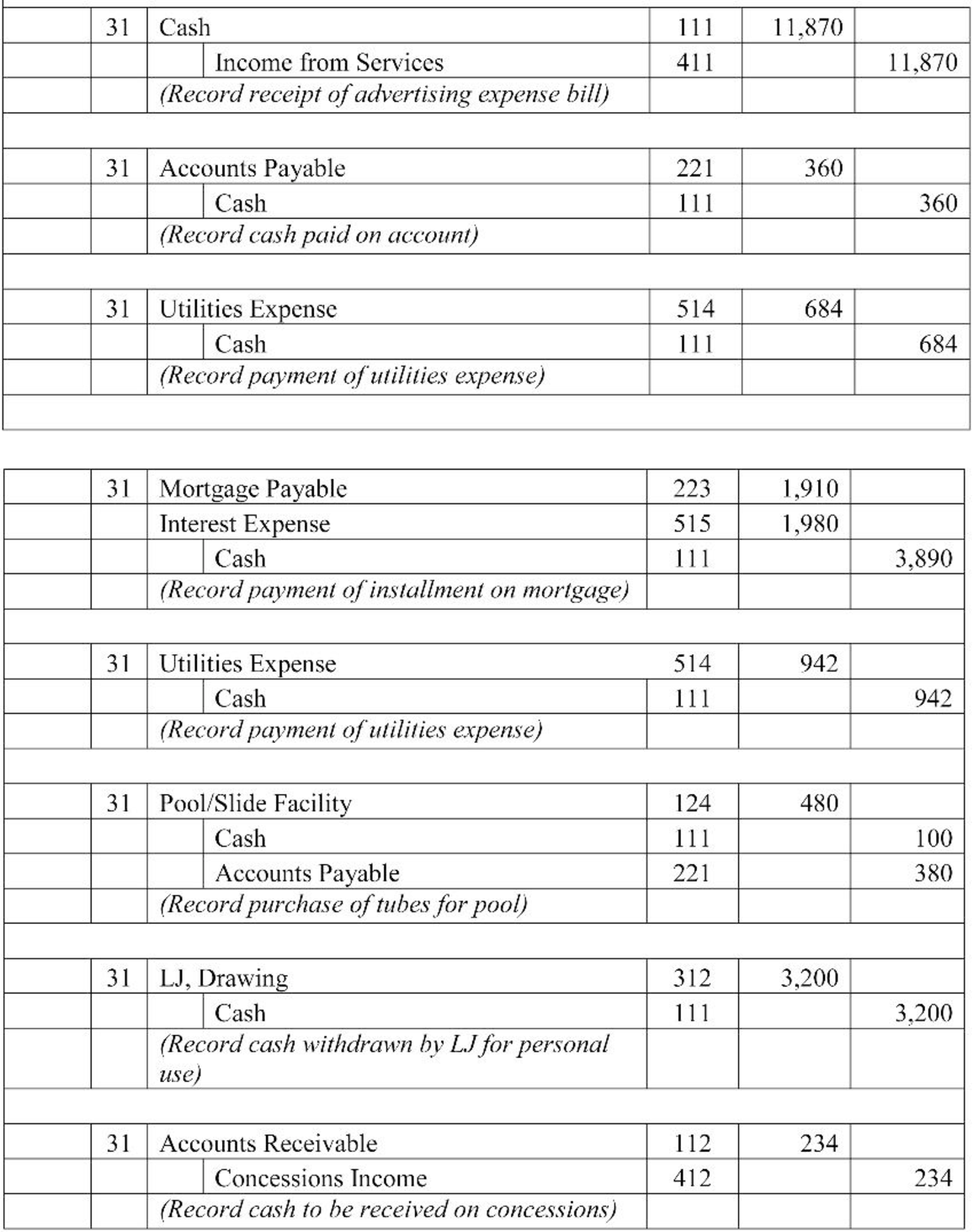

Table (1)

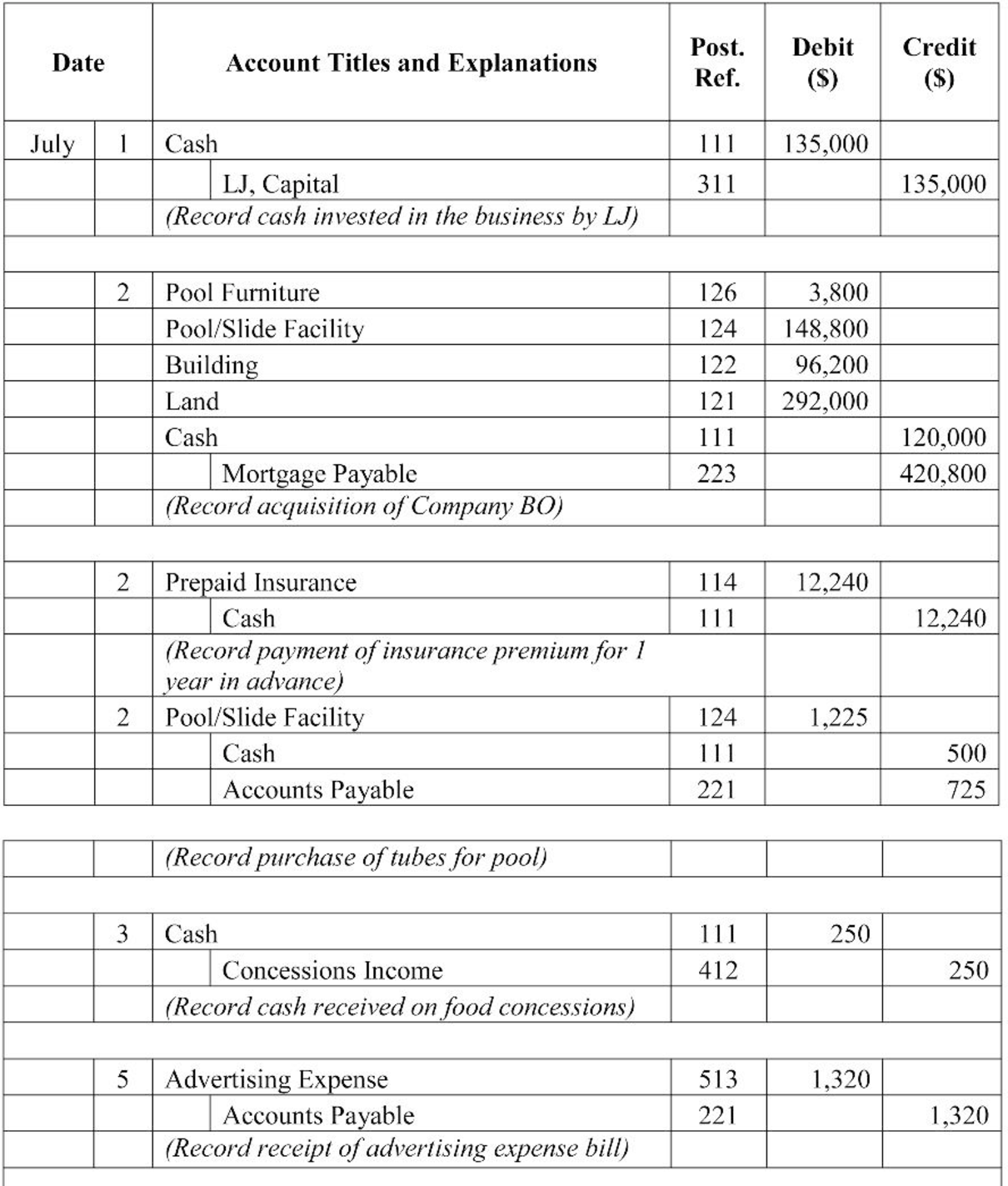

Table (2)

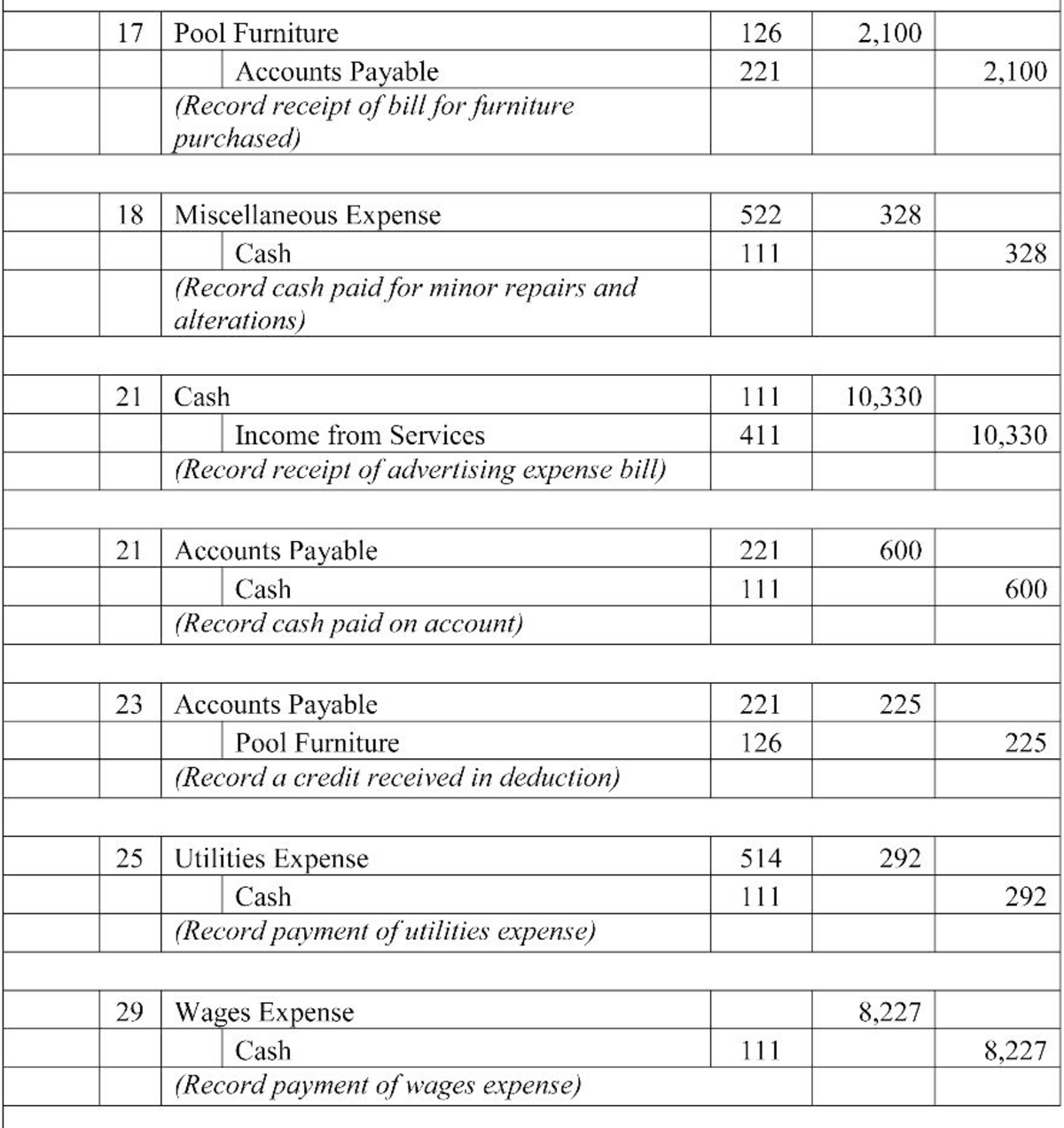

Table (3)

Table (4)

2.

Post the journalized transactions in the ledger accounts of the general ledger.

Explanation of Solution

Ledger: Ledger is a book in which the accounts are summarized and grouped from the transactions recorded in the journal.

Post the journalized transactions in the ledger accounts of the general ledger.

| ACCOUNT Cash ACCOUNT NO. 111 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 1 | 1 | 135,000 | 135,000 | |||

| 2 | 1 | 120,000 | 15,000 | ||||

| 2 | 1 | 12,240 | 2,760 | ||||

| 2 | 1 | 500 | 2,260 | ||||

| 3 | 1 | 250 | 2,510 | ||||

| 6 | 1 | 1,600 | 910 | ||||

| 6 | 2 | 128 | 782 | ||||

| 7 | 2 | 12,086 | 12,868 | ||||

| 14 | 2 | 10,445 | 23,313 | ||||

| 15 | 2 | 9,460 | 13,853 | ||||

| 16 | 2 | 1,150 | 12,703 | ||||

| 16 | 2 | 2,500 | 10,203 | ||||

| 18 | 3 | 328 | 9,875 | ||||

| 21 | 3 | 10,330 | 20,205 | ||||

| 21 | 3 | 600 | 19,605 | ||||

| 25 | 3 | 292 | 19,313 | ||||

| 29 | 3 | 8,227 | 11,086 | ||||

| 31 | 3 | 11,870 | 22,956 | ||||

| 31 | 3 | 360 | 22,596 | ||||

| 31 | 3 | 684 | 21,912 | ||||

| 31 | 4 | 3,890 | 18,022 | ||||

| 31 | 4 | 942 | 17,080 | ||||

| 31 | 4 | 100 | 16,980 | ||||

| 31 | 4 | 3,200 | 13,780 | ||||

Table (2)

| ACCOUNT Accounts Receivable ACCOUNT NO. 112 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 7 | 4 | 234 | 234 | |||

Table (3)

| ACCOUNT Prepaid Insurance ACCOUNT NO. 114 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 2 | 1 | 12,240 | 12,240 | |||

Table (4)

| ACCOUNT Land ACCOUNT NO. 121 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 2 | 1 | 292,000 | 292,000 | |||

Table (5)

| ACCOUNT Building ACCOUNT NO. 122 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 2 | 1 | 96,200 | 96,200 | |||

Table (6)

| ACCOUNT Pool/Slide Facility ACCOUNT NO. 124 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 2 | 1 | 148,800 | 148,800 | |||

| 2 | 1 | 1,225 | 150,025 | ||||

| 31 | 4 | 480 | 150,505 | ||||

Table (7)

| ACCOUNT Pool Furniture ACCOUNT NO. 126 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 2 | 1 | 148,800 | 148,800 | |||

| 2 | 1 | 1,225 | 150,025 | ||||

| 31 | 4 | 480 | 150,505 | ||||

Table (8)

| ACCOUNT Accounts Payable ACCOUNT NO. 221 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 2 | 1 | 725 | 725 | |||

| 5 | 1 | 1,320 | 2,045 | ||||

| 9 | 2 | 646 | 2,691 | ||||

| 16 | 2 | 1,150 | 1,541 | ||||

| 17 | 2 | 2,100 | 3,641 | ||||

| 21 | 3 | 600 | 3,041 | ||||

| 23 | 3 | 225 | 2,816 | ||||

| 31 | 3 | 360 | 2,456 | ||||

| 31 | 4 | 380 | 2,836 | ||||

Table (9)

| ACCOUNT Mortgage Payable ACCOUNT NO. 223 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 2 | 1 | 420,800 | 420,800 | |||

| 31 | 4 | 1,910 | 418,890 | ||||

Table (10)

| ACCOUNT LJ, Capital ACCOUNT NO. 311 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 1 | 1 | 135,000 | 135,000 | |||

Table (11)

| ACCOUNT LJ, Drawing ACCOUNT NO. 312 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 16 | 2 | 2,500 | 2,500 | |||

| 31 | 4 | 3,200 | 5,700 | ||||

Table (12)

| ACCOUNT Income from Services ACCOUNT NO. 411 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 7 | 2 | 12,086 | 12,086 | |||

| 14 | 2 | 10,445 | 22,531 | ||||

| 21 | 3 | 10,330 | 32,861 | ||||

| 31 | 3 | 11,870 | 44,731 | ||||

Table (13)

| ACCOUNT Concessions Income ACCOUNT NO. 412 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 3 | 2 | 250 | 250 | |||

| 31 | 2 | 234 | 484 | ||||

Table (14)

| ACCOUNT Pool Maintenance Expense ACCOUNT NO. 511 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 6 | 1 | 1,600 | 1,600 | |||

| 9 | 2 | 646 | 2,246 | ||||

Table (15)

| ACCOUNT Wages Expense ACCOUNT NO. 512 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 15 | 2 | 9,460 | 9,460 | |||

| 29 | 3 | 8,227 | 17,687 | ||||

Table (16)

| ACCOUNT Advertising Expense ACCOUNT NO. 513 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 5 | 2 | 1,320 | 1,320 | |||

Table (17)

| ACCOUNT Utilities Expense ACCOUNT NO. 514 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 25 | 3 | 292 | 292 | |||

| 31 | 3 | 684 | 976 | ||||

| 31 | 4 | 942 | 1,918 | ||||

Table (18)

| ACCOUNT Interest Expense ACCOUNT NO. 515 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 31 | 4 | 1,980 | 1,980 | |||

Table (19)

| ACCOUNT Miscellaneous Expense ACCOUNT NO. 522 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 6 | 2 | 128 | 128 | |||

| 18 | 3 | 328 | 456 | ||||

Table (20)

3.

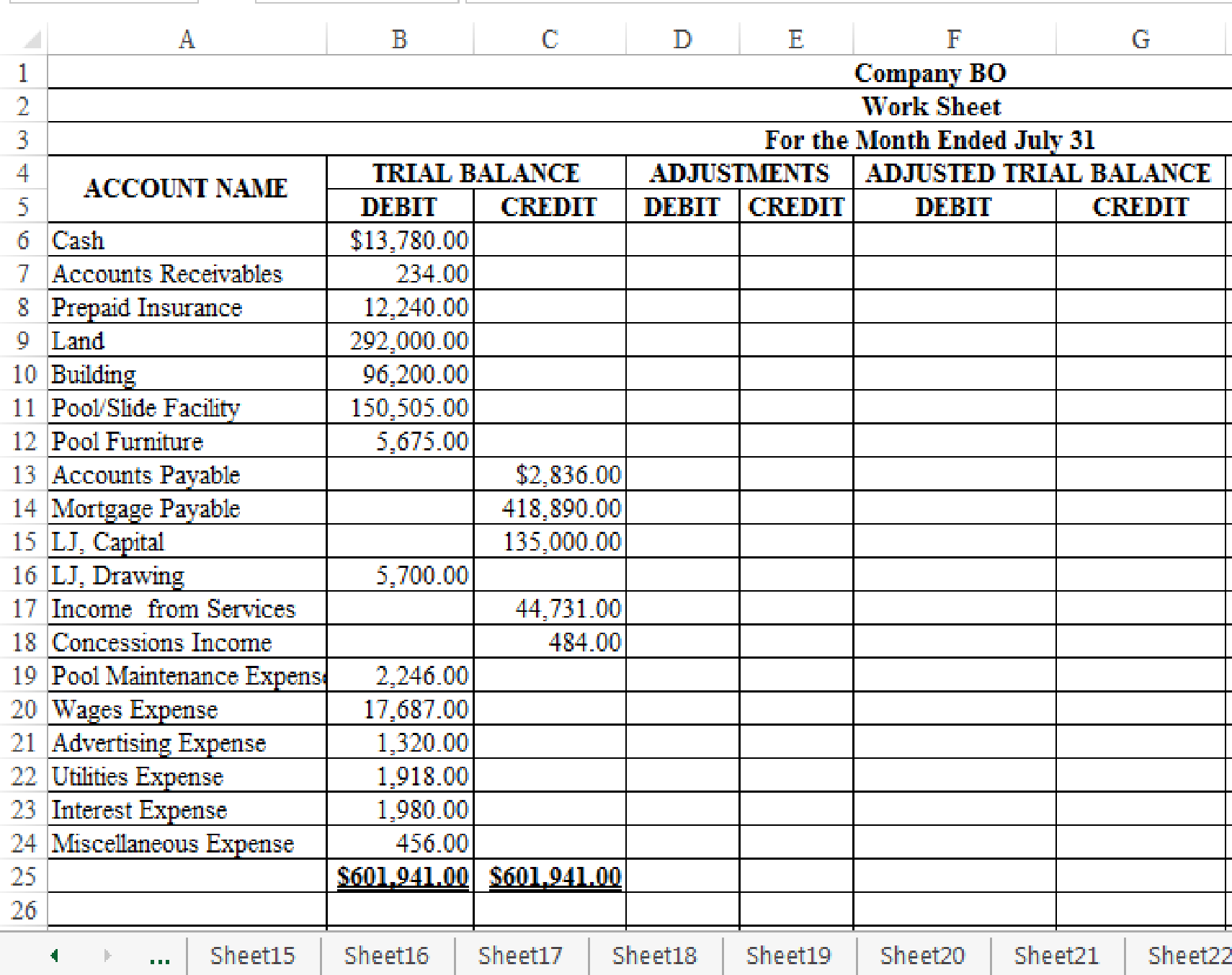

Prepare trial balance on the work sheet, from the account balances in Part (2).

Explanation of Solution

Worksheet: Worksheet is an accounting tool that help accountants to record adjustments and up-date balances required to prepare financial statements. Worksheet is a central place where trial balance, adjustments, adjusted trial balance, income statement, and balance sheet are presented.

Trial balance: Trial balance is a summary of all the asset, liability, and equity accounts and their balances.

Prepare trial balance on the work sheet, from the account balances in Part (2).

Figure – (1)

4.

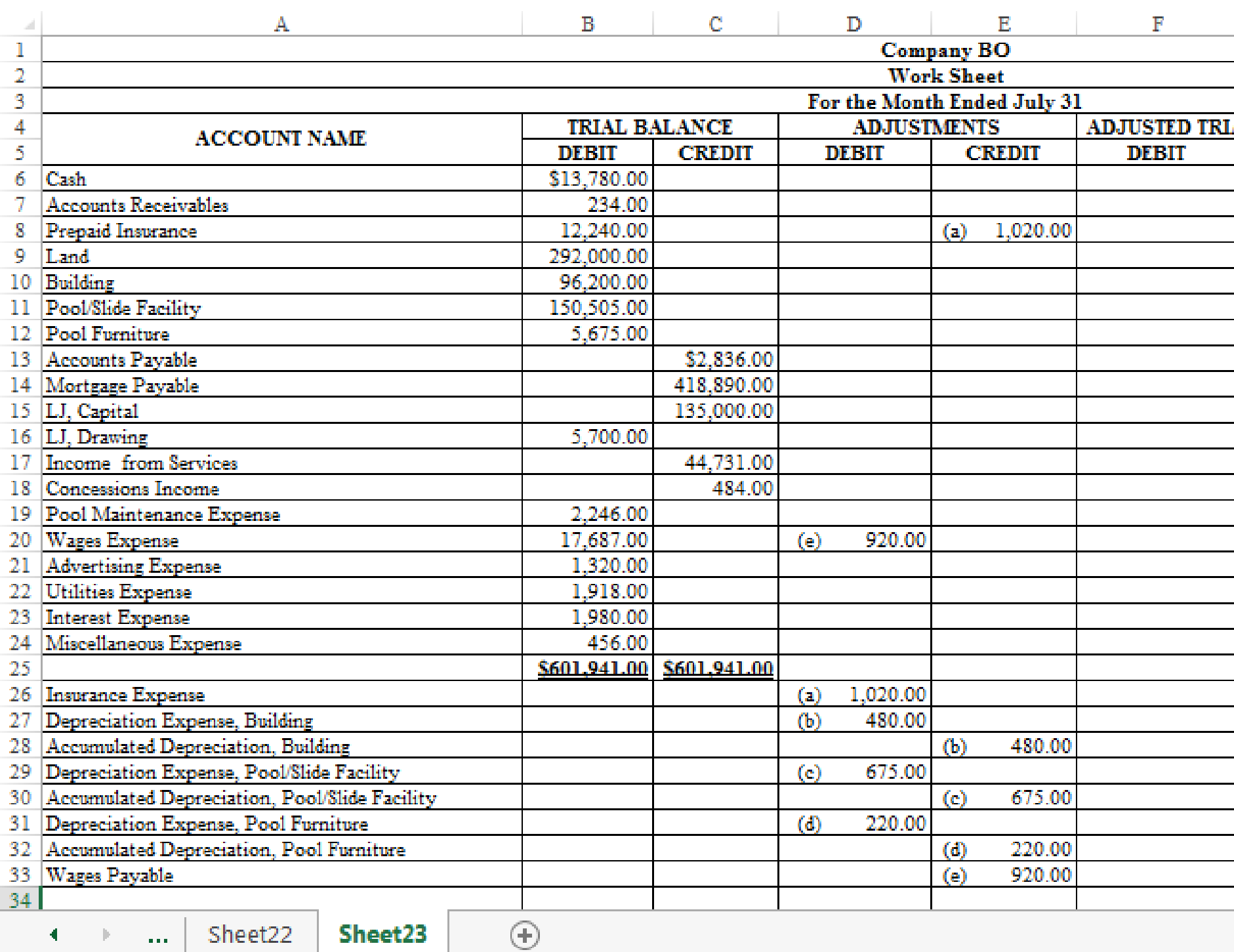

Indicate the given adjustments on the worksheet for Company BO for the month ended July 31, 20--.

Explanation of Solution

Worksheet: Worksheet is an accounting tool that help accountants to record adjustments and up-date balances required to prepare financial statements. Worksheet is a central place where trial balance, adjustments, adjusted trial balance, income statement, and balance sheet are presented.

Indicate the given adjustments on the worksheet for Company BO for the month ended July 31, 20--.

Figure-(2)

5.

Prepare adjusting journal entries for Company BO.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and owners’ or stockholders’ equity) to maintain the records according to accrual basis principle and matching concept.

Prepare adjusting journal entries for Company BO.

Adjusting entry (a) for the prepaid insurance:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| July | 31 | Insurance Expense | 517 | 1,020 | ||

| Prepaid Insurance | 114 | 1,020 | ||||

| (Record part of prepaid insurance expired) | ||||||

Table (21)

Description:

- Insurance Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Prepaid Insurance is an asset account. Since amount of insurance is expired, asset account decreased, and a decrease in asset is credited.

Adjusting entry (b) for the depreciation expense for building:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| July | 31 | Depreciation Expense, Building | 518 | 480 | ||

| Accumulated Depreciation, Building | 123 | 480 | ||||

| (Record depreciation expense) | ||||||

Table (22)

Description:

- Depreciation Expense, Building is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Accumulated Depreciation, Building is a contra-asset account, and contra-asset accounts would have a normal credit balance, hence, the account is credited.

Adjusting entry (c) for the depreciation expense for pool/slide facility:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| July | 31 | Depreciation Expense, Pool/Slide Facility | 519 | 675 | ||

| Accumulated Depreciation, Pool/Slide Facility | 125 | 675 | ||||

| (Record depreciation expense) | ||||||

Table (23)

Description:

- Depreciation Expense, Pool/Slide Facility is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Accumulated Depreciation, Pool/Slide Facility is a contra-asset account, and contra-asset accounts would have a normal credit balance, hence, the account is credited.

Adjusting entry (d) for the depreciation expense for pool/slide facility:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| July | 31 | Depreciation Expense, Pool Furniture | 520 | 220 | ||

| Accumulated Depreciation, Pool Furniture | 127 | 220 | ||||

| (Record depreciation expense) | ||||||

Table (24)

Description:

- Depreciation Expense, Pool Furniture is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Accumulated Depreciation, Pool Furniture is a contra-asset account, and contra-asset accounts would have a normal credit balance, hence, the account is credited.

Adjusting entry (e) for the wages expense:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| July | 31 | Wages Expense | 512 | 920 | ||

| Wages Payable | 222 | 920 | ||||

| (Record accrued wages expenses) | ||||||

Table (25)

Description:

- Wages Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Wages Payable is a liability account. Since amount of payables has increased, liability decreased, and an increase in liability is credited.

6.

Post the adjusting entries journalized in Part (5) in the ledger accounts of general ledger.

Explanation of Solution

Post the adjusting entries journalized in Part (5) in the ledger accounts of general ledger.

| ACCOUNT Prepaid Insurance ACCOUNT NO. 114 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 2 | 1 | 12,240 | 12,240 | |||

| 31 | Adjusting | 1,020 | 11,220 | ||||

Table (26)

| ACCOUNT Accumulated Depreciation, Building ACCOUNT NO. 123 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 31 | Adjusting | 480 | 480 | |||

Table (27)

| ACCOUNT Accumulated Depreciation, Pool/Slide Facility ACCOUNT NO. 125 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 31 | Adjusting | 675 | 675 | |||

Table (28)

| ACCOUNT Accumulated Depreciation, Pool Furniture ACCOUNT NO. 127 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 31 | Adjusting | 220 | 220 | |||

Table (29)

| ACCOUNT Wages Payable ACCOUNT NO. 222 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 31 | Adjusting | 920 | 920 | |||

Table (30)

| ACCOUNT Wages Expense ACCOUNT NO. 512 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 15 | 2 | 9,460 | 9,460 | |||

| 29 | 3 | 8,227 | 17,687 | ||||

| 31 | Adjusting | 920 | 18,607 | ||||

Table (31)

| ACCOUNT Insurance Expense ACCOUNT NO. 517 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 31 | Adjusting | 2 | 1,020 | 1,020 | ||

Table (32)

| ACCOUNT Depreciation Expense, Building ACCOUNT NO. 518 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 31 | Adjusting | 480 | 480 | |||

Table (33)

| ACCOUNT Depreciation Expense, Pool/Slide Facility ACCOUNT NO. 519 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 31 | Adjusting | 675 | 675 | |||

Table (34)

| ACCOUNT Depreciation Expense, Pool Furniture ACCOUNT NO. 520 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 31 | Adjusting | 220 | 220 | |||

Table (35)

7.

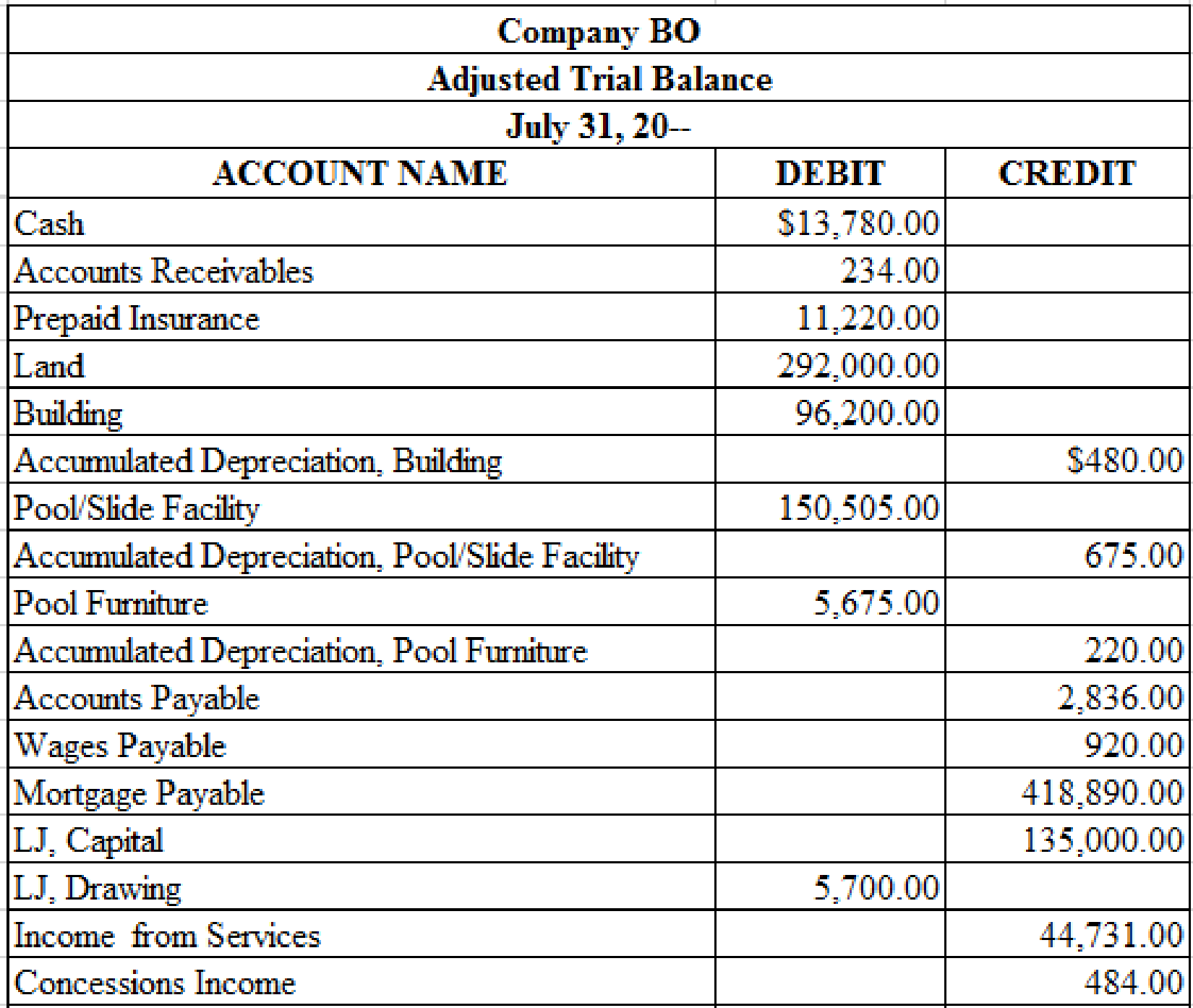

Prepare an adjusted trial balance for Company BO as at July 31, 20--, based on the account balances derived in Parts (2) and (6).

Explanation of Solution

Adjusted trial balance: The trial balance which reflects the adjusting entries and incorporates the effect of all adjustments in the ledger accounts, is referred to as adjusted trial balance.

Prepare an adjusted trial balance for Company BO as at July 31, 20--, based on the account balances derived in Parts (2) and (6).

Figure - (3)

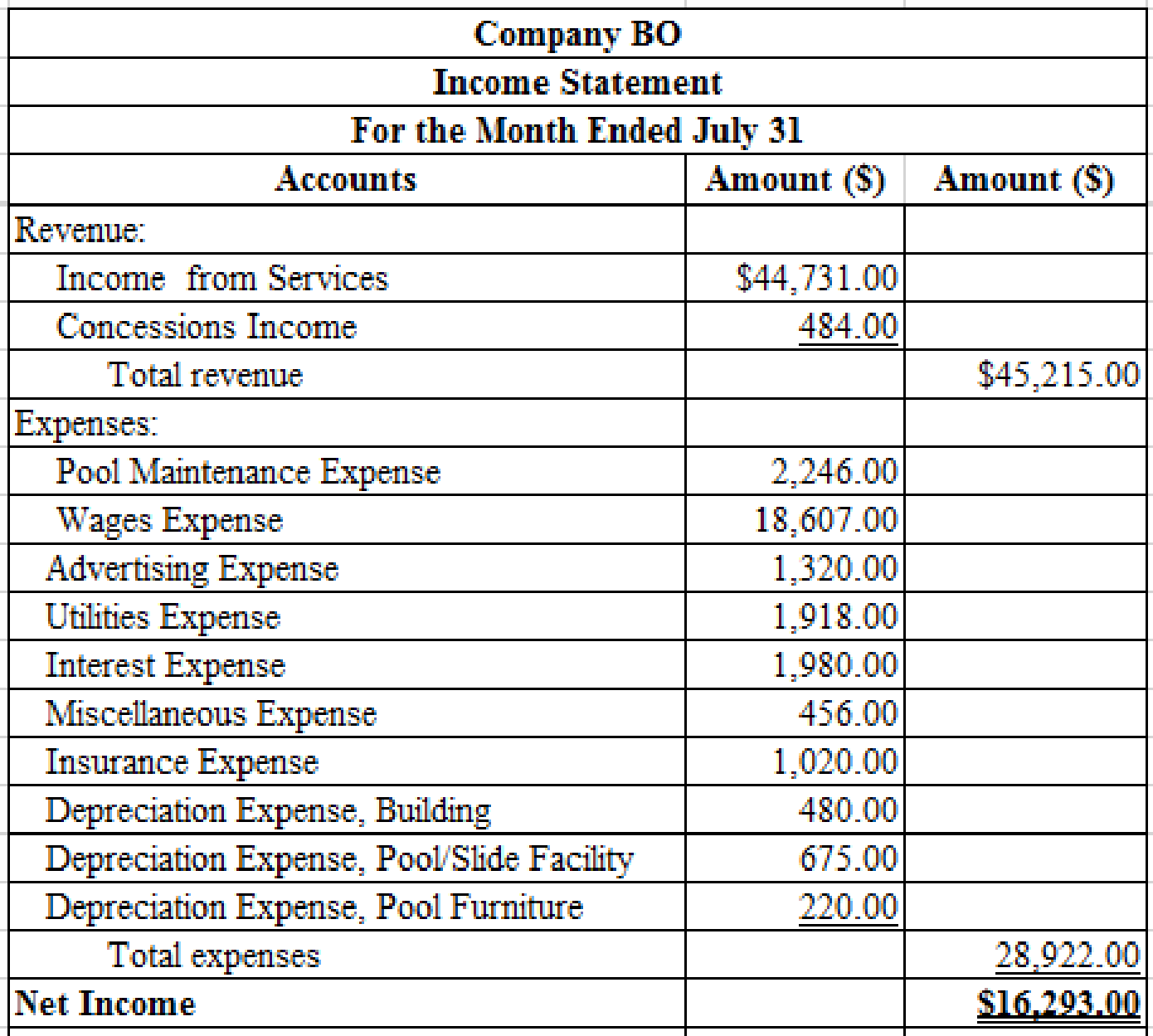

8.

Prepare an income statement of Company BO for the month ended July 31, based on the account balances derived in Parts (2) and (6).

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations, and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement of Company BO for the month ended July 31.

Figure - (4)

9.

Prepare a statement of owners’ equity of Company BO, based on the account balances derived in Parts (2) and (6), and net income computed in Part (8).

Explanation of Solution

Statement of owners’ equity: This statement reports the beginning owner’s equity and all the changes which led to ending owners’ equity. Additional capital, net income from income statement is added to, and drawings are deducted from beginning owner’s equity to arrive at the end result, ending owner’s equity.

Prepare a statement of owners’ equity for Company BO for the month ended July 31.

| Company BO | ||

| Statement of Owners’ Equity | ||

| For the Month Ended July 31, 20-- | ||

| LJ, Capital, July 1, 20-- | $0 | |

| Investments during July | $135,000 | |

| Net income for July | 16,293 | |

| 151,293 | ||

| Less: Withdrawals for July | 5,700 | |

| Increase in capital | 145,593 | |

| LJ, Capital, July 31, 20-- | $145,593 | |

Table (36)

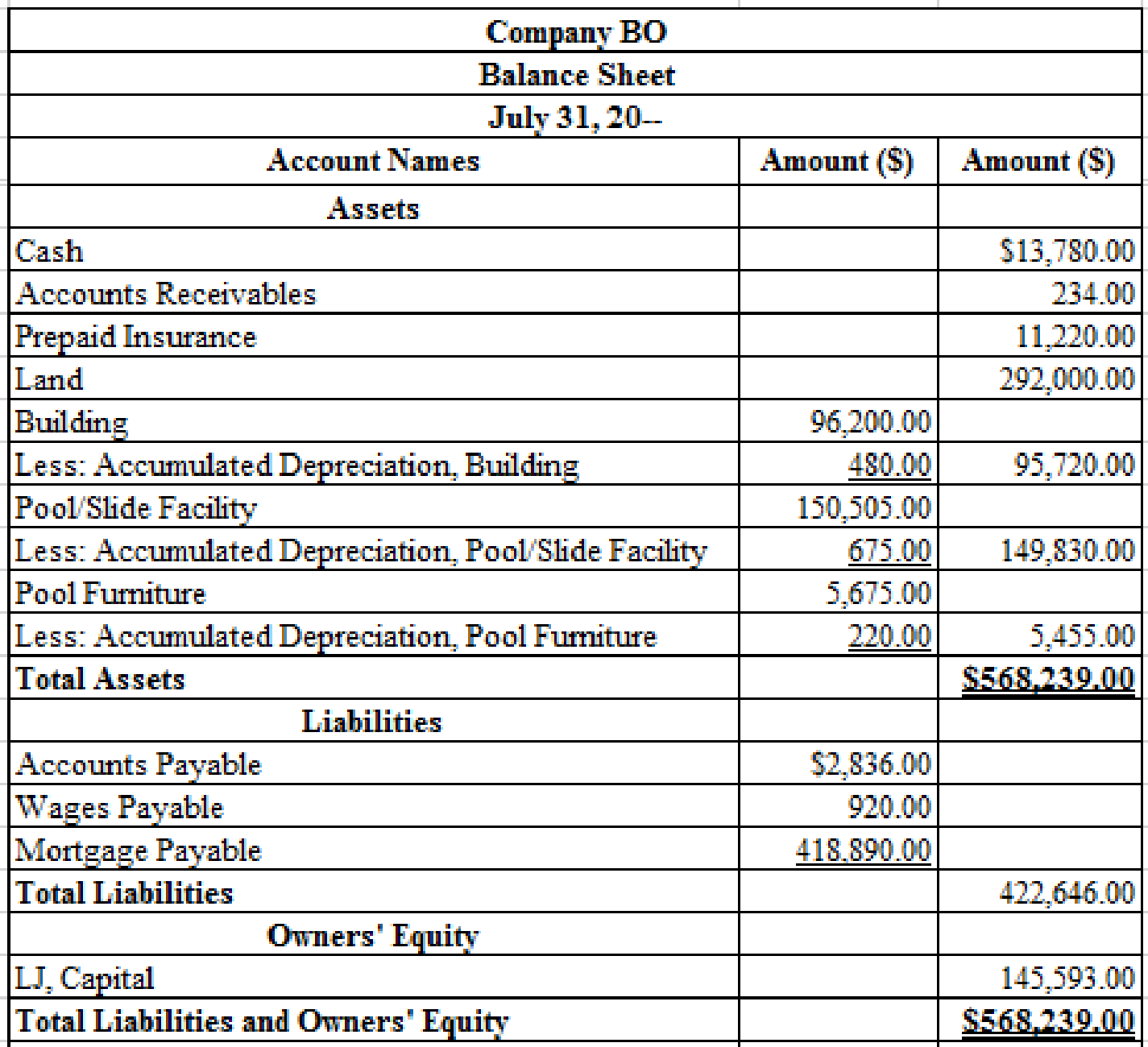

10.

Prepare a balance sheet for Company BO, based on the account balances derived in Parts (2) and (6), and capital of the owner from the statement of owners’ equity prepared in Part (9).

Explanation of Solution

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and owners (owners’ equity) over those resources. The resources of the company are assets which include money contributed by owners and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and owners’ equity.

Prepare the balance sheet for Company BO as at July 31, 20--.

Table (37)

11.

Prepare closing entries numbering the entries 1 through 4.

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to capital account are referred to as closing entries. The revenue, expense, and drawing accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Steps in closing procedure:

- 1. Close the revenue accounts to Income Summary account.

- 2. Close the expense accounts to Income Summary account.

- 3. Close the Income Summary account and transfer the net income or net loss balance to the Capital account.

- 4. Close the Drawing account to Capital account.

Prepare closing entries numbering the entries 1 through 4.

Entry 1:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| July | 31 | Income from Services | 411 | 44,731 | ||

| Concessions Income | 412 | 484 | ||||

| Income Summary | 313 | 45,215 | ||||

| (Record closing of revenue to Income Summary account) | ||||||

Table (38)

Description:

- Income from Services and Concessions Income are revenue accounts. Revenue account has a normal credit balance. Since revenue is closed to Income Summary account, the account is debited.

- Income Summary is a clearing account which closes revenue, expense, drawings, and net of revenues and expenses to capital accounts. The account is credited to hold the transferred balance from revenue account.

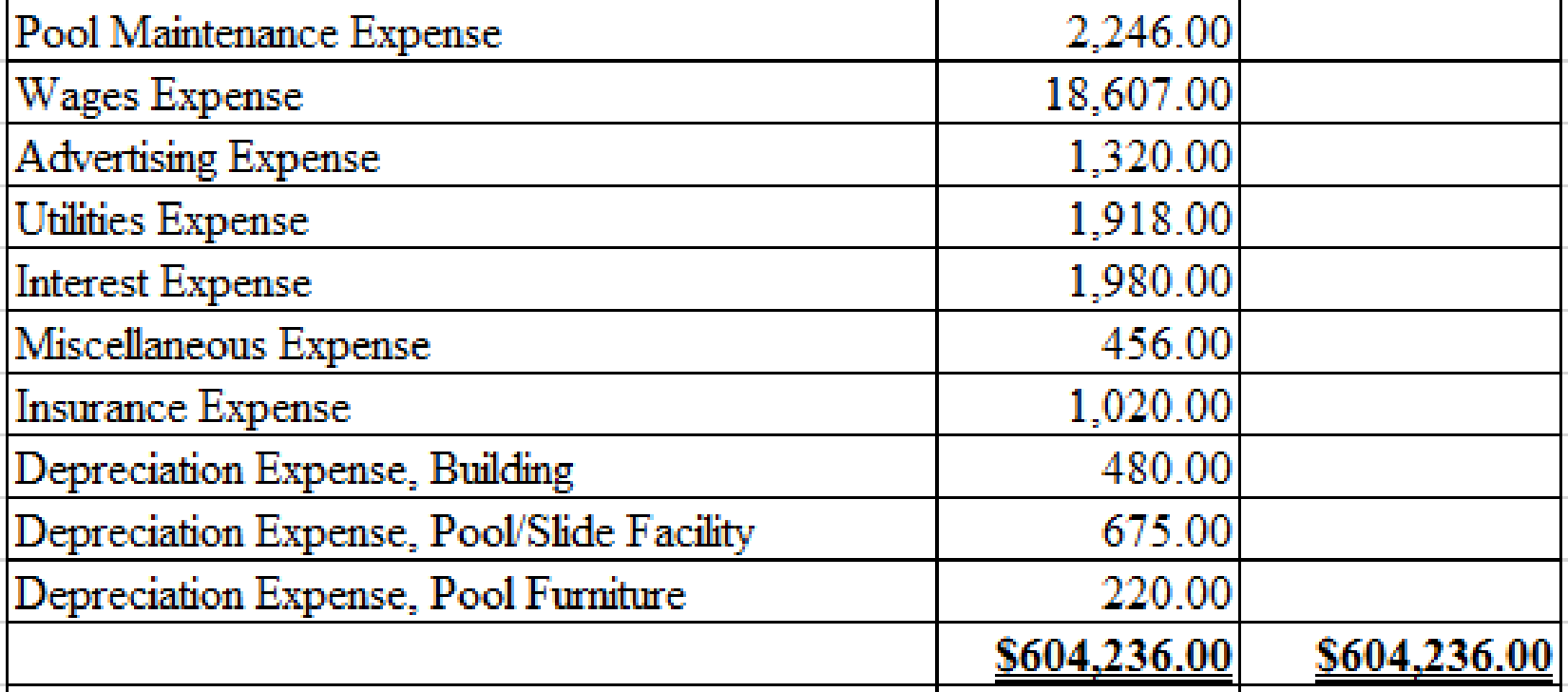

Entry 2:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| July | 31 | Income Summary | 28,922 | |||

| Pool Maintenance Expense | 2,246 | |||||

| Wages Expense | 18,607 | |||||

| Advertising Expense | 1,320 | |||||

| Utilities Expense | 1,918 | |||||

| Interest Expense | 1,980 | |||||

| Insurance Expense | 1,020 | |||||

| Depreciation Expense, Building | 480 | |||||

| Depreciation Expense, Pool/Slide Facility | 675 | |||||

| Depreciation Expense, Pool Furniture | 220 | |||||

| Miscellaneous Expense | 456 | |||||

| (Record closing of expenses to Income Summary account) | ||||||

Table (39)

Description:

- Income Summary is a clearing account which closes revenue, expense, drawings, and net of revenues and expenses to capital accounts. The account is debited to hold the transferred balance from expense accounts.

- All expense accounts have a normal debit balance. Since expenses are closed to Income Summary account, the accounts are credited.

Entry 3:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| July | 31 | Income Summary | 16,293 | |||

| LJ, Capital | 16,293 | |||||

| (Record closing of net income to capital account) | ||||||

Table (40)

Description:

- Income Summary is a clearing account which closes revenue, expense, drawings, and net of revenues and expenses to capital accounts. Since net income is closed, the account is reversed, hence, the Income Summary account is debited.

- LJ, Capital is a capital account. Since net income is transferred to the account, the value increased, and an increase in capital is credited.

Entry 4:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| July | 31 | LJ, Capital | 5,700 | |||

| LJ, Drawing | 5,700 | |||||

| (Record closing of drawing to capital account) | ||||||

Table (41)

Description:

- LJ, Capital is a capital account. Since drawings is transferred to the account, the value decreased, and a decrease in capital is debited.

- LJ, Drawing is a capital account. Since drawings is transferred, the account is credited to reverse the previously debited effect.

12.

Post the closing entries to ledger accounts.

Explanation of Solution

Post the closing entries to ledger accounts.

| ACCOUNT LJ, Capital ACCOUNT NO. 311 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 1 | 1 | 135,000 | 135,000 | |||

| 31 | Closing | 16,293 | 151,293 | ||||

| 31 | Closing | 5,700 | 145,593 | ||||

Table (42)

| ACCOUNT LJ, Drawing ACCOUNT NO. 312 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 16 | 2 | 2,500 | 2,500 | |||

| 31 | 4 | 3,200 | 5,700 | ||||

| 31 | Closing | 5,700 | 0 | ||||

Table (43)

| ACCOUNT Income from Services ACCOUNT NO. 411 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 7 | 2 | 12,086 | 12,086 | |||

| 14 | 2 | 10,445 | 22,531 | ||||

| 21 | 3 | 10,330 | 32,861 | ||||

| 31 | 3 | 11,870 | 44,731 | ||||

| 31 | Closing | 44,731 | 0 | ||||

Table (44)

| ACCOUNT Concessions Income ACCOUNT NO. 412 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 3 | 2 | 250 | 250 | |||

| 31 | 2 | 234 | 484 | ||||

| 31 | Closing | 484 | 0 | ||||

Table (45)

| ACCOUNT Pool Maintenance Expense ACCOUNT NO. 511 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 6 | 1 | 1,600 | 1,600 | |||

| 9 | 2 | 646 | 2,246 | ||||

| 31 | Closing | 2,246 | 0 | ||||

Table (46)

| ACCOUNT Wages Expense ACCOUNT NO. 512 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 15 | 2 | 9,460 | 9,460 | |||

| 29 | 3 | 8,227 | 17,687 | ||||

| 31 | Closing | 17,687 | 0 | ||||

Table (47)

| ACCOUNT Advertising Expense ACCOUNT NO. 513 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 5 | 2 | 1,320 | 1,320 | |||

| 31 | Closing | 1,320 | 0 | ||||

Table (48)

| ACCOUNT Utilities Expense ACCOUNT NO. 514 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 25 | 3 | 292 | 292 | |||

| 31 | 3 | 684 | 976 | ||||

| 31 | 4 | 942 | 1,918 | ||||

| 31 | Closing | 1,918 | 0 | ||||

Table (49)

| ACCOUNT Interest Expense ACCOUNT NO. 515 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 31 | 4 | 1,980 | 1,980 | |||

| 31 | Closing | 1,980 | 0 | ||||

Table (50)

| ACCOUNT Miscellaneous Expense ACCOUNT NO. 522 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 6 | 2 | 128 | 128 | |||

| 18 | 3 | 328 | 456 | ||||

| 31 | Closing | 456 | 0 | ||||

Table (51)

| ACCOUNT Wages Expense ACCOUNT NO. 512 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 15 | 2 | 9,460 | 9,460 | |||

| 29 | 3 | 8,227 | 17,687 | ||||

| 31 | Adjusting | 920 | 18,607 | ||||

| 31 | Closing | 18,607 | 0 | ||||

Table (52)

| ACCOUNT Insurance Expense ACCOUNT NO. 517 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 31 | Adjusting | 2 | 1,020 | 1,020 | ||

| 31 | Closing | 1,020 | 0 | ||||

Table (53)

| ACCOUNT Depreciation Expense, Building ACCOUNT NO. 518 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 31 | Adjusting | 480 | 480 | |||

| 31 | Closing | 480 | 0 | ||||

Table (54)

| ACCOUNT Depreciation Expense, Pool/Slide Facility ACCOUNT NO. 519 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 31 | Adjusting | 675 | 675 | |||

| 31 | Closing | 675 | 0 | ||||

Table (55)

| ACCOUNT Depreciation Expense, Pool Furniture ACCOUNT NO. 520 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 31 | Adjusting | 220 | 220 | |||

| 31 | Closing | 220 | 0 | ||||

Table (56)

| ACCOUNT Income Summary ACCOUNT NO. 313 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| July | 31 | Closing | 45,215 | 45,215 | |||

| 31 | Closing | 28,922 | 16,293 | ||||

| 31 | Closing | 16,293 | 0 | ||||

Table (57)

13.

Prepare a post-closing trial balance for Company BO as at July 31, 20--.

Explanation of Solution

Post-closing trial balance: Post-closing trial balance is a summary of all the asset, liability, and capital accounts and their balances, after the closing entries are prepared. So, post-closing trial balance reports the balances of permanent accounts only.

Prepare a post-closing trial balance for Company BO as at July 31, 20--.

| Company BO | ||

| Post-Closing Trial Balance | ||

| July 31, 20-- | ||

| Account Names | Debit ($) | Credit ($) |

| Cash | $13,780 | |

| Accounts Receivables | 234 | |

| Prepaid Insurance | 11,220 | |

| Land | 292,000 | |

| Building | 96,200 | |

| Accumulated Depreciation, Equipment | $480 | |

| Pool/Slide Facility | 150,505 | |

| Accumulated Depreciation, Pool/Slide Facility | 675 | |

| Pool Furniture | 5,675 | |

| Accumulated Depreciation, Pool Furniture | 220 | |

| Accounts Payable | 2,836 | |

| Wages Payable | 920 | |

| Mortgage Payable | 418,890 | |

| LJ, Capital | 145,593 | |

| $569,614 | $569,614 | |

Table (58)

Want to see more full solutions like this?

Chapter 5 Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

Principles of Accounting Volume 1

Fundamentals Of Cost Accounting (6th Edition)

Financial Accounting: Information for Decisions

Financial Accounting

Managerial Accounting (4th Edition)

Auditing and Assurance Services (16th Edition)

- This problem is designed to enable you to apply the knowledge you have acquired in the preceding chapters. In accounting, the ultimate test is being able to handle data in real life situations. This problem will give you valuable experience. CHART OF ACCOUNTS You are to record transactions in a two-column general journal. Assume that the fiscal period is one month. You will then be able to complete all of the steps in the accounting cycle. When you are analyzing the transactions, think them through by visualizing the T accounts or by writing them down on scratch paper. For unfamiliar types of transactions, specific instructions for recording them are included. However, reason them out for yourself as well. Check off each transaction as it is recorded. Required 1. Journalize the transactions. (Start on page 1 of the general journal if using Excel or Working Papers.) 2. Post the transactions to the ledger accounts. (Skip this step if using CLGL.) 3. Prepare a trial balance. (If using a work sheet, use the first two columns.) 4. Data for the adjustments are as follows: a. Insurance expired during the month, 1,000. b. Depreciation of pool structure for the month, 715. c. Depreciation of fan system for the month, 260. d. Depreciation of sailboats for the month, 900. e. Wages accrued at June 30, 810. Your instructor may want you to use a work sheet for these adjustments. 5. Journalize adjusting entries. 6. Post adjusting entries to the ledger accounts. (Skip this step if using CLGL.) 7. Prepare an adjusted trial balance 8. Prepare the income statement 9. Prepare the statement of owners equity. 10. Prepare the balance sheet. 11. Journalize closing entries. 12. Post closing entries to the ledger accounts. (Skip this step if using CLGL.) 13. Prepare a post-dosing trial balance. Check Figure Trial balance total, 281,858; net income, 7,143; post-dosing trial balance total, 263,341arrow_forwardWhat Do You Think? You work as an accounting clerk. You have received the following information supplied by a client, S. Winston, from the clients bank statement, the clients tax returns, and a variety of other July documents. The client wants you to prepare an income statement, a statement of owners equity, and a balance sheet for the month of July for Winston Company.arrow_forwardThe step-by-step process to record business activities and events to keep financial records up to date is ________. A. day-to-day cycle B. accounting cycle C. general ledger D. journalarrow_forward

- In Chapter 11, the first step of the computer accounting cycle is to: Question 26 options: Post entries to the general ledger Set up a business and select a chart of accounts Journalize entries Change accounting periods Print the general ledger trial balancearrow_forwardJanis Engle has prepared the following list of statements about the accounting cycle. 1. “Journalize the transactions” is the first step in the accounting cycle. 2. Reversing entries are a required step in the accounting cycle. 3. Correcting entries do not have to be part of the accounting cycle. 4. If a worksheet is prepared, some steps of the accounting cycle are incorporated into the worksheet. 5. The accounting cycle begins with the analysis of business transactions and ends with the preparation of a post-closing trial balance. 6. All steps of the accounting cycle occur daily during the accounting period. 7. The step of “post to the ledger accounts” occurs before the step of “journalize the transactions.” 8. Closing entries must be prepared before financial statements can be prepared. Instructions Identify each statement as true or false. If false, indicate how to correct the statement. Please answer it with proper explanationarrow_forwardAs a bookkeeper of a new start-up company, you are responsible for keeping the chart of accounts up to date. At the end of each year, you analyze the accounts to verify that each account should be active for accumulation of costs, revenues and expenses. In July, the accounts payable clerk has asked you to open an account named “New Expenses”. You know that an account name should be specific and well defined. You feel that the A/P clerk might want to charge some expenses to that account that would not be appropriate. Why do you think the A/P clerk need this “New Expenses” account? Who needs to know this information and what action should you consider?arrow_forward

- As the bookkeeper of a new start-up company, you are responsible for keeping the chart of accounts up to date. At the end of each year, you analyze the accounts to verify that each account should be active for accumulation of costs, revenues, and expenses. In July, the accounts payable clerk has asked you to open an account named New Expenses. You know that an account name should be specific and well defined. You feel that the A/P clerk might want to charge some expenses to that account that would not be appropriate. Why do you think the A/P clerk needs this New Expenses account? Who needs to know this information and what action should you consider?arrow_forwardListed below in random order are the eight steps comprising a complete accounting cycle:Prepare a trial balance.Journalize and post the closing entries.Prepare financial statements.Post transaction data to the ledger.Prepare an adjusted trial balance.Make end-of-period adjustments.Journalize transactions.Prepare an after-closing trial balance.a. List these steps in the sequence in which they would normally be performed. (A detailedunderstanding of these eight steps is not required until Chapters 4 and 5.)b. Describe ways in which the information produced through the accounting cycle is used by acompany’s management and employees.arrow_forwardexplain why a business would want to set up an accounting system using special journals instead of using only a general journal to record transactions. What are the benefits of using a special journal system for a business that has a large number of transactions each month?arrow_forward

- You are an accounting intern working for SpringFit Corporation. You have recently been assigned to help one of the accountants who is doing an internal audit of the business. You will be assisting with a review of the payables issued by SpringFit Corporation. Your first task is to review the previous year’s journal entries, shown as follows: Journal Entries, Year 1 PAGE 15 GENERAL JOURNAL ACCOUNTING EQUATION DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 Jan. 1 Cash 1,062,060.00 ↑ 2 Premium on Bonds Payable 62,060.00 ↑ 3 Bonds Payable 1,000,000.00 ↑ 4 Jun. 30 Interest Expense 19,397.00 ↓ 5 Premium on Bonds Payable 3,103.00 ↓ 6 Cash 22,500.00 ↓ 7 Jul. 1 Cash 1,921,280.00 ↑ 8 Discount on Bonds Payable 78,720.00 ↓…arrow_forwardYou are an accounting intern working for SpringFit Corporation. You have recently been assigned to help one of the accountants who is doing an internal audit of the business. You will be assisting with a review of the payables issued by SpringFit Corporation. Your first task is to review the previous year’s journal entries, shown as follows: Journal Entries, Year 1 PAGE 15 GENERAL JOURNAL ACCOUNTING EQUATION DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 Jan. 1 Cash 1,062,060.00 ↑ 2 Premium on Bonds Payable 62,060.00 ↑ 3 Bonds Payable 1,000,000.00 ↑ 4 Jun. 30 Interest Expense 19,397.00 ↓ 5 Premium on Bonds Payable 3,103.00 ↓ 6 Cash 22,500.00 ↓ 7 Jul. 1 Cash 1,921,280.00 ↑ 8 Discount on Bonds Payable 78,720.00 ↓…arrow_forwardThe life of a business is divided into specific time periods,usually a year, to measure results of operations for eachsuch time period and to portray financial conditions at theend of each period.(a) This practice is based on the accounting assumptionthat the life of the business consists of a series of timeperiods and that it is possible to measure accuratelythe results of operations for each period. Commenton the validity and necessity of this assumption.(b) What has been the effect of this practice on accounting?What is its relation to the accrual system?What influence has it had on accounting entries andmethodology?arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College